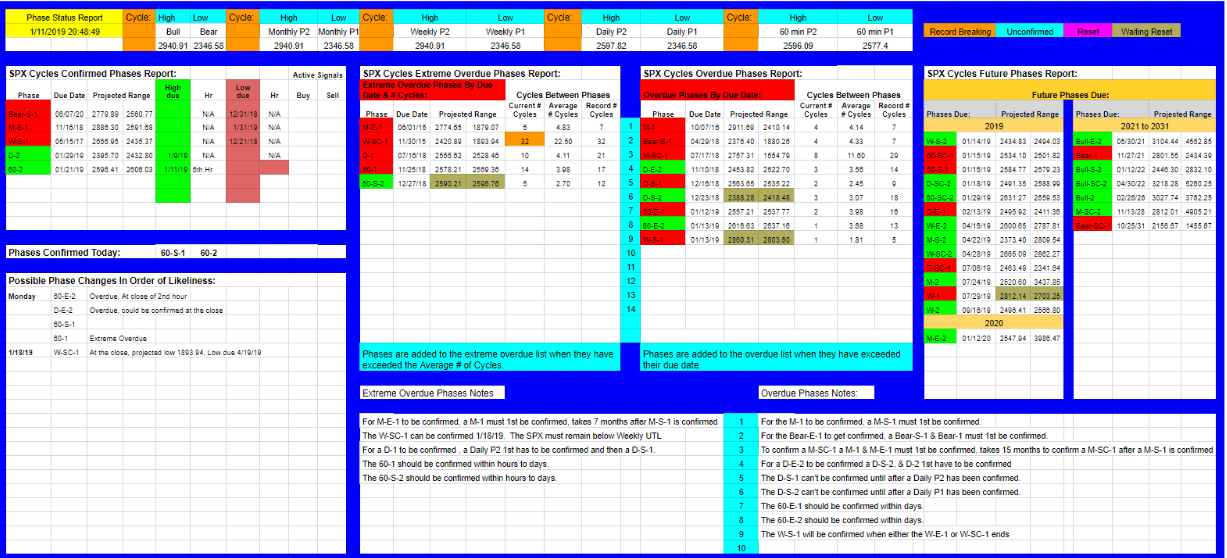

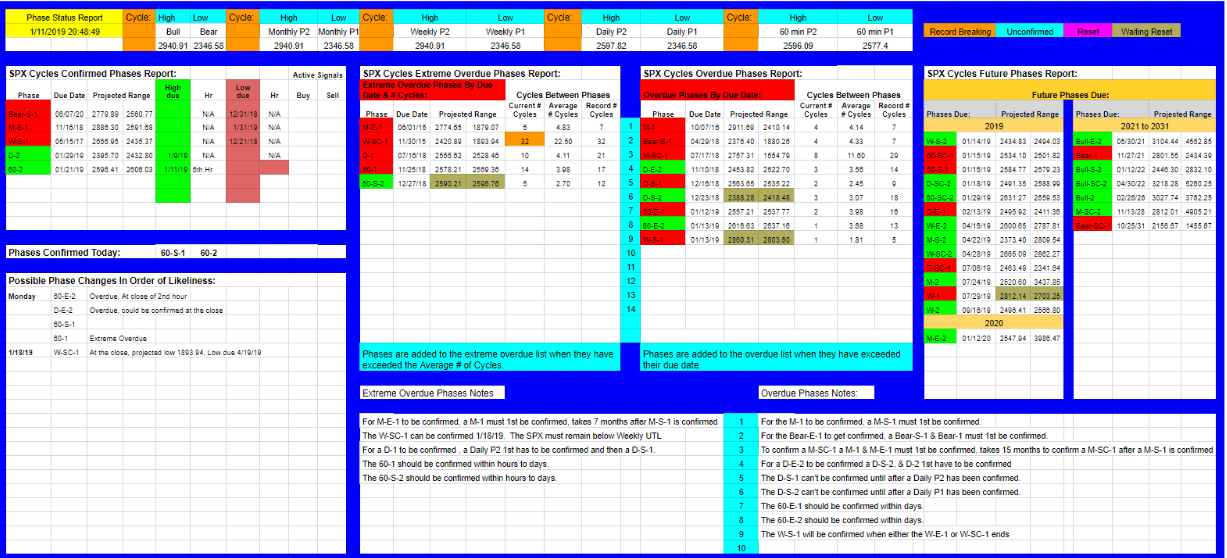

Ok, if your following along. You noticed on the previous chart, I had a 60-2 as a possibility for Friday. Well it got confirmed Friday at the close with a projected high range of 2596.41 to 2606.03. Currently the high for this phase is 2596.09. The 60-2 high could be in, it was due Friday at the 6th hour. However, the 60-E-2 is overdue and could possibly be confirmed Monday at the close of the 2nd hour, if the 60-E-2 is confirmed the projected high range will be 2616.63 to 2637.16, the 60-E-2 high will then be due Tuesday at the 4th hour. If the 60-E-2 does get confirmed, there will then be the possibility of the D-E-2 getting confirmed at the close on Monday or Tuesday, the D-E-2 projected high range is 2453.82 to 2522.70, so if the D-E-2 is confirmed the projected high range will already be exceeded. For the Bears that would be good, because a large upside phase would then be out of the way for a while. The Bulls would like to see this current Daily (P2) up cycle end, and get a Daily short (P1) down cycle (D-S-1) confirmed with a current projected low range of 2563.65 to 2535.22, which would then reset the Daily (P2) up cycle projections, which would then be a lot more favorable for the Bulls. A confirmed Daily D-S-1 would pretty much guarantee the confirmation of the large way way extremly overdue Weekly W-SC-1, which would be a very large bear phase out of the way, that has a projected low range of 2420.89 to 1893.94, the current Weekly Cycle low of 2346.58, could very well be the W-SC-1 low, the W-SC-1 low would not be due until 4/19/19, but based on the current projected phases, I don't see any 60 min or Daily future phase AT THIS POINT, that would take the Weekly Cycle lower than the current 2346.58, so the W-SC-1 could very well be a short W-SC-1. So this next week could be a very interesting week with some large up & down phases in play.

So in summary, Monday for the upside I am looking for a possible 60-E-2 (overdue) & D-E-2 (overdue) or if we go the downside route, I will be looking for at most a 60-S-1 or 60-1, the 60-1 is extremely overdue and has a current projected low range of 2578.21 to 2569.36. If the 60-E-2 is confirmed the D-E-2 could be confirmed either Monday or Tuesday at the close. Then on Friday I am looking for the BIG Weekly W-SC-1 (which has been overdue since 11/30/15) to finally get confirmed. When the W-SC-1 ends the only Weekly overdue down (P1) phase will be the W-S-1 which is due 1/13/19 (tomorrow). The next Weekly P1 phase due will then be the W-1 due 7/29/19. Before that there will be 3 Weekly up (P2) phases due the W-S-2 due 1/14/19, the W-E-2 due 4/16/19 & the large W-SC-2 due 4/28/19. So it's starting to look pretty Bullish going out to April and we could see this short Bear (Bear-S-1) come to an end by April.

|