Check this out.

-------

BMO: Our Market Timing Model Is About As Negative As It Ever Gets

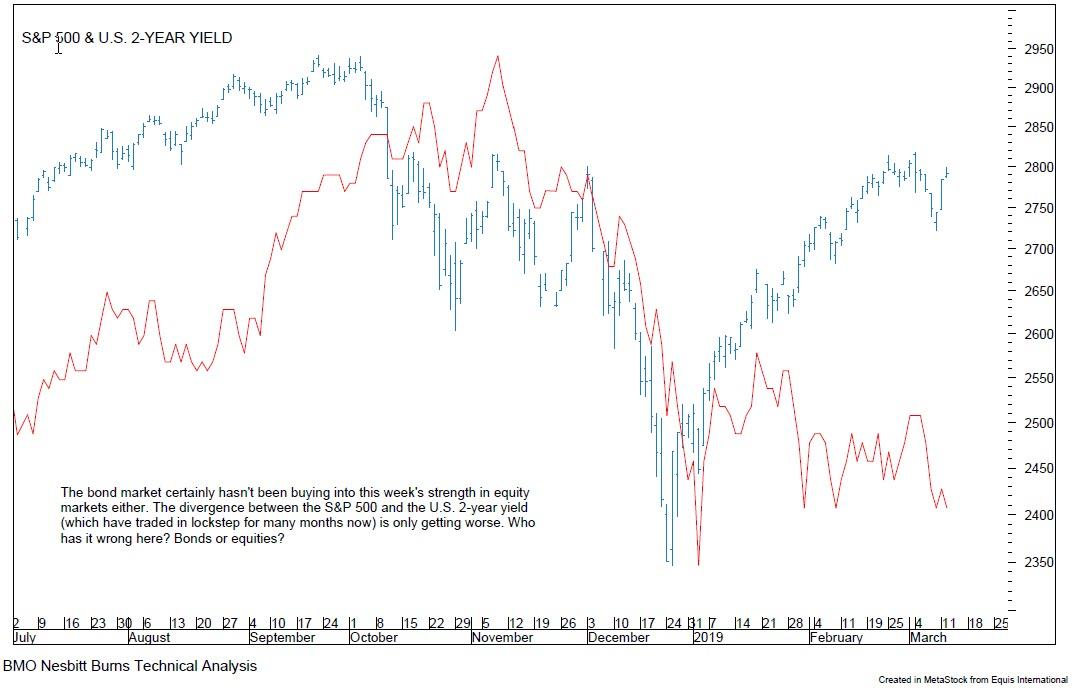

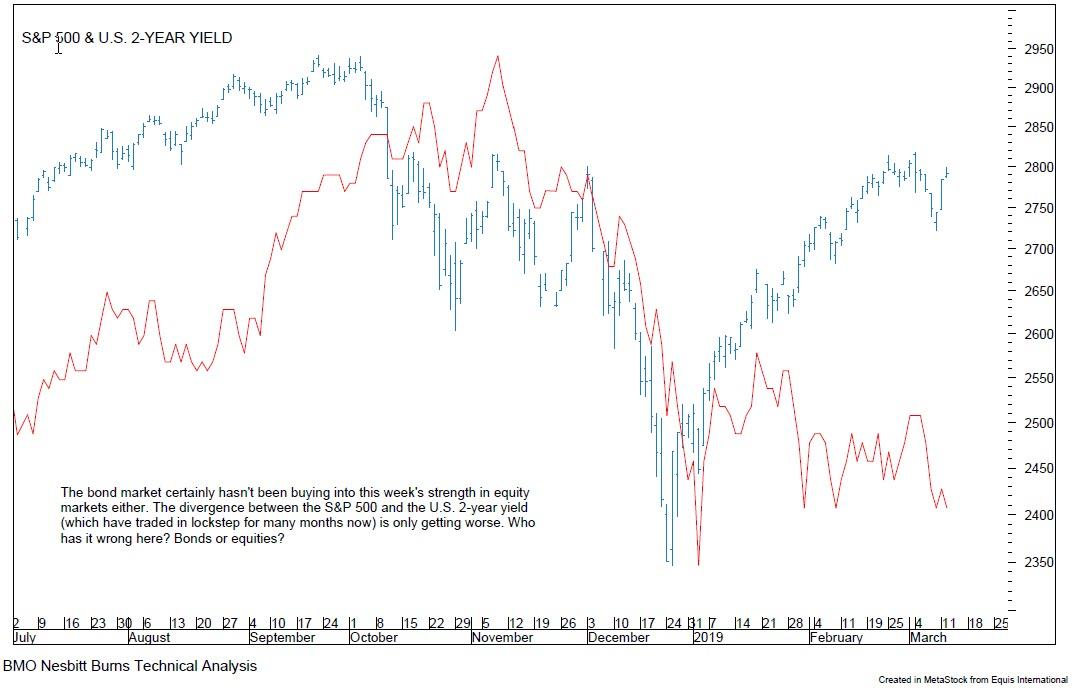

Something very strange has been taking place in the market over the past three days: as we showed on several occasions earlier this week, while stocks are once again soaring, led by the old faithful tech sector, and perhaps facilitated by the low-volume flux ahead of this Friday's quad-witching which tends to always inflict 'max pain' on established derivative positions, bonds are not only not "buying it" quite literally, but are telegraphing further economic weakness ahead. Nowhere is this more visible than in the latest divergence between stocks and bonds shown below.

This morning, BMO's chief technical analyst Russ Visch makes just this observation and in his daily action report writes that "the divergence between the S&P 500 and the U.S. 2-year yield (which have traded in lockstep for many months now) is only getting worse. Either the bond market has it wrong here, or equity markets do."

The bond market certainly hasn't been buying into this week's strength in equity markets either. The divergence between the S&P 500 and the U.S. 2-year yield (which have traded in lockstep for many months now) is only getting worse. Who has it wrong here? Bonds or equities?

We couldn't agree more, and while we reserve judgment on who is right and who is wrong - although the historical track record has shown time and again that it is bonds that virtually always end up being correct in the long- or even medium-run - Visch has no such qualms, and writes that "despite the recent price strength our short-term equity timing model remains negative so we’re willing to bet it’s the latter."

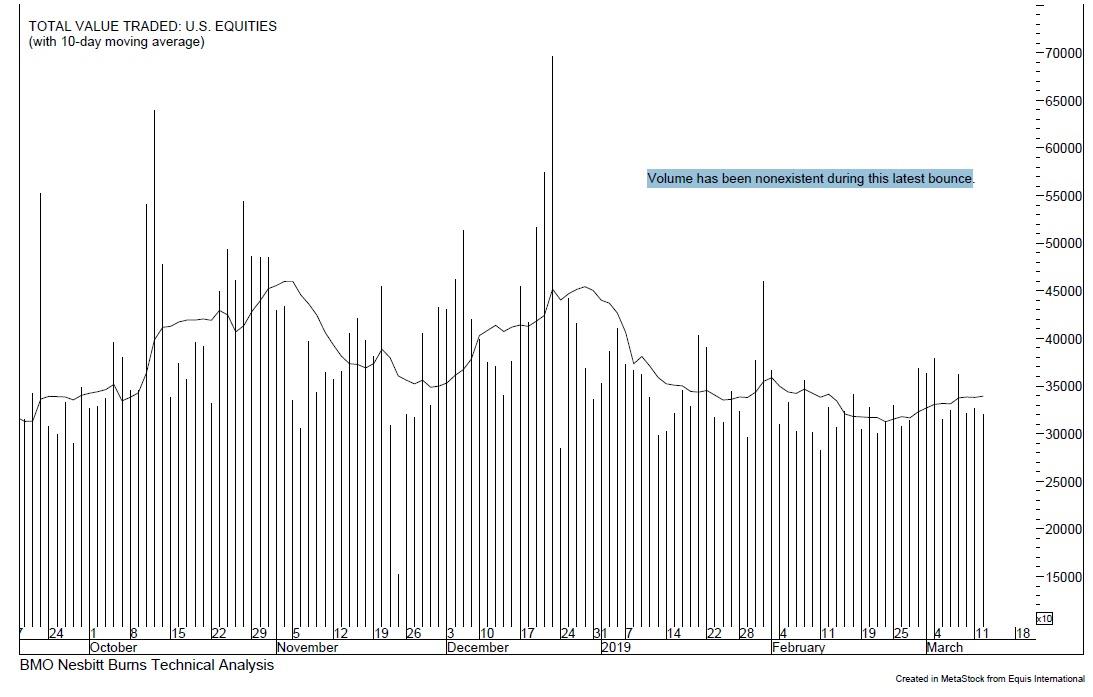

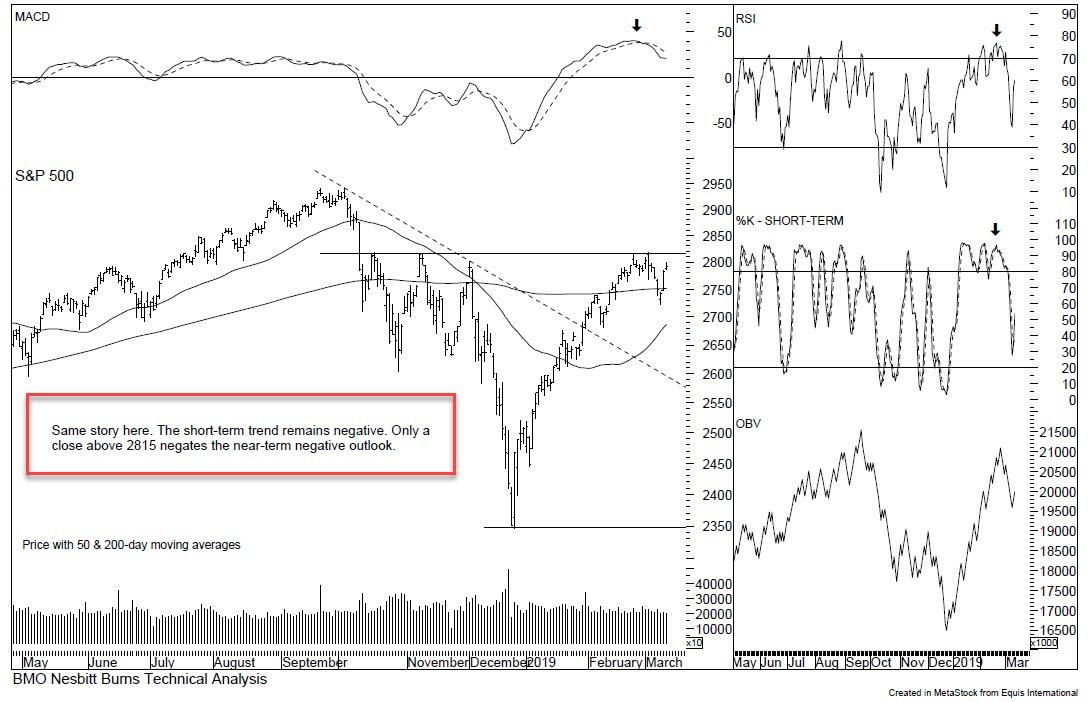

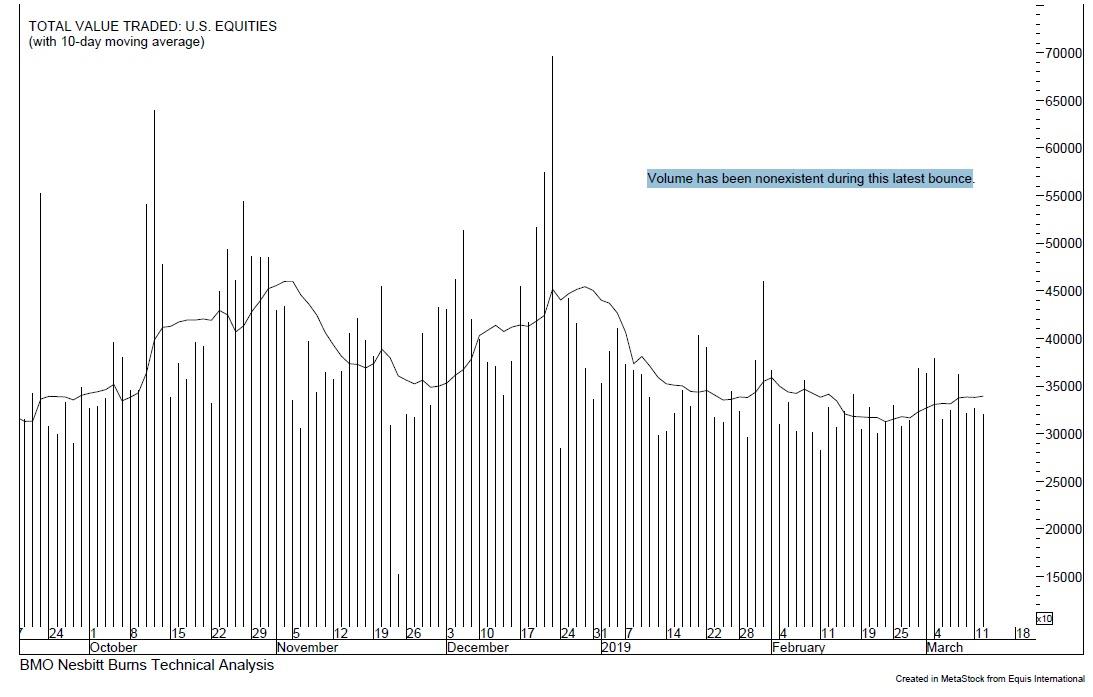

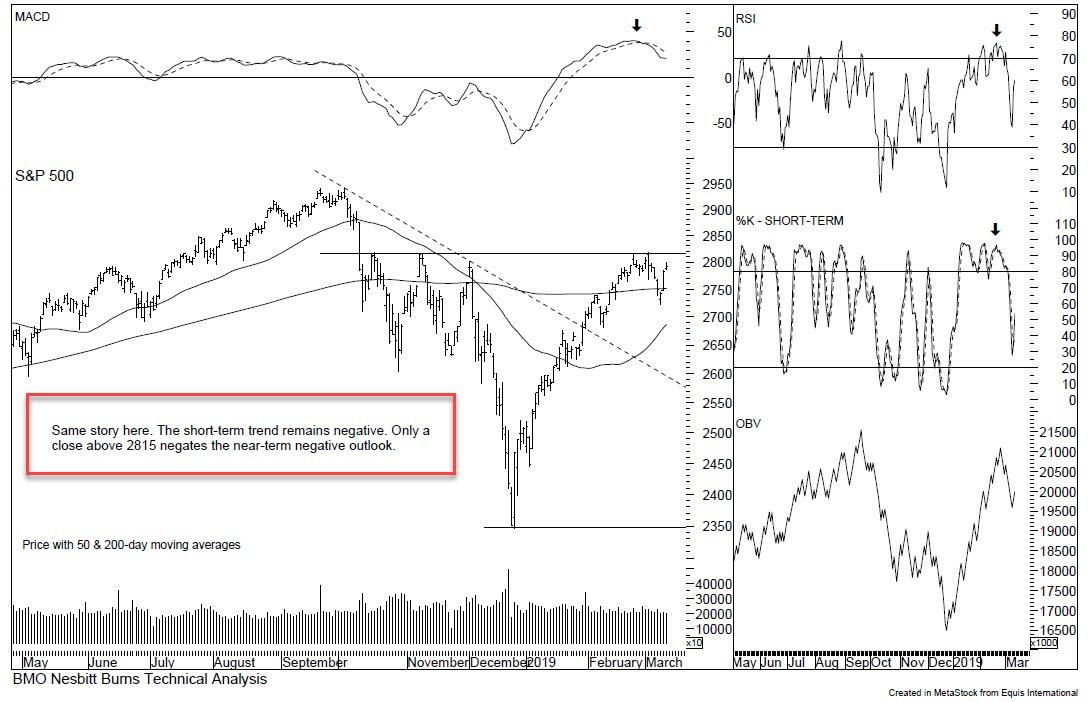

And speaking of BMO's market timing model, Visch notes that "while the trend for equities has been positive so far this week", it remains a "bit of a head scratcher since coming into the week our short-term timing model was just about as negative as it ever gets" and adds that "there’s not a lot to like outside of the price action in the major averages" bringing attention to the lack of participation, saying that "volume has been nonexistent during this latest bounce."

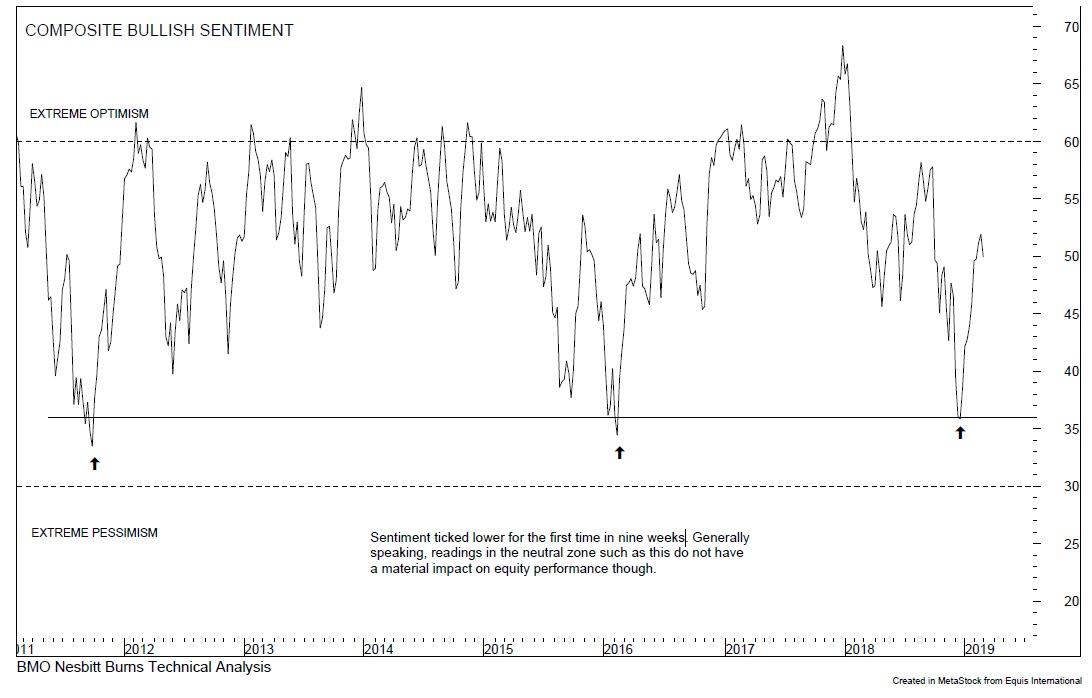

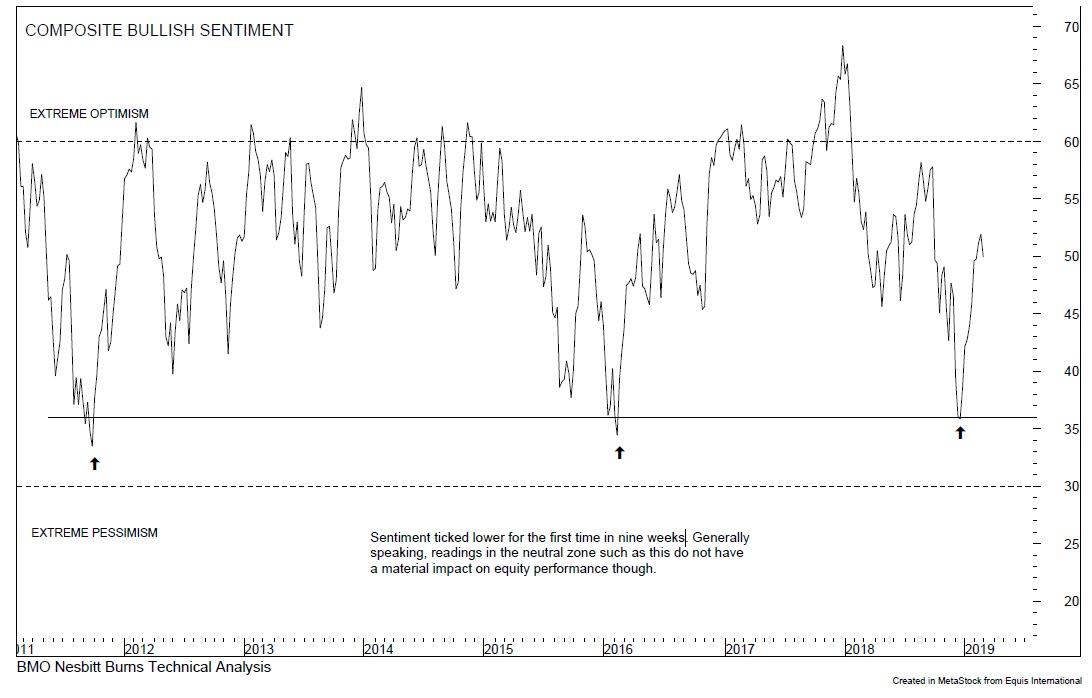

Meanwhile, he points out that composite bullish sentiment ticked lower for the first time in nine weeks.

So what can make Visch - and his model - turn bullish? As he caption the S&P chart below, while "the short-term trend remains negative. Only a close above 2815 negates the near-term negative outlook" and similarly for the Nasdaq, only a close above multiple resistance levels in the 7650-7675 zone "negates the short-term negative call here."

|