Trump's Middle Class Tax Hike:

Last year, my federal tax return (for 2017) was over $4,000

This year, my federal tax return (for 2018), I owe some hundreds dollars.

Total paycheck federal income tax deduction remained virtually the same between 2017 and 2018.

- My income level probably falls in the 70-85 percentile, Middle Class.

- My income remained almost the same between 2017 and 2018.

- However, the Adjusted Taxable Income went up by more than $30,000.

- The biggest difference was the elimination of various deductions in Trump Tax Law:

Family deduction; State tax deduction; Property tax deduction; Charitable contribution, ..

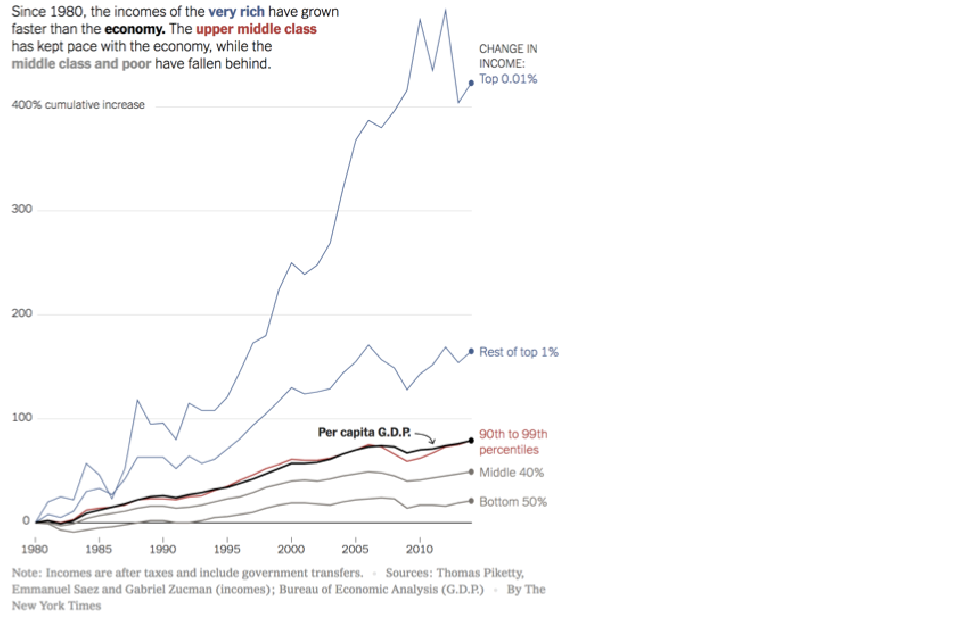

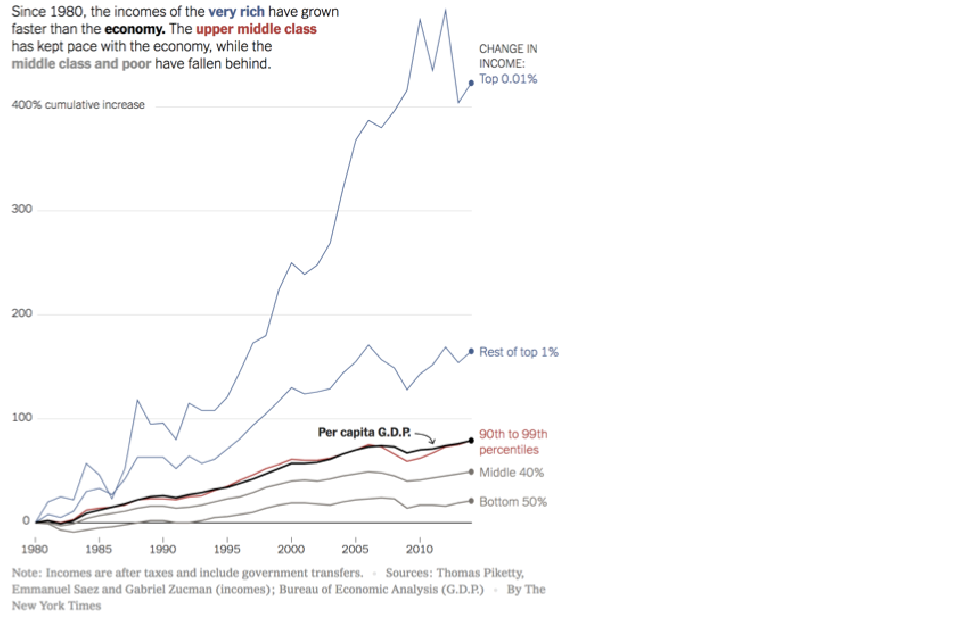

In the Chart below:

Upper middle class is 90th to 99th percentile, making $120k to $425k after tax. Their income growth is at par with the GDP growth.

Middle, lower middle and poor people lost ground for the past 40 years, with their income growth falling further below the GDP growth, while the Top1% gaining ground with their income growth much in excess of the GDP growth. The Top0.01% Billionaires saw their income growth sky rocket.

If a Nation's economic productivity growth is measured by the GDP growth, then the people must share the benefit in a fair way. On average this should be reflected in the income growth, not just the 0.01%, 1% or 10% of the people. It must be reflected in the income growth for the 70-95% of the people.

America's system is broken. Ronald Reagan started it. All GOP presidents aggravated the income inequality problem further. Donald Trump exploded the problem with his tax cut to the ultra wealthy (1% and 0.01%) and Trump Tax Hike for the bottom90%.

|