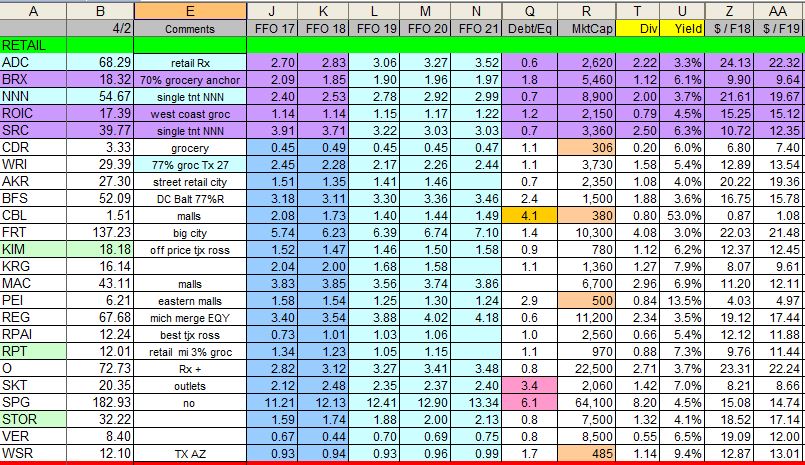

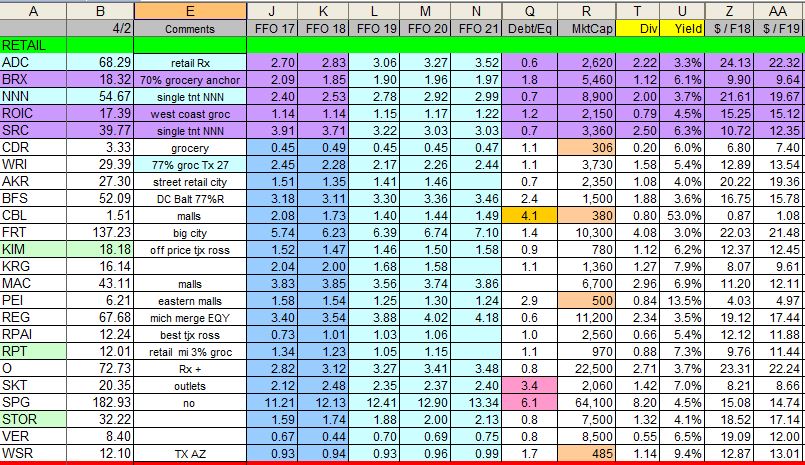

| | | S Felix -- I looked at your holdings and being a close follower of reits, i thought i share some data and thoughts. Here's part of my spreadsheet on reits that i follow. (not all my columns, and just retail reits here.)

B = stock price n 4/2

J - N = FFO actual and analyst estimates

Z, AA = price / FFO 2018 and 2019

I notice that your retail reits are PEI and CBL -- mall owners. yep, high yield and low PE, but also high debt, low market cap, and possible BK risk or other trouble (IMO). I am more cautious with retail and only hold BRX, ROIC, SRC.

In non retail.

I sold SBRA recently due to bad vibes, but it is prob a good one to own. Nice yield, but a few issues.

In lodging, AHT (you own) has way too much debt. I like INN and recently added CPLG (see value thread, M. Burry). But these are not major holdings of mine.

FYI - my significant $$ reits are MAA CPT IRT BDN PDM LXP DRE. I prefer low risk industrial and residential. offices have some nice values. industrial prices are a bit high. in senior care, WELL is good too, but a little pricey.

I enjoy your thread and sometimes get good ideas...

|

|