the policy is now firmly on, money flowing, and fuel cell powered cars shall populate the road

uncertain what it all shall do to the energy picture

at some juncture, sooner rather than later, the Middle East oil producers best prepare selves to remain relevant, or Teotwawki

bloomberg.com

China's Hydrogen Vehicle Dream Chased With $17 Billion of Funding

A hydrogen station in Liuan, Anhui Province. Source: Anhui Mingtian Hydrogen Energy Technology Co. Sign up for Next China, a weekly email on where the nation stands now and where it's going next.

China’s policies to boost its fledgling hydrogen-powered auto industry are coming at just the right time for entrepreneur and former carmaker executive Wang Chaoyun.

His startup, Anhui Mingtian Hydrogen Energy Technology Co., makes fuel-cell stacks for vehicles propelled by the element, which produces no emissions from the tailpipe. During Mingtian Hydrogen’s brief existence, the fuel-cell vehicle industry has received more than $1 billion worth of investments from Chinese companies, according to data compiled by researcher BloombergNEF.

Source: Anhui Mingtian Hydrogen Energy Technology Co.

“When I set up the company in 2017, it felt like fighting ahead in complete darkness, with people doubting my choice of going down the road of fuel cell,’’ said Wang, 56, who’s also the general manager. “The lights are on now, with more hands producing a stronger flame.’’

China, the world’s biggest car market, is putting its manufacturing and policy might behind hydrogen fuel cells, just as it did with electric vehicles. The government wants 1 million fuel-cell vehicles on the roads in a decade and is seeding that plan with hundreds of millions of yuan to spur research and development, and to subsidize purchases. And, as seen with EVs, a slew of startups and established companies are trying to capitalize.

Wan Gang, who’s been called the father of China’s electric-car movement, said the nation should establish “a hydrogen society.’’ While China plans to phase out longtime subsidies for the maturing EV industry next year, funding for fuel-cell vehicles may stay in place, he said in a June 9 interview.

China’s Father of Electric Cars Says Hydrogen Is the Future

BNEF tracked more than $17 billion worth of announced investments in the industry through 2023. One of the largest is China National Heavy Duty Truck Group’s plan to spend $7.6 billion to manufacture fuel-cell vehicles in Shandong province on the east coast.

Mingtian Hydrogen, which translates as Tomorrow’s Hydrogen, plans to invest 2.5 billion yuan ($363 million) for an industrial park in Anhui province to manufacture fuel-cell stacks and associated components. The first phase is completed, said the company, which is backed by the Chinese Academy of Sciences.

It currently supplies stacks in small volumes to Guangzhou Automobile Group Co. and China FAW Group Corp. for passenger vehicles, and it expects to start mass production next year. The company wants the capacity to make 100,000 sets of fuel-cell stacks and components by 2022 before expanding to 300,000 sets in 2028.

Mingtian Hydrogen is seeking to raise 100 million yuan at a valuation of 1 billion yuan, Wang said. The funds would help develop products and expand capacity.

Its domestic competitors include Sunrise Power Co., Shanghai Shenli Technology Co. and Guangdong Nation-Synergy Hydrogen Power Technology.

To be sure, the nation still has a long way to go before the hydrogen society reaches fruition. The number of fuel-cell vehicles on the road -- both passenger and commercial -- will only be about 5,000 by next year, according to government projections.

“The FCV market will depend heavily on subsidies for at least the next five years,” BNEF said in a November research report. “Given the investments made by Chinese automakers and battery suppliers in the EV value-chain, it is still not clear if FCV production will rise rapidly beyond supporting the needs of demonstration projects.”

China Subsidies for New Energy Vehicles

Aid for fuel cell vehicles remain constant while other powertrains see decline

Sources: BloombergNEF, Ministry of Finance

Note: The subsidy for BEVs depends on their range, the figure above shows the maximum amount of subsidy given to BEVs.

Wang’s background is in the industry he’s trying to compete with. He spent three decades working for Anhui Jianghuai Automobile Group Corp., Beiqi Foton Motor Co. and Chery Automobile Co. in quality control, product development and sales. He graduated from Shanghai’s Tongji University, the same school where Wan Gang served as president.

China may see the mass adoption of hydrogen fuel-cells in commercial vehicles within five years and in passenger vehicles over the next 10 years, Wang said. That time span is required to establish a reliable supply chain, ranging from hydrogen production to refilling stations.

“Industry players need to be prepared for the long march and don’t hesitate or give up easily,’’ Wang said in a June 20 interview.

In a typical EV, lithium-ion batteries store electrical energy produced outside the car.

Hydrogen fuel cells use a chemical reaction to produce energy, converting hydrogen stored in the vehicle into electricity, and emit only water vapor. Hydrogen has a higher energy density than lithium-ion batteries, meaning fuel-cell vehicles typically recharge faster, weigh less and have a longer driving range than EVs.

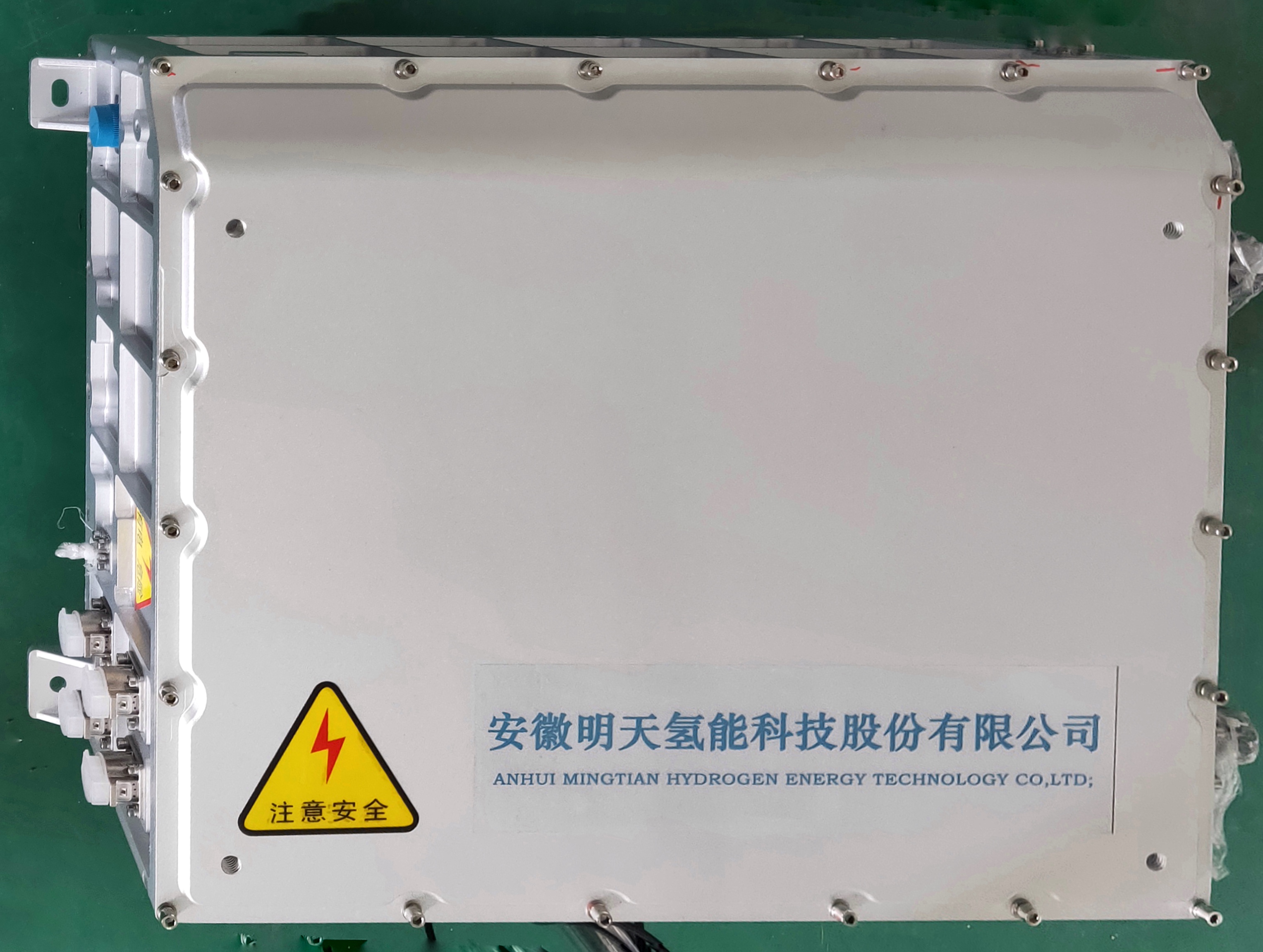

A fuel cell stack manufactured by Anhui Mingtian.

Source: Anhui Mingtian Hydrogen Energy Technology Co.

The government’s “Made in China 2025’’ industrial blueprint promises continued support for both electric and fuel-cell vehicles.

China introduced subsidies for new-energy vehicles in 2009, according to BNEF. For the years 2016 to 2020, the subsidies for fuel-cell vehicles can range from 200,000 yuan per passenger vehicle to 500,000 yuan for a heavy commercial vehicle.

“It feels like springtime coming,’’ Wang said. “The industry is becoming more and more vibrant since last year, and it’s like we’re throwing a celebration feast with a lot of people joining.’’

— With assistance by Ying Tian, and Hannah Dormido

|