VXX: Sell And Sell Short

Oct. 3, 2019

QuandaryFX

VXX follows a methodology which has a strong annualized negative 53% return over the last decade.

The VIX just hit a fresh 20 day high which historically is followed by a drop in the index the majority of the time.

The VIX rallied by nearly 7 points over the last two weeks - rallies of this size are reverted over the next month most of the time.

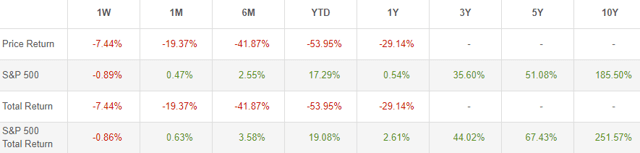

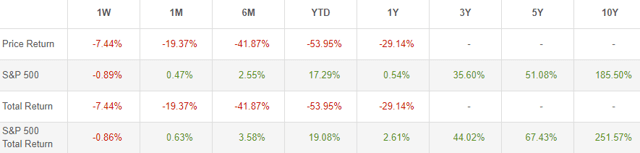

Today was a good day for long traders of the iPath S&P 500 VIX Short-Term Futures ETN ( VXX) with shares appreciating by nearly 7%. While these gains are noteworthy, it is important to frame up these returns in the context of the long-run losses seen in the instrument. Specifically, as you can see in the following momentum table from Seeking Alpha, VXX is currently down over 50% this year with all measured time periods showing a loss.

It is my belief that these losses are poised to accelerate. Specifically, I believe that the current pop in the VIX is offering an excellent opportunity to short VXX on either an outright basis or through options.

Understanding VXX Prior to jumping into an analysis of the recent moves in the VIX, let’s do a brief recap on VXX. I’ve covered VXX fairly extensively before ( here and here), so I won’t do too much of a deep dive on the instrument and its underlying index in this piece.

To understand why VXX drops in almost all major time periods studied, look no further than its methodology. Like many other volatility ETPs, VXX follows the ever-so-popular S&P 500 VIX Short-Term Futures Index. This index weights exposure in the front two VIX futures contracts such that the average holding period is roughly 1 month into the future. This exposure method requires the strategy to hold greater and greater length in the back month contract as time progresses and expiry approaches. Because of this, roll yield becomes a greater factor in the returns of the instrument during a typical month since a greater length is held in the second month. Since roll yield is negative in a contango market and VIX futures are almost always in contango ( see data here), the long-run returns of this index clocked in at an astounding negative 53% annualized return for the last decade. Ouch.

At present, VIX futures are in slight backwardation in the front two contracts which means that roll yield is generally positive for VXX, but this state rarely lasts. Indeed, when the current level of fear moderates a bit, contango is likely to result since the market will expect higher levels of volatility in the future than the present and roll yield will shift negative once again.

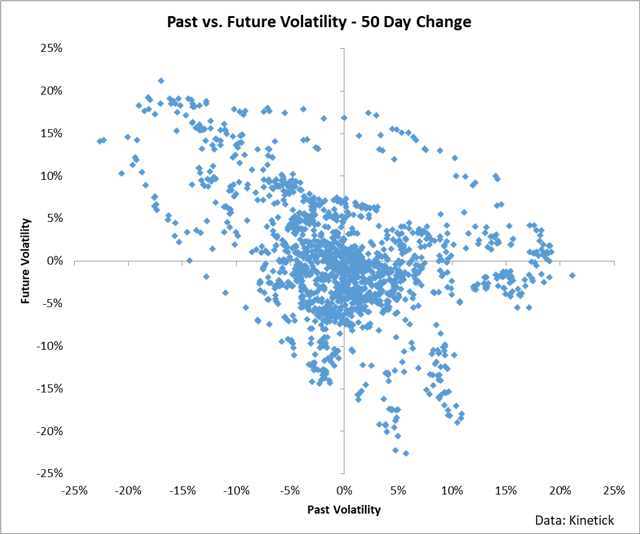

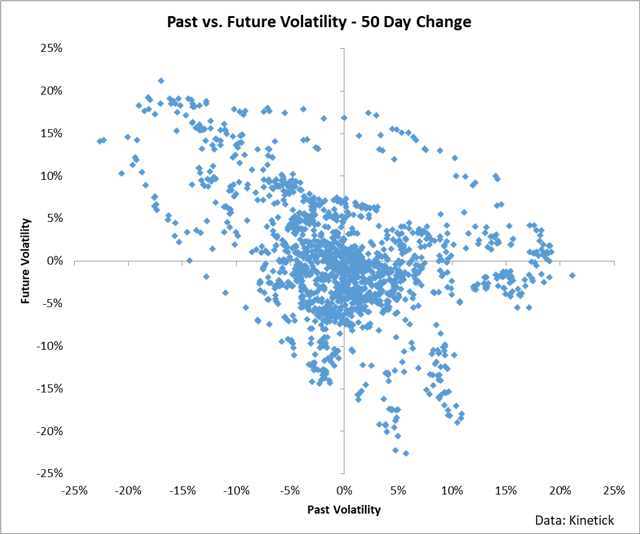

Tradable Catalysts At present, the VIX itself is giving some statistically-significant sell signals resting around the concept of mean reversion in volatility. There are several ways to quantify mean reversion in volatility, but as a starting point, here is a scatter chart showing the future 50 day returns in volatility paired up with past 50 day returns in volatility.

The relationship in the above chart is fairly consistent and says that in general, when volatility rises, it likely will fall in the future. We could play around with timeframe of the study to various results, but the concept is robust across most periods examine. The point being this: when the VIX rallies, it pays to look for shorting opportunities.

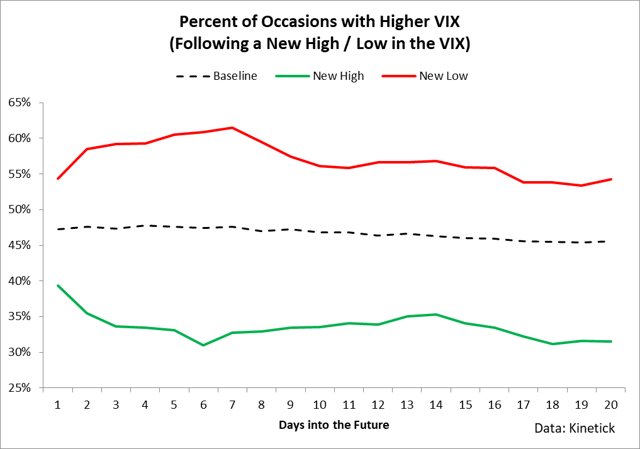

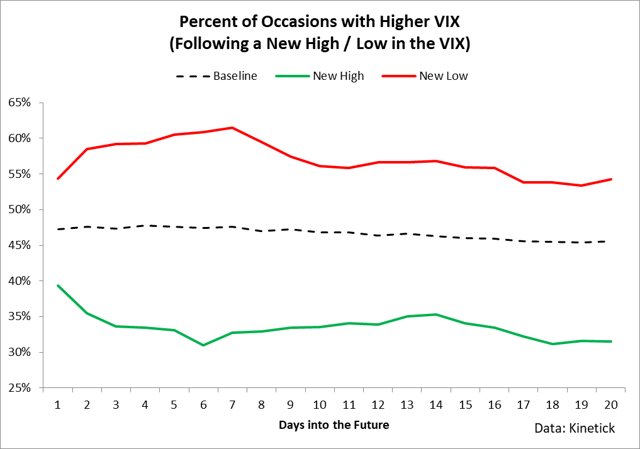

To numerically quantify this, we can take the current rally in VIX and see what has historically happened after similar type rallies. Let’s start with a simple query of what happens when the VIX hits a new high or a new low. Specifically, the VIX has hit a fresh 20-day high over the last 24 hours. The chart below shows the percentage of times that the VIX increased or decreased following a fresh hit of 20-day highs and lows up to a month in the future using all market data since 1992.

Historically speaking, when the VIX hits a fresh 20-day high, there is around a 65-70% chance that it will drop over the next month. The critic will point out that this hindsight analysis cannot account for the market action of today, but I would counter with the fact that this uses all data from 1992 which captures several bull and bear markets as well as two major recessions. The data is robust and the data is giving a clear signal: it is time to look for a short VIX trade.

Another way of examining the data is to look at the magnitude of the recent movement in the VIX. Specifically, the VIX itself has increased by 6.8 points over the last two trading weeks. Numerically speaking, there have been 293 periods in which the VIX has increased by this much or more over a two week timeframe. Of these periods, only 28% saw further upside in the index over the next month. In other words, past rallies in the VIX of this magnitude or more have historically been followed by a drop in the VIX 72% of the time over the next month. Again, this data represents 27 years of history and captures the full market cycle.

The statistics strongly suggest shorting the VIX after the recent rally in the index. There will always be a hundred and one reasons to discard historic analysis and claim that “this time is different,” however the underlying statistics are robust across the past 27 years. It is an excellent time to short volatility and capture the downside in VXX as its underlying index reverts to the mean.

ConclusionVXX follows a short-term VIX futures methodology which historically returns an annualized loss of 53% per year. Despite the brief pop in the outright level of VIX, I believe that roll yield will once again switch to contango and shares of VXX will drop. The recent pop in the VIX offers a quantified entry point into shorting the VIX and I would suggest doing so with either a stop in place or through options to limit the tail risk to the investment. It’s time to short VXX |