| | | Amid Trump Tariffs, Farm Bankruptcies And Suicides Rise

Chuck Jones Senior Contributor

Markets

I cover technology companies, worldwide economies and the stock market

Pat Sheldon, a corn and soybean farmer from Percival, Iowa. (Annie Gowen/The Washington Post via Getty Images)

The Washington Post/Getty ImagesFarmers are pretty much under stress all the time since many factors that affect their livelihood are outside of their control. However, over the past few years the combination of lower prices, rain that has created havoc with their ability to plant and finally China freezing the imports of U.S. grown crops due to President Trump’s tariffs has unfortunately created almost the perfect storm against them.

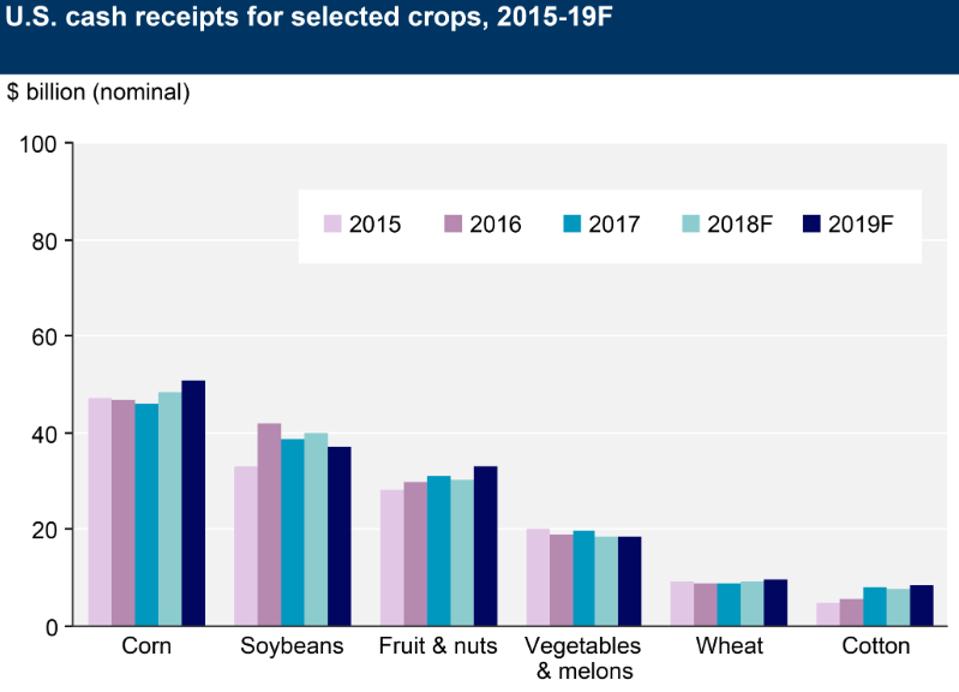

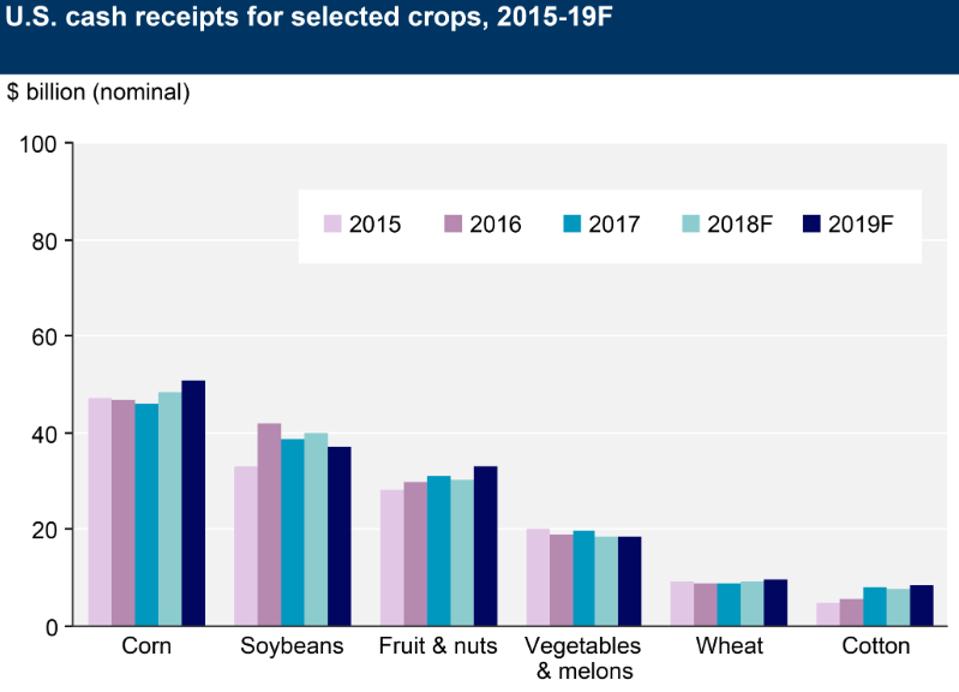

Corn and soybeans are the largest cash crops grown in the U.S. per NASS, the U.S. Department of Agriculture’s National Agricultural Statistics Service. In 2018 the value of corn was $51.5 billion, with soybeans second at $39 billion. The next largest crop was hay, a distant third at $17 billion. For comparison the value of apples grown in the U.S. was about $4 billion and oranges was $2 billion.

U.S. crop cash receipts

USDA, Economic Research Service, Farm Income and Wealth Statistics. March 6, 2019Body blow to farmers

Today In: Money

After China made its announcement that it would stop importing U.S. agricultural products American Farm Bureau Federation President Zippy Duvall said, “China’s announcement that it will not buy any agricultural products from the United States is a body blow to thousands of farmers and ranchers who are already struggling to get by.”

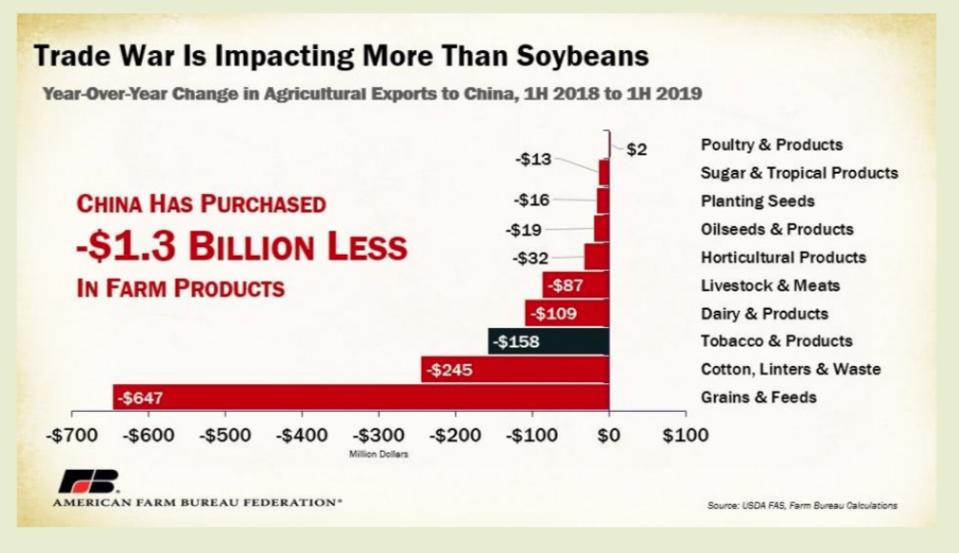

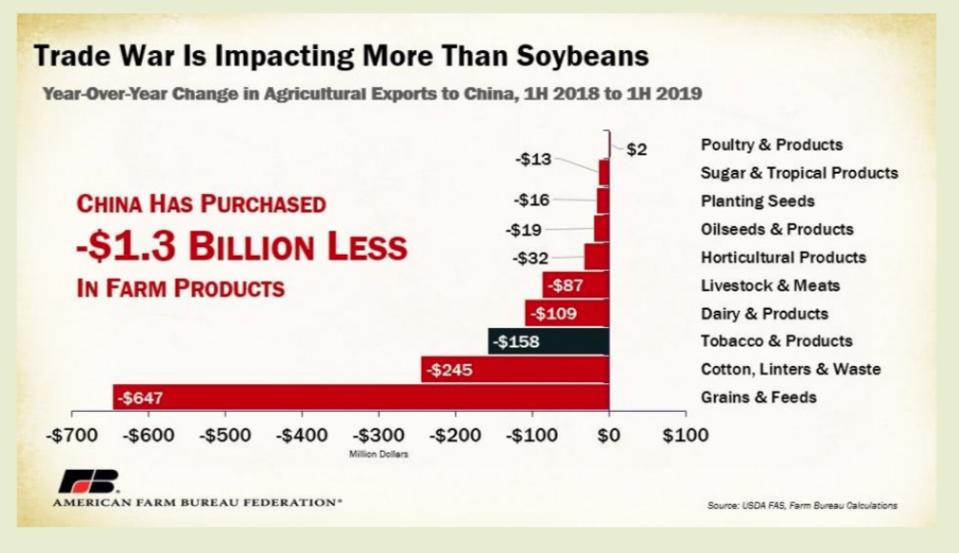

He added, “In the last 18 months alone, farm and ranch families have dealt with plunging commodity prices, awful weather and tariffs higher than we have seen in decades. Farm Bureau economists tell us exports to China were down by $1.3 billion during the first half of the year.”

PROMOTED

Impact of China trade war on agricultural products

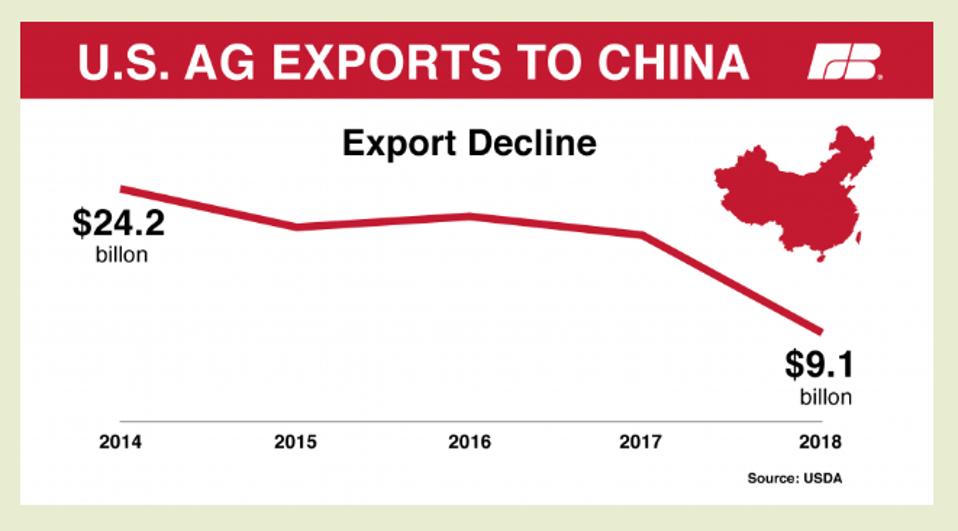

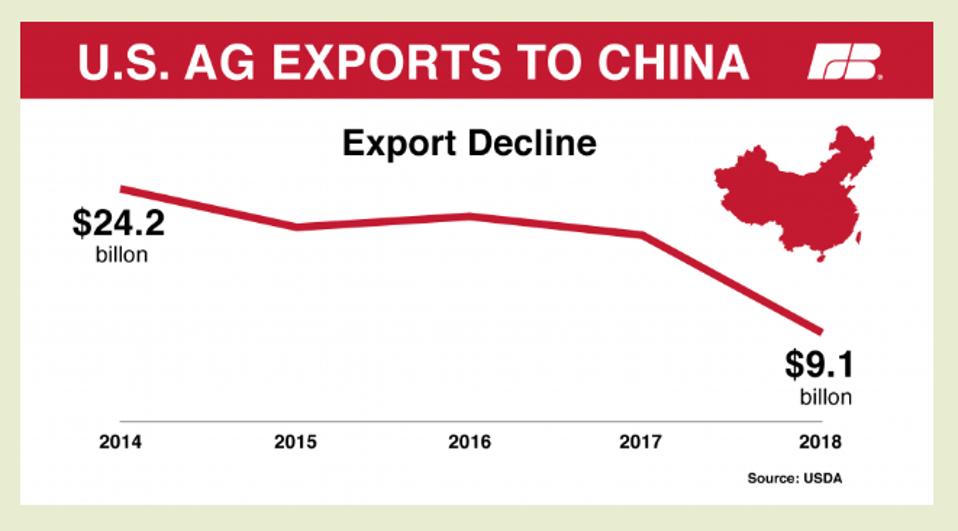

USDA FAS, Farm Bureau CalculationsDuvall pointed out, “Now, we stand to lose all of what was a $9.1 billion market in 2018, which was down sharply from the $19.5 billion U.S. farmers exported to China in 2017.”

U.S. ag shipments to China

USDA, Farm Bureau China bought $9 to $10 billion in soybeans per year

China had been buying 30-35 million tons of soybeans, which is 22% to 25% of total U.S. production.

In 2018 the U.S. produced:

· 4.6 billion bushels of soybeans

· One bushel weighs 60 pounds

· Equaling total production of 276 billion pounds

· Or 138 million tons

China buying 30-35 million tons:

· Is 22% to 25% of the total U.S. production

· Or 1 to 1.15 billion bushels

· At a price of $8.50 per bushes this equates to

· $8.5 to $10 billion in revenue from China to U.S. farmers

Soybean price chart

StockCharts.comCorn farmers are also being impacted by Trump

China had not had nearly the same effect on corn farmers. However, in early August when China announced that it would stop importing U.S. agricultural products corn prices dropped by about 10%.

Corn prices

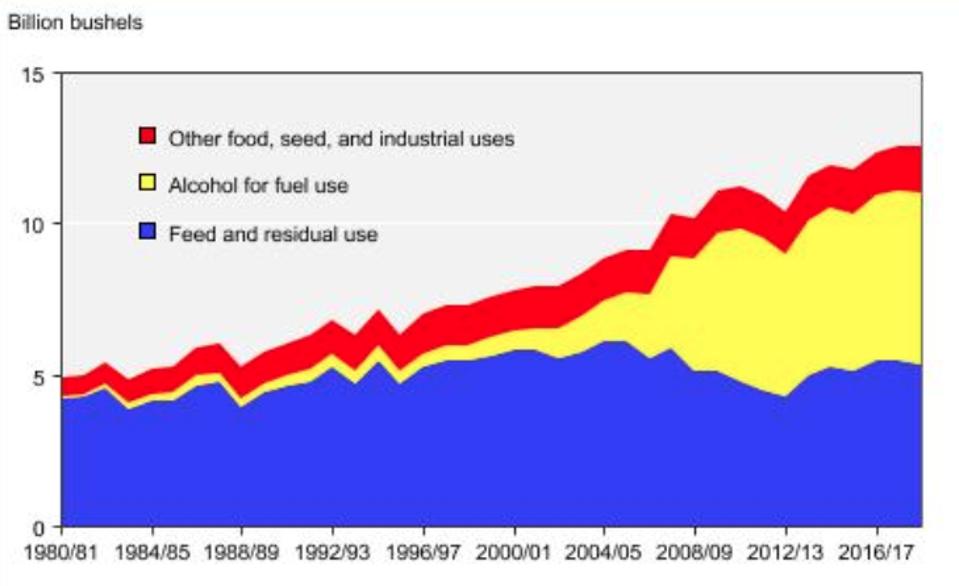

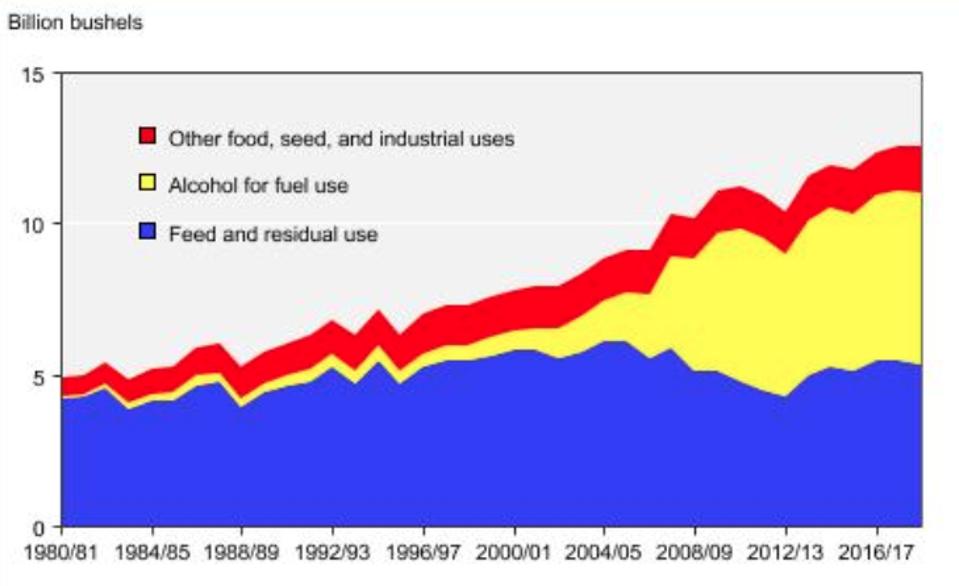

StockCharts.comThe recent decision by Trump’s EPA to exempt an additional 31 small oil refineries from incorporating ethanol, which is made from corn and accounts for 40% of total corn use per the USDA, will put even more stress on farmers.

US CORN PRODUCTION ETHANOL

U.S. corn production usesFarmer loan delinquencies and bankruptcies are rising across the U.S.

The American Farm Bureau Federation, also known as the Farm Bureau, published a report in July that dove into farm loan delinquencies and bankruptcies based on Federal Deposit Insurance Corporation and U.S. court data.

The information showed that, “the delinquency rates for commercial agricultural loans in both the real estate and non-real estate lending sectors are at a six-year high and … were above the historical average of 2.1%.”

Farm loans past due

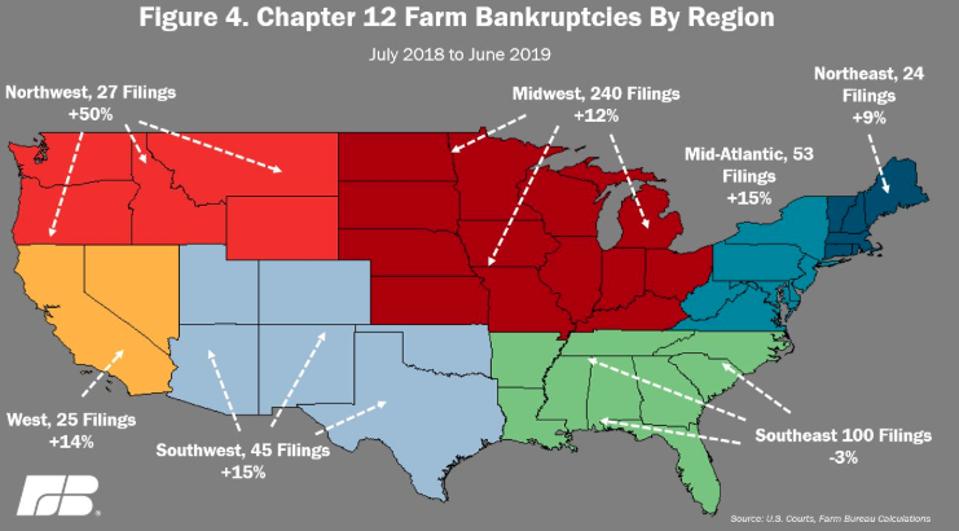

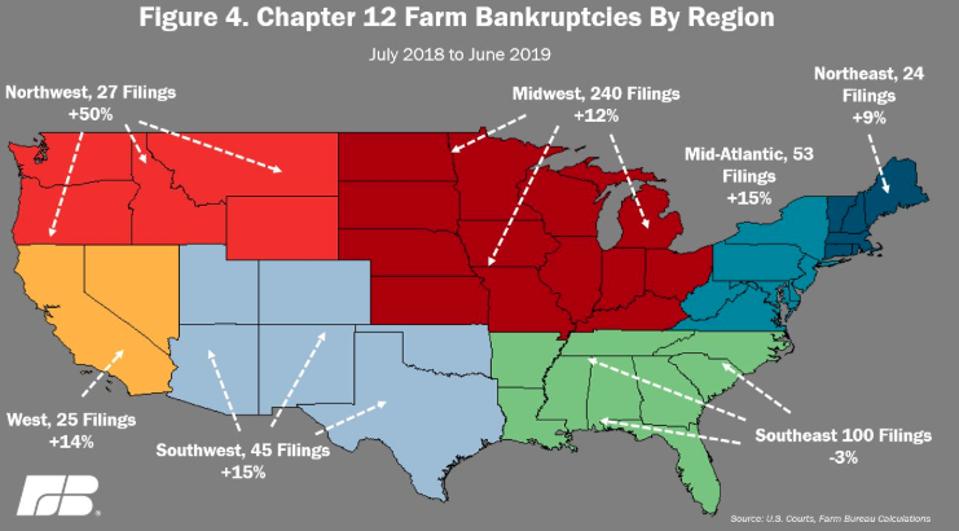

FDIC Call Report Data, Farm Bureau CalculationsThe Farm Bureau report showed that farmer bankruptcies had risen in every region of the U.S. for the year ending in June except for the Southwest. Wisconsin, Kansas and Minnesota led the nation in Chapter 12 filings; bankruptcy filings in Kansas and Minnesota increased so significantly in the past year that they reached the highest levels of the past decade

Farm bankruptcies by region

U.S. Courts, Farm Bureau CalculationsWhile Trump’s decision to impose tariffs on China and its subsequent retaliation is not the only reason for the stress farmers are under, it is a self-inflicted wound. John Newton, the Chief Economist at the Farm Bureau, summarized the farmer’s situation as, “The deteriorating financial conditions for farmers and ranchers are a direct result of several years of low farm income, a low return on farm assets, mounting debt, more natural disasters and the second year of retaliatory tariffs on many U.S. agricultural products.”

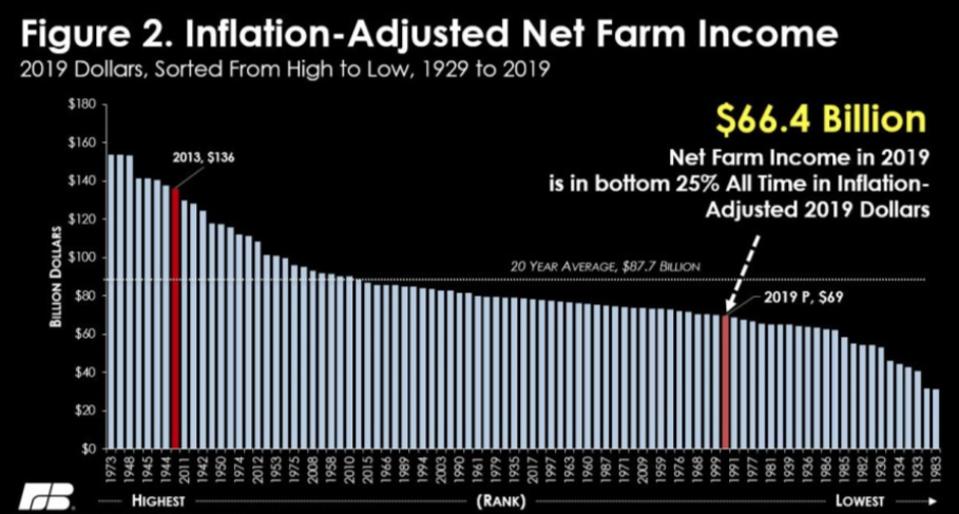

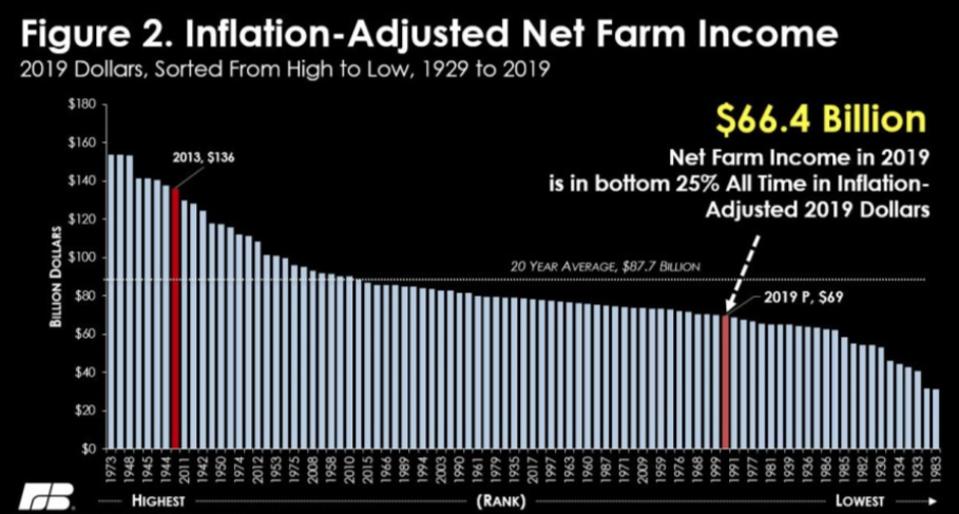

2019 farm income should be in the bottom 25% of the past 90 years

In another report from Newton, his analysis shows that while farm income in 2019 should increase by 10% from 2018, that would put it in the bottom 25% of the past 90 inflation-adjusted years. His analysis also includes direct payments from the Trump Administration’s Market Facilitation Program, and while it is not on the chart, 2018’s was even lower than 2019’s projected result.

Inflated-adjusted net farm income

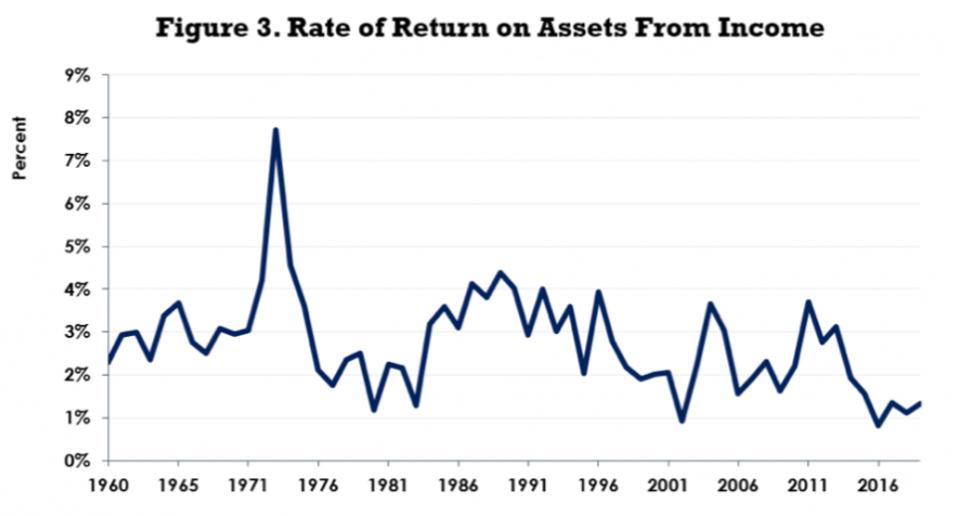

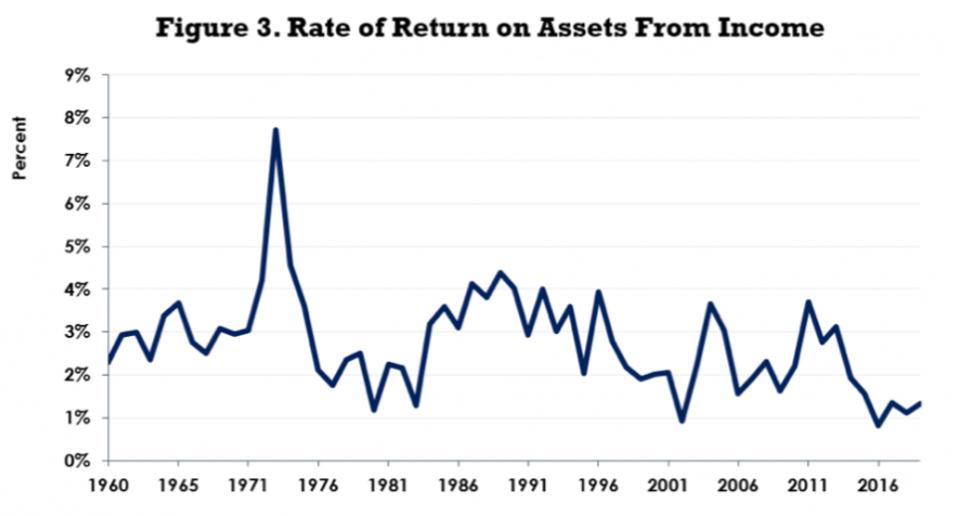

USDA ERS, Farm Bureau AnalysisFarmers live off of thin margins

Farmers have high fixed costs including the land that they own, the equipment they must buy and the seed they need to grow their product. However, their revenue is variable and can change based on factors totally out of their control. The chart below shows farmer’s rate of return on their assets has fallen to under 2% for the past 6 years and for 2019 Newton projects it to be 1.3%.

Rate of return on farm assets

USDA ERS, Farm BureauChina will find other suppliers or grow more crops themselves

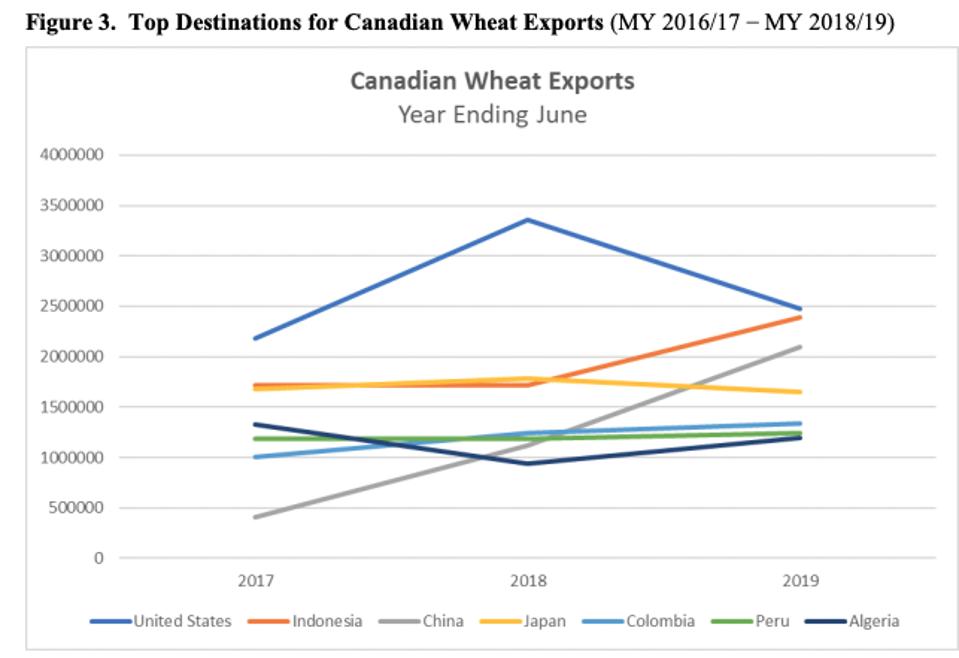

Farmers are probably the first to realize that they will have lost a lot of Chinese market share to other countries or that China will start to grow more of the crops they have been importing. It has taken decades to grow the Chinese market but a significant amount will be lost in just a few years due to Trump’s tariffs and China’s retaliation.

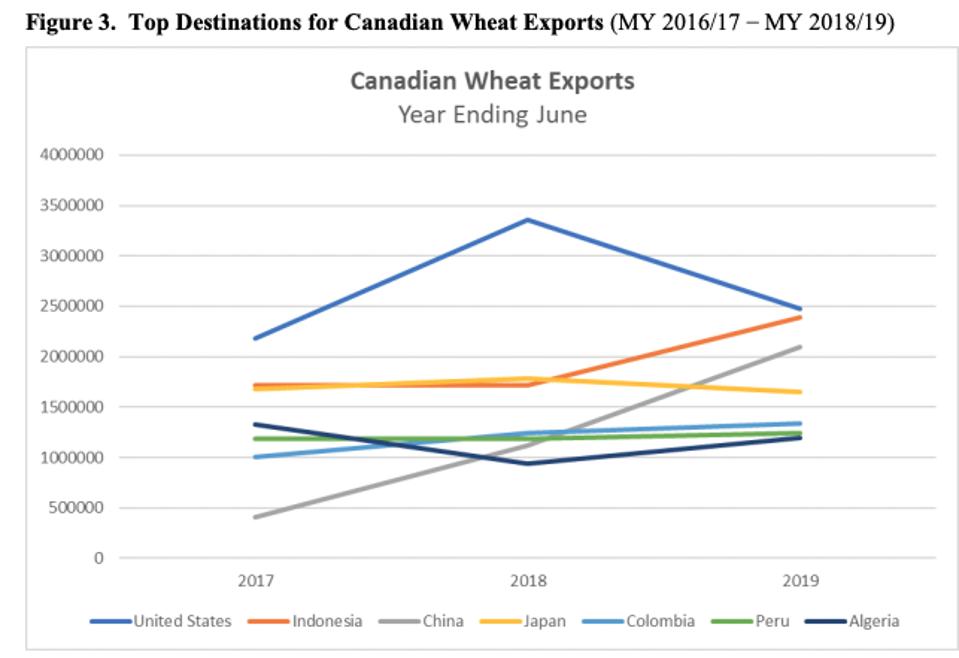

A USDA study shows that Canadian shipments of wheat to China have grown over 400% in two years. The report said, “Canada’s share of total Chinese imports of wheat has rocketed above 60% in marketing year 2018/19, up from 32% in marketing year 2017/18, as U.S. wheat exports to China have plunged and Australian exportable supplies have fallen sharply.”

Top destinations for Canadian wheat exports

USDA, Global Trade AtlasThe Farm Bureau provided these facts.

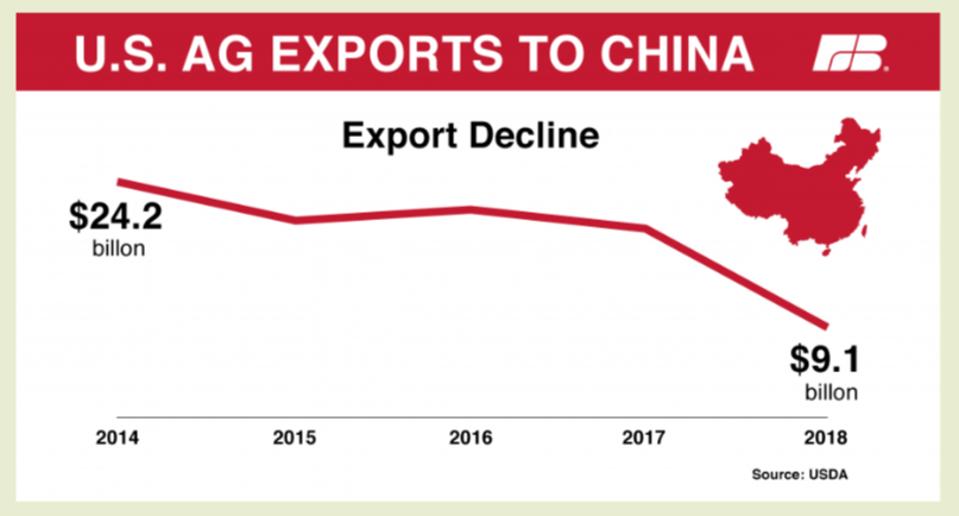

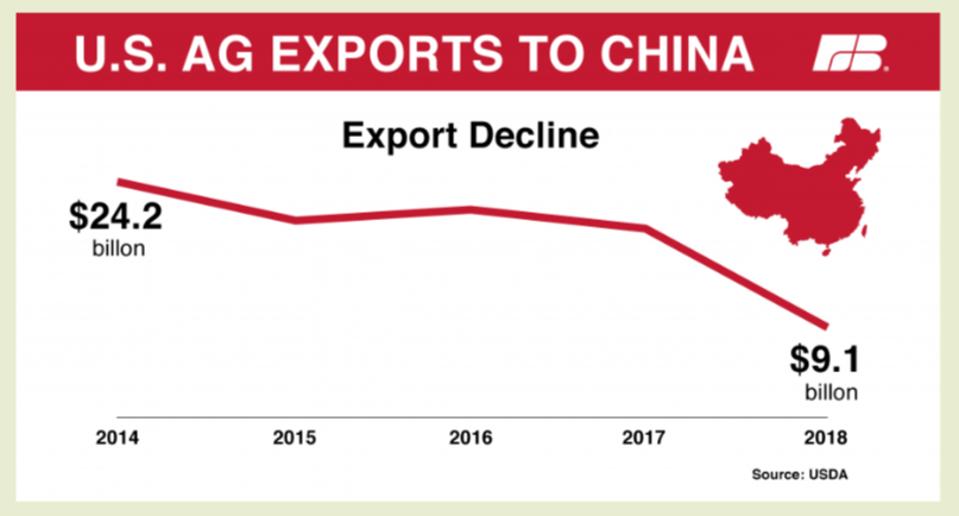

- From 2017 to 2018, U.S. agricultural exports to China fell more than 50 percent, dropping to $9.1 billion

- In 2014, U.S. agricultural exports to China exceeded $24 billion

- From 2000 to 2017, U.S. agricultural exports to China increased by 700%

U.S. agricultural exports to China

USDA, Farm BureauChina will also increase the amount of soybeans it grows itself. It will be difficult to almost impossible for U.S. farmers to find a market for the amount of soybeans that China won’t be buying.

|

|