Great article. Very true...On the economy, here's the un-inversion that Gundlach warned about for the imminent recession signal.

-------

Treasury Yield Curve Un-Inverts: "Seals Fate Of Imminent Recession"

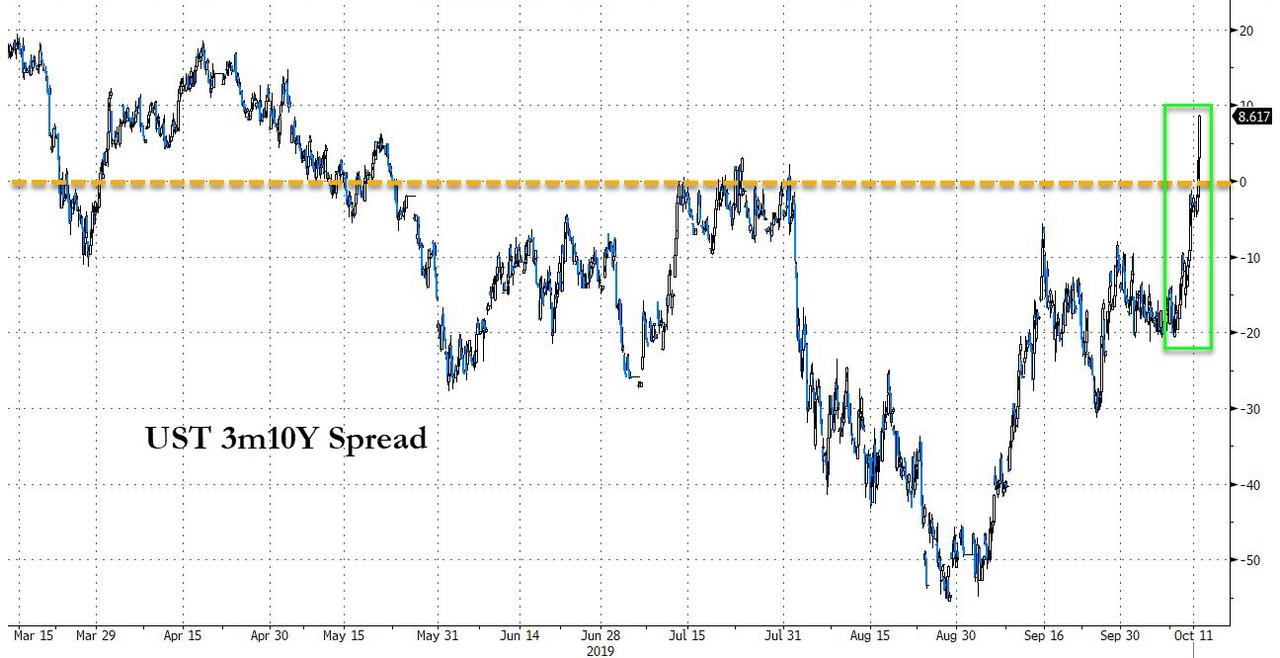

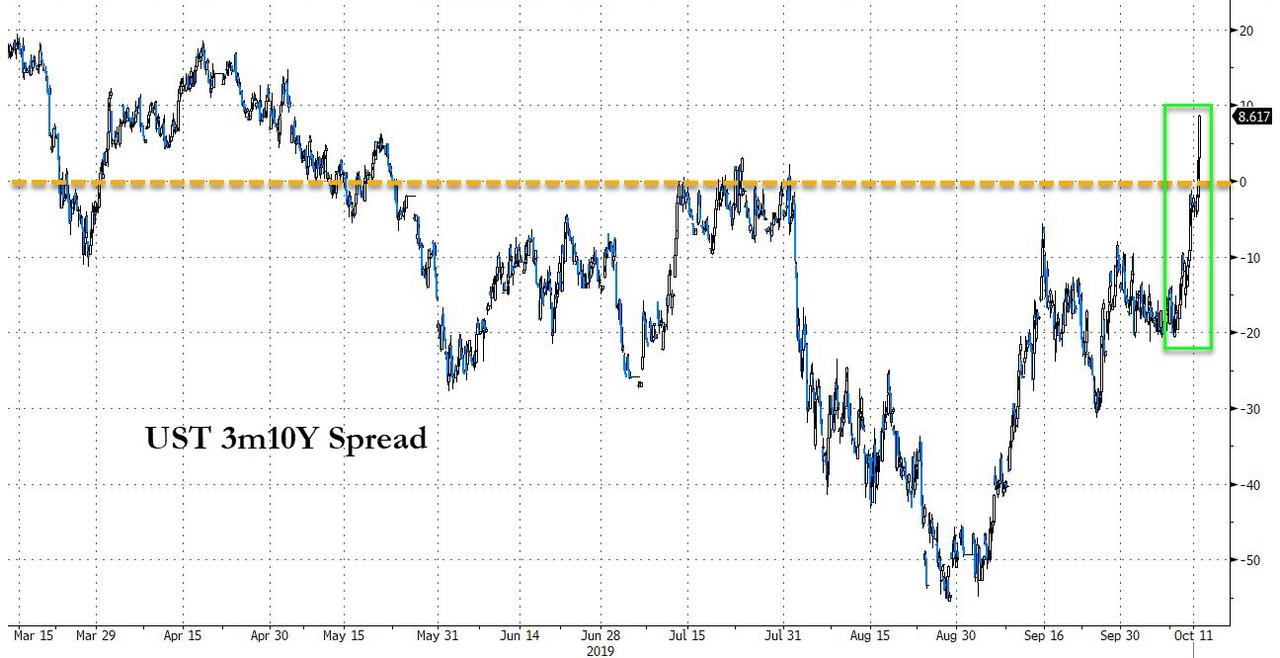

The most-watched, and most-accurate in forecasting recessions, segment of the US Treasury yield curve has - ominously - uninverted.

Source: Bloomberg

At first glance, mainstream media will laud the apparent downshift in fear, but, as DoubleLine's Jeff Gundlach recently noted, added, seeing the yield curve steepen isn't necessarily be a good sign.

- "That would almost seal the fate of recession coming," he said. "It's not so much the inversion - the inversion is a warning that there's one coming. But, you start to get in the imminence category once it first starts steepening out from the inversion, because, by then, the Fed has realized it's behind the curve, the market knows it too, and everybody knows the Fed's going to be slashing interest rates." - Yahoo Finance

Source: Bloomberg

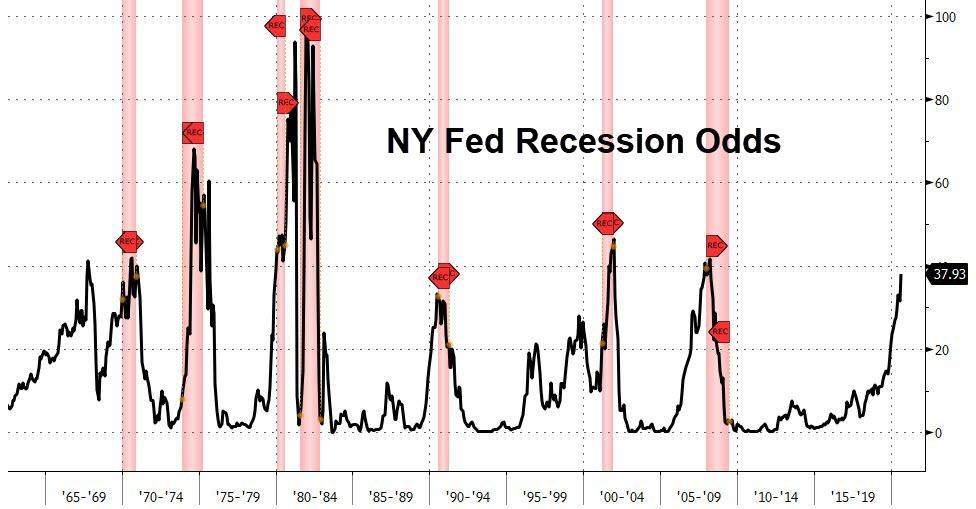

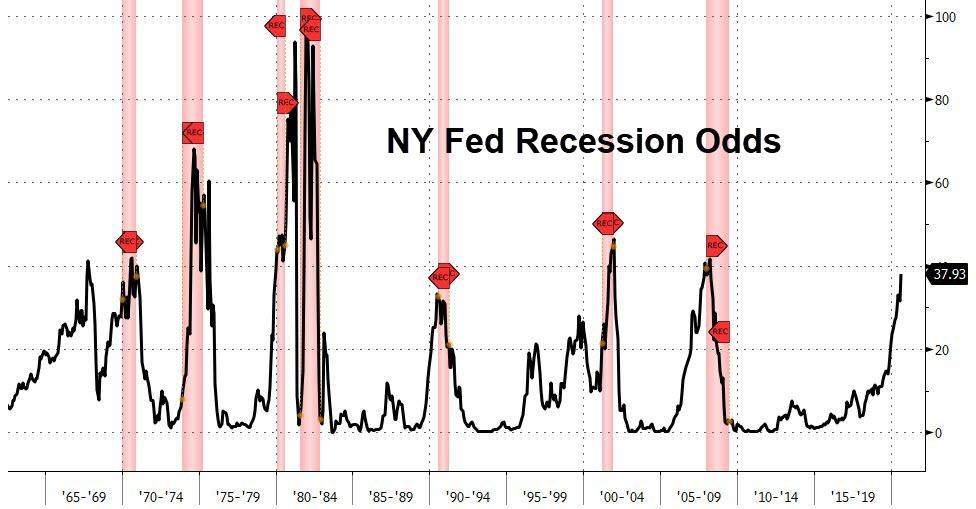

Recession Odds remain at post-crisis highs...

Source: Bloomberg

Get back to work Mr. Powell? Well, as the trade deal looks more imminent (skinny, lite, mini), rate-cut odds have dropped...

Source: Bloomberg |