| | |

Core Gold AGM 4) - Question Period B - Operations

Share Accumulation, 5%

A shareholder asked to what extent bidders are permitted to acquire Core Gold shares. Mark Bailey, Gregg Sedun and Sam Wong replied. Titan has not signed a CA, but would re required to declare if they were intending on gaining a substantial interest, especially over 10%. If understood correctly, once bids are submitted, bidders are typically limited to acquiring no more than 5% of the shares.

Titan and Vertex

August 8 Titan purchased the Vertex debt, per their circular, and September 15 Titan announced that Vertex’ shares had been pledged to Titan for their intended takeover bid. A question that some shareholders have asked: was there a ‘quid pro quo’, for example pledging of shares to Titan in exchange for the assumption of debt, or whichever kind of arrangement? Following the AGM, on October 15 Core issued a release:

“The timing of the Titan Offer is intended to pre-empt the Strategic Review process and is intended to force Core Shareholders to make determination on the Titan Offer without Core Gold having had the opportunity to fully canvas the market and other available opportunities.

“Titan was given the opportunity to participate in the Strategic Review process but declined. The Board of Directors can only fully assess the adequacy of the Titan Offer with the benefit of the results of the Strategic Review."

One ponders what Titan’s bid processes might have looked like, if carried out in a manner more friendly and transparent to Core shareholders. An independent valuation of their assets, cash to shareholders, taking Core shareholder concerns seriously, all would have made a different impression.

Titan’s intentions appear unclear. The process around Vertex appears murky to many. It’s possible that Titan may have had a contractual obligation to bid a second time, or some other as yet unknown motivating factor.

Below - double rows of process tanks.

Ecuador Fuel Subsidies

The government of Ecuador cancelled their plans to end road fuel subsidies, and the protesting groups declared peace.

Mark Bailey and Keith Piggott explained that the mining equipment Core employs already has paid world prices for diesel for a long time; only trucking diesel was in question.

In the press

Chris Temple and Mark Turner both wrote in the past few weeks about their recommendations on Core, if for different reasons. Mark Turner = “Otto” focuses arbitrage opportunity, “up sharply, but the arb left means there's likely more to come. Disclosure: I own a few, won't sell into a 2-handle though.” His reports are available at IKN.

Chris Temple at National Investor has written knowledgeably about Core a number of times, describing its “Cadillac of operations” and highly desirable projects. He also feels:

“... board and present management have buried the hatchet and are jointly looking again at those “strategic alternatives”... “ This is tempting again; because as you know I am familiar with the assets and—as others—consider them to be HUGELY attractive,” .. “... all of the board now seems to be pulling in the same direction.”. Obtain his latest National Investor to catch up.

Below - fresh water is recycled at Portovelo.

Industry Setting

Wood MacKenzie in a September, 2019 article, points out that most gold ounces are being obtained via mergers and acquistions: “We expect to see this trend of increased M&A activity to continue, particularly amongst the more mid-tier gold producers as they look to solidify their own positions in the industry” - “We have, as of late, noticed an uptick in some majors opting to increase their footholds in a select few juniors with promising exploration opportunities” - “Due to insufficient exploration spend, gold reserves have depleted significantly with the global average mine life falling from 16 years in 2012, down to an estimated 11 years in 2018.” Their chart of average mine life is below.

mining.com

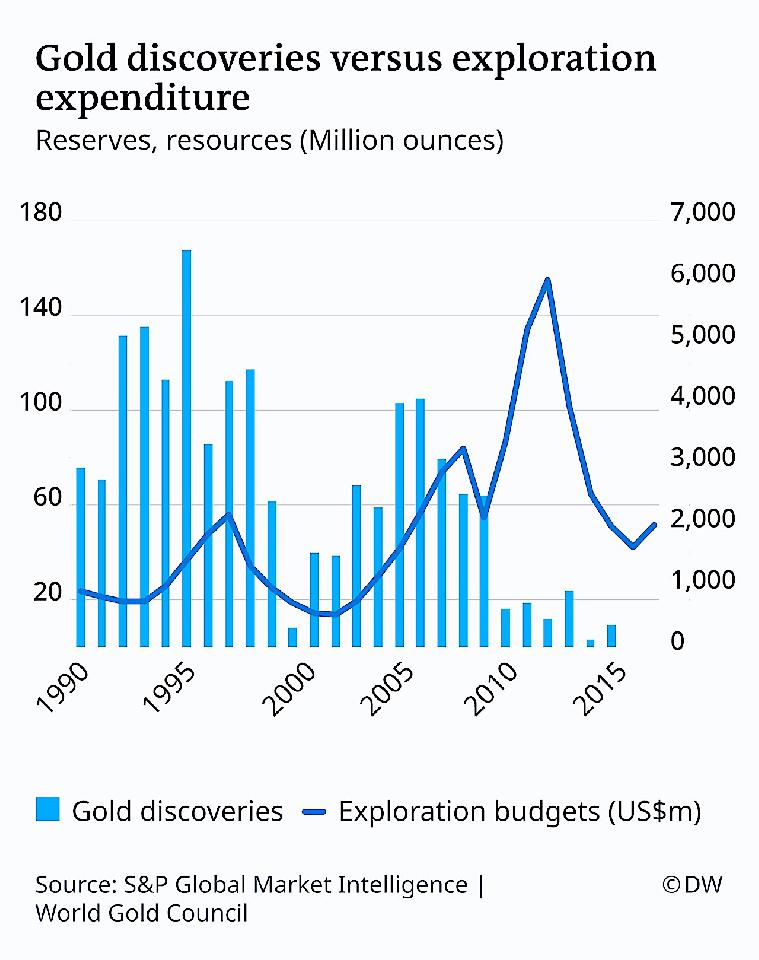

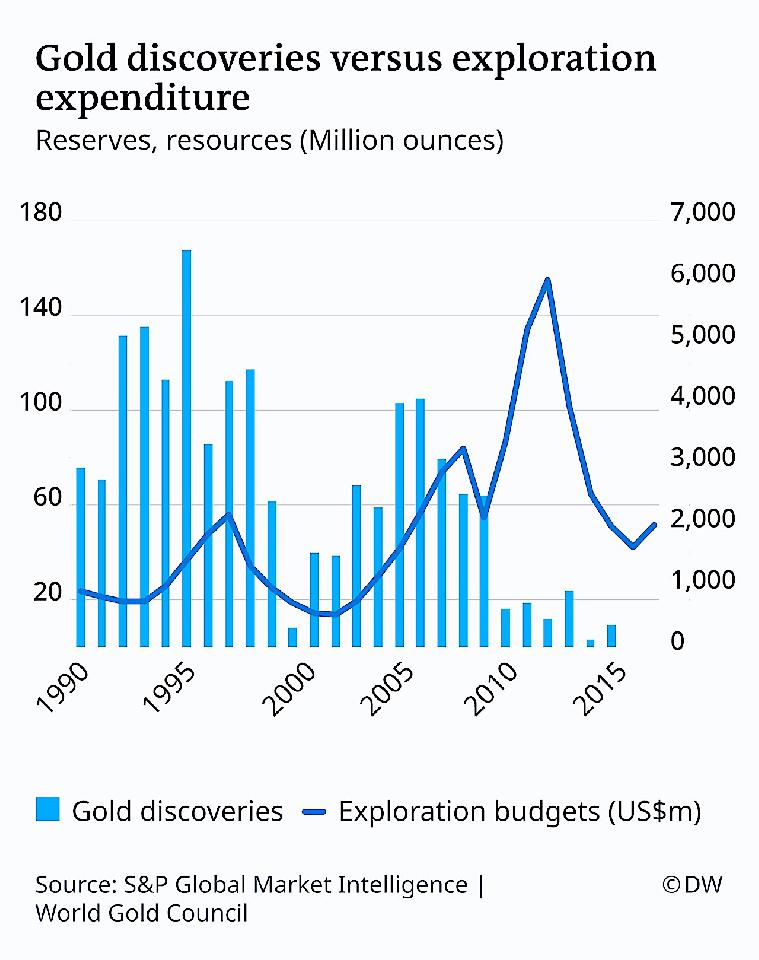

The reserves of gold miners are dwindling strongly. Per an article at dw.com, John Ing at Maison Placements: “The gold miners realize that the prices of companies are at such attractive levels that it's cheaper to buy gold in the stock market than it is to go and explore for it.” Ryan Handley at Laurentian Bank: "Given the lengthy amount of time required to explore, discover, delineate, permit, finance, and build a new mine, merger and acquisition is a much faster way to replace reserves." The average mine grade has fallen from over 10 gram per ton in the early 1970s to around 1.4 grams per ton today, according to Metals Focus, a precious metals consultancy. A link and the chart for the article are below:

dw.com

Strategic Process and Prospects

At the AGM, all parties seemed to arrive somewhat on guard, then gaining a more relaxed pose as it became clear that most everyone is on the same side - wishing true success for Core Gold in its strategic process. Shareholders are happy to have the strategic process they’ve wanted all along, with the hope that there is a level playing field.

Ecuador, only recently opened up for mining is one of the most desirable places on the planet now. Fruta del Norte is staring up, and the junior miner stocks are showing some life. There has been speculation that properly explored, Dynasty with its 6 km strike length could host 10 or even 20 million ounces - additional ounces show up in every 5 meter bench mined.

Core’s assets are located in South America’s geologically riveting “hinge”, particularly dense with ancient magmatic intrusions and gold-carrying thermal systems. Core’s projects are in southern ecuador, with the least political difficulties and the environment friendliest to mining.

The company is in a collaborative mode, cooperating to accomplish a truly worthy strategic push to find the right companies and the right kind of finance - to actually take Core to the next level in a big way. It was refreshing that Core’s latest press release included a link to how to get your shares back, for those few that may have pledged to Titan.

Serious investment will be attracted by a company that is already mining and doing so successfully, uncovering new veins every day, and which offers such great drilling opportunities at Dynasty, Copper Duke and Linderos. Overall, the mood at the AGM indicated that the elevator is going up. |

|