Gold: Jaime Carrasco On Oct. 31, 2018, I discussed on BNN.ca how I was positioning clients to benefit from the wealth transfer that would result from the coming shift in the currency reserve.

My investment thesis was and continues to be that the global economy was reaching many levels of extremes that in the past had proven pivotal to the currency reserve, unleashing a massive opportunity. I argued that these extremes could be best paralleled in the 1930s, because that was the last time the global economy had transition from a shift of the currency reserve. A year later, I'm very happy to report that client's third-quarter results show they’re already benefiting from this shift.

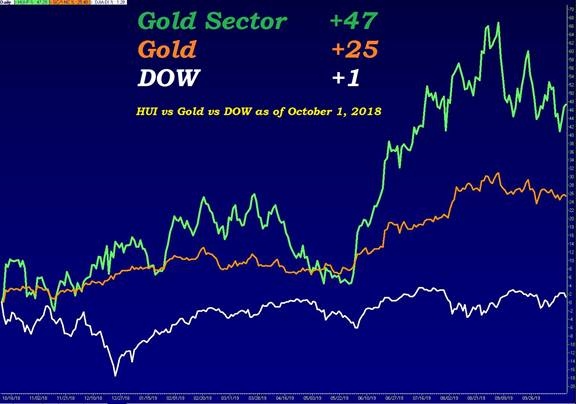

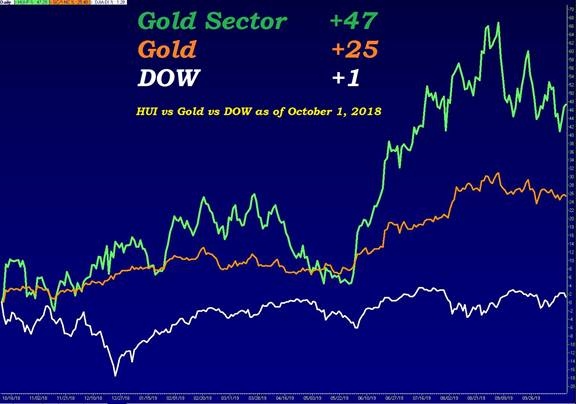

This process can best be seen in the above chart comparing the relative performance of the DOW, gold and the HUI Gold Index as of Oct, 1, 2018. As you can see, gold and the HUI have greatly outperformed during this period. Up to now this first move has only been noticed by those already positioned, but that is about to change once this recent consolidation is finished and gold breaks above US$1,550. In my opinion the break above this level should have greater force than the first leg, as more "smart money" enters the trade. If market trend still apply, this coming second wave will be notable.

Many very influential financial players are warning us that the currency reserve is in transition. This past August Bank of England Governor Mark Carney warned that central banks might need to join together to create their own replacement reserve currency. Likewise, Bridgewater chairman Ray Dalio wrote a great piece reviewing the parallels to the 1930s and their significance to the currency reserve and gold. Just last week, the Dutch Central Bank warned that if the currency reserve fails the world will need gold to reset the system. Considering these warnings, is it any wonder why global central banks have been the biggest buyers of physical gold over the last two year?

These warnings are music to my ears, because they further validate my investment thesis. Accordingly, I continue to advise that investors hold at least a 10-per-cent allocation in the sector while I keep clients’ at 20 per cent.

Tony Dwyer, our chief market strategist, believes that this market has more upside to come. This is a very rational assumption considering the exit of funds out of the fixed income markets over the last year and the new stimulus being applied by the Fed. What this means is that while the market could double again, gold is beginning to rotate as we reach the end of the economic cycle. This move has meant that our allocation in the sector has worked in protecting our portfolios as we head into an eventual downturn.

Jaime Carrasco on BNN.ca Market Call 2nite Wed Oct 23rd @ 1800ET |