Besides the wines that may be mispriced, same can be true of the true sovereign, and someone decided to wager what a cup of coffee might go for in a gold @ 4000 world, relative to what us$ 1.75M buys in coffee today, or something ...

bloomberg.com

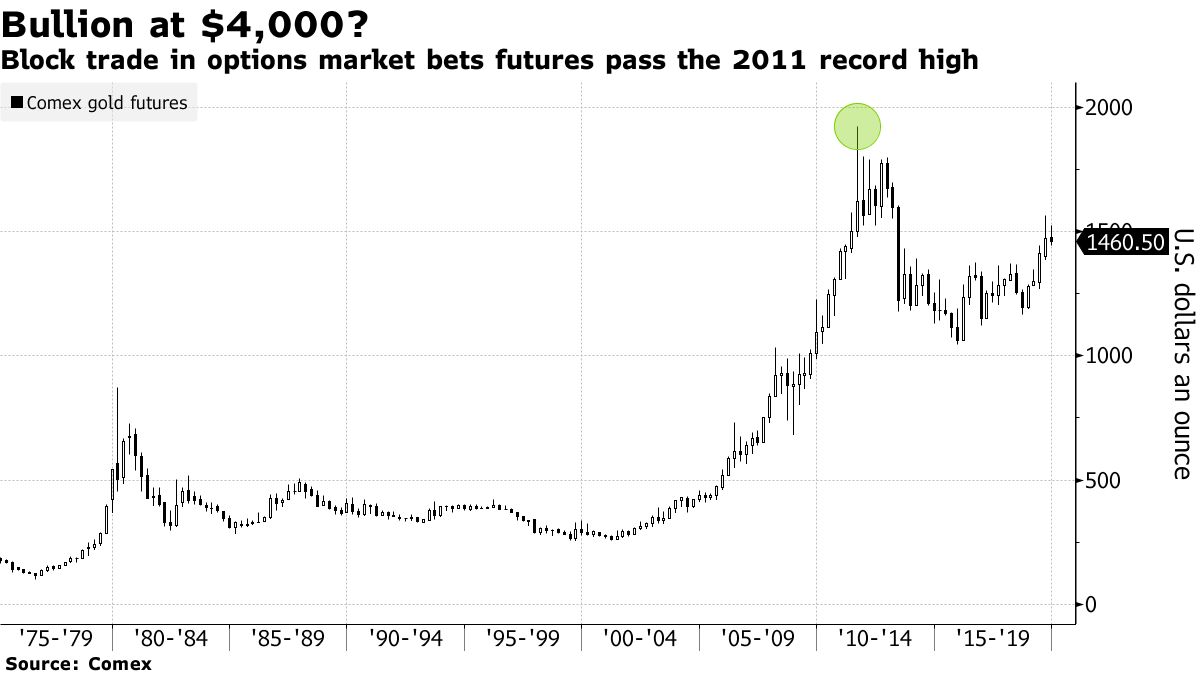

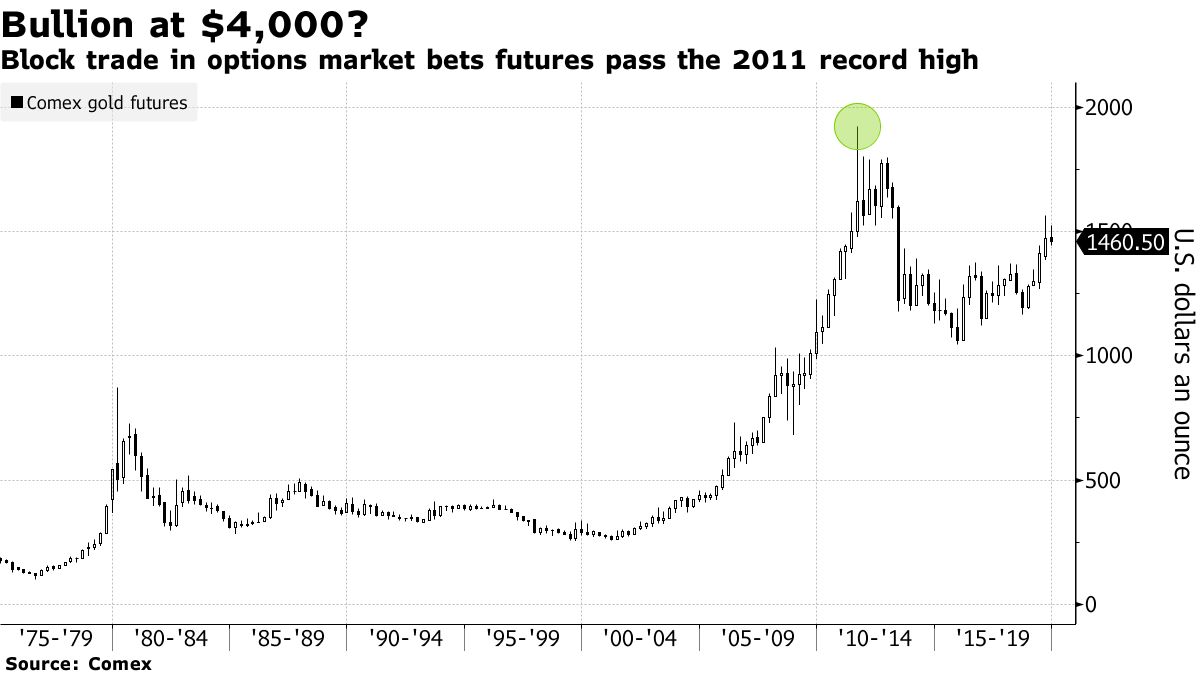

Huge Bets That Gold Could Triple to $4,000 Trade in New York

Yvonne Yue LiNovember 28, 2019, 2:32 AM GMT+8

The gold options market saw $1.75 millionin block trades betting the precious metal could almost triple in more than a year, surpassing the record.

Around noon in New York, 5,000 lots for a gold option giving the holder the right to buy the precious metal at $4,000 an ounce in June 2021 changed hands. The bets were sold at $3.50 an ounce.

“It’s like 18-month term life insurance; what will the world look like if gold is at $4,000,” Tai Wong, the head of metals derivatives trading at BMO Capital Markets, said in an email. “They are hoping for a quick violent move,” he said, referring to the people who bought the call options.

Gold futures climbed to a record $1,923.70an ounce in 2011 as the Federal Reserve bought over $2 trillion of debt to stimulate the U.S. economy. While bullion has rallied 14% this year, the precious metal is still 24% below the current all-time high.

Bullion for delivery in February settled at $1,460.80 an ounce at 1:33 p.m. in New York. Futures for June 2021 delivery, which settled at $1,494.40 on Wednesday, will need to almost triple before expiration to make the call options profitable for its holder.

— With assistance by Michael Roschnotti |