Re << Bull Markets Last Much Longer Than You Think >>

... it ought to be right, probably is, already at least so far for sure, and this time, given the manipulated bull, and artificially comatose-d bear, the bull particularly extended.

when the bull breaks, and it must at some point, expected or not, the bear may be singularly nasty

given the lack of outs in a bull-of-everything, one item stands out ...

the item is constricted in supply and in availability, for the planet, at 2 swimming pool's volume

very interesting in an interest-less situation

it would be noteworthy as and when the Swiss National Bank accumulates gold by issuing negative interest rate money. It has already been doing so accumulating shares again NIRP paper money. Amazingly, no one cared.

bloomberg.com

Goldman Says Case to Diversify With Gold ‘as Strong as Ever’

Yvonne Yue Li

7 December 2019, 04:27 GMT+8

Goldman Sachs Group Inc. said investors should diversify their long-term bond holdings with gold, citing “fear-driven demand” for the precious metal.

“Gold cannot fully replace government bonds in a portfolio, but the case to reallocate a portion of normal bond exposure to gold is as strong as ever,” Goldman analysts including Sabine Schels said in a note Friday. “We still see upside in gold as late cycle concerns and heightened political uncertainty will likely support investment demand” for bullion as a defensive asset.

The precious metal climbed to a six-year high in September as the Federal Reserve cut borrowing costs and the total pile of debt yielding less than zero climbed to a record $17 trillion, boosting the appeal of non-interest bearing gold.

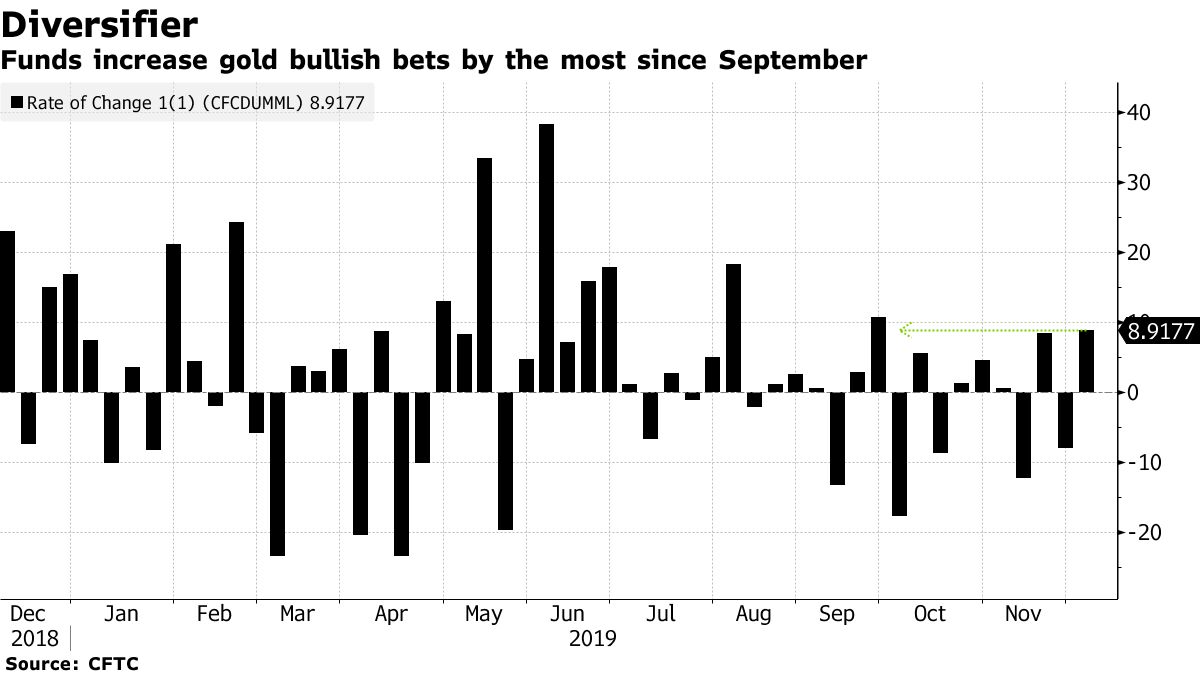

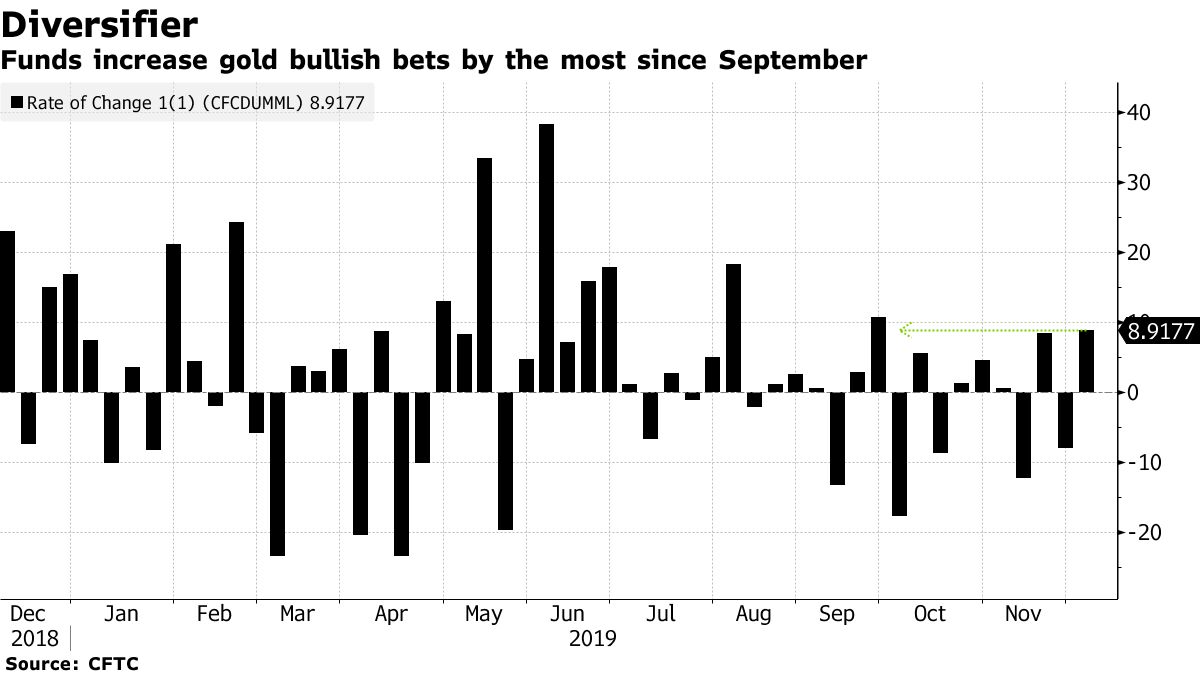

Hedge funds and other large speculators boosted their bullish bets on the precious metal by 8.9% in the week ended Dec. 3, government data showed Friday. That’s the biggest gain since late September.

Gold has fallen more than 6% from the peak to close at $1,460.17 in the spot market Friday.

While Goldman said the correction on bullion prices has further room to run, the bank is still sticking to its forecast prices will climb to $1,600 over the next year.

— With assistance by Marvin G Perez

(Adds hedge fund position in fourth paragraph.) |