the msm wants us to believe gold is not moving for reasons other than being cheap

buddies believe ultra-ramp shall happen starting 15th of January

bloomberg.com

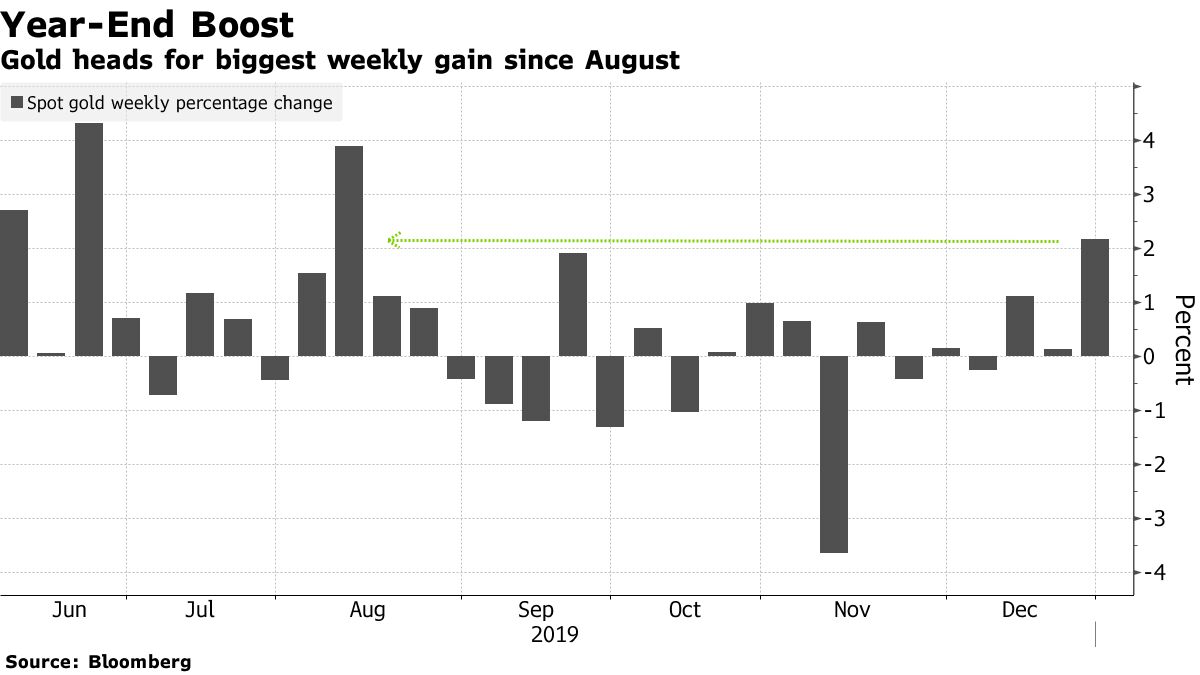

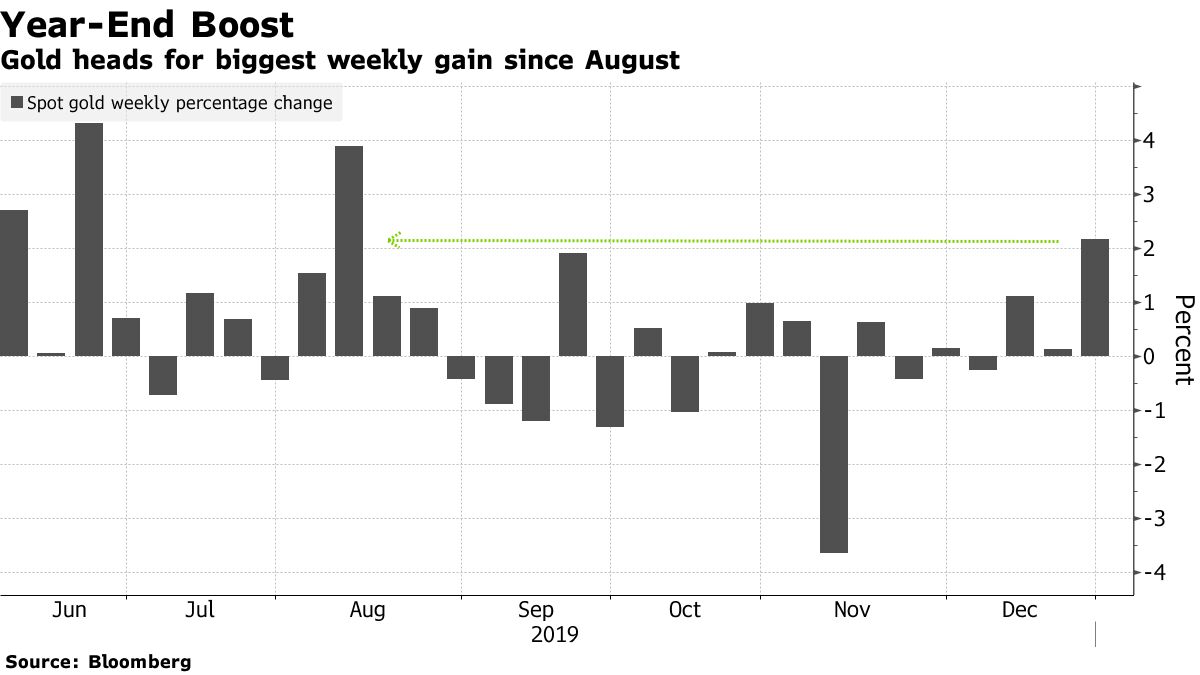

Gold Heads for Best Week Since August as Rally Gathers Pace

Ranjeetha Pakiam27 December 2019, 14:50 GMT+8

Gold is heading for its biggest weekly advance in more than four months as it powers toward its best year since 2010.

Bullion held near the highest in seven weeks on Friday, with its late-2019 rally coming even as Asian equities rose, U.S. benchmarks notched fresh records and U.S.-China trade concerns eased.

The precious metal is up 18% this year as central banks reduced interest rates, and the to-and-fro between the U.S. and China over trade boosted demand for havens. The Federal Reserve has signaled it would keep interest rates on hold through 2020 following three cuts this year, and a gauge of the dollar has erased its annual gains.

“A weakening dollar helped to propel precious metals prices but this single factor is insufficient to explain a jump like this,” Margaret Yang, an analyst at CMC Markets Singapore Pte., said in a note. “Bargain hunting is probably a better justification as gold looks for a technical rebound after three-month consolidation.”

Spot gold retreated 0.1% to $1,509.42 an ounce at 2:23 p.m. in Singapore, after touching $1,514.09, the highest intraday level since Nov. 4. It’s up 2.1% this week, the biggest gain since the period ended Aug. 9. Prices peaked at $1,557.11 in early September, the highest in more than six years.

In other precious metals, spot silver fell 0.5%, while palladium advanced 0.3% and platinum rose 0.2%. |