You might be right! If the bubble pops and jobs slow in the innovation sector, then all those innovation cities will become VERY unaffordable even for the well-healed millennials. Then the exodus to suburbs and exurbs could accelerate. Here's an article on the Bay Area...which gets me back to my theme: in the long term, I think innovation jobs in the top innovation cities like San Fran and Boston will continue to drive housing prices higher in those cities, but in the short term there just has to be a correction. Everything is too frothy, including real estate, stocks, and bonds.

-------

Home Prices Stall In Bay Area After Seven Year Tech Party

Despite all the new wealth created by tech IPOs in 2019, home prices in the Bay Area are stagnating at potentially dangerous peaks.

According to real estate firm Compass, the median price of a home in San Francisco rose 1.3% Y/Y to $1.6 million, the smallest growth since 2012.

Compass said the median price for homes in Santa Clara County, which includes San Jose, Santa Clara, Cupertino, Palo Alto, Sunnyvale, Stanford, and Santa Clara, collectively saw 6% declines to $1.26 million.

Last spring, CNBC was drumming up the narrative that tech IPOs, including Uber, Slack, Pinterest, and Zoom Video Communications, would boost the housing market with new buyers. However, many of the IPOs went bust last year and didn’t create a new buyer pool as home prices are at danger of reversing from record-high levels.

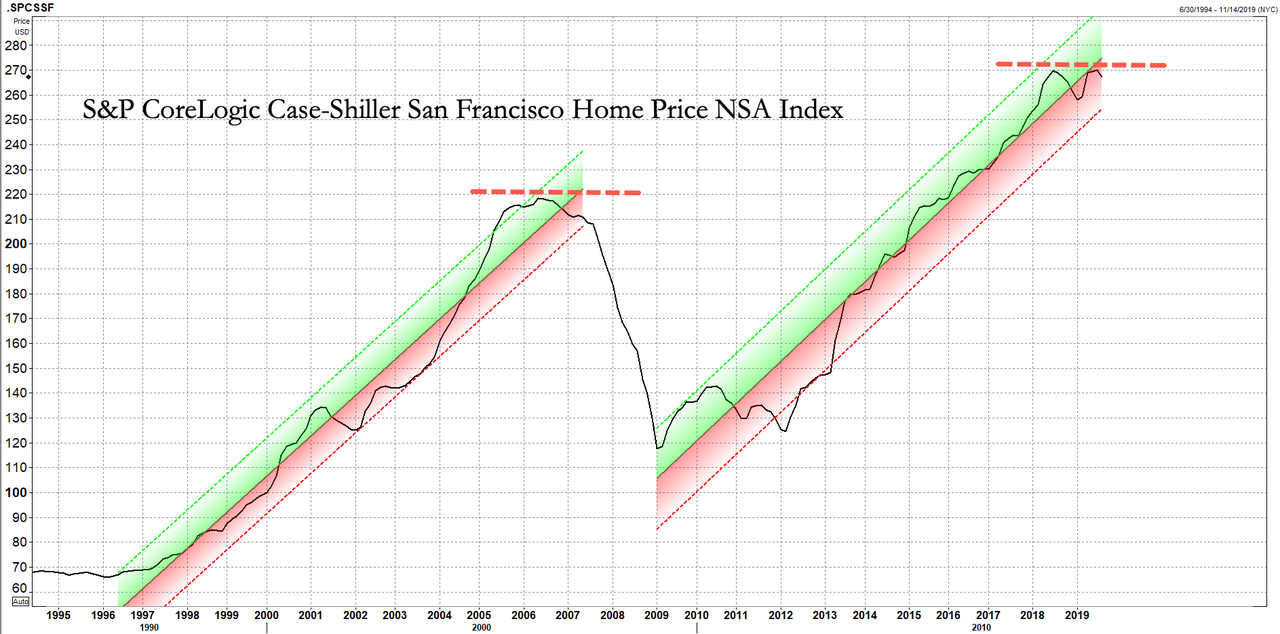

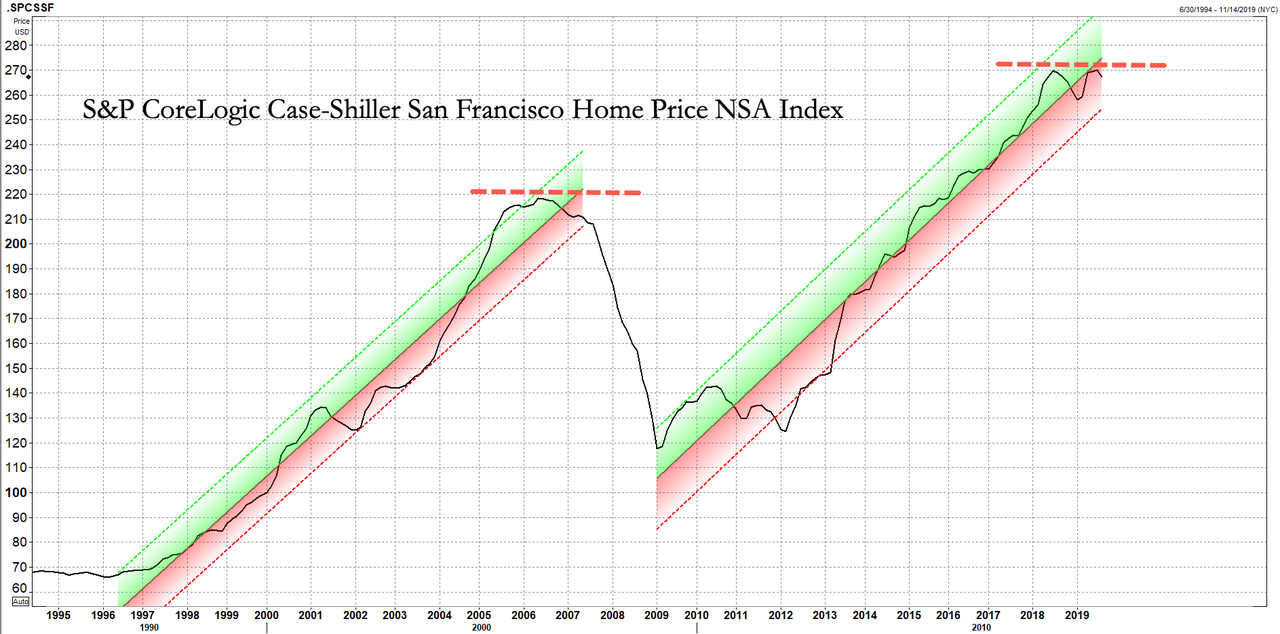

The S&P CoreLogic Case-Shiller San Francisco Home Price NSA Index shows that the average change in the value of the residential real estate in the region has been slipping since July 2018.

After a seven-year tech party and the Federal Reserve injecting obscene amounts of liquidity into the market to fuel bubbles -- it seems that Bay Area home prices could have hit a structural high. This means a correction could be nearing. |