Besides lobbing munitions at higher strike prices and from further-away time-distances, am also engaged in high-intensity armored encounters at near-money / very-near-expiration distances to extract infantry ensnared in house-to-house combat ... think saving private Ryan

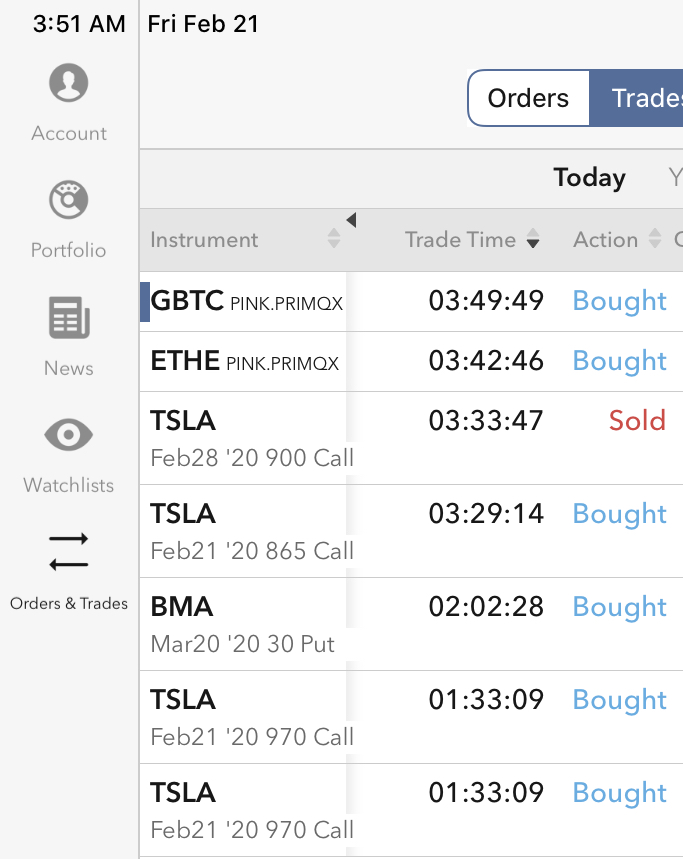

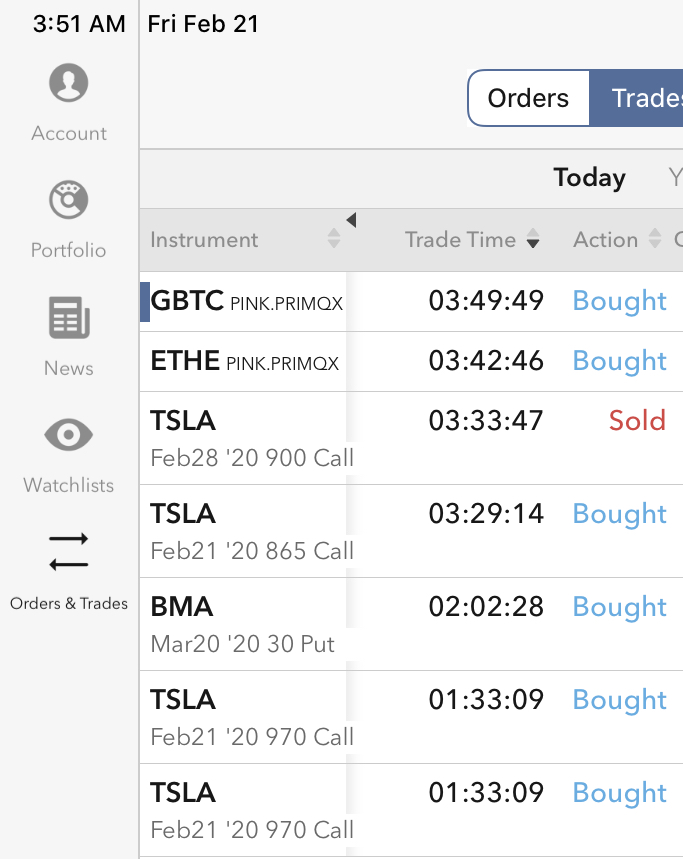

Did below ...

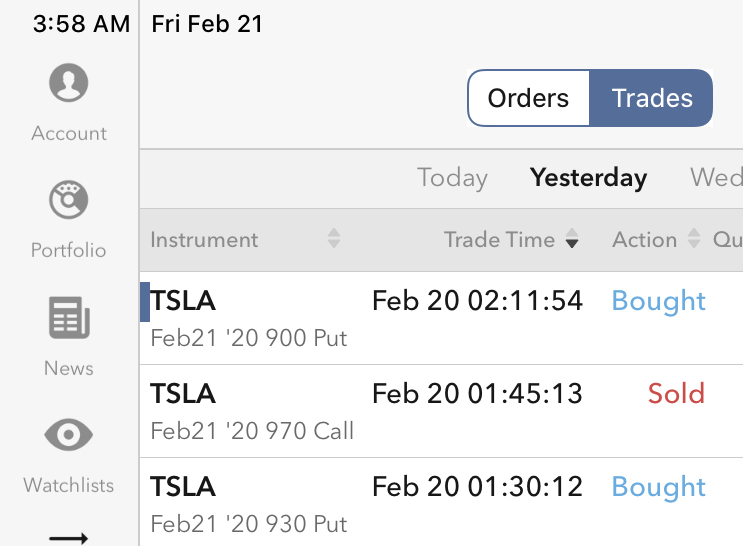

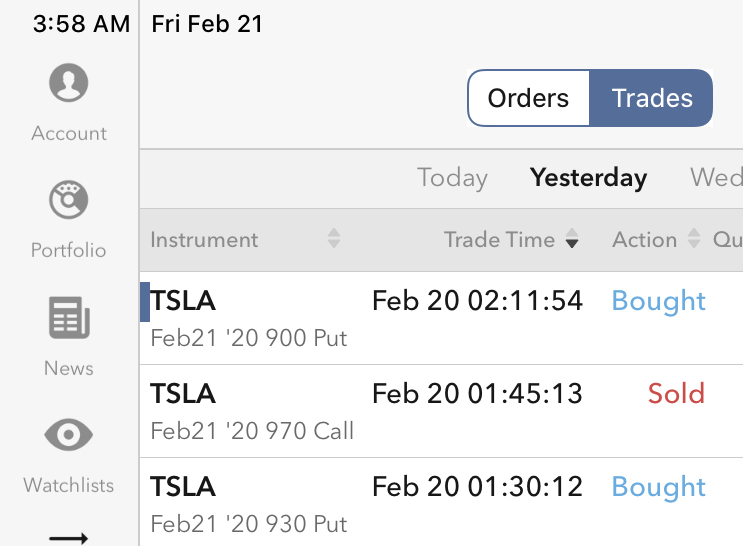

(1) bought back TSLA Feb 21st Call Strike 970 at 0.61, which I shorted yesterday at 7.59, a ten-bagger, given that am unwilling to hold for another 24-hrs for the sake of extra 0.61 on a 7.59 trade.

(2) bought back finance.yahoo.com BMA Mar 20 Put Strike 30 at profit, to reduce clutter in mind, and to satisfy twitchy finger

(3) bought back TSLA Feb 21 Call Strike 865 (in the money) at 29.40, and

(4) offset-shorted TSLA Feb 28 Call Strike 900 (near-money) at 36.05 to not let go of net cash

(5) the above actions would be unlikely (to have chance to do, and to work) in a low volatility arena

(6) bought ETHE finance.yahoo.com based on your post, and whilst doing DD on ETHE, saw GBTC finance.yahoo.com so bought that as well.

No idea what either does, but believe as long as gold remains dirty cheap, both should at least hold some value until final boom or kaboom.

Both should halve and should double at some stage, for usually am neither lucky enough to pick the bottom nor unfortunate enough to hit the top. I shall consider selling when doubled, and shall go into denial when halved. DD completed.

Both are essentially close-to-free options on a whole lot of stuff, and options are good. Pity neither features options - I guess “options” on “close-to-free options” would be “near-futures”.

(7) Re << Wish I could turn back the clock for myself or that the power of compound interest had been drilled into my hormone-addled brain when I was in my 20s.>>

Do not be in haste. I am still regretting saying to then-new prospect Yvonne, “no, i do not have any plans for lunar new year vacation, but i do not want to spend too much money”. Am sure the hormonal buildup did not do me any good in the then short term, and not much good in the long term. It was a lose-lose prioritization, for the Yvonne never offered to go on joint holiday trip again, and the money I saved by not going probably lost many times by any number of foolish ways.

|