Article by a blogger about a few stocks including WDC. I normally don't post links to blogger articles, but this guy seems to be more competent than most.

Link: seekingalpha.com

Here is the pertinent excerpt:

Western Digital The stock has fallen more than 27% from its February highs to the lowest trading point in the correction so far. Supply and demand are contingent on China's ability to assemble computer hardware, and the primary affected side of the equation is supply - as the assembling of parts is needed to deliver an end product to consumers and clients. However, Western Digital does not have a fab in China but instead locations in Taiwan and Malaysia, with a recent joint venture with Toshiba located in Japan. As far as supply goes, Western Digital is outside the critical area of relying on Chinese permission to go to work. Of course, this passes over the need for wafer supplies and equipment. However, this is not in severe jeopardy as Taiwan is one of the top suppliers of raw materials as well.

Demand is where things become unclear, similar to Apple's situation, but further up the chain. The risk remains in the category of Western Digital's HDDs and SSDs waiting to go into products that are assembled in China. If workers in China are not operating at 100%, this means a back up of product and revenue. Offsetting this risk slightly is the lean inventory producers have returned to after a digestion period among clients last year.

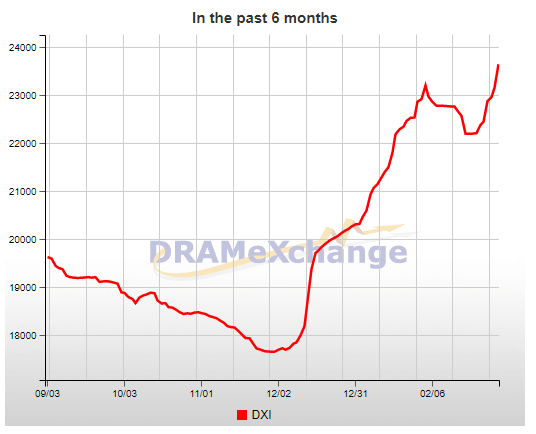

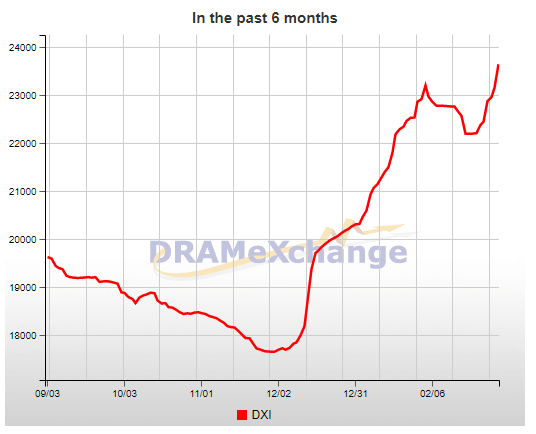

Supply is not constrained, but if demand is lacking, then product sits waiting to be sold. But we can look to the tell-tale sign of DRAMeXchange's DXI to understand if prices are falling as lower demand or increased supply results in lower prices. If they are, we know the supply-demand balance has moved toward near-term oversupply.

(Source: DRAMeXchange.com)

After a brief blip in the first half of February, the rest of the month has turned around. It seems the net result is a continued tight supply-demand chain. Of course, this is a DRAM specific tracking resource, but NAND is crucial in many of the same components DRAM is so it works to follow the other when immediate information is scarce.

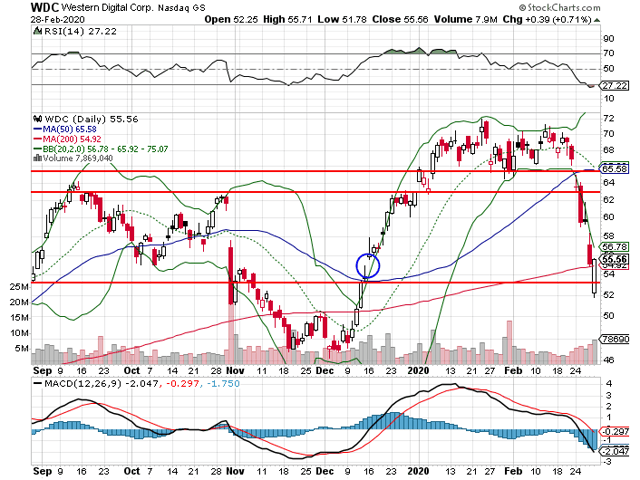

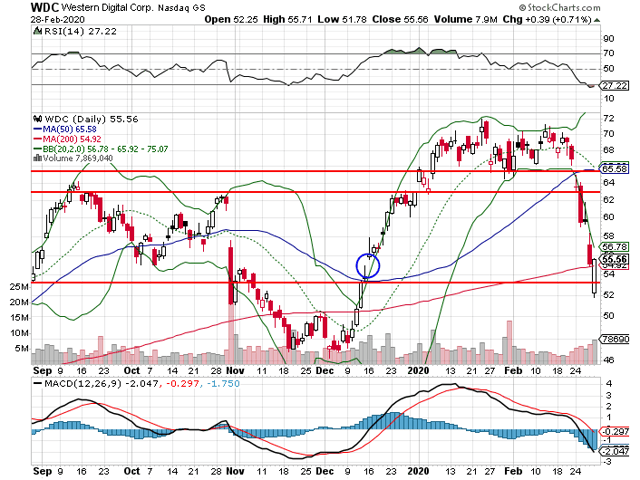

On the chart, the stock closed a gap from December and has created two new down gaps, which are suitable for a move back up toward them.

The Friday close showed strength at two support levels and wound up closing above the lowest support level (bottom horizontal red line) and the 200-day moving average. Additionally, the stock is outside the lower Bollinger band and typically likes to move back inside of the bands sooner rather than later. At these levels, I had added and will continue to add to the position in WDC I started when it was in the mid-to-high $40s. The dividend yield of 3.6% also plays a factor in creating a bottom in shares.

********************************************************************************************************************************

UWG |