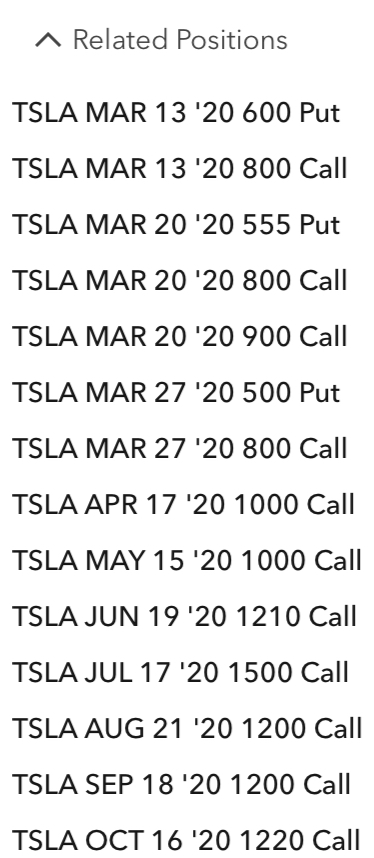

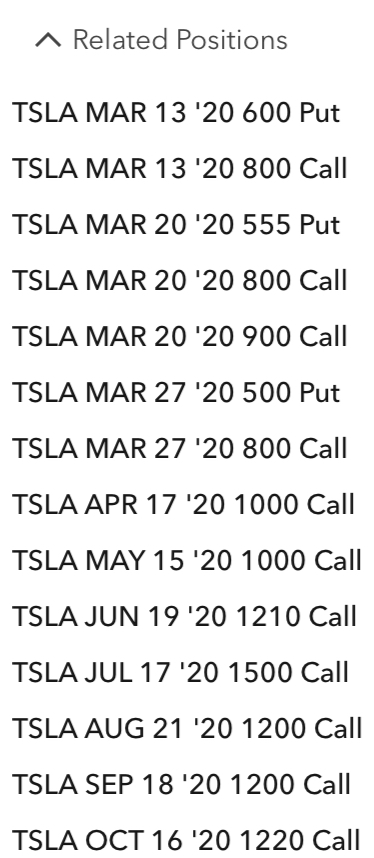

Completed my hand of short TSLA options for March (13, 20, 27th), pincer movements, phalanx-ed, modulated by timing of impact.

Now we wait to show dealer cards when expiration dates arrive over the months.

Am sort of backstopped by the rest of the short options going out to January 15th 2021 (not show in table as needed to show the related positions before that date)

In theory, should TSLA crash below my put strikes in March, the longer dated short calls would react positively and in phalanx formation, offsetting the negative impact on the layered puts, enough to afford opportunity to trade out, and

Should TSLA zip up through the call strikes in March, the shorted March puts should become worthless, and I get opportunity to increase longer term short Call positions for a better tomorrow.

In for a penny in for a pound, over a few short weeks, and within slaughter zone of 500 - 800, safe-enough in era where nothing is safe, especially when wagering against a religion on the one hand, and a viral pandemic on the other hand.

Hopefully survive March in good form, and then onward to wet-work for April. It was good that February was a winning month against Tesla, to cushion possible negative kinetics.

Also, had earlier shorted Puts on GLD, March 27th, 151.5 and 155 strikes. Not willing to buy immediately but wanted exposure, else feel left out. Am mindful of Armstrong admonition.

|