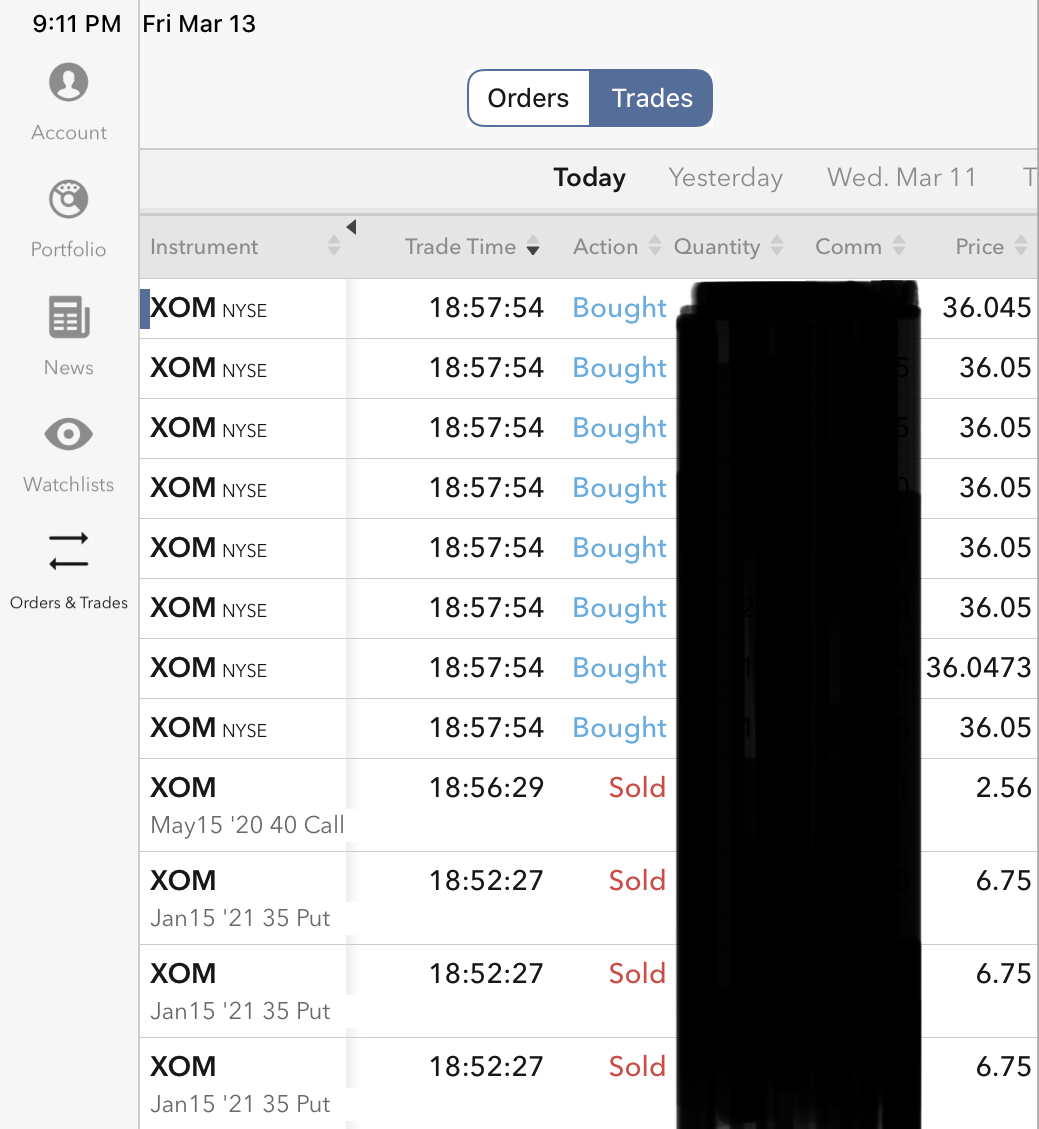

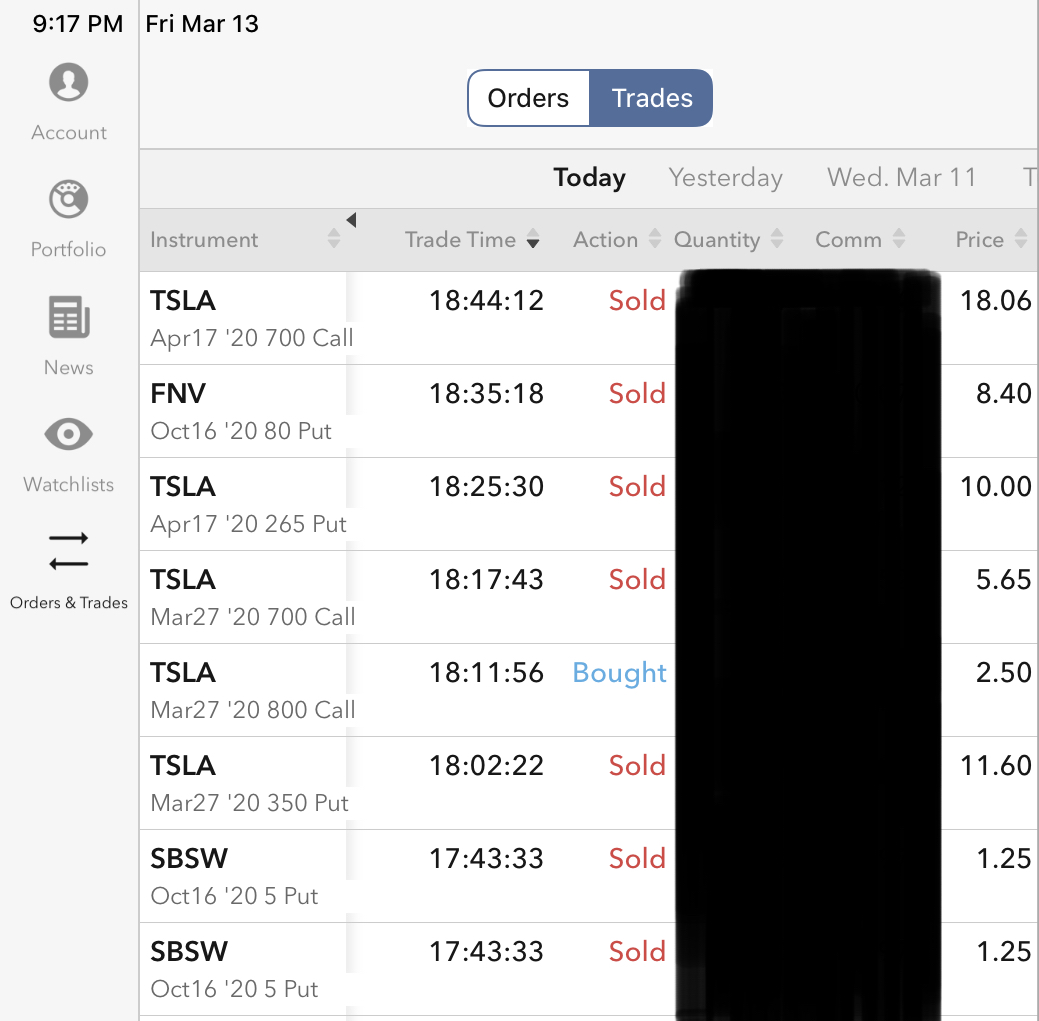

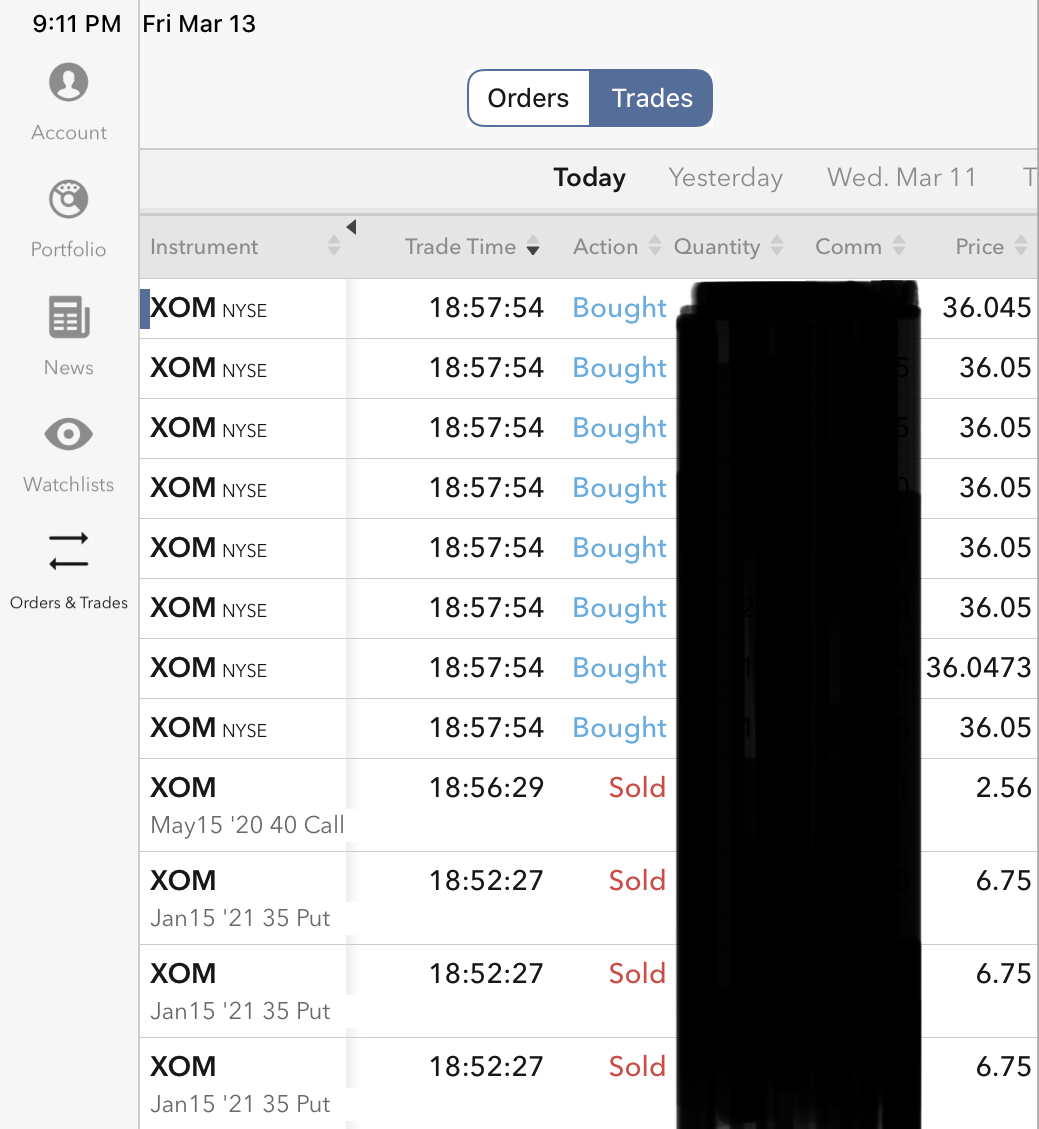

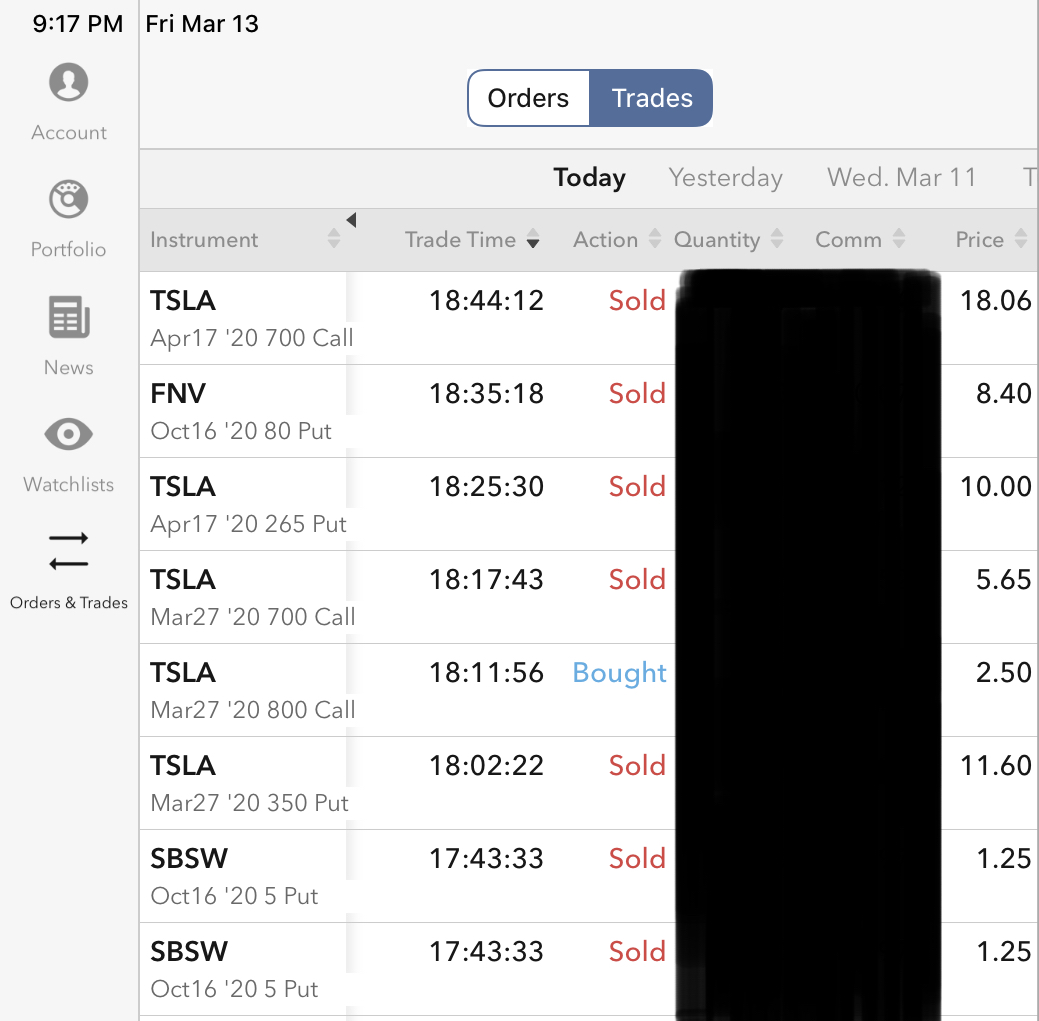

Hold DRD, at loss, and added to stake by issuance of DRD Puts, now also at loss, and this night added to stakes XOM, TSLA, anti-TSLA, FNV, and

SBSW which controls DRD, with a broader metals portfolio and livelier options market.

Nice thing about DRD is that it has two governance structures to comply w/, that of DRD Board, and that of SWSB Board.

Tried to sell puts on DRD but even when I offered below bid I could not get the deal done - iow, the market for less visible shares is broken, and if so, means the pricing for DRD itself is likely mispriced.

Believe folks want dollar, and not gold.

The market is broken.

Fairly convinced I want to go the other way on DRD, a bank backed by gold tailings, and paying very respectable dividends. Happy to add more. Happy to short TSLA calls to help finance purchase of DRD by direct purchase and shorting puts.

People now rushing into dollars because they have to / must, per dire imperative, even as they suspect, correctly, that dollar / cash is a trap / ambush.

When trap is sprung, watch out.

I am choosing to get to where I suspect the market heading to, as opposed to where the market is for now bum-rushed towards.

I may turn out to be wrong. I like to learn what narrative gets me to be wrong. A company specific issue might be, but unlikely given that the entire market is vortexing down indiscriminately. DRD is just another boat amongst an ocean of sinking crafts.

Should the market fail to recover, empires shall fall. Too early, since we are not yet at 2026 / 2032.

|