Discovered that ruminating over crypto takes as little time as would over gold, just less fun, because whilst cryptos do not appear useful, sounds useful, albeit mysterious, and always best left to the market to think about and express in pricing

Am glad they recovered to above buy points Message 32652457

This day’s crypto news, cyber fresh

Biggest Winner in Crypto Crash Is Most Controversial Coin

Bitcoin’s Ethereum Rivalry Could Be Assuaged With tBTC Bridge

Cryptocurrencies Index Flashes First Buy Signal in Three Months

Have few ideas on any of above, but intend to learn how these virtual-objects trade.

bloomberg.com

Biggest Winner in Crypto Crash Is Most Controversial Coin

Olga KharifApril 1, 2020, 6:32 PM GMT+2

LISTEN TO ARTICLE

With most asset classes hurting during the coronavirus pandemic, one cryptocurrency has emerged as the biggest winner in that sector: The token known as Tether.

While crypto bellwether Bitcoin’s market capitalization has shrunk 37% since mid-February, Tether’s increased by 38%, or nearly $2 billion, according to researcher Messari.

For years, Tether’s most well-known version has been promoted as being pegged to the U.S. dollar and as a conduit for doing transactions with little price volatility. That cash-like equivalency of the so-called stablecoin has become even more apparent to crypto investors when the value of most other digital coins tumbled.

“The world has been piling into dollars, and it just so happens that stablecoins are among some of the most unencumbered dollars you can obtain, outside of the financial system,” said Nic Carter, co-founder of crypto market tracker Coin Metrics.

Most of the time, each Tether is roughly equivalent to $1, though the manner of issuance isn’t transparent. The private company incorporated in Hong Kong behind Tether has said that it creates tokens based on customer demand.

Over the past year or so, the company has also started issuing Tethers on a variety of digital ledgers, making it harder for researchers and authorities to track them.

“Anecdotally, some non-U.S. traders have told me that they actually prefer the more lightly surveilled Tether because they feel that it’s less likely that their coins get arbitrarily frozen for violating the terms of service,” Carter said.

Following international and government mandates, many crypto companies updated their terms of service to require users to verify identities. Tether says its users also have to adhere to know-your-customer requirements.

“We can’t predict if the trajectory will remain the same, but the current interest gives us confidence in further steady growth of Tether’s monetary base,” Paolo Ardoino, an executive at Tether-affiliated crypto exchange Bitfinex, said in an email.

Tether and related companies, including Bitfinex, have long lived in the legal cross-hairs. Last year, New York Attorney General Letitia James went after Tether-related companies, claiming they hid a loss of about $800 million of comingled client and corporate funds. Bitfinex has appealed an August ruling ordering the company to face the claim. The companies argued the case in front of an appeals court in Manhattan in early March and are awaiting a ruling from that is likely to come within months.

While Tether claims to be backed by reserves of fiat, those reserves have never been verified in a public audit, and a past legal filing revealed that the coin is only partly backed by cash.

A slew of other stablecoins -- those that also try to barely fluctuate compared with the dollar -- have benefited from Bitcoin’s rout as well, though they remain much smaller in total capitalization. USD Coin, supported by Coinbase Inc. and Circle Internet Financial, has seen demand grow 60% in the past month, according to Circle Chief Executive Officer Jeremy Allaire. Another regulated stablecoin, Paxos, rose as well.

As more investors get into stablecoins, that could increase the cryptocurrency market’s volatility, said Sid Shekhar, co-founder of market tracker TokenAnalyst.

“The more Tether there is in existence (and specifically the more sitting on exchanges), the more there is opportunity for sharp swings in price as traders can immediately buy in (or sell out) as opposed to the slower process of converting sending and fiat into crypto,” Shekhar said. “This naturally lends itself to increased volatility.”

Tether’s growing importance could also dim the prospects of other coins, such as Bitcoin.

The computing networks that support the networks are also paid mostly in Bitcoin or Ether. If everyone is using Tethers instead of the coins they are paid in, fewer computers may be willing to lend their support.

“I’d say what it means is that the dollar is gradually becoming the native currency of some of these public blockchains, to the possible detriment of their ‘native’ currencies,” such as Bitcoin, Carter said. “If native currencies lose their appeal as transactional media and collateral, then the security of these networks may be impaired.”

— With assistance by Chris Dolmetsch

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

bloomberg.com

Bitcoin’s Ethereum Rivalry Could Be Assuaged With tBTC Bridge

Matthew LeisingApril 2, 2020, 7:00 PM GMT+2

LISTEN TO ARTICLE

For almost as long as there have been digital currencies, a rivalry has existed between Bitcoin and Ethereum. Now, a project called tBTC is seeking to forge a truce between the two by allowing Bitcoin owners access to the financial applications that run on Ethereum.

The idea is to let Bitcoin users turn their coins into tBTC, a token that can run on the Ethereum blockchain, allowing them to use tBTC as collateral to earn interest, trade using leverage or access enhanced financial privacy applications, all without having to sell their Bitcoin. Then the tBTC can be changed back to Bitcoin. The effort, expected to begin on April 27, raised $7.7 million in a second wave of financing from investors including Fenbushi Capital, according to a statement Thursday.

Joining Bitcoin and Ethereum will allow the blockchain economy to grow more fully, said Steven Becker, president of MakerDAO, an online platform for creating digital dollars, or so-called stablecoins, and generating loans secured by crypto tokens -- all run by a blockchain-based computer program.

“tBTC is brilliant because ultimately it links two major concepts together,” Becker said in an interview. Allowing Bitcoin and Ethereum to work together, to be interoperable, is “how all these networks are going to come together to create the on-chain economy.” MakerDAO users will likely decide in the coming weeks if tBTC can be used as collateral in its system, Becker said.

tBTC got its start when Matt Luongo wanted to buy a house. The project lead of tBTC said his wife suggested that he sell his Bitcoin to fund the new home, yet Luongo wanted to use the Bitcoin as collateral for a loan. After searching around, he couldn’t find a way to collateralize his stash.

“It really bothered me that I was talking to all these people when all I wanted to do was access the U.S. dollar value of my Bitcoin,” he said in an interview. He knew of Ethereum projects like MakerDAO, yet there was no way to use Bitcoin for loans via MakerDAO.

Bitcoin will be converted to tBTC using an off chain protocol called Keep, Luongo said. Keep announced Thursday that it raised $7.7 million in a private token sale, which will mostly go to fund tBTC development. The project previously raised $12 million in 2018 from investors including Andreessen Horowitz and Polychain Capital.

The rivalry between Bitcoin and Ethereum goes back partly to Vitalik Buterin. The creator of Ethereum was first and foremost a staunch supporter and advocate of Bitcoin. He co-founded Bitcoin Magazine and wrote hundreds of articles to help thousands of new adherents understand what the new digital technology could accomplish. Yet he grew frustrated with the limits of Bitcoin, and created Ethereum to allow users to create any type of program that would live atop a global system of distributed computers.

Ethereum is now the second-largest blockchain by market value after Bitcoin. In the process, many hardline Bitcoin users feel Buterin sold out their values. The acceptance of some Bitcoin users will be hard to find for an Ethereum-based project.

“It’s going to be an extraordinarily healthy debate,” MakerDAO’s Becker said.

The vast majority of people tBTC’s Luongo has spoken to in the Bitcoin world say tBTC is a good idea, yet there is a loud minority of Bitcoiners who don’t want anything to do with another coin or blockchain, he said.

“It’s been really interesting, he said. “We’re hitting people’s funny bone.”

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

bloomberg.com

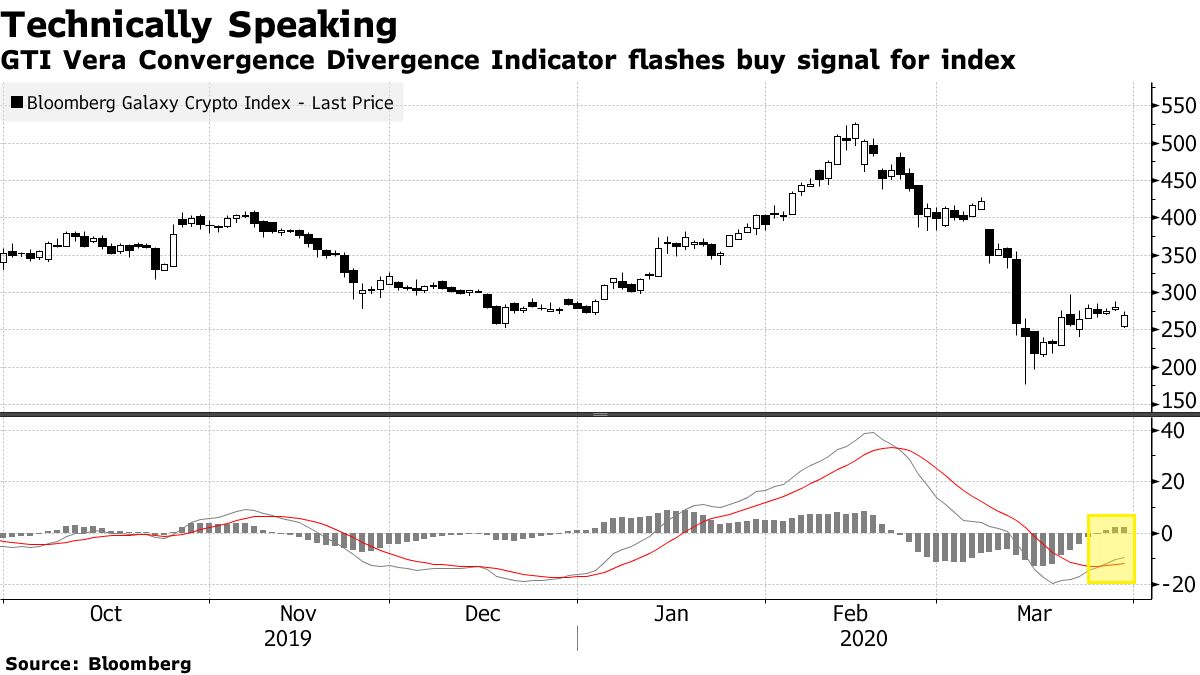

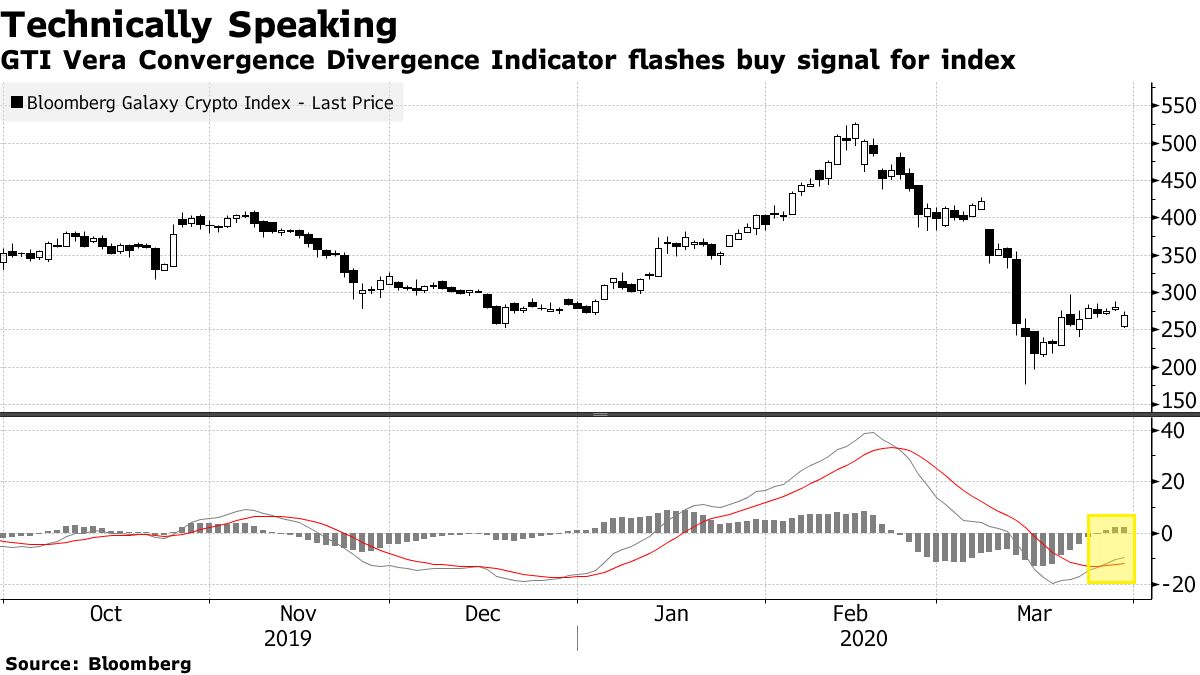

Cryptocurrencies Index Flashes First Buy Signal in Three Months

Vildana HajricMarch 30, 2020, 4:42 PM GMT+2

LISTEN TO ARTICLE

After weeks of brutal selling, technical gauges are signaling potentially positive developments ahead for battered crypto assets.

According to the GTI Vera Convergence Divergence Indicator, which measures up and down shifts, the Bloomberg Galaxy Crypto Index flashed its first buy signal in over three months. In addition, it ended the strongest selling trend since late July.

Cryptocurrencies have been under pressure this year, selling off in tandem with traditional assets as investors try to price in the coronavirus outbreak that has shut down economies globally. In the meantime, arguments that digital currencies act as havens have lost steam, with Bitcoin declining more than 25% in March. The largest digital token is on pace for its third consecutive quarterly decline.

Still, many investors remain bullish on digital assets as central banks around the world take unprecedented steps to shore up their economies. Billionaire investor Mike Novogratz of Galaxy Digital Holdings Ltd., for instance, said last week he’s used recent dips to buy Bitcoin.

“Central banks continue to print money and route it through expensive networks of people and banks, further inflating debt. A decentralized currency and exchange like Bitcoin breaks this cycle of money leakages,” said Christel Quek, chief commercial officer and co-founder at Bolt Global. “I see cryptocurrencies emerging stronger after the pandemic settles.”

Bitcoin fell 6.7% as of 10:40 a.m. in New York on Monday to trade around $6,346. Peer coins, including Litecoin and XRP, also increased. The Bloomberg Galaxy Crypto Index lost as much as 10% during the session.

“Bitcoin is much more valuable than its current price, but it is still a relatively new asset class and technology,” said Don Wyper, chief operating officer at DigitalMint. “In the short term, volatility is still the name of the game.”

— With assistance by Kenneth Sexton

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |