This day’s work:

(1) Re <<Wuhan>>

Wuhan numbers no longer matter as it was several generations ago, i am guessing.

Of course, new numbers of relapse in Wuhan would matter a lot, because it foreshadows same same everywhere else unless everywhere does different and is lucky.

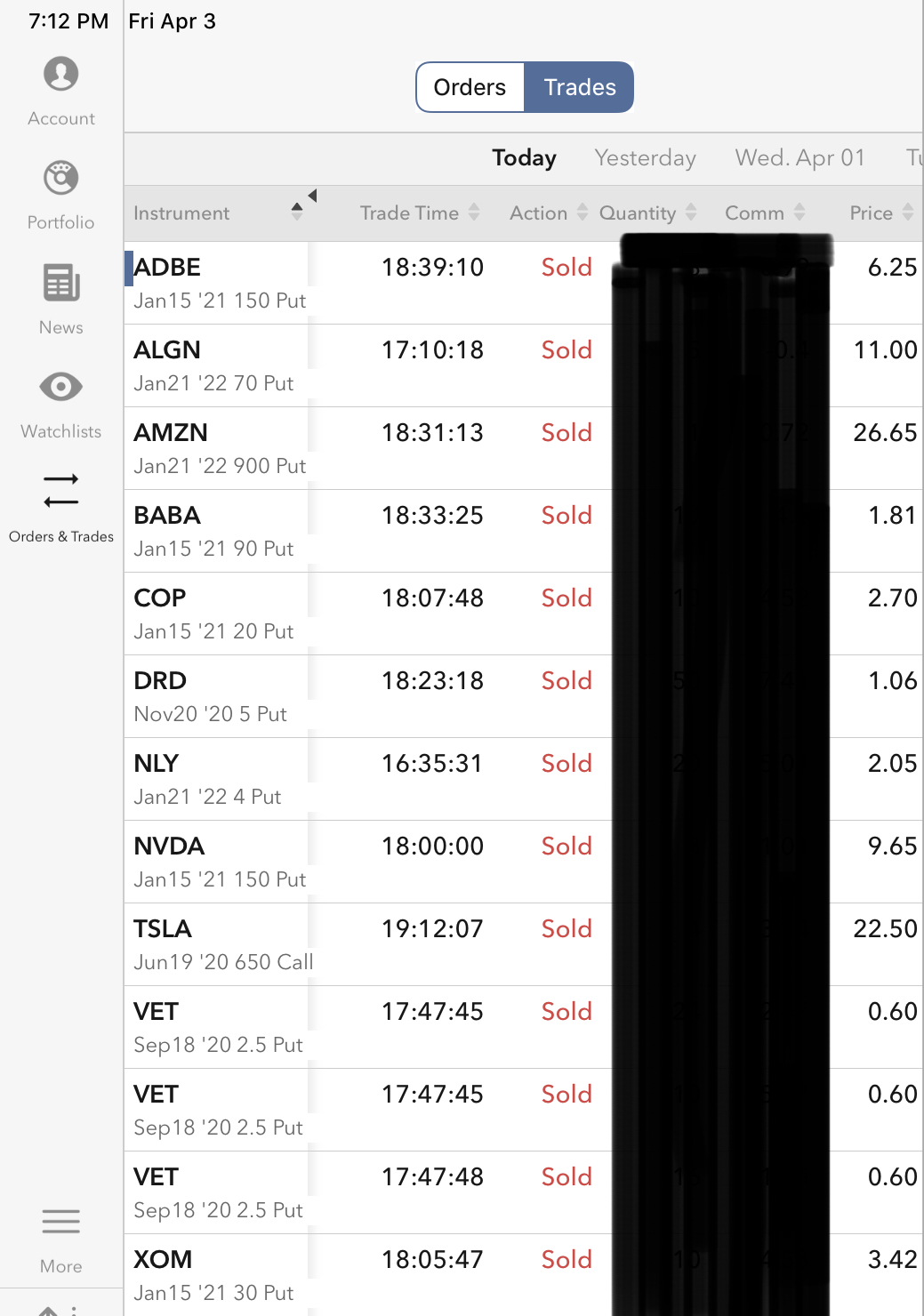

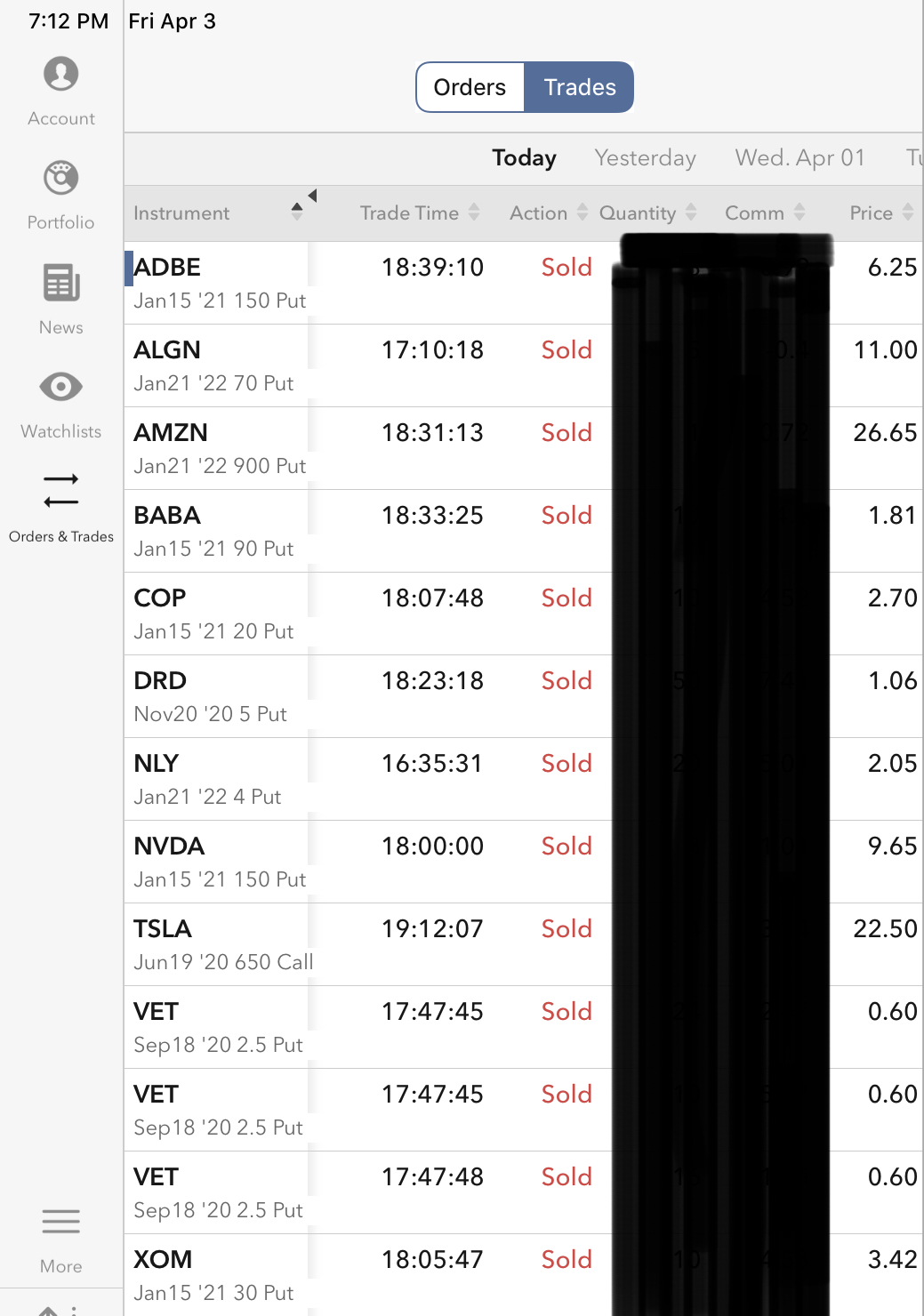

(2) In the meantime this late afternoon (Cape Town time) during tea and before dinner shortly, I did machinations on a number of items, net long and net short, but all by shorting put and call options, respectively. Call me shy, or term options expensive, begging to be sold.

My rule of thumb on shorting Put options was simple, set strike prices at 50% of current market price, or, if not possible, then get a lot of premiums so that the eventual possible purchase cost is as close as possible to 50% of current purchase price. In the case DRD I make an exception, because I actually want to be put if lucky.

On the call option, only TSLA made the cut, to be harvested, and aged.

It may be now an addiction of mine, shorting TSLA, like taking vitamins. Good for health. Okay, okay, may be getting carried away asking to be carried away. Let us get over the weekend first.

Whatever is done, must generate cash :0) do not care about interim mark-to-market, as volatility on my book is not risk, but opportunity.

(3) Take Annaly (NLY) for example, currently going for ~$4.00 per share, presumably must cut dividend by 50%, or even eliminate altogether, but as Capitol Hill must bail out mortgage complex, might survive, and if not, gold would be worth much more, so am prepared to buy NLY at $4.00 between now and 21st January 2022, and be rewarded $2 now. I am discounting the possibility of being put anytime soon - may be unwarranted belief.

(4) RE XOM and COP, playing with the expiration dimension to score a ~10+% rate of return.

(5) It could be the case that, in an unlikely but possible V recovery, a lot of the premium ends up being free money.

|