The chart is mislabeled, because the corona virus is only partly impacted by the situation is USA. It is something akin to “the day the world stopped”

Re mortgage, Teams are arrayed against each other, and NLY is just another combatant amongst many

But it would be helpful if NLY tell folks what they face and are doing to try to make it through the valley of many deaths.

Like ... how do businesses make it across the valley when loaded with obligations, empty of backstops, and have revenue cutoff ... mass extinction as did dinosaurs when the asteroid hit?

We may be witnessing the mass bail-in by shareholders in one fell swoop to the system’s vulnerability call, per planetary multi-levels zero-state systemic reset even as the big and bigger and smaller governments all join in, not coordinated, not united, but coincidental forced bailing of the system. Irresistible force surging to meet unmovable object. We are observers but situated in the middle.

Easter would be a long long-weekend, for catchup of administrations, and of reflections.

The leaders best come forth with some inspired inspiring messages.

bloomberg.com

After $50 Billion of Losses, No One Comes to Save the Mortgage Market

Tom MaloneyApril 3, 2020, 7:12 PM GMT+2

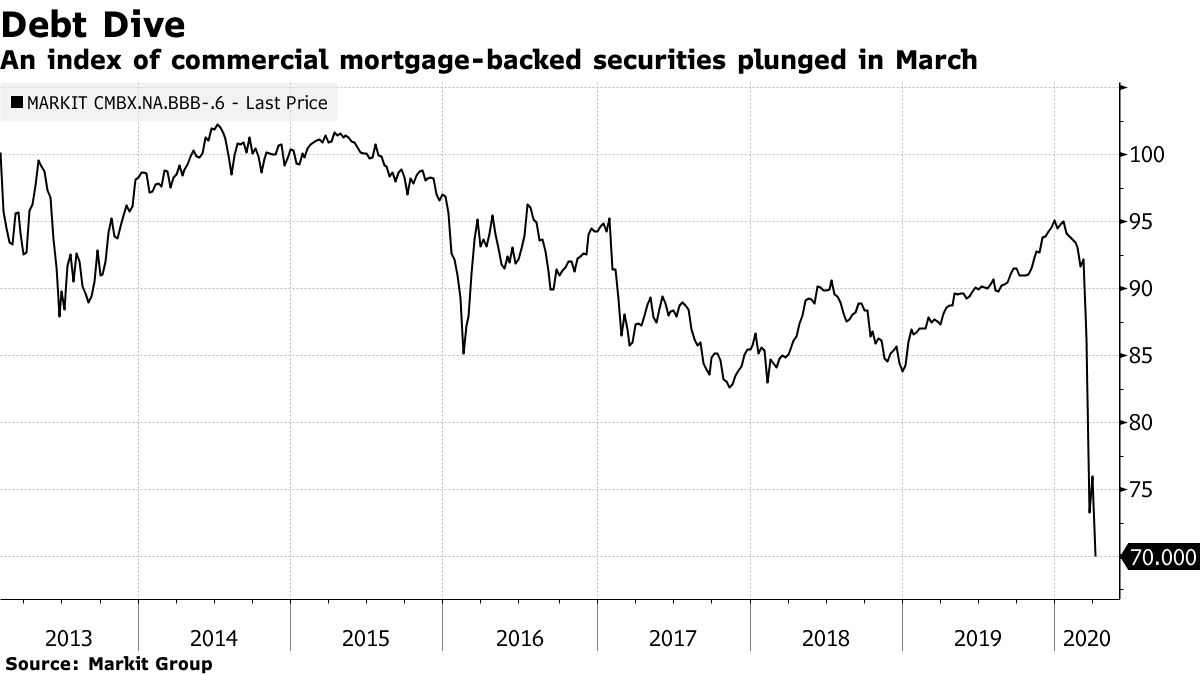

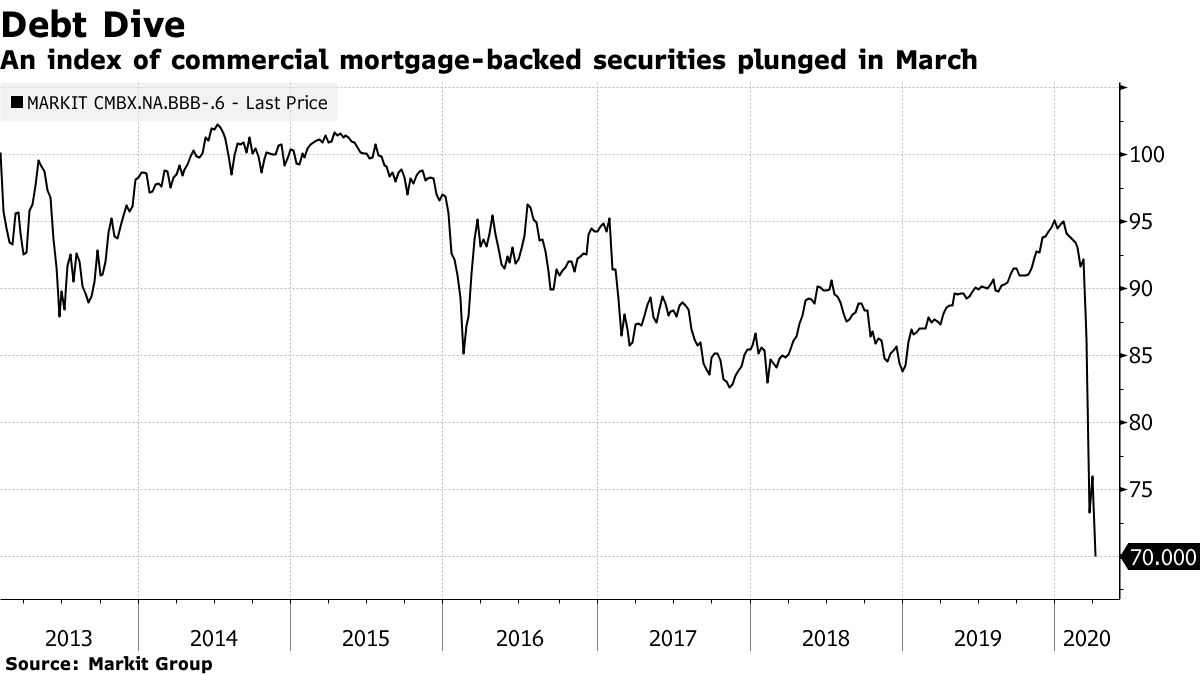

The market for mortgage-backed securities was in free fall, with fear running rampant and banks seizing collateral.

So Tom Barrack, the chairman of real estate investment trust Colony Capital Inc., published an 1,800-word plea for the Federal Reserve to buy bonds backed by homes, cars and other assets and for banks to halt margin calls.

That was last Saturday. In the week since, three top investors in the sector have engaged restructuring advisers, two others sold $7 billion of debt at a discount and publicly traded mortgage REITs in the U.S. lost more than $12 billion of market value, bringing total declines this year to at least $50 billion.

The carnage shows no signs of abating. Prominent asset managers including Blackstone Group Inc., TPG and Apollo Global Management Inc. have been sucked into the vortex wrought by the coronavirus pandemic, with their associated mortgage REITs losing more than two-thirds of their value on average so far in 2020.

| Firm | Decline through April 2 | | AG Mortgage Investment Trust | (88 %) | | Exantas Capital | (86 %) | | MFA Financial | (86 %) | | Granite Point Mortgage Trust I | (84 %) | | Western Asset Mortgage Capital | (84 %) | | Invesco Mortgage Capital | (82 %) | | Redwood Trust | (82 %) | | TPG Re Finance Trust | (81 %) | | Two Harbors Investment | (77 %) | | New York Mortgage Trust | (76 %) | | Ladder Capital | (74 %) | | New Residential Investment | (74 %) | | Colony Credit Real Estate | (73 %) | | Cherry Hill Mortgage Investment | (72 %) | | Anworth Mortgage Asset | (72 %) | | Apollo Commercial Real Estate | (71 %) | | Arbor Realty Trust | (70 %) |

The pandemic has crippled commerce across the U.S., putting almost 10 million people out of work in a matter of weeks and sparking fears that huge numbers of businesses and individuals will fail to make rent and mortgage payments. As a result, investors are fleeing from residential and commercial debt that isn’t backstopped by the federal government.

Read more: Nobody knows what will happen when the rent comes due on April 1

“Nobody wants to buy those securities when the underlying contracts are not performing,” especially when it remains unclear how long the disruption will last, Barrack wrote in his post on Medium.

Nobody, that is, except perhaps Starwood Capital Group’s Barry Sternlicht, JPMorgan Chase & Co. and others looking for deals as billions of dollars of debt hit the block.

Sternlicht, who manages $60 billion, said in a letter to shareholders last week that his firm is looking to “take advantage of market dislocations” even as shares of his publicly traded REIT have tumbled 61% this year through Thursday.

TCW, an asset manager overseeing about $217 billion, is buying selectively. So are family offices, according to people familiar with the transactions. And JPMorgan, the biggest U.S. bank, said Monday it was raising as much as $10 billion to invest in dislocated markets, including credit and real estate.

“For buyers in this market, it’s about willingness and ability right now,” said Mark Fontanilla, who owns a market strategy consulting firm that specializes in structured finance. “Things are so uncertain, you need to have deployable, stable capital to be able to hold positions, especially less liquid ones, through the uncertainty.”

Why the Mortgage Market Needs Its Fixes Fixed: QuickTake

In some cases, asset managers’ private funds are bidding on assets being unloaded by their own publicly traded REITs. New Residential Investment Corp., managed by Fortress Investment Group, sold bonds with a face value of $6.1 billion. One of the buyers was an entity also affiliated with Fortress, the company disclosed in a filing Thursday.

REITs with too much leverage and not enough liquidity have been the most prolific sellers. Leverage, used to increase returns when times are good, are now amplifying losses. This is typically done through so-called repurchase agreements, or repos, through which borrowers post securities as collateral. When the value of those assets drop, they must post more collateral or cash. When they can’t meet margin calls, banks may liquidate the assets, driving down prices even further.

“I don’t think that the leverage amount that people have been using is inappropriate,” said Eric Reilly, a partner in Mayer Brown’s banking and finance group. “In order to get the returns that investors are looking for, whether you are a public REIT or a fund, it’s difficult to invest in high quality assets and meet your return.”

In the past month, five mortgage REITs have notified investors that they’ve been unable to meet margin calls and started discussing forbearance agreements with their lenders. Other REITs have canceled, delayed or modified dividends, or liquidated riskier parts of their portfolios. While private funds also use leverage, they often have access to liquidity through capital calls, giving them more flexibility than their publicly traded peers. But they aren’t necessarily immune. Their problems may just be less apparent because of more relaxed disclosure requirements.

| REIT | Action | | Invesco Mortgage Capital | Entered into forbearance discussions. Sold portfolio of CMBS debt with a face value of $922 million. | | Redwood Trust | Delayed dividend. Cut short-term repurchase facilities by 50%. | | New York Mortgage Trust | Entered forbearance discussions. Sold $1.7 billion of mortgage-backed securities. | | MFA Financial | Entered forbearance discussions. | | TPG Re Finance Trust | Delayed dividend. In discussions with lenders and engaged Houlihan Lokey for strategic advice. | | AG Mortgage Investment Trust | Entered forbearance discussions. Certain counterparties liquidated assets under financing arrangements. | | Cherry Hill Mortgage Investment | Paid dividend in mix of cash and stock. | | Exantas Capital | Entered forbearance discussions. | | Western Asset Mortgage Capital | Suspended dividend, liquidated some assets. | | Anworth Mortgage Asset | Delayed dividend declaration. | | Ladder Capital | Hired Moelis & Co. for strategic advice. | | New Residential Investment | Sold portfolio of non-agency debt with face value of about $6.1 billion. Slashed dividend by 90%. | | Two Harbors Investment | Sold $1.7 billion of non-agency mortgage-backed securities, unwound associated debt. Hired Lazard for strategic advice. |

“There are a lot more mortgage funds and real estate funds than mortgage REITs,” Reilly said. “There’s probably a couple of funds out there in some form of distress for every mortgage REIT you see.”

Meanwhile, the market is waiting to see if the Fed sides with Barrack by including non-agency mortgage backed securities in its intervention efforts.

For any relief program to work, all parties need to be part of the rescue program, including non-bank lenders, Reilly said.

“This is nobody’s fault,” he said. “It came out of the blue, from across the world, and basically punched people in the mouth.”

— With assistance by Heather Perlberg, Adam Tempkin, and Gillian Tan

Sent from my iPad |