SYK.

Looking at this company based on my parameters I'd say its Fundamentals were very sound.

I'd say that its Debt is on the high side, but at current interest rates that's not having too much of a detrimental effect. Of course the opposite would be true if its debt remained relatively high and interest rates went up.

It's SG&A may be regarded as being on the high side but I guess that goes with the nature of its business.

At least there's still close to 26% of its Revenues left over at the EBITDA level after SG&A is deducted ......

SYK's price chart is typical of so many companies, Quality wise or not, since this Virus crisis started .......

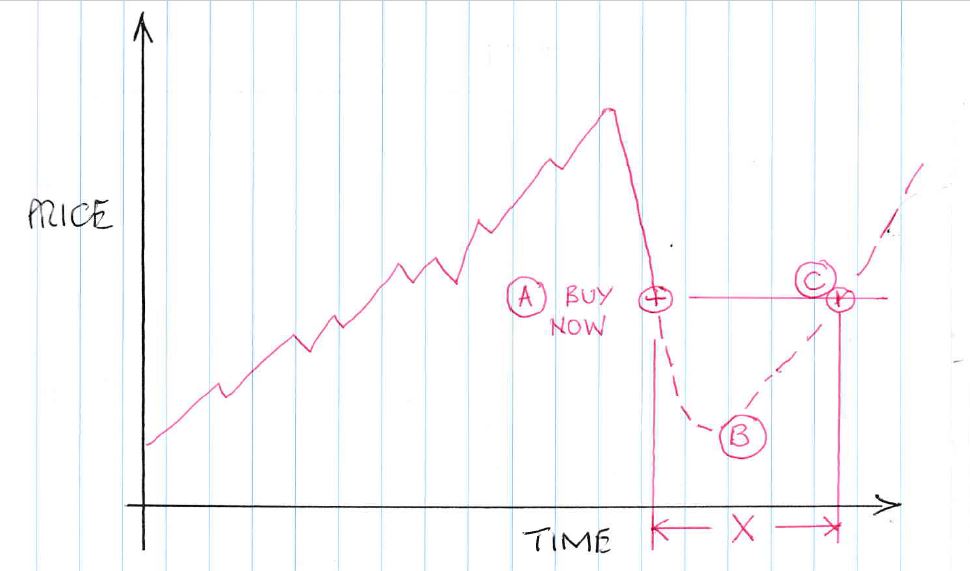

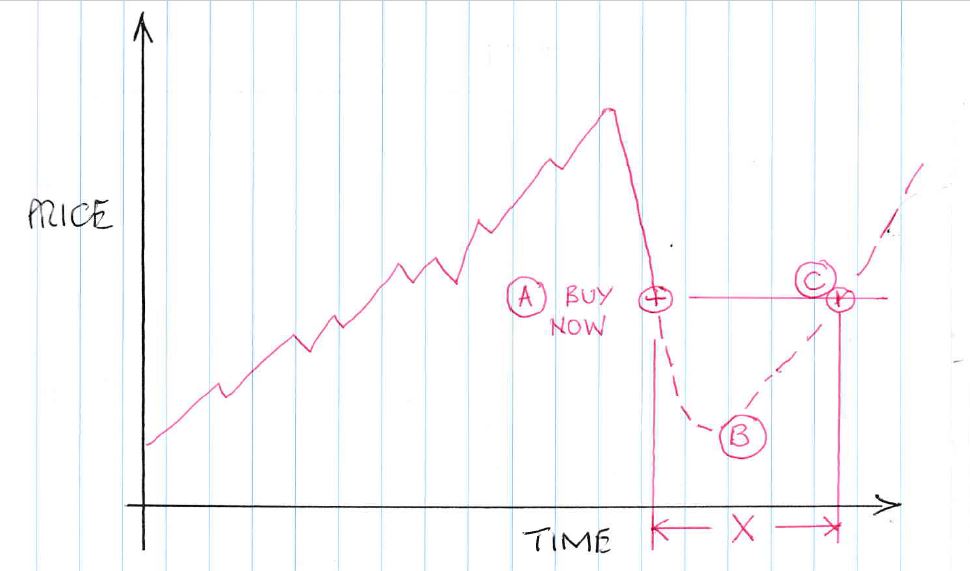

Hopefully this rough price chart diagram will show what I was getting at with regard to when to get into a stock, especially a Quality company's stock .....

Let's say one bought into SYK now at "A". No doubt that's a "bargain" price based on its previous price history.

But then its price falls still further down to "B". The price one paid at "A" has lost Capital Gain based on those shares that one bought at "A".

One only improves on the price one paid for the shares at "A" after the time period of "X".

But then, after the "crisis" is over and some sense of normality returns to the stock market, SYK's share price starts to steadily rise, which is not uncommon for companies with good and sound Financial Fundamentals. Those are usually the first to rise because those companies are the most sought after.

So buying into SYK somewhere between "B" and "C" should see a steady upward move in SYK's price with little or no period of time for a loss in Capital Gain as was the case with "X".

Now where, between "B" and "C", would be the opportune time to buy SYK, is the question. And that's where I proposed using some aspect of TA, because one is looking for some reasonable confirmation of Buying Volume and the return of the public and fund managers to the stock market. . |