Re <<What happens if a coronavirus vaccine is never developed? It has happened before>>

(1) for discussion's sake, suppose for a moment that the virus becomes a perennial and that a vaccine does not happen within 10 years, effectively a century for practical purposes, and likely beyond the planning horizon of anyone who makes plans, then what?

(1a) At the personal level, life less fun by some number between negative negative 89 - 99% except for loners, and for them, a toss up, between happy lonesomeness and draconian regime of annual outpour of walkers in the sun, assuming we do not have the worst case where the virus is not diminished by summers;

(1b) At the organisational level such as a church or an association, would have captive audience whenever they are not binging on Netflix (by the way, I am told "Trotsky" is an excellent Russian production on Netflix)

(1c) At the corporate level, meetings may become more efficient, by way of more productive, and cheeper, unless folks use the opportunity as escape from being alone, but the point of the meetings may be lessened as customers in hiding. Very difficult to plan another Big Mac Happy Meal promotion and such.

(1d) At the municipality level, taxes have to be lowered as folks can no longer pay, unless sustained bailouts happen irrespective of sustainability. Roads do not have to be maintained and schools cannot be physically opened, in the worst case that the virus flair is not only perennial, on clockwork, evolving, and immunity only works for the last virus caught

(1e) At the nation-state level, for the ones that practice universal electioneering, difficult, as people contact cut back, and priorities change, from trade wars and such to "what are you doing to return my life";

and for the nation-states practicing other styles of governance, easier, as the vector points to everything easier, cashless, full-view camera networks, social tracking, etc etc

(1f) At the multi-nations level, same same, except even more pointless for some projects, and more urgent for other projects, priorities defined by available budget and true imperative

(1g) For the monetary space, the issue becomes which persons, entities, and nations are sustainable in the neo-verse of new reality. Maybe nothing or that everything altered.

(2) Am scheduled for a social gathering for tomorrow (Sunday), a beach walk plus a two-family (altogether 4 of us and 2 of them) lunch, and as wine cannot be sold, a wine merchant shall give us a bottle, for cooking purpose. We have never scheduled beach walk before.

(3) In the meantime, the vector seems to be accelerating us toward unfamiliar territory, as if we are being bum-rushed into a vortex-ing negative space, where our positive bias is blackhole gravity shredded

cannot say whether good or bad, and am only sure the space is unfamiliar.

generally pause before entering unfamiliar, but under the circumstances, no pause possible, just bum-rushing.

even as there are folks still waiting for positive rate hikes, and thinking they are right.

bloomberg.com

Traders Are Baffled Why the Futures Market Is Pricing in Negative Rates

Vivien Lou Chen8 May 2020, 22:10 GMT+2

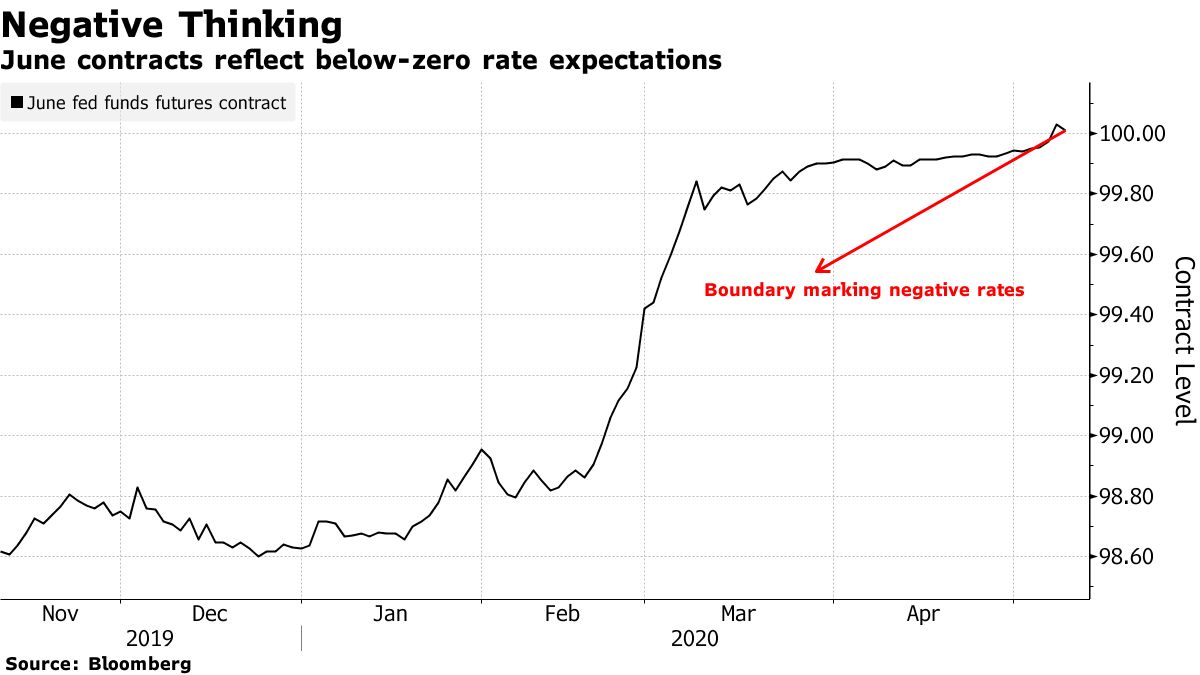

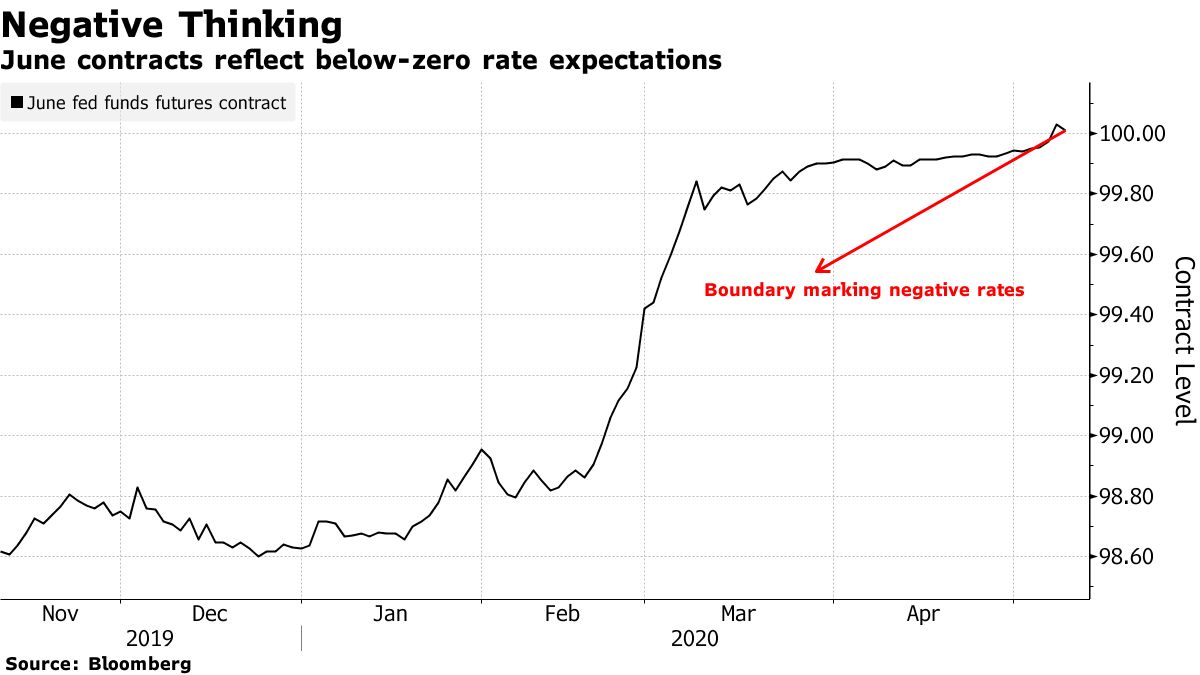

The futures market is again pricing in the possibility of the U.S. joining Europe and Japan with negative rates, catching money managers, traders and analysts off guard.

Expectations for the timing of below-zero rates -- as shown by contracts on the Fed funds rate -- shifted to the middle of 2021 after earlier indicating this scenario as soon as December amid dour jobs data that showed the worst employment downturn in U.S. history. But investors are still trying to figure out why markets have so rapidly embraced a theme that’s an anathema to many.

The timing is certainly odd. Despite continuing evidence of the economic damage caused by the coronavirus, investors have been embracing risk and volatility gauges are either falling or relatively stable in the past two days. In addition, Federal Reserve bank officials are still dismissing the notion of negative rates, while large investors don’t see the scenario happening and the consequences of any such move could be disastrous.

“I am surprised to see some of these expectations for negative rates so soon after the Fed has done so much, from significant asset purchase programs to zero rates and flooding the economy with liquidity,” said Larry Milstein, head of government debt trading at R.W. Pressprich & Co. in New York. “I would have thought that the market would wait to see how this all plays out, yet some investors think the Fed doesn’t have many more levers left.”

However, record-low yields are pointing to an undercurrent of worry in the market, with Scott Minerd, global chief investment officer of Guggenheim Partners, saying Friday that declining Treasury yields indicate negative rates could soon be here. Plus recent dramatic falls in one-month and three-month London interbank offered rates, on top of an influx of cash into money-market funds, may have prompted reluctant traders to begin fretting about the possibility of ever lower rates and to move up those expectations, even if only to hedge the risk, according to Jim Vogel, who manages fixed-income strategy at FHN Financial Capital Markets.

Still others see a litany of other possible reasons behind the market’s thinking that range from technical factors, such as stop-outs of short positions, to bank-hedging flows and -- more broadly -- growing deflation fears. Memories of April’s collapse in oil prices, due to too much supply and too little storage space, may have also offered an early glimpse into how low rates could get even for those holding out hope the Fed never goes there.

Billionaire Jeffrey Gundlach, co-founder of DoubleLine Capital, warning in a late Wednesday tweet about building pressures on fed funds to go negative along with the “fatal” consequences may have brought the expectations to the fore, according to Milstein.

Tony Farren, managing director at broker-dealer Mischler Financial in Stamford, Connecticut, expected it might take until August for the market to begin pricing in negative U.S. rates. In that late summer scenario, expectations for the economy to come “roaring back” instead fizzle out, inflation stays extreme low or turns into deflation, and Treasury yields across the board all make a run for zero.

“I’m still searching for a reason and see no reason why fed funds futures should have gone negative now,” he said. “I’m at a loss.”

Read More

— With assistance by Alex Harris

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |