Hello Haim,

I was trying to stimulate discussion to see where I might be wrong.

(1) Re storage fee, at the small quantity level, storage at largest and ostensibly solid banks, storage costs runs maximum @ US$ 300 per 10” x 10” x 24” box, for example valuepenguin.com .

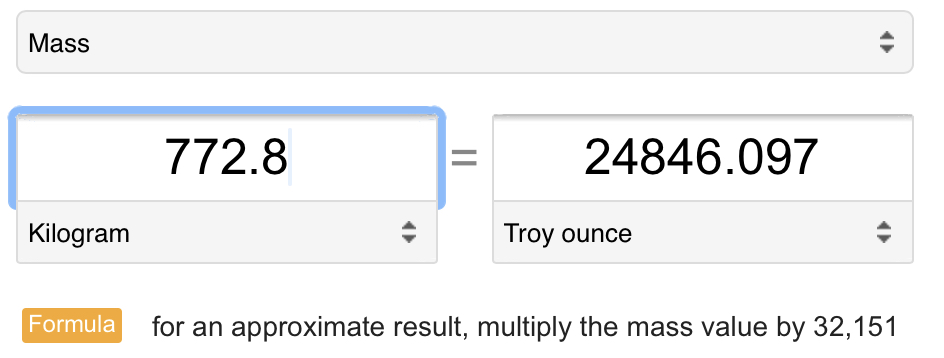

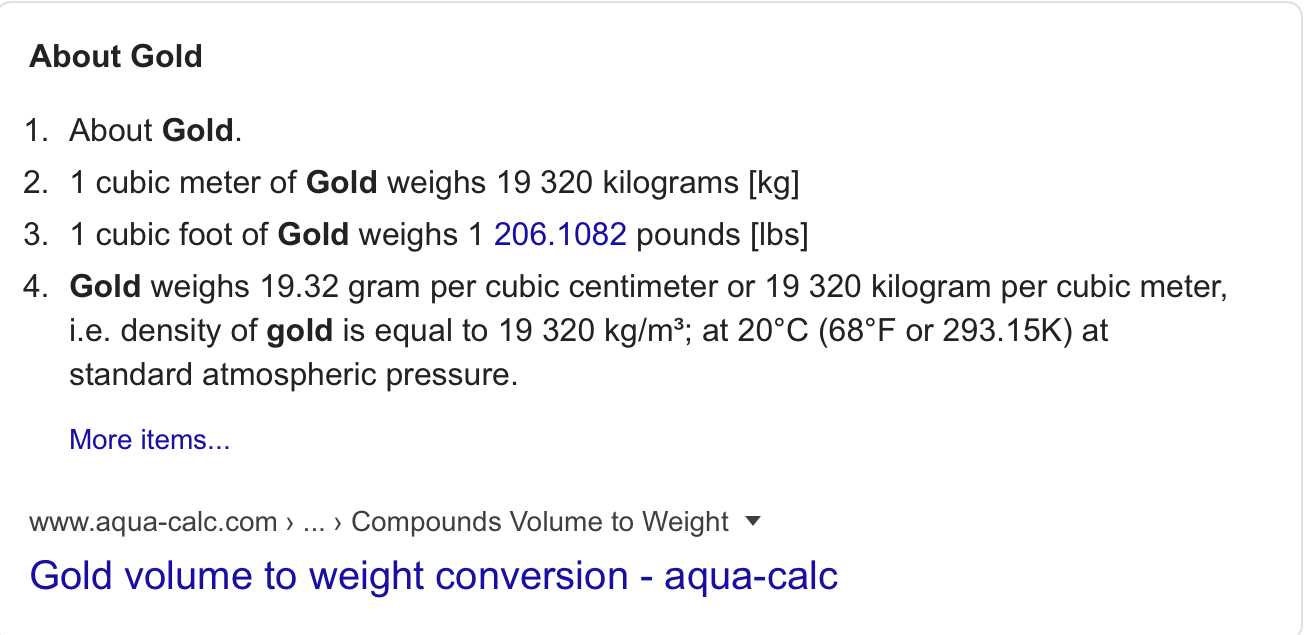

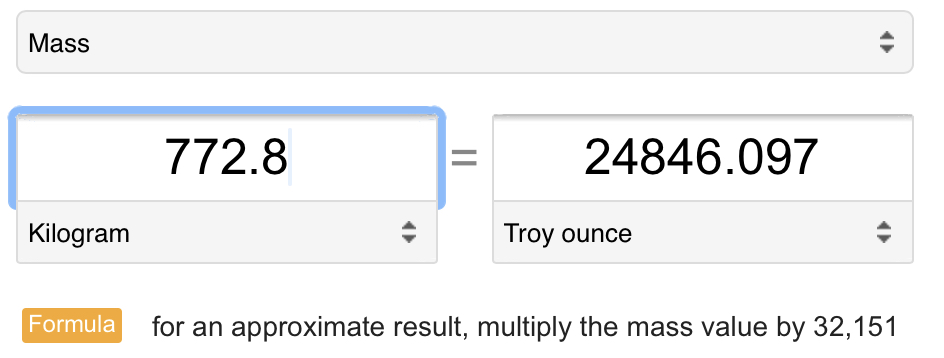

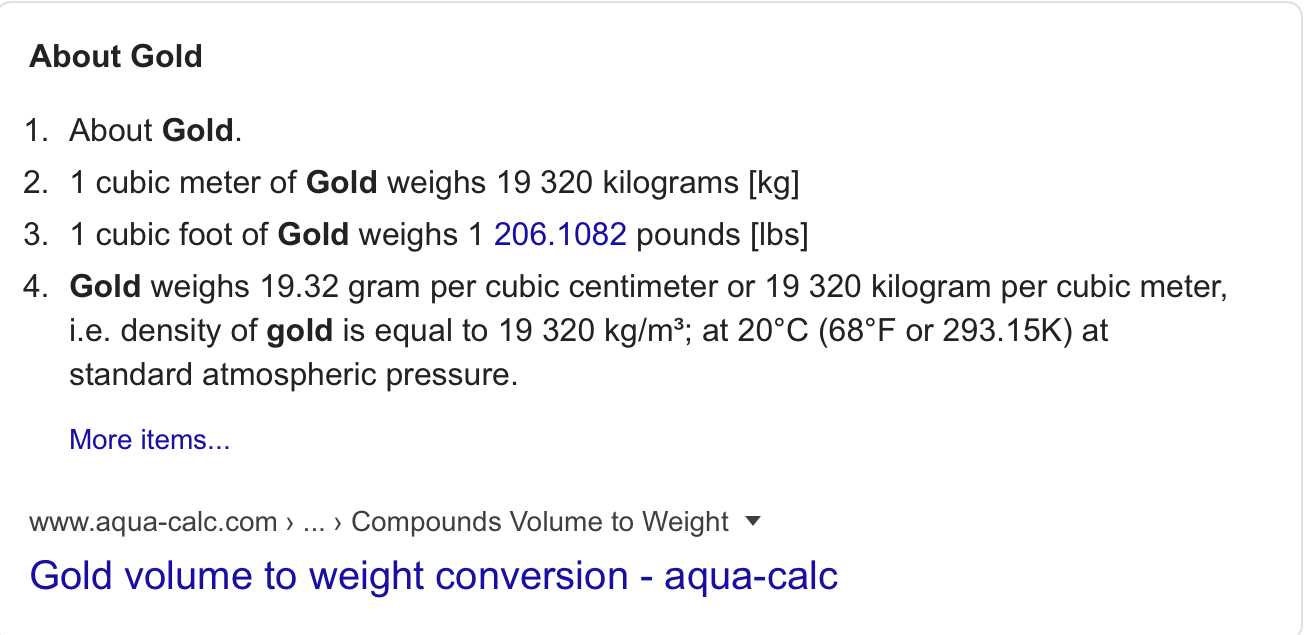

Such a box can in theory contain a solid block of anything measuring 2,400 cubic inches or 0.04 cubic meter, which would be 19,320 kg per cubic meter x 0.04 = 772.80kg of gold, or about 24,846 coins worth of gold.

We can slice off 10% for air gap as coins are not blocky, and we can box 22,361 coins, at current price, US$ 39M. US$ 300 cost seems reasonable.

Of course, no accounting for insurance.

(2) Other venues are available goldmoney.com , at 0.22% per annum. I do not recommend such.

(3) For the big boys ultra-vault.com fully insured, running at between 0.2-0.5% depending on whatever above my pay grade

(4) Alternatively one can just hide it, given the typical volumes of the gold savings quantity

I do not consider storage cost to be a factor w/r to gold holdings considering the privations of other forms of savings.

(5) Land, buildings, ... all are (just) taxable addresses, and administrative headaches. IOW, speculations and/or operating businesses, as opposed to savings, that which can be counted on whenever needed.

(6) As far as dividends, shorting put options of paper gold (GLD) on consistent basis would yield more premium income than most dividend payers.

(7) What the below chart tells us is that gold, since 2000, and since the start of time, and likely to the end of time, be true savings (as opposed to speculation), and as investment, hard to beat by most passive LTBH investors

|