DNB is going public again 6/30.

In the prospectus I read this:

"Dun & Bradstreet in an all-cash take-private transaction (the "Take-Private Transaction"). Following the completion of this offering and the concurrent private placement and assuming an initial public offering price of $20.00 per share (the midpoint of the price range set forth on the cover of this prospectus), the Investor Consortium will own approximately 66.1% of our common stock, or 64.6% if the underwriters exercise their option to purchase additional shares in full. In connection with a letter agreement, certain members of the Investor Consortium or their respective affiliates agree, for three years following the date hereof, to vote all of their shares in all matters related to the election of directors, including to elect certain individuals to the Company's board of directors at each of the next shareholder meetings at which such individuals are eligible for election. As a result of the Investor Consortium's ownership of our common stock and the letter agreement, the Investor Consortium will be able to exercise significant voting influence over fundamental and significant corporate matters and transactions. Therefore, we expect to be a "controlled company" within the meaning of the corporate governance standards of the NYSE on which we have applied to list our shares of common stock."

Moreover they say for the next 3 years, it sounds like anyone not in the consortium will have no control over the direction of the company.

And then perhaps after the 3 years it will continue to be difficult to make changes.

securitieslawyer101.com

"Under the Nasdaq and NYSE rules a "controlled company" is a company with more than 50% of its voting power held by a single person, entity or group. Under NYSE and Nasdaq rules, a controlled company is exempt from certain corporate governance requirements"

shares: there are lots of them....

"Following the Take-Private Transaction, our sole stockholder was Star Parent, L.P. ("Star Parent"), which owns all 314,494,968 shares (originally issued as 1,000 shares prior to the Stock Split (as defined below)) of our issued and outstanding common stock. Prior to the Stock Split, we were authorized to issue (a) 2,950,000 shares of Common Stock, par value $0.01 per share, and (b) 1,050,000 shares of Preferred Stock, par value $0.001 per share. On June 23, 2020, we amended our Amended and Restated Certificate of Incorporation to increase the total number of authorized shares of capital stock from 4,000,000 shares to 2,025,000,000 shares, consisting of 2,000,000,000 shares of Common Stock, par value $0.0001 per share and 25,000,000 shares of Preferred Stock, par value $0.001 per share. On June 23, 2020, we effected a 314,494.968 for 1 stock split (the "Stock Split"). In connection with the closing of this offering and the concurrent private placement, Star Parent will distribute an aggregate of 278,728,434 shares of our common stock to certain of its limited partners, including affiliates of the Investor Consortium, in exchange for their partnership units in Star Parent, and an aggregate of 35,766,534 shares of our common stock will continue to be held by Star Parent. All of the common share and per share information referenced throughout the consolidated financial statements for the successor periods and accompanying notes thereto have been retroactively adjusted to reflect the Stock Split. Members of our board of directors and certain of our executive officers, employees and other limited partners will hold an indirect interest in such shares held by Star Parent. Such limited partners will be able to exchange such units in exchange for shares of our common stock held by Star Parent in accordance the terms of the Star Parent Partnership Agreement (defined below) to be in effect following this offering."

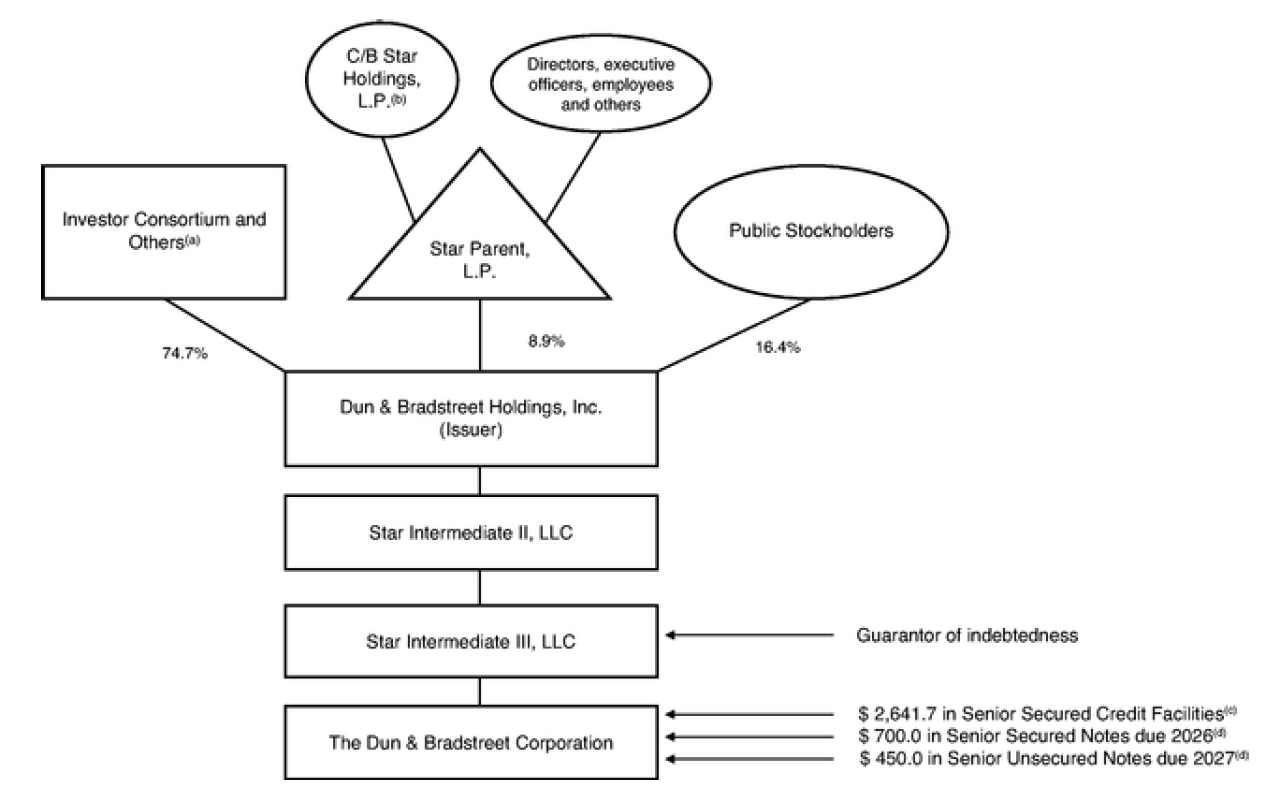

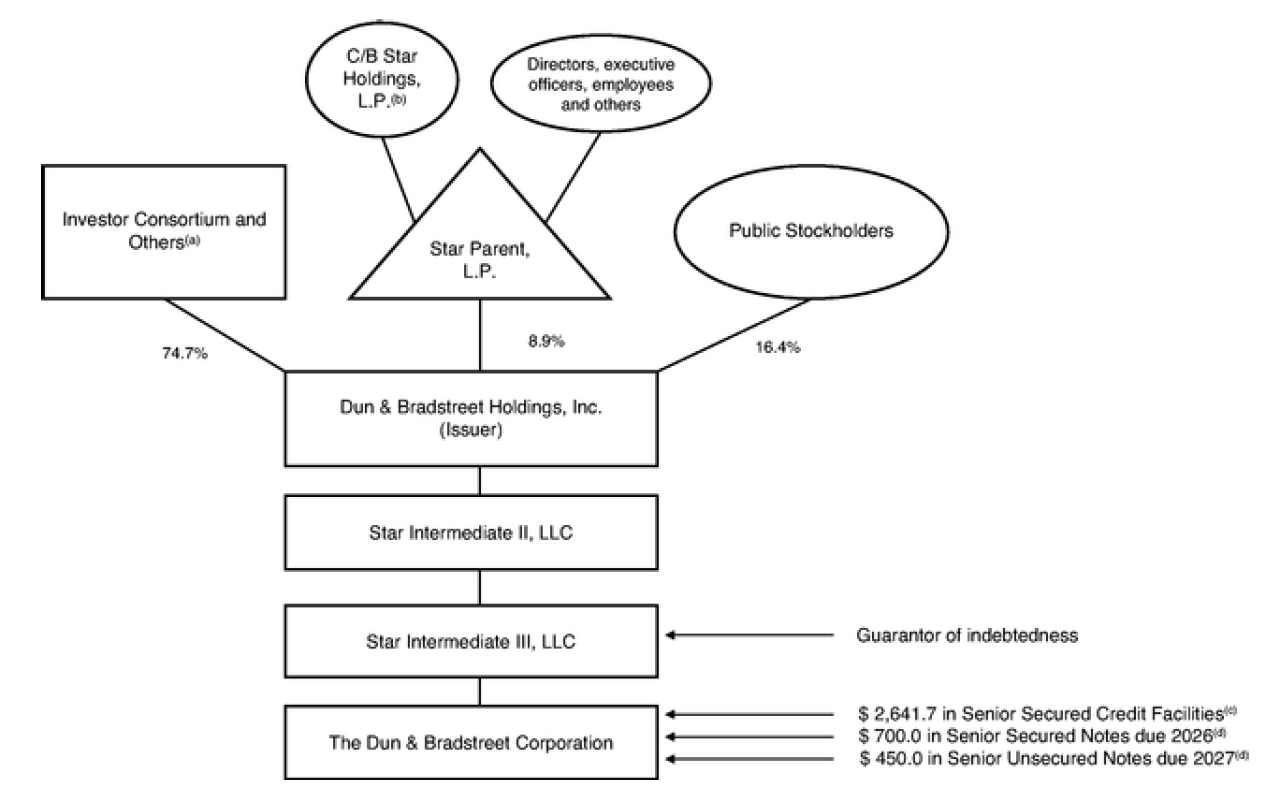

end result: the public will hold 16.4% of the stock

the consortium 74.7% and star parent (parent of DNB) will hold 8.9%

Who

| % ownership

| General Public

| 16.4% | | Consortium | 74.7% | Star Parent LP

| 8.9% |

Corporate structure after the IPO

No dividends will be paid out.

They don't follow the Generally Accepted Accounting Principles (GAAP) in financial reporting.

They are anti-taiwan and instead support the "one china" policy which plans to dissolve Taiwan.

Lastly, the way their business model works:

new companies apply for DNB number and get one.

then to be in compliance they pay DNB $ to keep things in order. |