Rechecked waypoints and recalibrated alignment w/r to TSLA.

Am alert that earnings report shall happen 21st night, and wish to recognize the easy profit that happened between yesterday and today, and moved the heavy artillery in the away direction (increased strikes. With weighted average of the expiration term kept constant, +/-) to be safer and still barraging.

Shall close-in once non-earnings clearer. I basically set waypoints and calibrate alignment to bag a particular number every week. I do the deeds on iPad after I play chess w/ the Jack and before pre dinner drinks.

Difficult to conclude that TSLA will sustainably decline as between the RobinHooders and enthusiastic analysts who can know what might happen, as both groups are just throwing numbers around.

Recognised profit on the BBL puts, and closed some DRD puts.

zerohedge.com

Tesla's Share Of The Global Auto Market Is 0.8% But Its Market Cap Is 3x The Entire S&P Autos SectorWe have said much about the staggering surge in Tesla stock (in no small part thanks to generous "gamma gamblers" who keep buying massively OTM money call options expiring in a few days), and here, courtesy of Deutsche Bank's Jim Reid, is some more since one can never have enough Tesla.

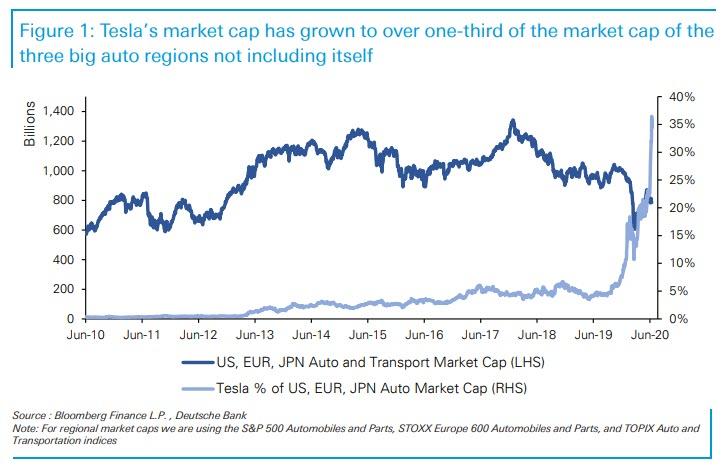

As the credit strategist notes, Tesla is up +330% since March 18th, and over +760% since June 2019 when it was troubled by bankruptcy concerns. Just 2 weeks ago it surpassed Toyota to become the world’s largest automaker.

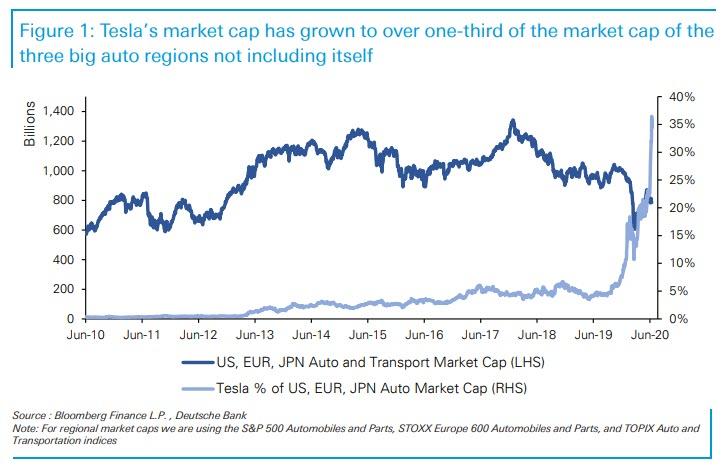

As the chart shows, Tesla’s market cap ($287bn) has grown to over a third of the combined market cap of the US, EU and Japanese auto indices.

Since March, Tesla has added just over 8 Ford Motor Companies, 27 Renaults, or more than the entire market cap of Toyota. In fact, Tesla is over 3 times the size of the “S&P 500 Automobiles and Parts” sector, even though it’s not a member or in the S&P 500 (it would be the 15th largest).

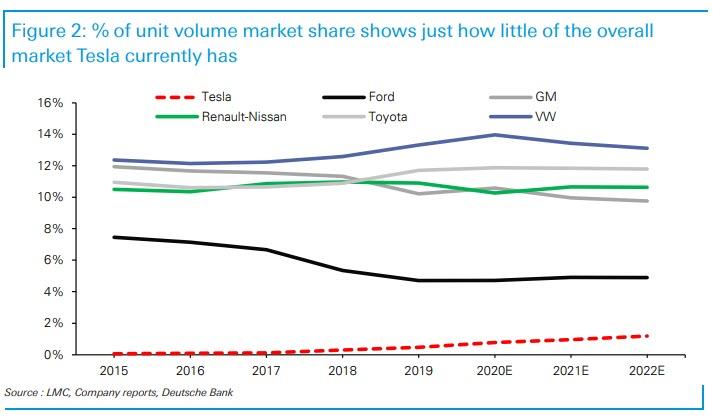

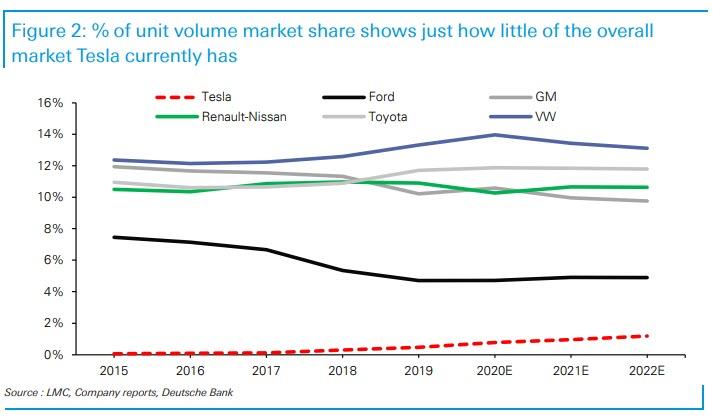

According to our US Autos Analyst Emmanuel Rosner, Tesla’s overall share of the global autos market has grown from 0.1% in 2017 to an expected 0.8% in 2020, but remains minuscule. For context VW is at c.14%. However Tesla’s market share growth in its areas of focus has been particularly impressive, displacing many incumbents.

There are a few reasons for the stunning price action. Electric vehicles are seen as the future, ESG investing is growing, and Tesla is a darling of the Robinhood investment community. We see earnings next week.

For a flash survey: Do you think Tesla is overvalued or not? You can also pick don’t know. Click on the hyperlinks to vote. Answers ahead of earnings.

Sent from my iPad |