Whew ... :0)

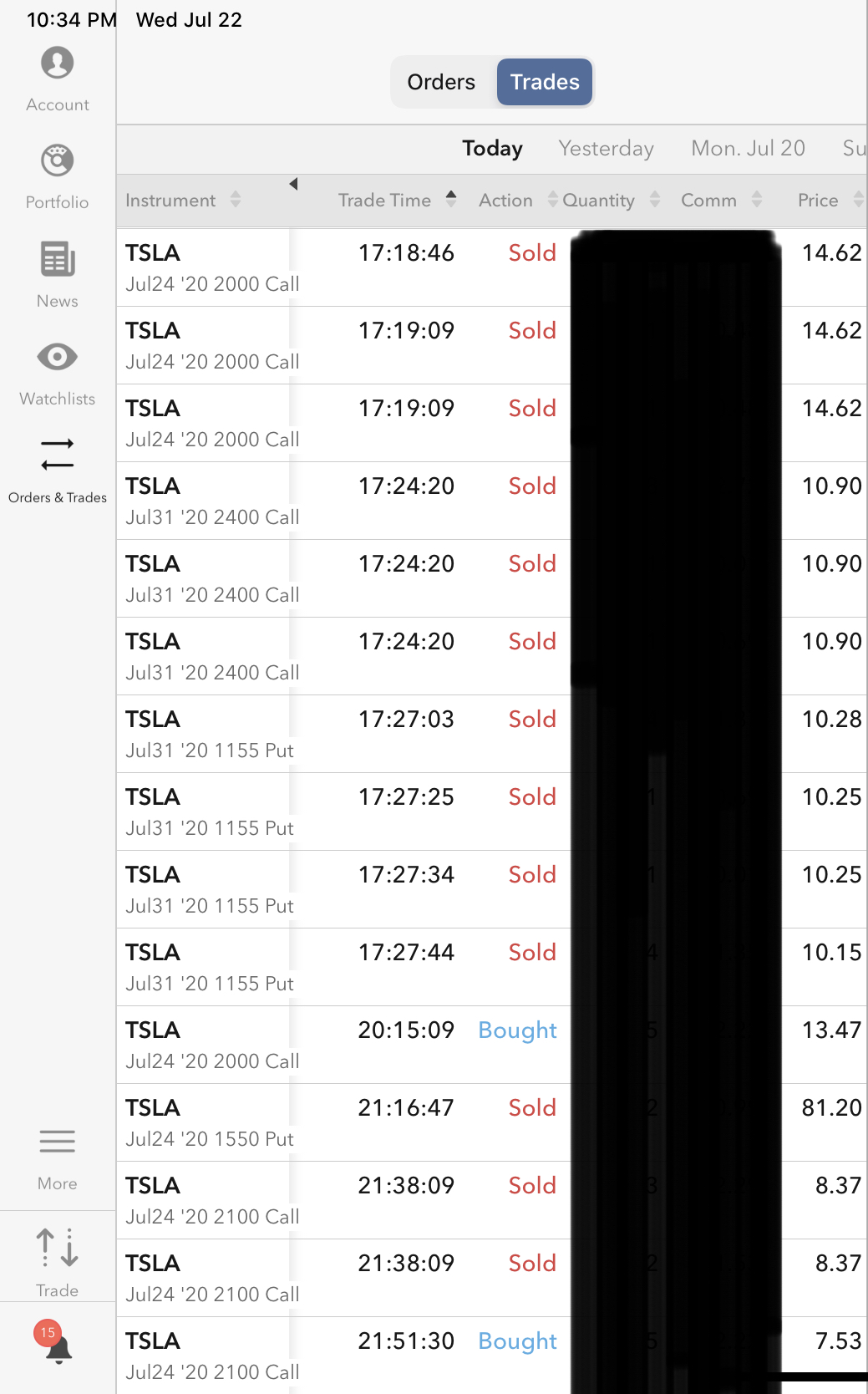

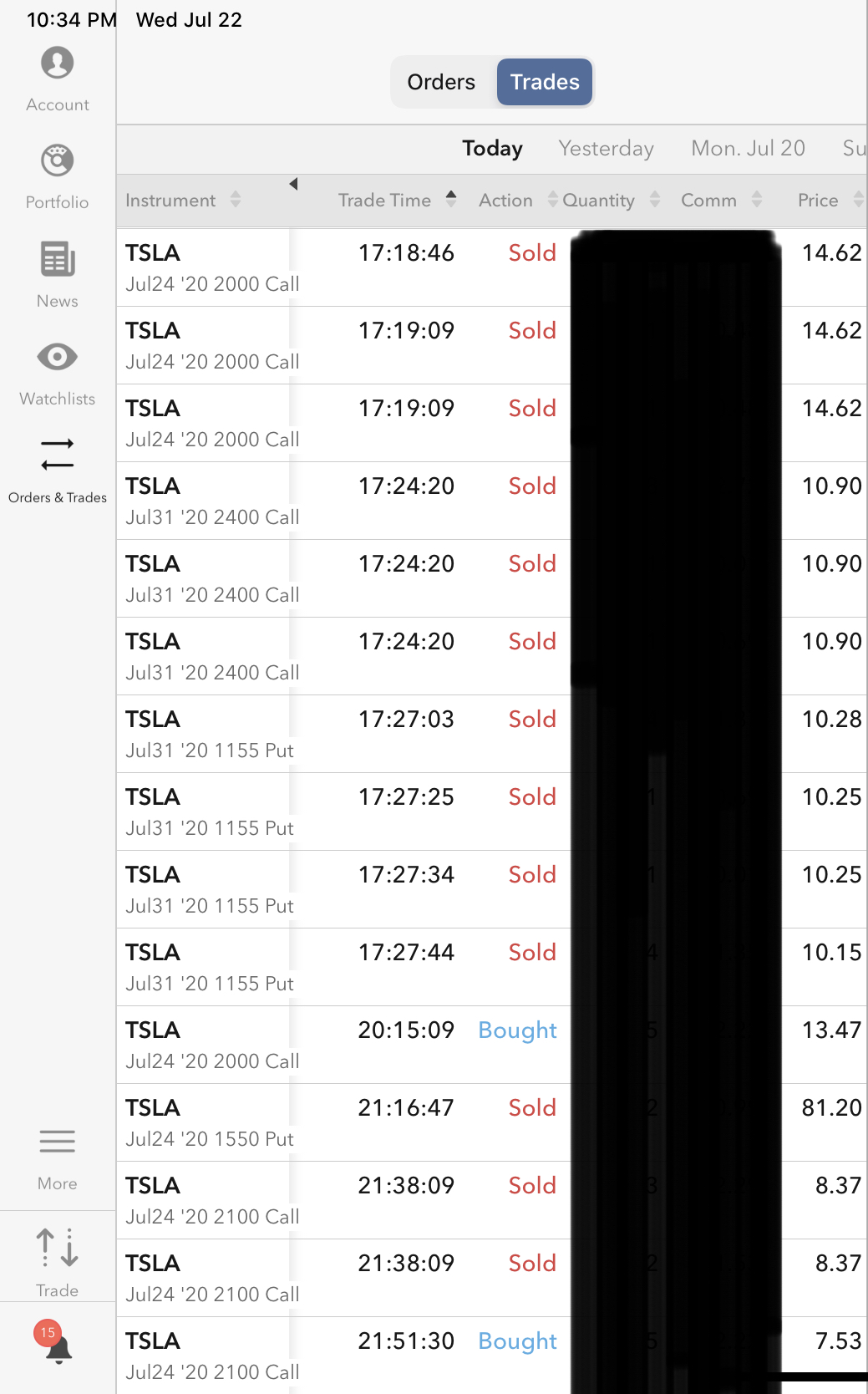

Am glad I did fine-tuning before market closed Message 32847365 to be more correct than earlier day deployment Message 32846797

<< There is an arbitrage opportunity I am fairly sure >>

I have already explore at least one prospective arbitrage opportunity for a fellow really begging for the coins willing to pay double what I am not paying. I may try to acquire a third set for I prefer to keep my existing two sets.

The intra-day redeployment maneuvering also added cash collected as well as increased value

Even though the earnings report can be interpreted as materially misleading by some, but never mind, the direction is up, and the shorted puts should blowup on my counter-parties, even as the shorted calls cannot likely save them. I should get my coins free and clear, hopefully, Friday expiration time.

Tomorrow is a good time to recalibrate for the 31st expiration, and to set boots on the ground for TSLA August campaign.

finance.yahoo.com

Tesla earnings: Tesla posts surprise Q2 profit, ramping up cash despite coronavirus

Emily McCormick

Tesla ( TSLA) delivered second-quarter results after the closing bell Wednesday, with market participants having anxiously awaited the report after the electric vehicle-maker bucked the trend of the broader auto industry and reported better than expected quarterly deliveries.

Here were the main results from Tesla’s Q2 report, compared to consensus estimates compiled by Bloomberg:

Revenue: $6.04 billion vs. $5.4 billion expected vs. $6.35 billion Y/Y

GAAP earnings per share: 50 cents, vs. GAAP loss per share of $1.06 expected and GAAP loss per share of $2.31 Y/Y

Tesla’s second-quarter results came on the heels of an incredible 280% stock rally for the year to date, as investors bet on the company’s long-term prospects with the coronavirus pandemic weighing more heavily on established auto competitors. The near-fourfold increase in Tesla’s stock made it the second-best performer in the Nasdaq 100 after Moderna ( MRNA), and rocketed Tesla’s market capitalization to nearly $300 billion to make it the world’s most valuable automaker.

Heading into the report, investors honed in on Tesla’s profitability potential to see whether the company would manage to eke out a profit baed on GAAP (Generally Accepted Accounting Principles). Such a result would mark the company’s fourth consecutive quarter of GAAP profitability, making the stock eligible to be considered for inclusion in to the S&P 500. This would broaden the pool of potential investors into Tesla’s stock, with buyers of index funds and ETFs tracking the S&P 500 gaining exposure to the car-maker’s shares.

A Tesla Model 3 car is displayed during the Tesla China-made Model 3 Delivery Ceremony in Shanghai. (Photo by STR/AFP via Getty Images)

Consensus analysts expected Tesla would report a modest GAAP loss for the second quarter, even after the company unexpectedly posted a quarter-over-quarter jump in deliveries despite the coronavirus pandemic.

Tesla reported earlier this month that it delivered 90,650 vehicles in the three months ending in June, after delivering about 88,400 in the first quarter of the year. The sequential increase came even as Tesla grappled with a nearly two-month closure of its factory in Fremont, California – the company’s only car-making facility in the US. The factory, closed in March as virus-related shutdowns swept California, came back online in mid-May.

Prior to the global spread of the coronavirus, Tesla had said in January that it expected full-year vehicle deliveries “should comfortably exceed 500,000 units.” In April, Tesla added it had “capacity installed to exceed 500,000 vehicle deliveries this year” even given factory shutdowns related to the pandemic.

Still, Tesla’s newly ramped facility in Shanghai offered some respite as the pandemic overtook the US during the second quarter. While Tesla did not break out Q2 production or delivery figures by geography, WedBush analyst Dan Ives said in a note before earnings results that he believed China was “a clear standout” during the quarter, with the Shanghai Gigafactory appearing to be “on a run rate to hit 150k unit deliveries in the first year,” he added.

According to the China Passenger Car Association (CPCA), Tesla sold 11,095 Shanghai-made Model 3 vehicles in China in May, or more than triple the sales in April.

This post is breaking. Check back for updates.

—

Emily McCormick is a reporter for Yahoo Finance. Follow her on Twitter: @emily_mcck

Sent from my iPad |