Tesla is a Chinese company, for now, and it appears that Team Shanghai is doing for Tesla what it did for VW Santana, making it the go-to EV. Should it be ordained as taxi fleet car, watch out above

The quarter was marked by a “step change” in China, where Shanghai accounted for a sharply higher proportion of Tesla’s global production and deliveries, according to Morgan Stanley’s Adam Jonas. Cash flow was also impressive, he said.

bloomberg.com

Tesla’s ‘Home-Run Quarter’ Leaves Even the Bears Praising Elon Musk

Joe Easton

Tesla Inc. electric vehicles charge at the Tesla Supercharger station in Fremont, California.

Photographer: Nina Riggio/Bloomberg Tesla Inc. shares extended their meteoric gains in U.S. pre-market trading as even the most pessimistic analysts struggled to find faults in the electric carmaker’s quarterly earnings report.

It was a “home-run quarter” for Elon Musk’s firm, according to Wedbush’s Dan Ives, as the company reinstated its original delivery target of 500,000 units in fiscal 2020 and reported its fourth consecutive profit. Cowen’s Jeffrey Osborne upgraded his rating to market perform, removing the underperform recommendation he has held since initiating coverage of the stock in 2016.

The quarter was marked by a “step change” in China, where Shanghai accounted for a sharply higher proportion of Tesla’s global production and deliveries, according to Morgan Stanley’s Adam Jonas. Cash flow was also impressive, he said.

“Bears really would have to nit pick at the release to construct a materially negative narrative,” Jonas wrote in a note.

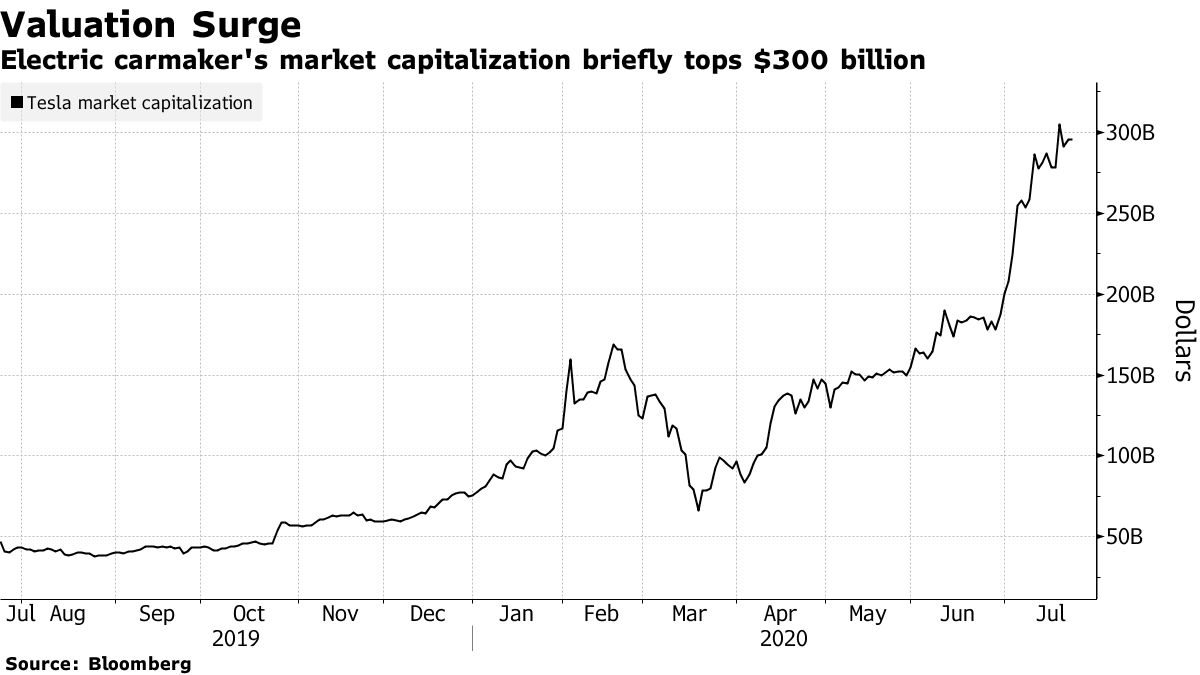

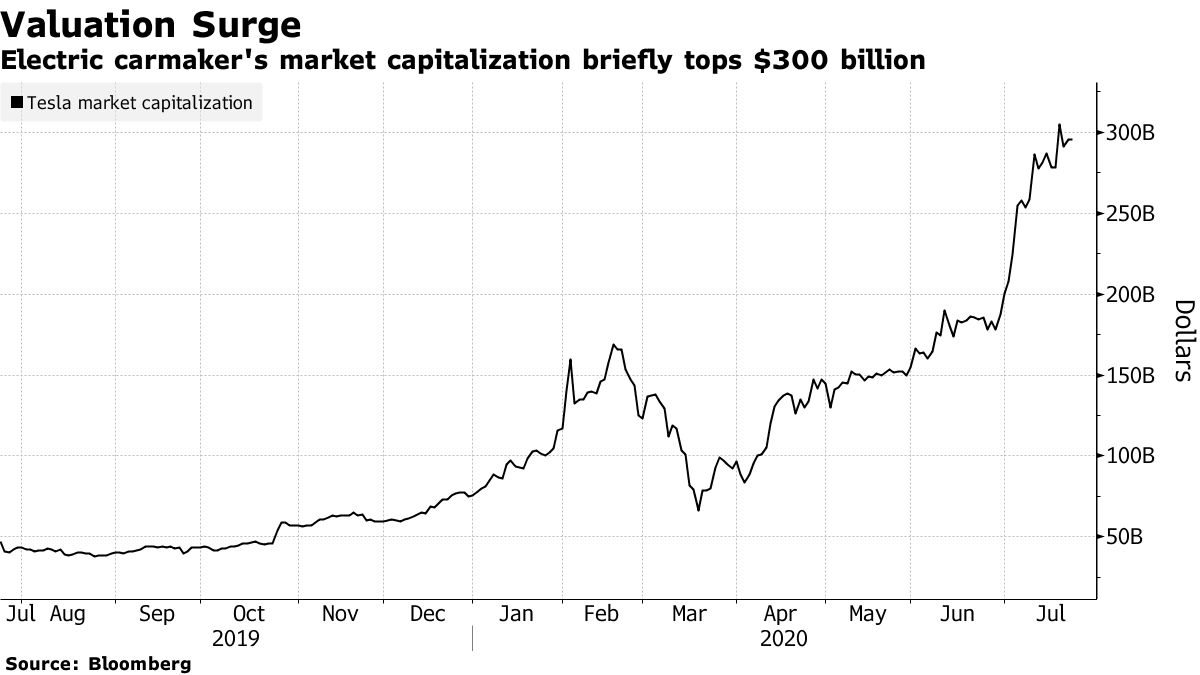

Tesla shares rose 5.2% in pre-market trading. The stock has almost quadrupled this year and is up more than sixfold in the past 12 months.

MORE: Tesla Growth Is Musk’s Goal After Profit Positions Stock for S&P

Here’s a summary of what analysts have to say:

Cowen, Jeffrey OsborneUpgrades to market perform from underperformPrice target to $1,100 from $300Execution on margins, cost control, lower capital spending and a faster ramp-up of factories and new vehicles have exceeded expectations. New factories, vehicle platforms and in-house batteries seen driving sentiment toward the stock.

Goldman Sachs, Mark DelaneyNeutralTesla has met the most important criteria investors were looking for: profit for the second quarter and commentary that 500,000 deliveries are achievable for the year.

The positive free cash flow result for the second quarter was an “upside surprise.”

Compared with Goldman estimates, the primary driver of profit upside was from regulatory credit sales and the release of deferred revenue.

Loup Ventures, Gene MunsterThe most important takeaway from the earnings report is that Tesla is “following Amazon’s playbook” by building a cycle of reinvesting profit to drive growth, scale and innovation.

It will be difficult for peers to build a vehicle that is feature and price competitive with Tesla, as the company has around 80% of the electric vehicle share in the U.S.

Sees Tesla adding energy as a central theme and this is where the long-term value will lie.

Wedbush, Daniel IvesNeutral, price target $1,800 from $1,250Second-quarter results were much better than expected and Elon Musk delivered a “home-run quarter” that defied skeptics.

Electric vehicle demand in China is accelerating and Tesla is competing with domestic and international competitors for market share.

China growth was a major source of strength in the second quarter and the growth story in the country is “worth $400 in a bull case” to Tesla, with electric vehicle penetration set to rise.

Morgan Stanley, Adam JonasUnderweight, price target $740Bears would have to “nitpick” at the results to find negatives.

Highlights include China production being positive for margins and outstanding free cash flow management.

Positive results show that comparisons between high scale electric vehicle companies and established internal combustion engines are becoming less meaningful.

— With assistance by Kit Rees, William Canny, and Beth Mellor

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |