| | | Hello orkrious, << Hugh Hendry, in a must read letter, thinks China is toast>>

Trust you continue to be well and happily busy.

I adore Hugh’s scribbling. Am really happy he is back in the game.

Re China, Hugh was and remains way early.

But re dollar, he is correct I believe, and if so, the anti-dollar should do very well

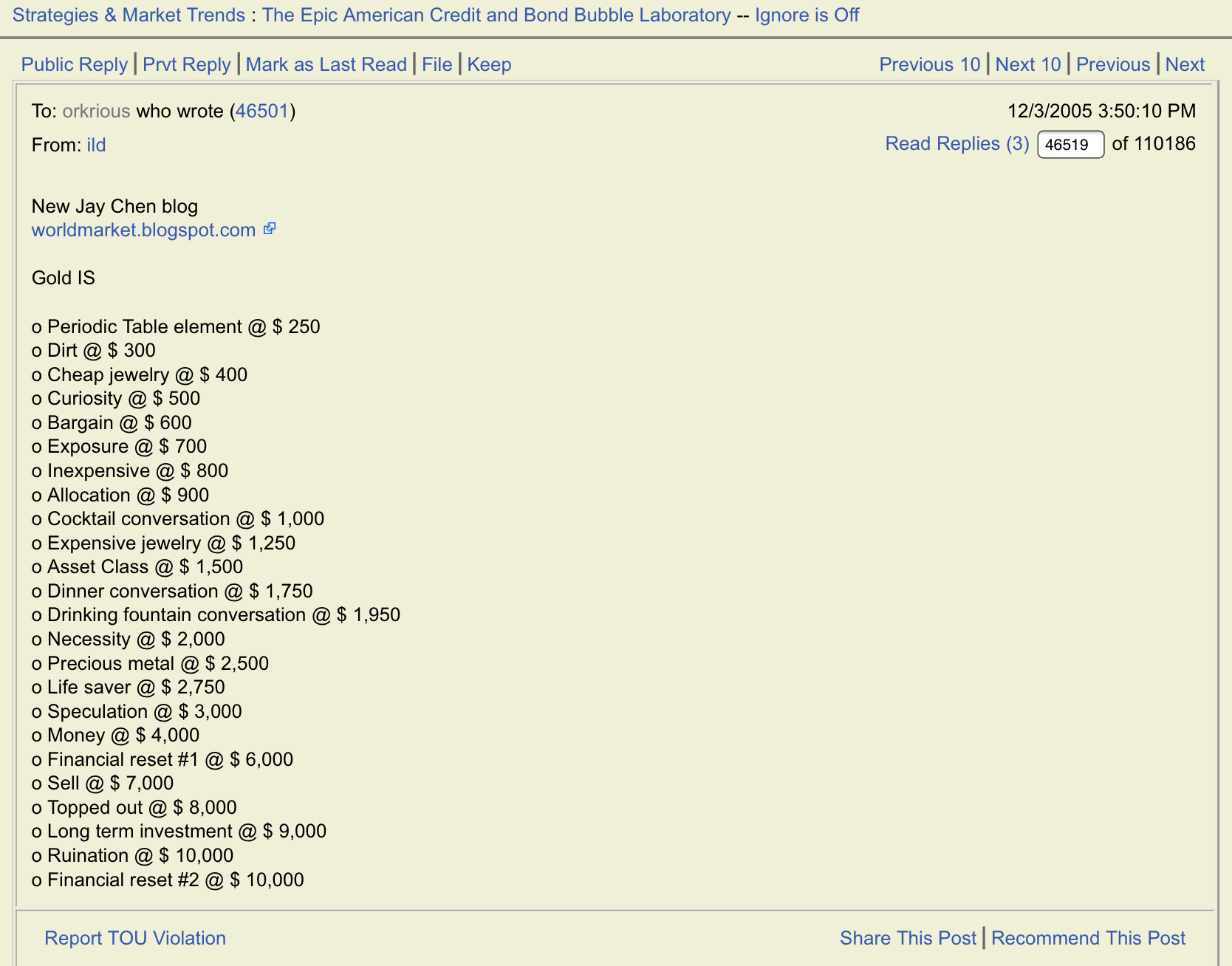

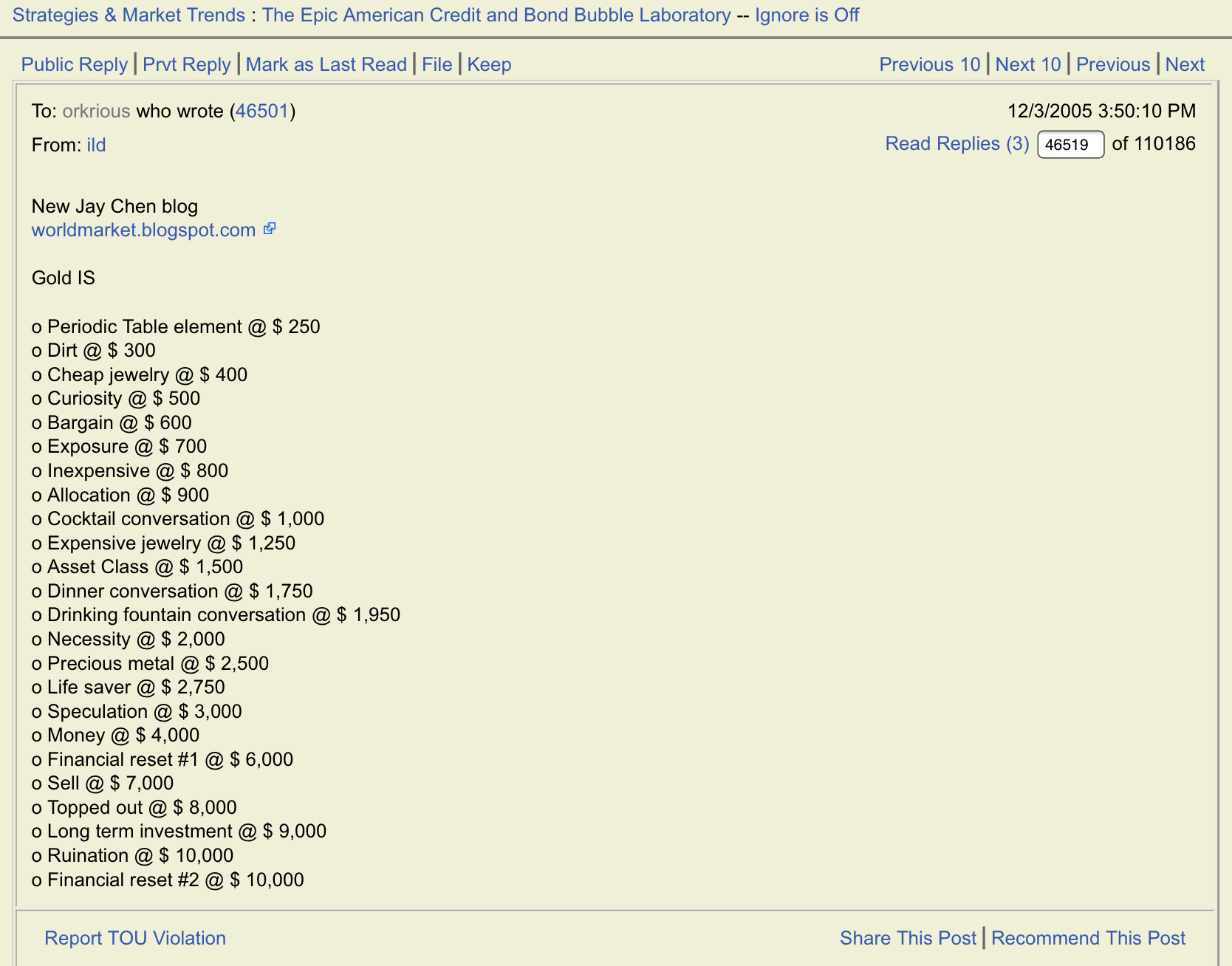

Remember, at 2,000 gold phase-changes into a necessity ... a guide i had worked out for RobinHooder back in 2005 :0)

Message 21941081

“In terms of stopping these periodic dramatic flares, would it not be better to target not bond prices, but instead to target the actual value of the dollar?” he asked.

In recent notes, Hendry has suggested that the dollar is “the new goldstandard,” and that it would be better to devalue the dollar than to continue focusing on QE initiatives. He argues that this would be “hugely bullish” for stocks.

cnbc.com

The U.S. can ‘change the world’ by devaluing the dollar, analyst claims

Chloe Taylor

U.S. policymakers could “change the world” by devaluing the dollar, one analyst has claimed.

Speaking to CNBC’s “Squawk Box Europe” on Monday, independent macro advisor Hugh Hendry said quantitative easing programs — where central banks buy assets like government bonds to inject liquidity into the economy — were not working.

Instead of targeting bonds as a form of economic stimulus, policymakers should look to the value of the greenback, he suggested.

“Quantitative easing — we’re being missold something,” Hendry argued. “Simply publishing or expanding these inert central bank reserves and trying to scare us all to death that they’re actually printing real money is a fraud.”

The underlying problem, he claimed, is that there is a shortage of dollars in the global market.

“America has decided over several decades to impose a global dollar standard, a monetary standard on the rest of the world,” Hendry said. “It’s one thing to be the king, (but) you have to behave regally, you have to behave like the king. So if you’re going to impose a dollar standard on the world, you have to stand by and provide sufficient liquidity. And that’s actually where they’ve been failing.”

Hendry said the widespread sell-off in March, where global markets plummeted amid the height of fears around the coronavirus, was partially due to investors having to sell assets in order to create dollars and repay debt.

While he conceded that the Fed and dollar swap lines were successful in those moments at holding supply back and “putting their thumb in the dam,” Hendry proposed that an alternative approach was needed to support the economy.

“In terms of stopping these periodic dramatic flares, would it not be better to target not bond prices, but instead to target the actual value of the dollar?” he asked.

In recent notes, Hendry has suggested that the dollar is “the new goldstandard,” and that it would be better to devalue the dollar than to continue focusing on QE initiatives. He argues that this would be “hugely bullish” for stocks.

“When I look at the world of macro, I think it’s telling us that we need a lower print on the dollar itself,” he told CNBC on Monday. “I think we need the Treasury, and not the Fed, to step up to the plate and tell the world ‘we’re going to target 70 or 60 on the dollar index.’ That would change the world.”

The dollar index, which measures the value of the greenback against a basket of major rivals, edged higher to around 97.728 on Tuesday.

Sent from my iPad |

|