Re <<Time to dump DRD?>>

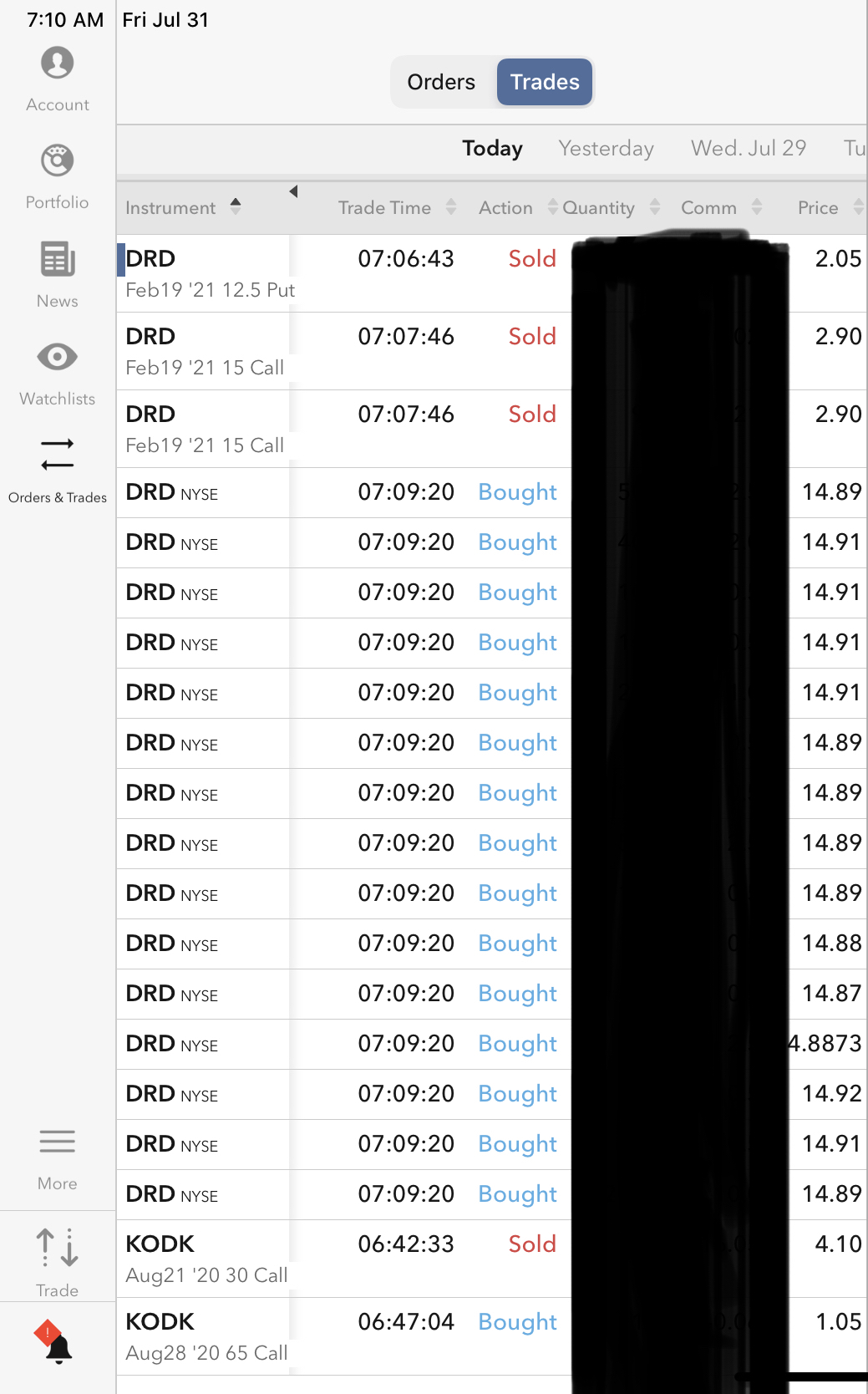

(1) Just upped stake in DRD by going long (14.92-14.89), call it at 14.90

Further upped stake by shorting equal number of puts, strike 12.50 expiration February, at 2.05

Reduced stake by shorting equal number of calls, strike 15 expiration February, at 2.90

Own this tranche at net cost 14.90 less (2.05 + 2.90), or 14.90 - 4.95 = 9.95

By 19th February or before I might have this tranche called away at 15 per share for a minuscule profit of 0.10 per share, and pocket the 4.95, making total haul 4.95+0.10, or 5.05 / 9.95 = 51%, not bad for ~7 months,

... alternatively ...

On 19th February or between here and there (given that the options are not liquid) I might have equal share of DRD put to me at 12.50, taking my average cost of this tranche of DRD to [(14.90+12.50)/2 - 4.95)] = 13.70 - 4.95 = 8.75, and I am okay with that, knowing DRD shall eventually recover to above 8.75 when gold more clearly / sincerely heading to 2,300, or 3,200.

I believe DRD gold bank cloud-ATM is a super mechanism that is not in counter to the FED or any other CB. OTOH it might be a trap because it seems too easy.

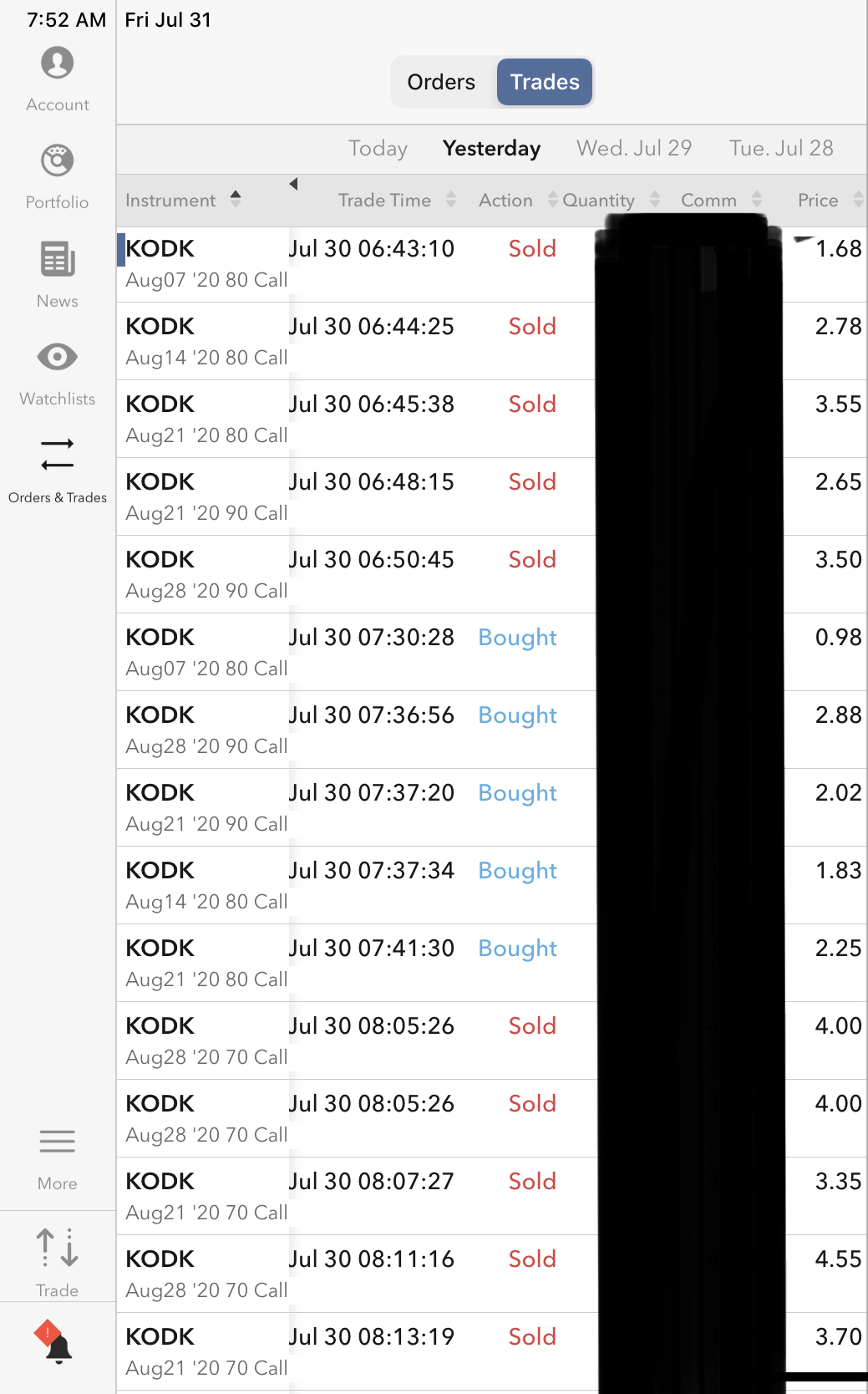

(2) And yes, did my daily trade of KODK, popping them like vitamins.

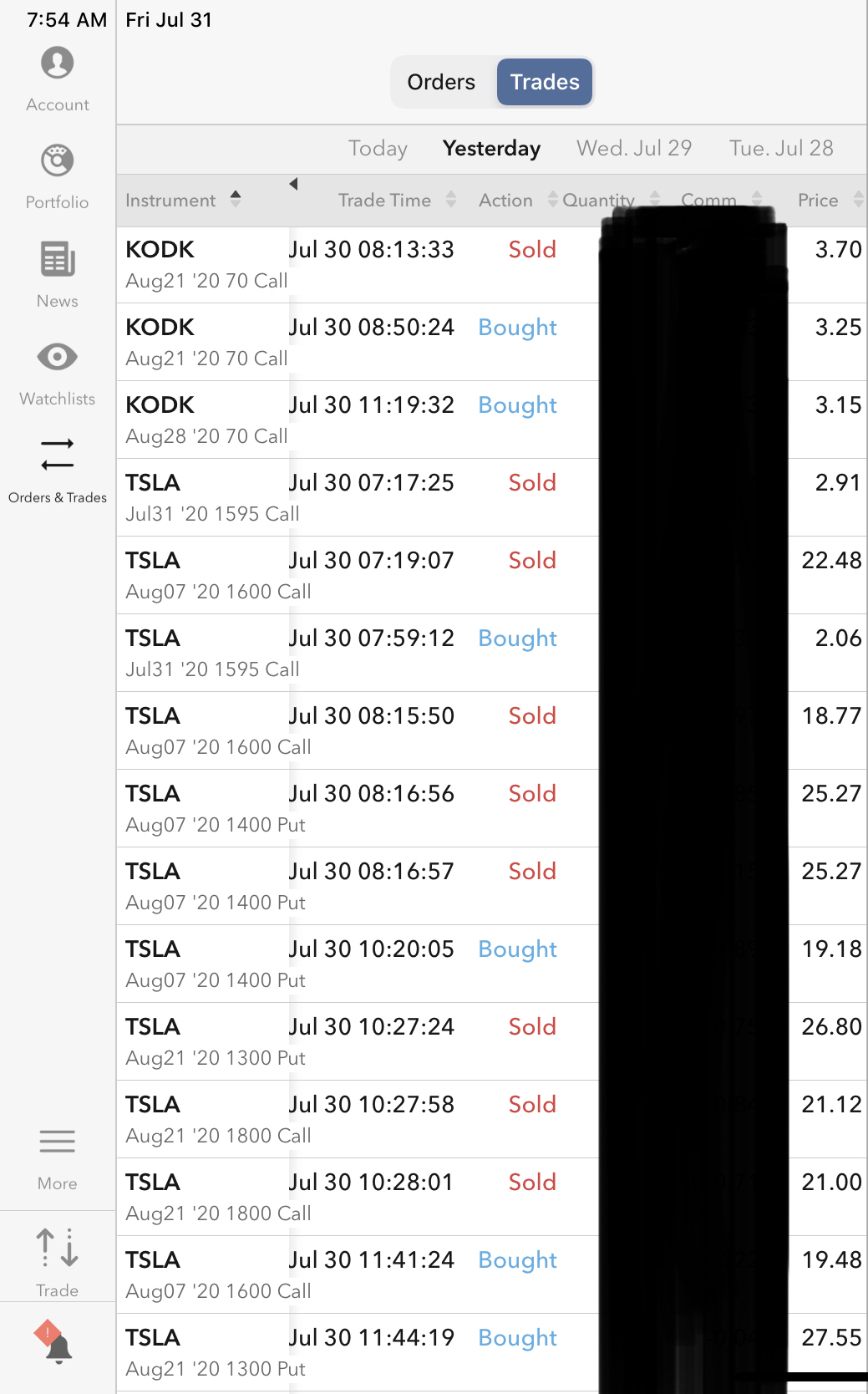

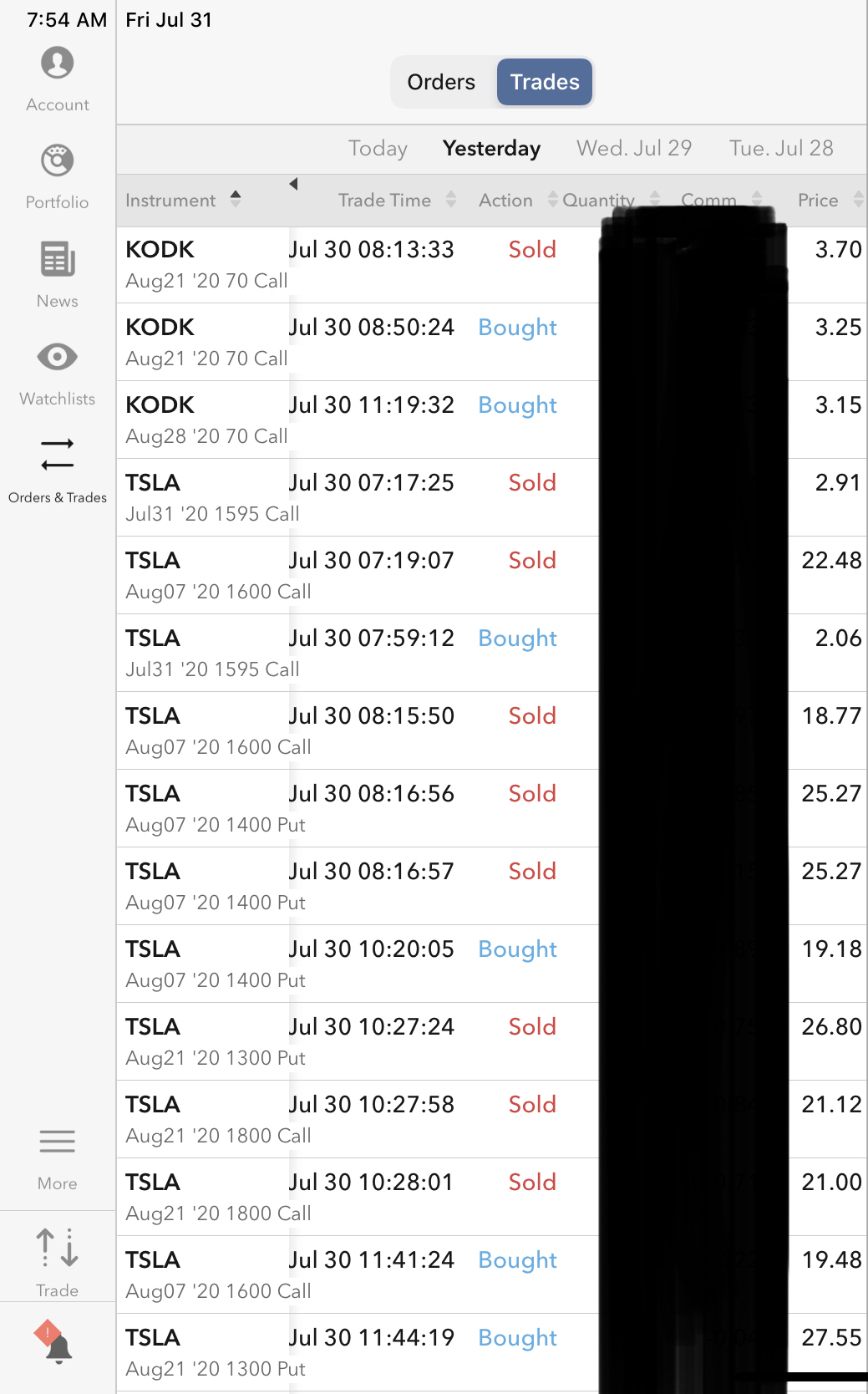

Am long KODK 28th August strike 65 costing 1.05, and short KODK 21st August strike 30 collecting premium 4.10, net 3.05 to pay for Vancouver airBnB lodging and cover food expenses. Had already done KODK & TSLA trades yesterday to defray burden of air tickets :0)

KODK may again ramp, setting up for more of the same at better prices. KODK may tank, in which case I close out the matter and run.

Classic special warfare and open-season on the Hooders, who of course in turn are insurrection fighters battling the institutions :0)

Yes, understatement would be “I like the RobinHooders for they must be enthusiastically magnanimous and fanatically sincere - but they are for the greater good”

(1) re DRD / KODK today

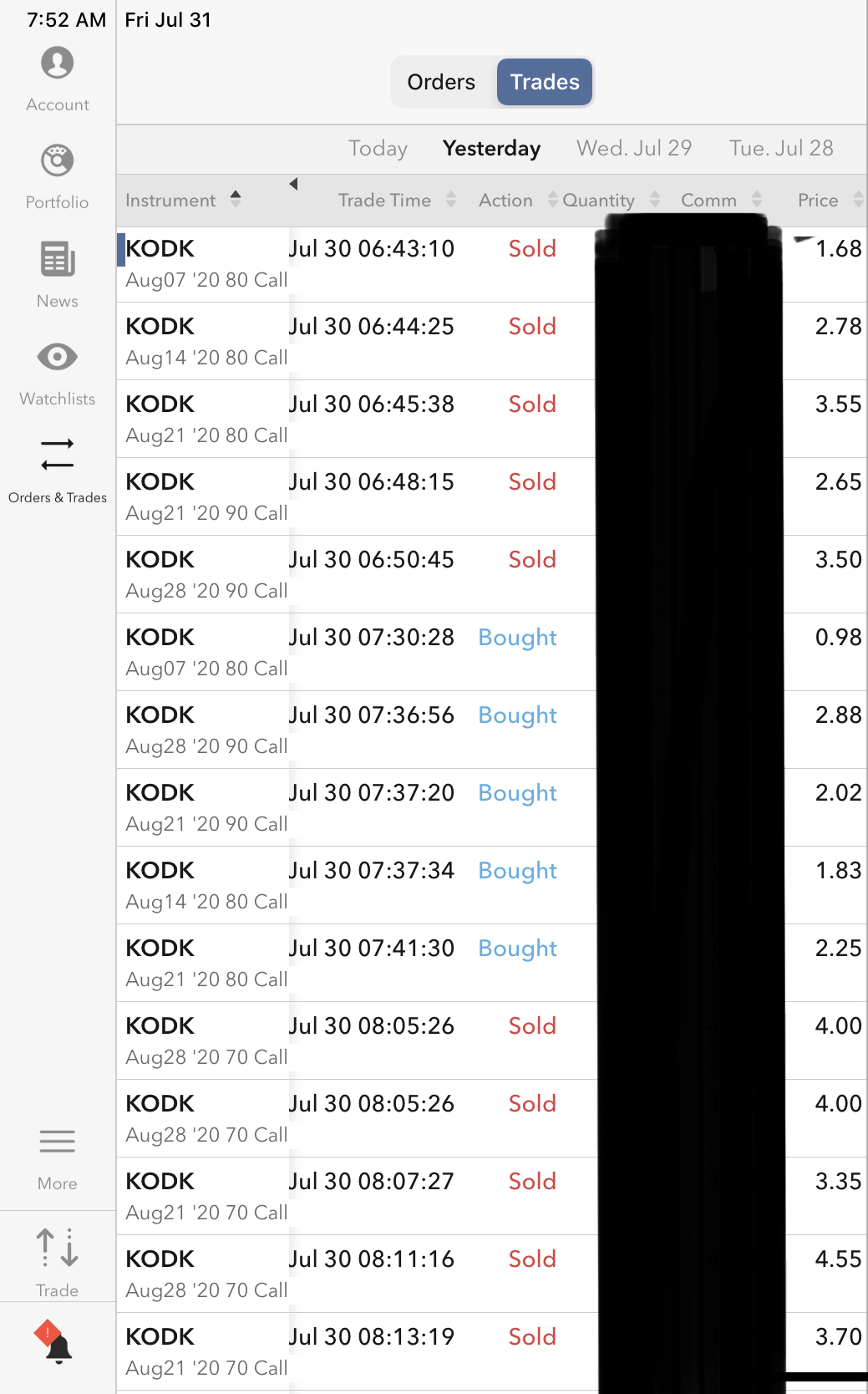

(2) Re KODK / TSLA yesterday ...

|