(1) Earlier this day did 3 actions following on to last nights sale of paper gold in HK.

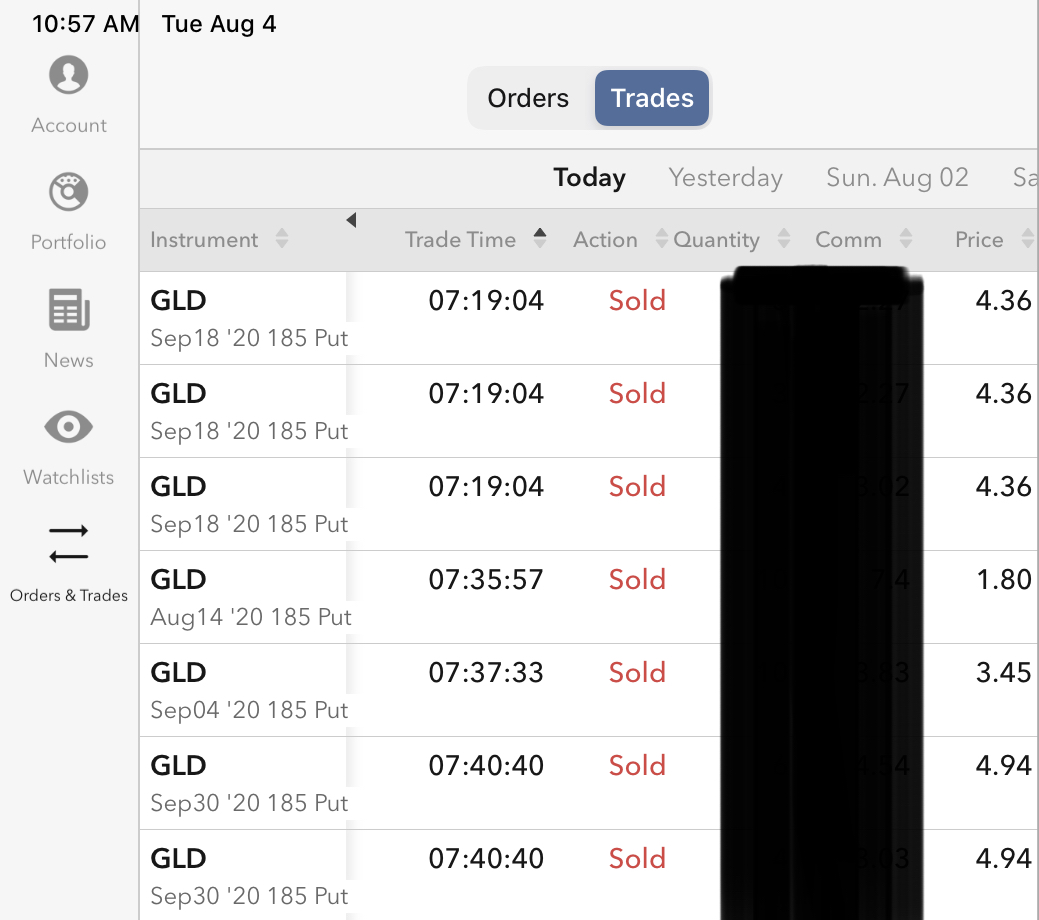

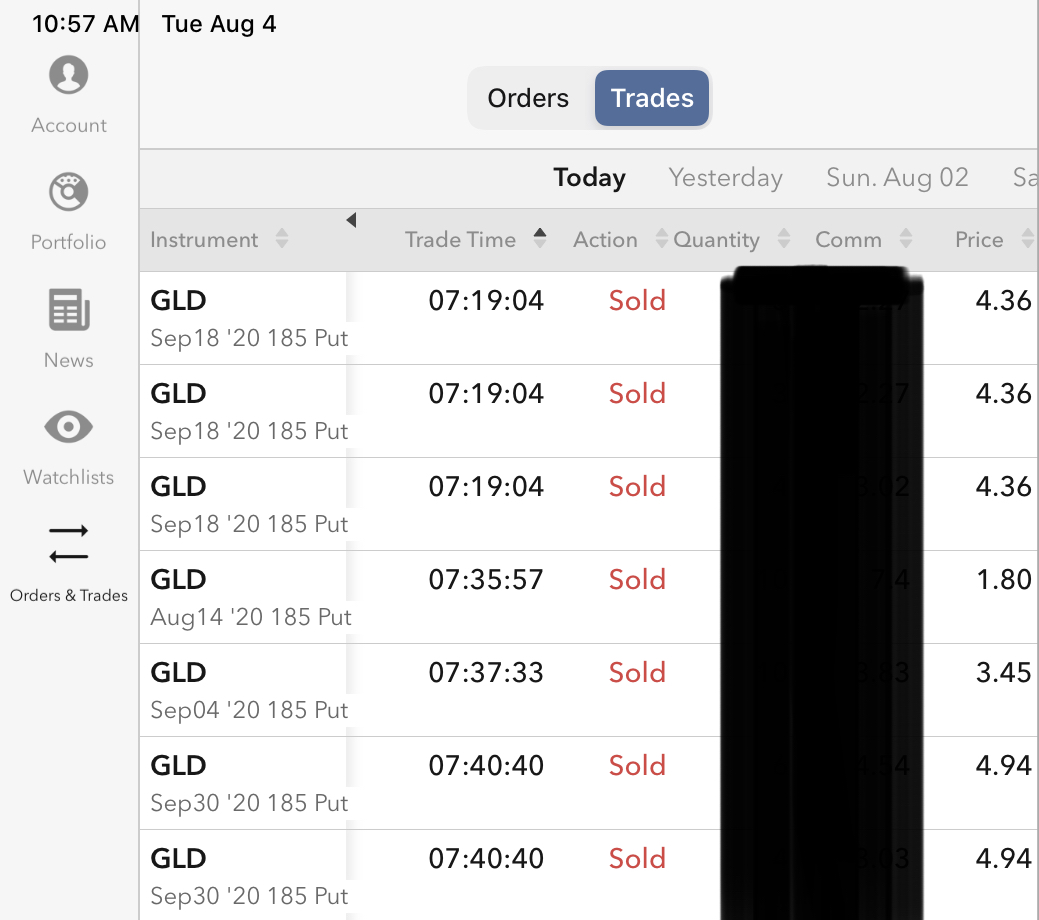

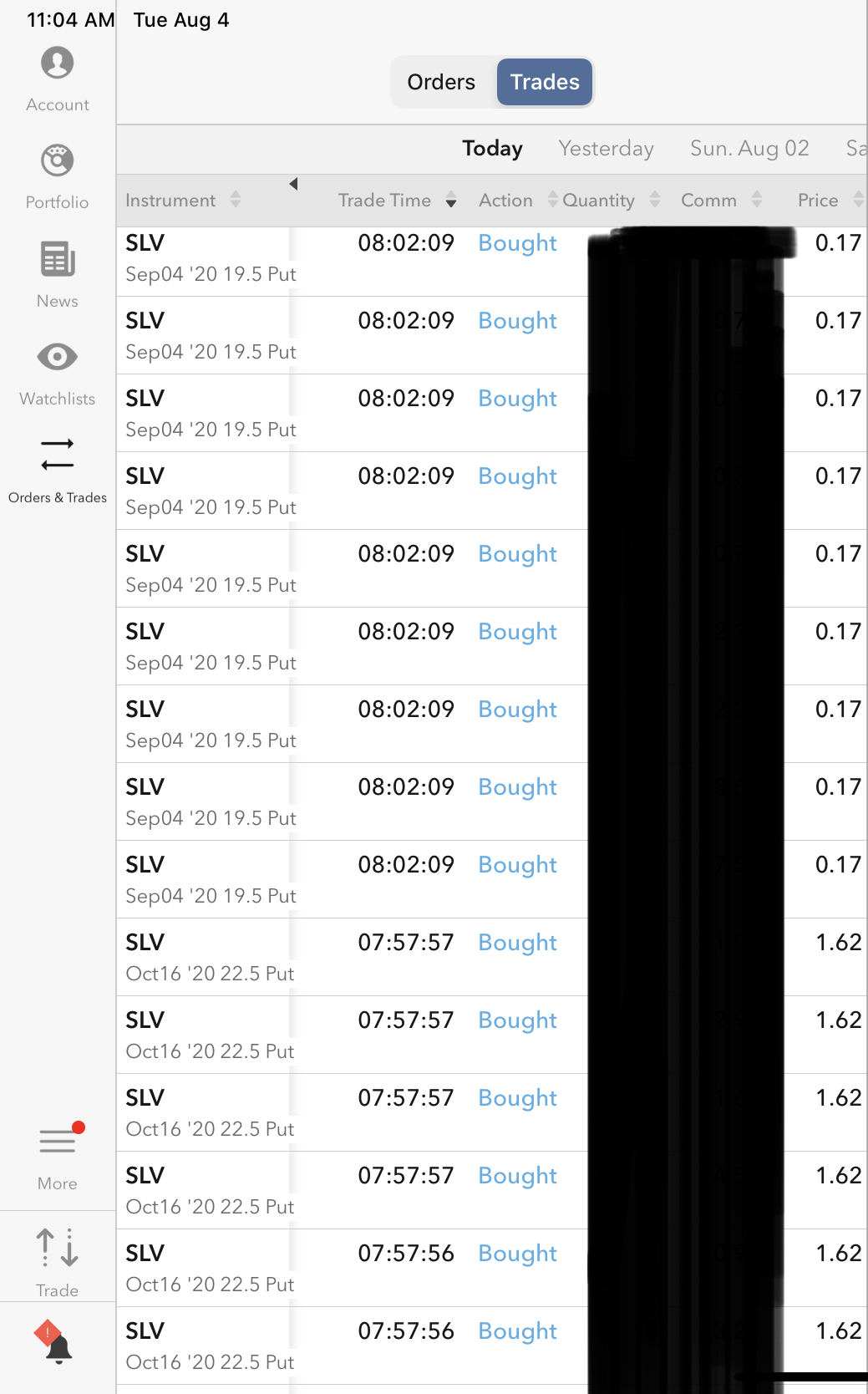

(1-i) Shorted puts, to tap residual energy of gold rocket, and should it flameout, so be it, more paper gold gets put in inventory at slightly lower pricing, and if not, more funding w/ which to buy physical.

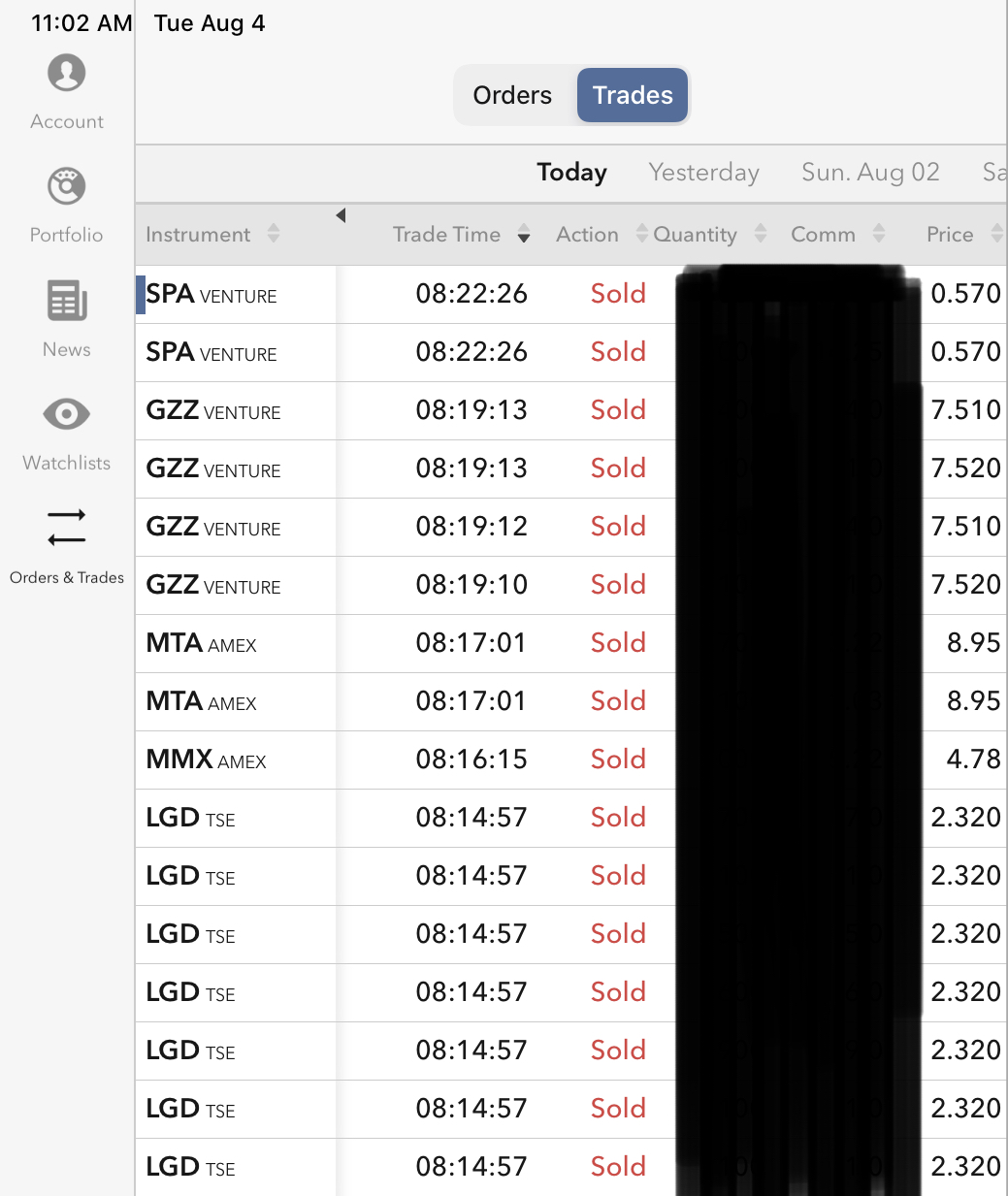

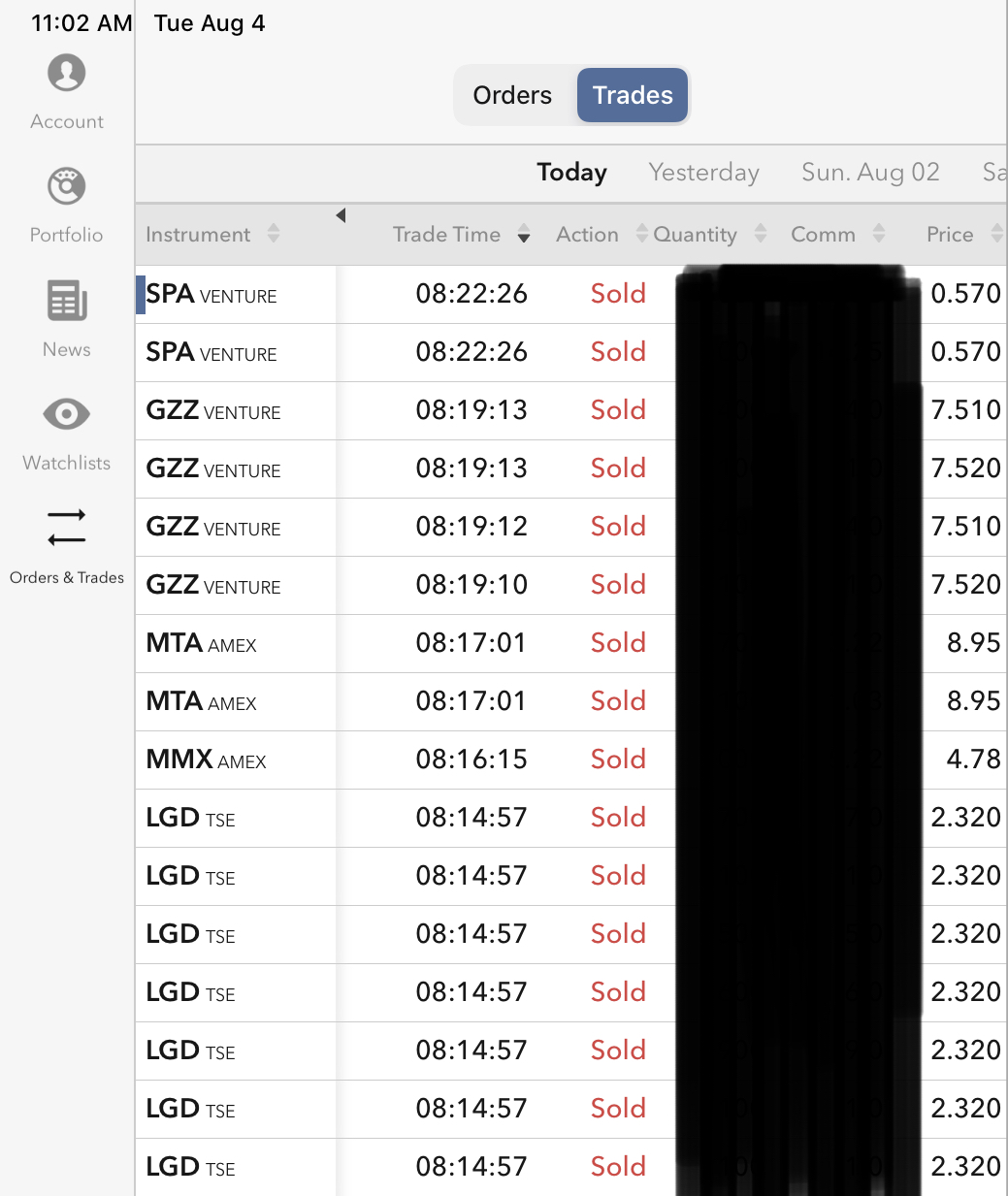

(1-ii) Took profit on four micro-junior miners I nought 2+ weeks ago Message 32844841 . I did equal-weight. Do not know very much about any of the four except that they were ordained to rise, did rise, and may have done their share for the moment. Shall step away for a few sessions and see.

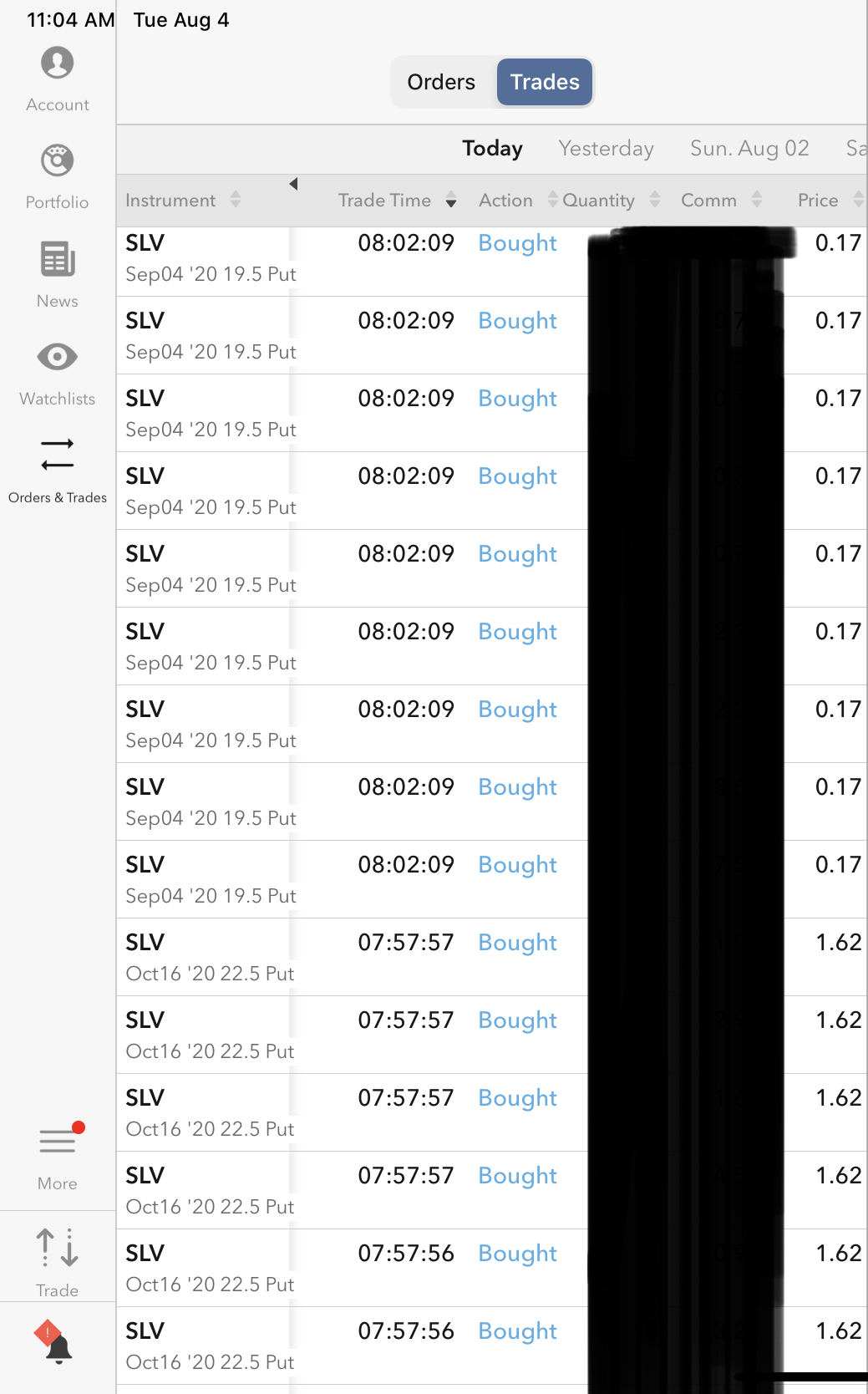

(1-iii) Bought cheap puts on silver as all believe silver shall continue to ramp, and I figure what-the-heck, on off-chance silver corrects, I would have more resources w/ which to buy gold, and if not, means my gold has done well w/ my PAAS, SLV and SIL.

In the meantime, breaching of the line is a beautiful sight to watch ...

bloomberg.com

Spot Gold Breaks Through $2,000 With Haven Seekers Piling In

Steven Frank

Spot gold surged to a record $2,000 an ounce as investors continue to seek a haven amid growing economic and geopolitical risks.

Gold has been rallying as the coronavirus pandemic prompts unprecedented amounts of stimulus to shore up economies, including lower rates, which are a boon for non-interest-yielding gold. Simmering geopolitical tensions -- including a massive explosion at Lebanon’s main port on Tuesday -- are also boosting demand.

“People want safety, and safety right now is gold because Treasuries are not yielding up,” Bob Haberkorn, senior market strategist at RJO Futures, said by phone.

Spot gold rose as much as 1.2% to $2,000.58 an ounce, and traded at $1,996.53 as of 12:50 p.m. in New York. Bullion for immediate delivery surged 11% in July, the biggest monthly gain since 2012.

Holdings in both gold and silver exchange-traded funds have risen to records in the past week as concern about the fallout from the coronavirus pandemic fuels demand for havens.

Investors are closely monitoring efforts in Washington to negotiate a new coronavirus relief package that many see as key to keeping the economy afloat as the pandemic curbs activity. The pressure is building, with the Senate set to leave on a break Friday, when crucial jobs data is due. Senate Democratic leader Chuck Schumer said Tuesday stimulus talks with the White House are finally moving in the right direction but they remain far apart on some issues.

“What Schumer was saying suggests we will get a package and reverse the sudden stoppage of benefits. This helps stocks and gold,” said Tai Wong, head of metals derivatives trading at BMO Capital Markets. “It means the Treasury will borrow trillions more which someday we will have to repay.”

Even as gold hits new highs, there are plenty of forecasts for further, substantial gains. Goldman Sachs Group Inc. says gold may climb to $2,300 as investors are “in search of a new reserve currency,” while RBC Capital Markets puts the odds of a rally to $3,000 at 40%.

The Message Behind Gold’s Rally: The World Economy Is in Trouble

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |