The Force is strong, OTOH

OTHO, too fast, and without respite

No complaints, just edgy, and must not fall off of the rocket

Maybe buy cheap silver puts even as silver climbs, knowing silver should fall more than gold as and when and if?

Dunno. Just guessing.

I have been trading stocks,

bought some preferred shares (i.e. Annaly, yielding 7.74 current yield, higher if called 2022, not for trading, just for supporting NLY cloud-ATM operation for it behaves as NLY, yields higher, but has no options, so I write options regularly but boringly, and go in / out NLY, with the preferred as cushion so when I do write Calls they are not totally naked even if when I do own NLY at times. At other times I may hold both for gaming.

Generally (almost always) net-long ‘risk’ even when shorting :0)

finance.yahoo.com

Been keeping on buying gold, holding DRD, SLV, SIL, trading rest of miners, and building LTBH positions in BBL and RIO and maybe NLY, and believing volatility ahead, risks plenty. Hoping 0388.hk takes a breather. Wife has one stock, 0388.HK and am not hearing the end of it finance.yahoo.com

Had BTC and ETHE but fell off of rockets.

Generally do not have a lot of positions for they confuse me. Am definitely not a 80% -in-equities ‘investor’. That time shall come, but later.

Have some small positions like SRPT and recently micro miners (off loaded such in past week)

Am and have always been a collector of gold.

bloomberg.com

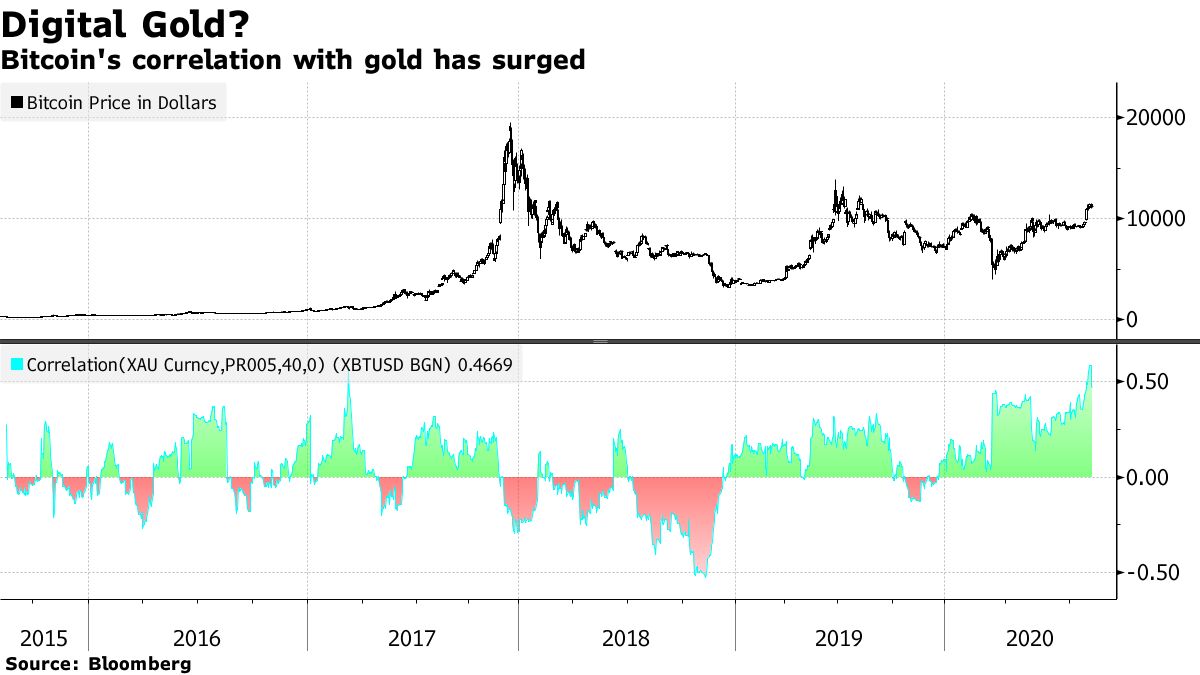

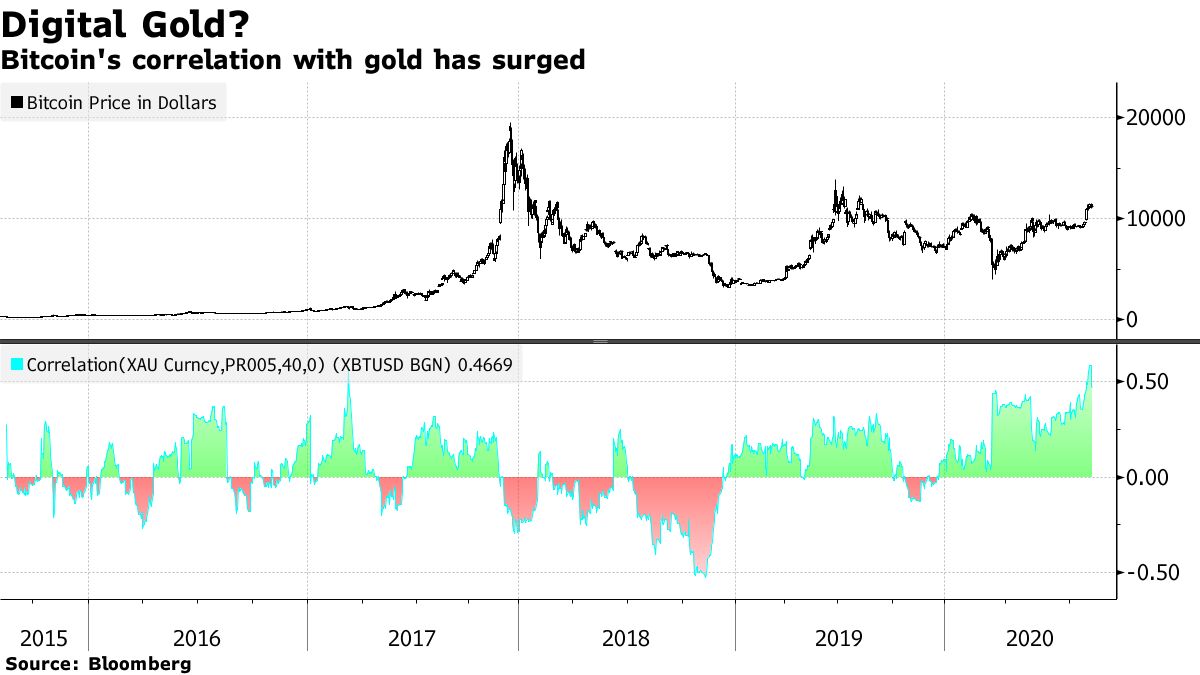

Older Investors Go for Gold, Younger Ones Bitcoin, JPMorgan Says

Joanna Ossinger

August 4, 2020, 9:12 PM PDT

The behavior of retail investors during the pandemic varies significantly across age groups, according to JPMorgan Chase & Co.

Investors generally are interested in alternative assets but older ones are buying gold while younger ones like Bitcoin, strategists led by Nikolaos Panigirtzoglou said. Millennials are embracing stocks, particularly technology shares, whereas older individuals are selling equities, they said.

“The older cohorts continued to deploy their excess liquidity into bond funds, the buying of which remained strong during both June and July,” the strategists wrote in an Aug. 4 note that analyzes investment flows.

Retail investor demand this year is evident in the 46% jump in stocks globally from March’s lows, the surge in worldwide holdings of gold-backed exchange-traded funds and recent rallies in cryptocurrencies. The presence of amateur traders is also being seen in everything from exuberant optionsto smoothed trading action, while their stock picks and market timing appeared to fare pretty well compared with institutions.

Gold and Bitcoin ETFs have been experiencing strong inflows over the past five months, as both old and young see the case for an “alternative” currency, the strategists wrote. The Bloomberg Dollar Spot Index has declined about 1.7% over the same period, fueling a debate about whether a prolonged period of dollar weakness is at hand.

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |