Re <<Looks like no massive rally. Bludgeoning instead.>>

Message 32874495 looks that way. If so, instead of missing a paper gold rally, I only have to endure a physical gold respite, and should I must guess, I guess either shallow / deep but of short duration (weeks instead of months, and certainly not years), primarily because the dollar must be trashed even as the stock market’s underpinnings (~20 shares?) be tested by electioneering.

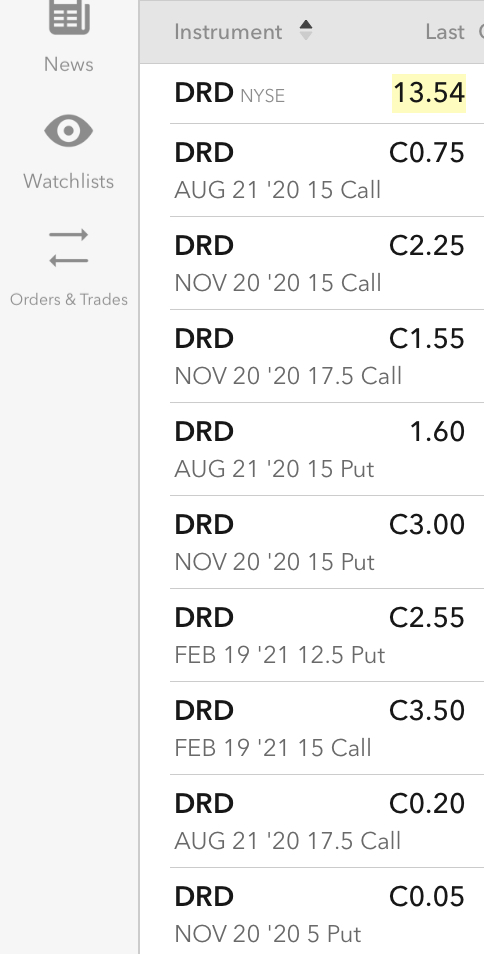

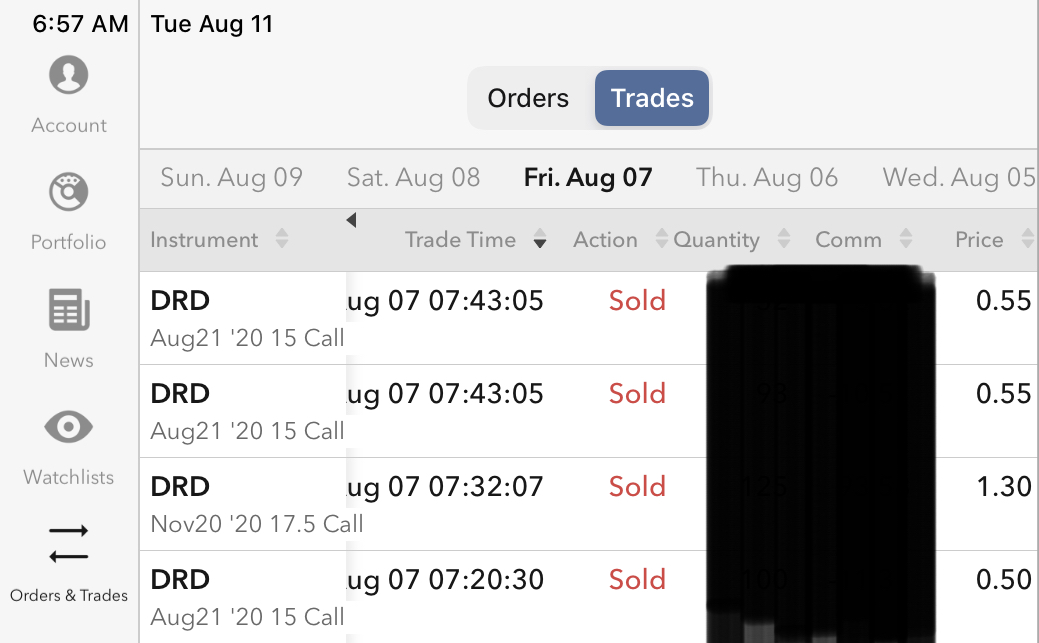

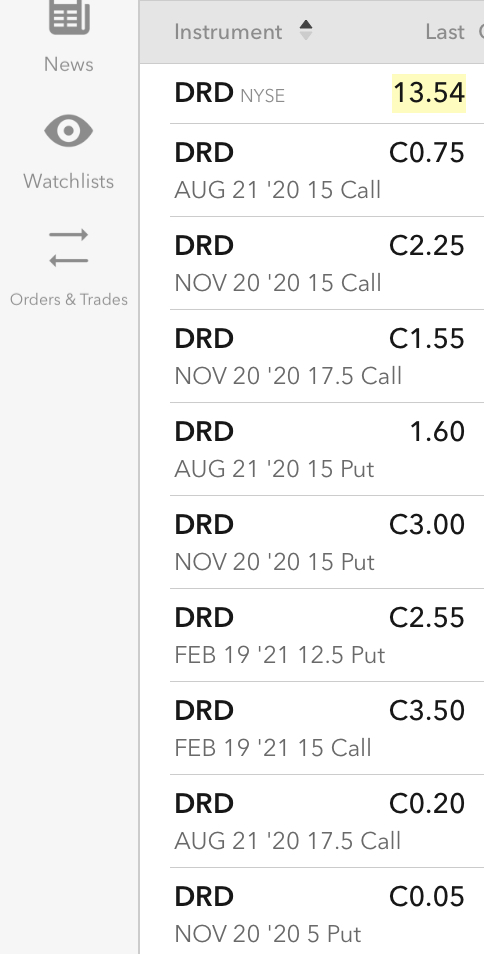

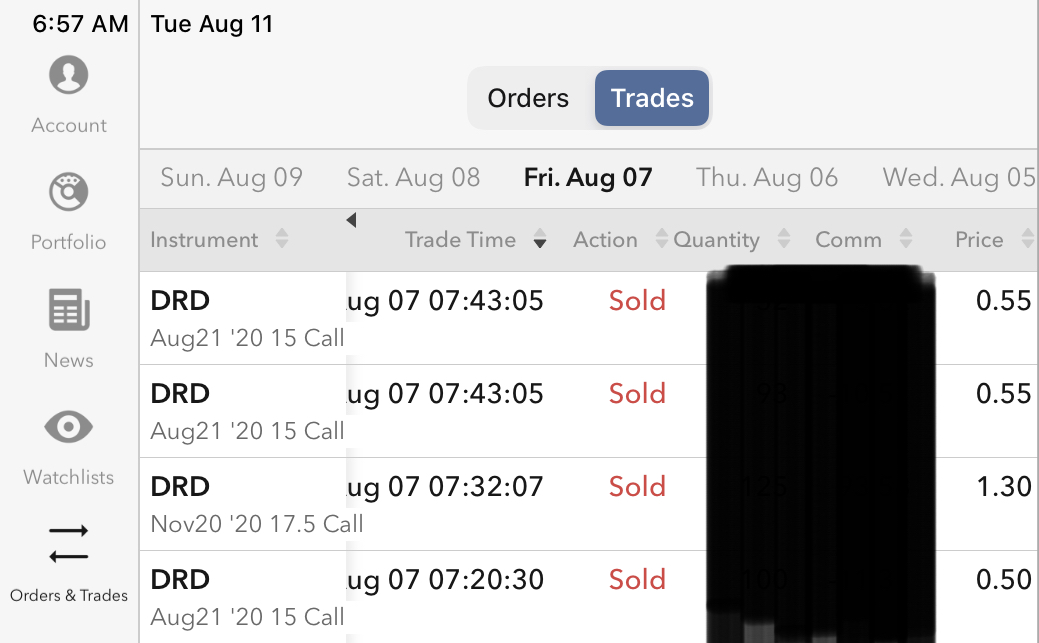

As re to DRD, am slightly net negative, by a smidgeon, as I had on Friday been compelled to add to shorting of calls. Even so the entire basket of DRD related deployment (all call and put options indicated are short positions) suffering, but only not as much as would have. The premiums earlier were extremely rich when most positions initiated. At least half should blow up in counter-parties faces, but I shall likely be put some more DRD which is fine, I hope.

Going forward, wait for August 21st option expiration and see. DRD can crater through 12.5 on the downside, and if so, we are fortunate for all-in opportunity. Test of faith.

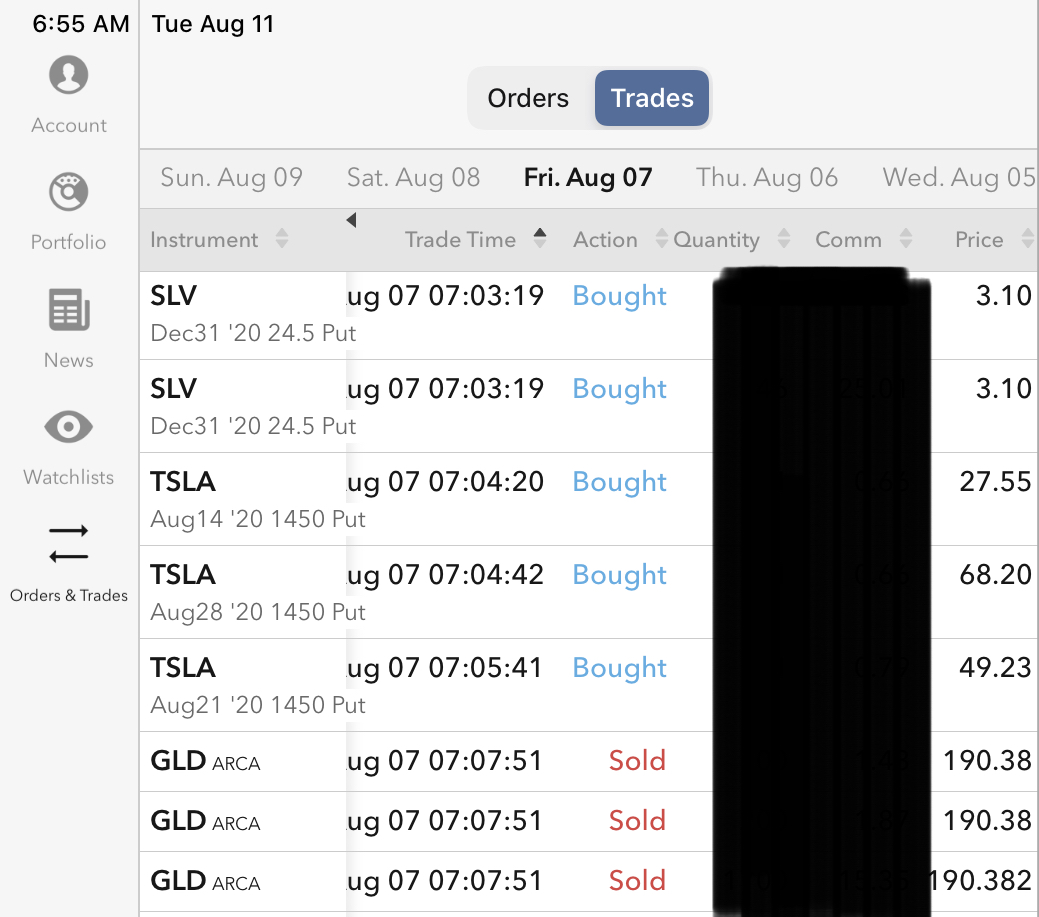

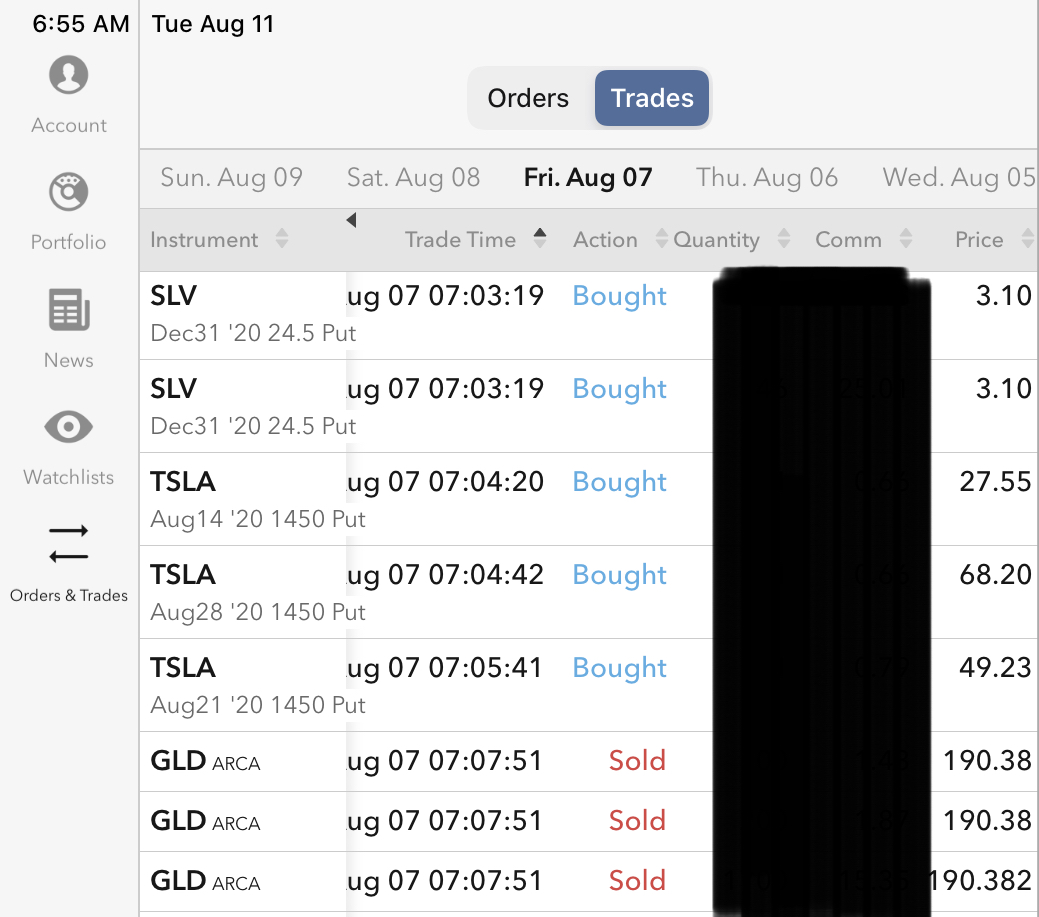

My silver wagering was always premised on the truth that it is more volatile than gold, on the up as well as downside.

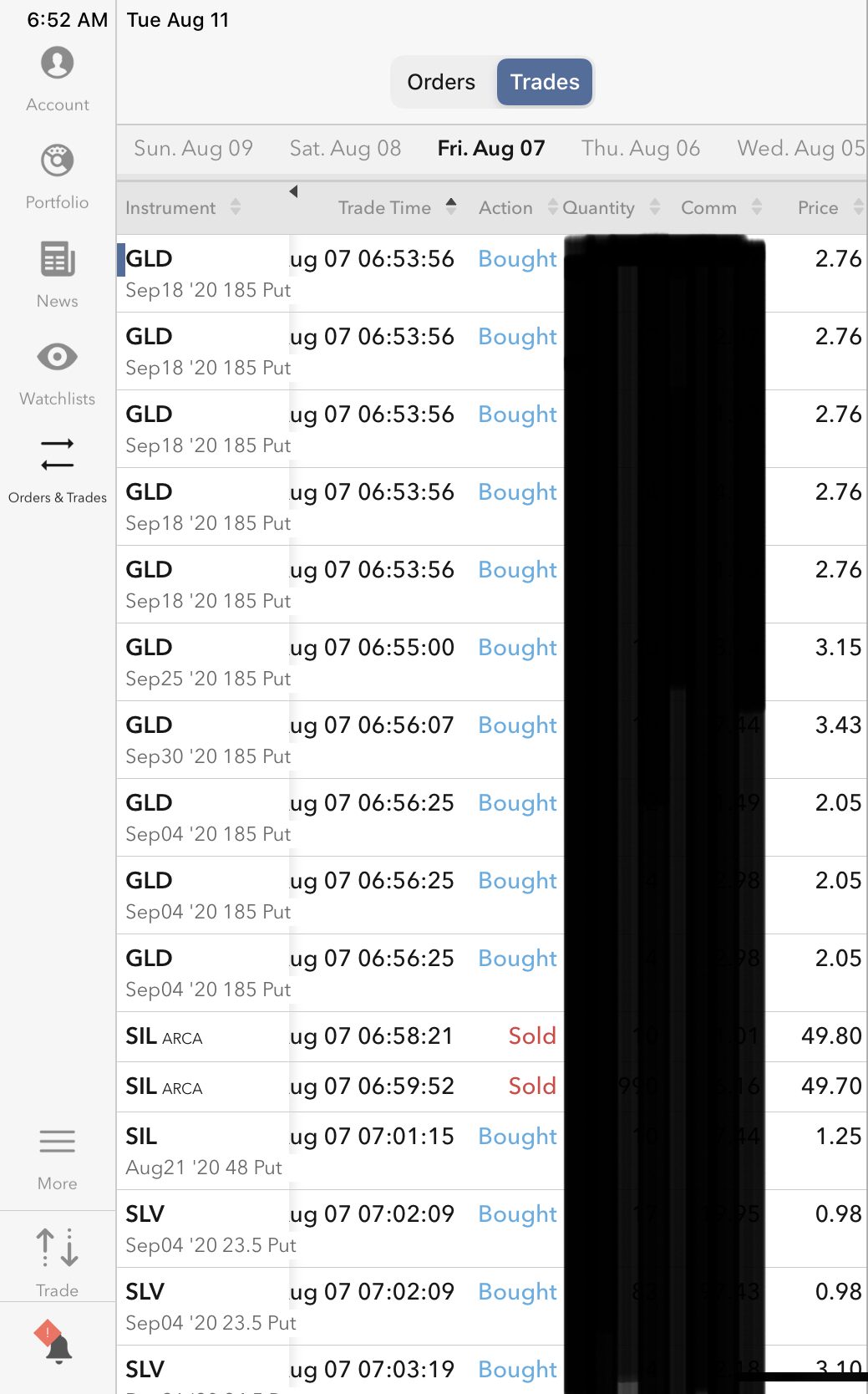

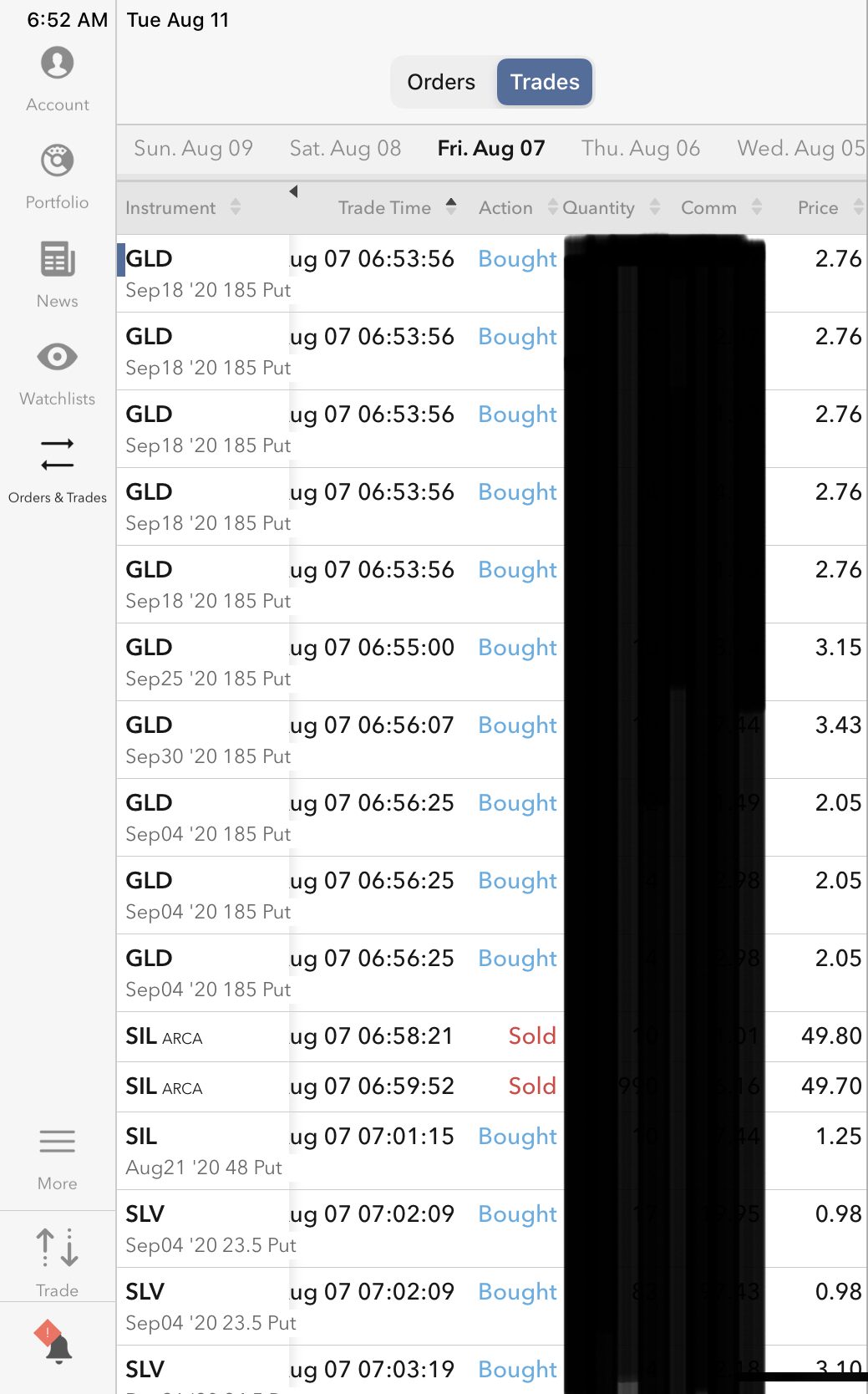

Sold GLD, closed TSLA put, and bought SLV puts on Friday

Closed silver and gold option positions on Friday

... and yesterday (Monday)

... and sold excess / naked DRD calls on Friday, obviously not enough. The market for DRD options shall not likely afford me an exit before expiration, and so I am dependent on exercise of earlier shorted puts August 21st. I actually need DRD to wobble else uncomfortably exposed

|