Re <<Looks like ... Ouch>>

Noted TSLA doing 5:1 split.

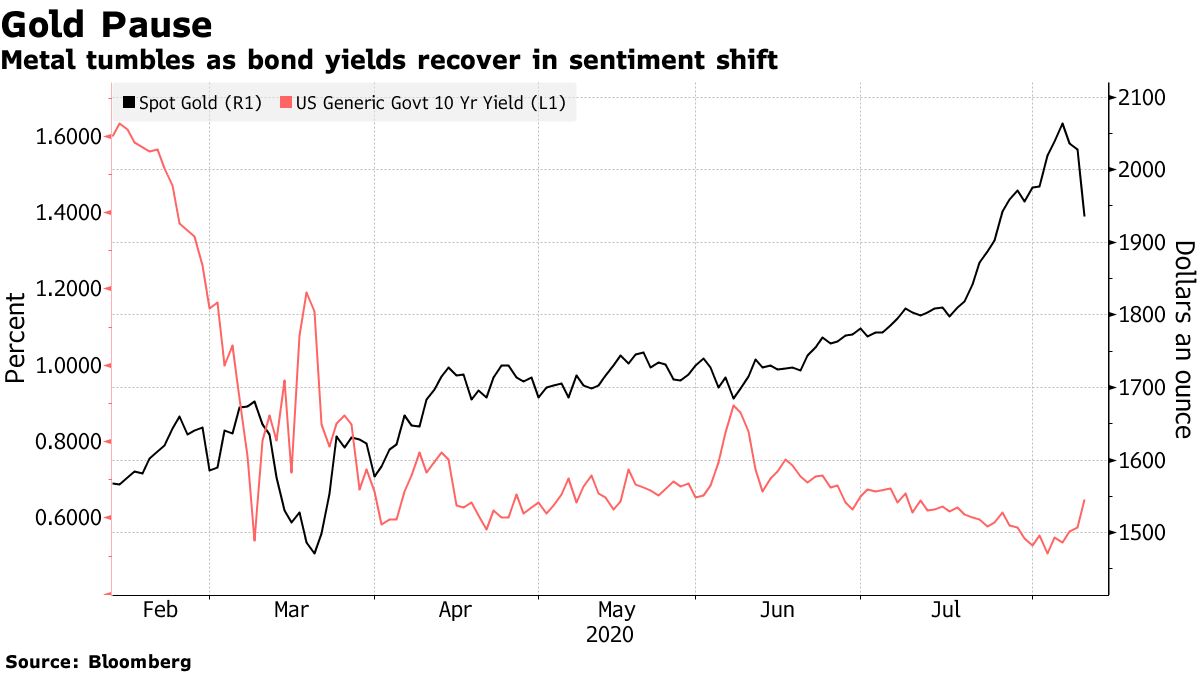

Looks like long rates may rise even as short rates remain tame, because the is what the FED wants, and has expended very little ammunition to get the crowds moving.

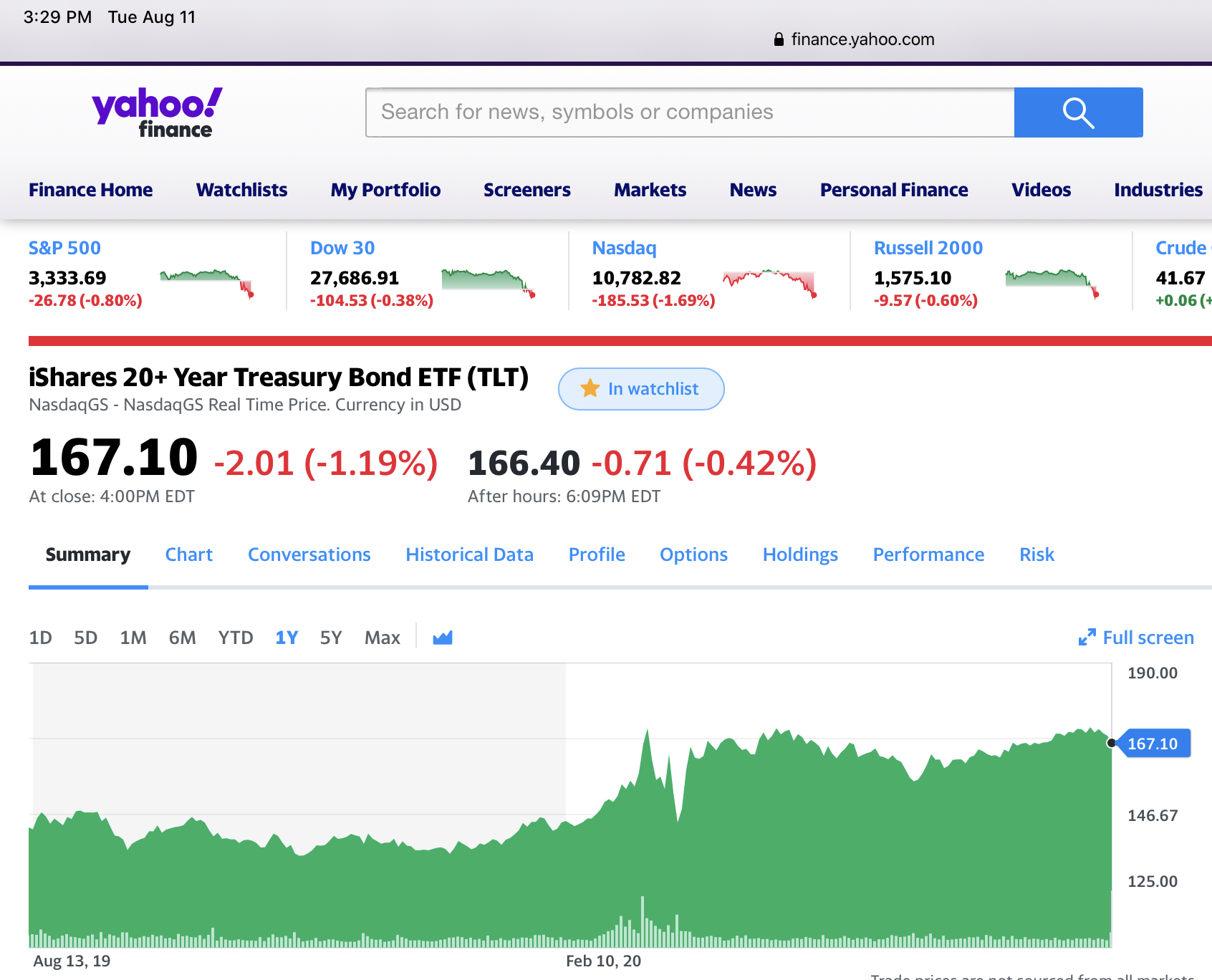

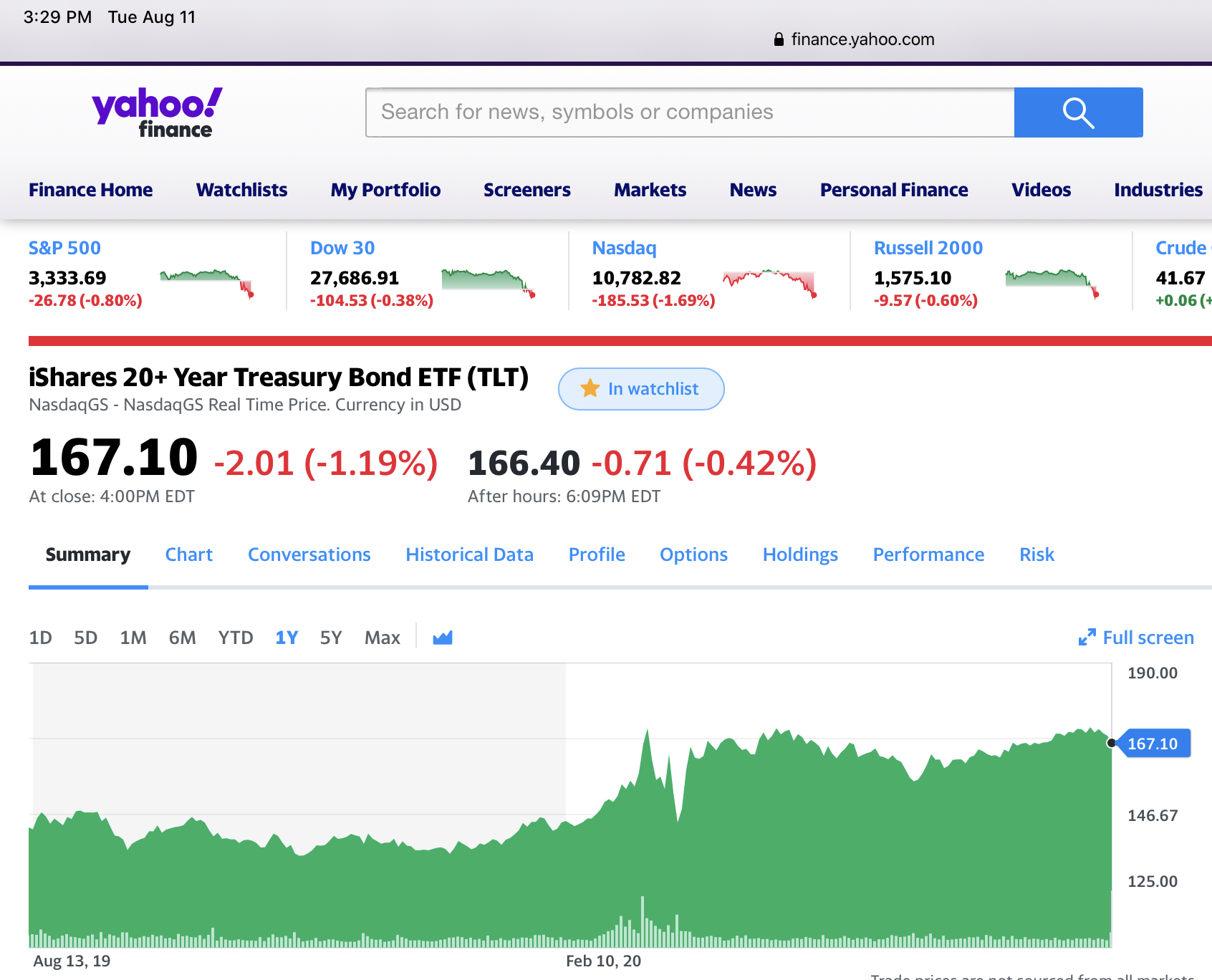

Looks like TLT hit a top (20-yrs rate at bottom, rebound between now and whenever, then go bid-less 2032) and can be shorted to lessen the pain of gold backfilling finance.yahoo.com

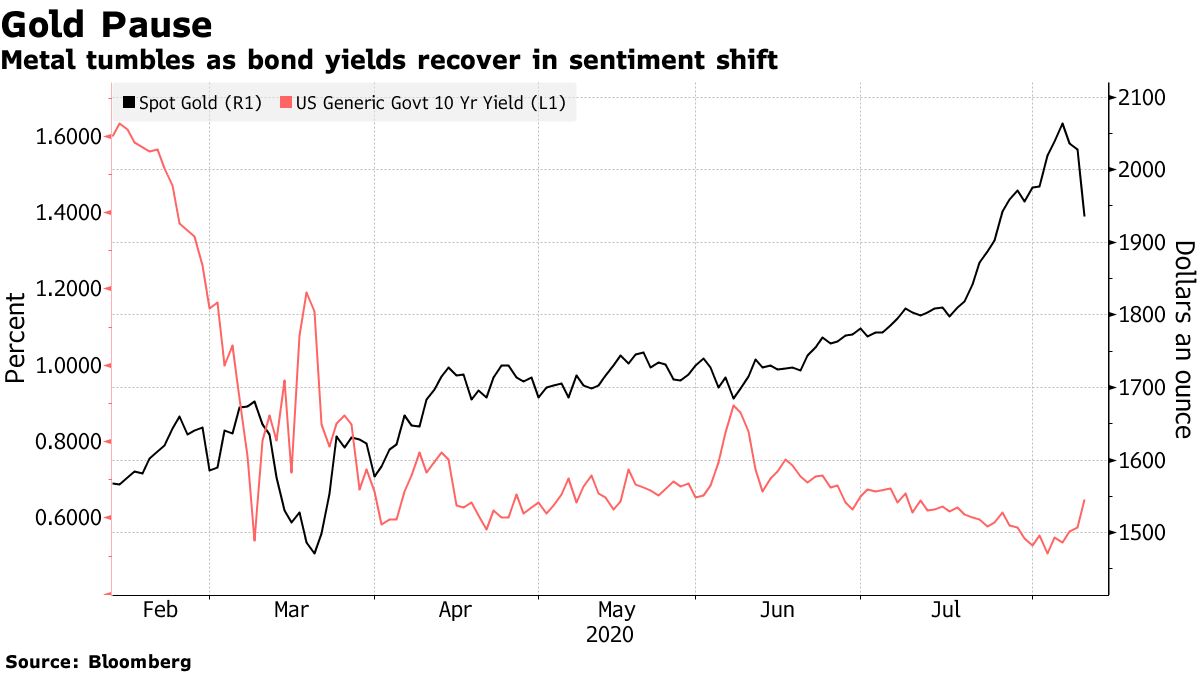

Looks like gold has little underpinning as mobs run for the hills, as supports crack then go asunder. Gold can go to the 16xxs.

If should be so, then silver gets nailed.

The rest of the equity may follow.

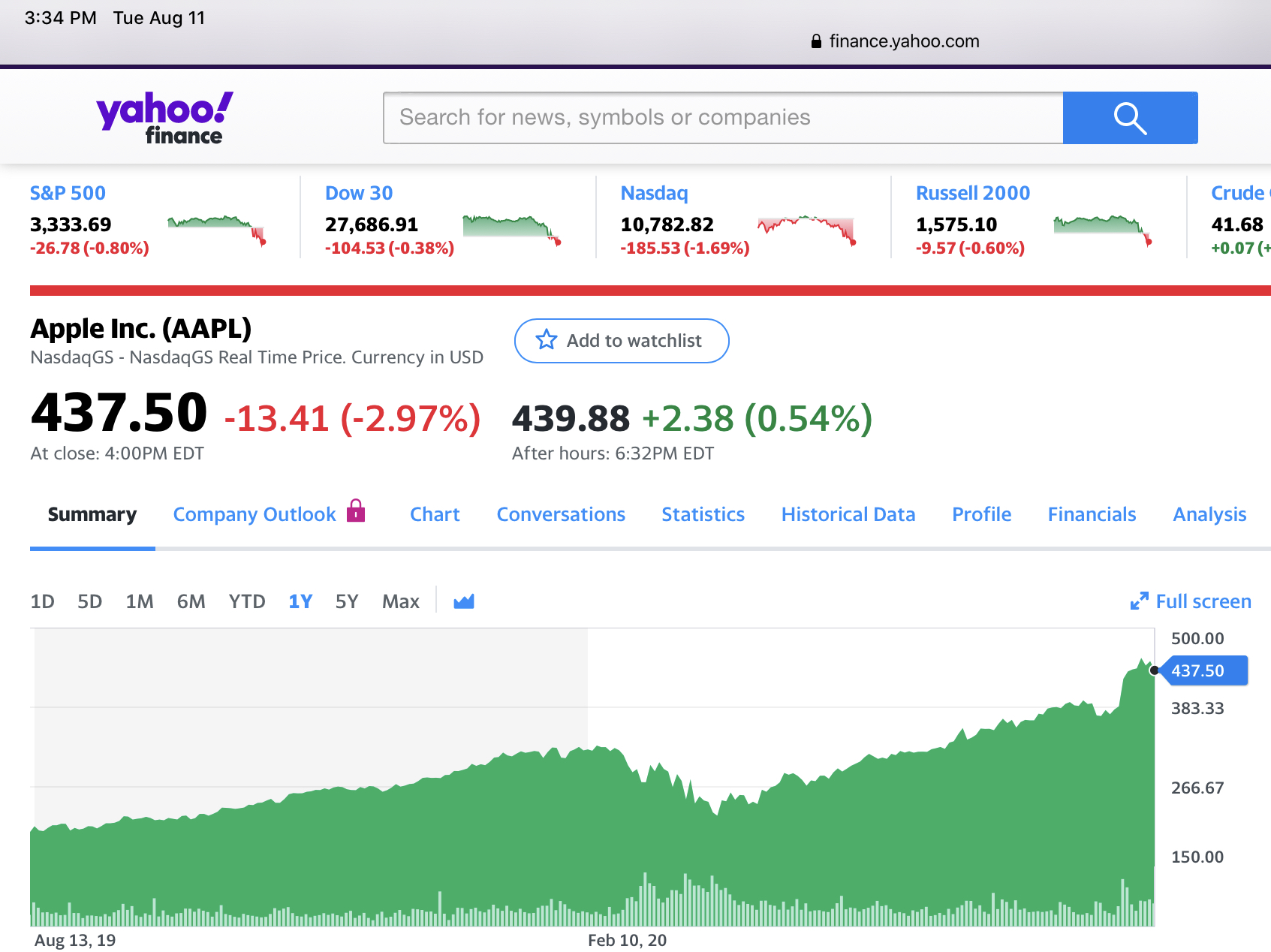

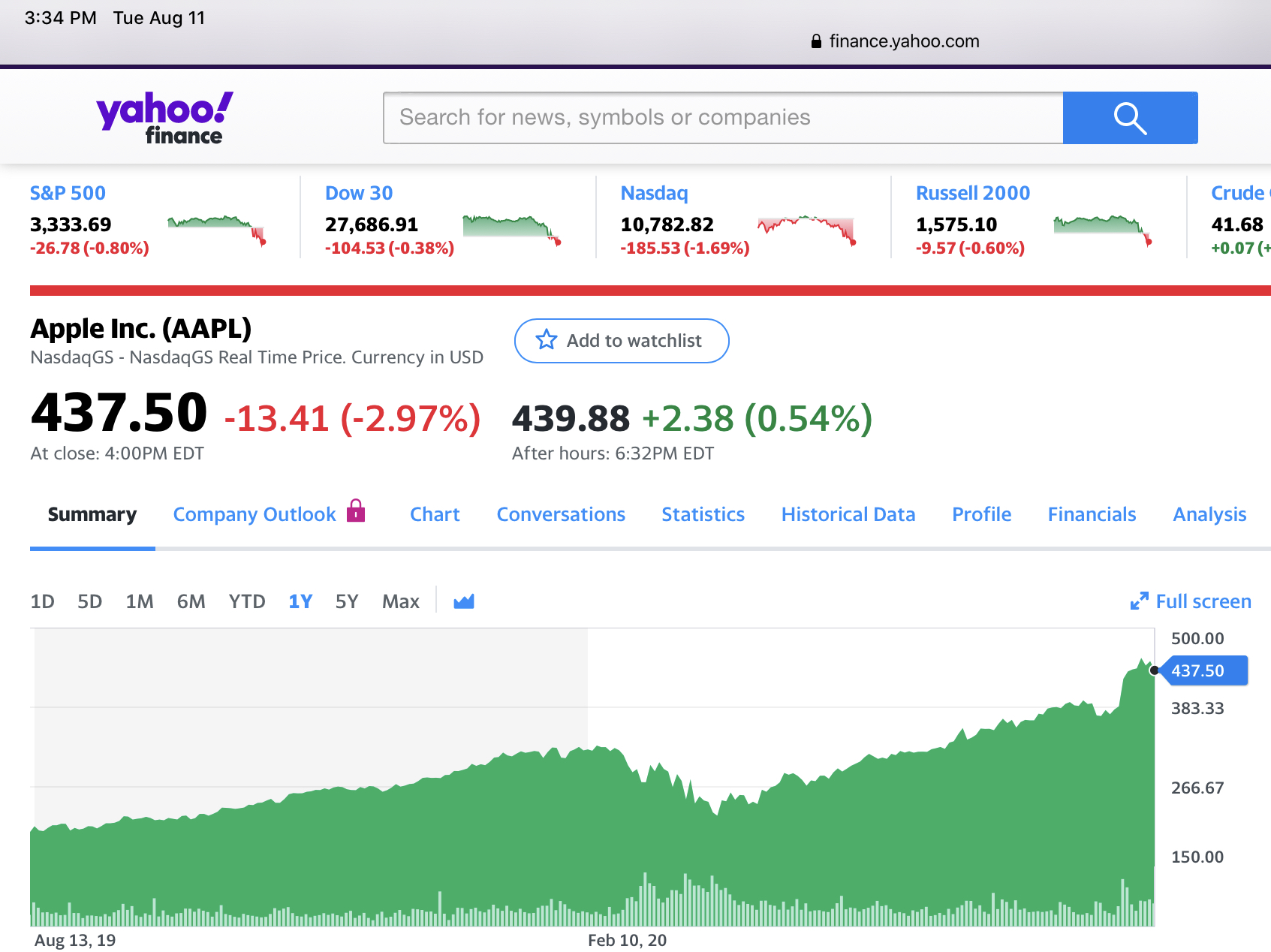

Watching AAPL finance.yahoo.com for signs of trade war damaging

All might participate in sling-shot post election.

Dangerous gaming. Just as well the physical was not marked up.

bloomberg.com

Gold Heads for Biggest Drop in Seven Years on Rising U.S. Yields

Justina Vasquez

August 11, 2020, 7:34 AM PDT

The rally that pushed gold to record heights above $2,000 an ounce has come to an abrupt halt, with the haven metal heading for the biggest drop in seven years after bond yields spiked higher.

Treasuries and European bond yields climbed, cutting into the negative real rates that had supported the metal. The 10-year Treasury yield jumped the most since June ahead of an expected flood of government and corporate debt issuance. U.S. producer prices increased faster than expected.

“Today real rates clearly moved higher and that’s clearly what moved gold lower,” Michael Widmer, head of metals research at Bank of America Merrill Lynch, said by phone from London. “You had stronger PPI data out and I think when that data came out the market had another look at rates and expectations.”

Exchange-traded fund investors also took a breather, seeing back-to-back outflows for the first time since June. On Friday, State Street Corp.’s SPDR Gold Shares, the largest gold-backed ETF, saw its biggest outflow since March. Meanwhile, a Bloomberg Intelligence gauge of senior gold miners dropped the most intraday since March, down as much as 6.3%.

Stocks rallied, as investors in risk assets took some comfort from the U.S. president’s comment on potential tax cuts, strong Chinese economic data and falling hospitalizations in California and New York.

Adding to positive market sentiment is a Covid-19 vaccine that Russian President Vladimir Putin said the country has cleared for use, and it hopes to begin mass inoculation soon. Globally, coronavirus infections breached 20 million cases, after doubling in six weeks. It took six months to reach 10 million.

Spot gold fell 5.5% to $1,915.23 an ounce at 2:46 p.m. in New York, heading for the biggest drop since April 2013. Earlier, the price broke below the $1,921 level that had stood as the record for almost nine years.

Futures for December delivery slid 4.6% to settle at $1,946.30 on the Comex in New York, the largest decline for a most-active contract since mid-March.

“It’s quite abrupt and brutal, but the price increase before was even more abrupt and brutal,” Carsten Fritsch, a commodity analyst at Commerzbank AG, said by phone. “The trigger could be the sharp rise in bond yields, which caused some profit-taking and then that cascaded. When people start to take profits, more will follow, and so we see this acceleration of price declines today.”

Spot silver dropped as much as 15% to $24.7534, and was heading for the biggest decline since October 2008.

Whither gold?

“I think the underlying, fundamental, positive reasons for gold haven’t gone away,” Tom Fitzpatrick, a Citigroup Inc. technical strategist, said by phone. “Once the momentum in this lags, we’ll probably consolidate for a while, but we still think we might find ourselves back up at $2,400 by the end of the year.”

BofA’s Widmer says the gold rally has only hit a pause, and reiterated the bank’s $3,000 an ounce 18-month target.

“Financial repression is not gone and I think dollar debasement is not gone either,” Widmer said. “Implicitly and explicitly, central banks are backstopping governments at the moment, and I think that’s really the bullish firmness behind that $3,000 per ounce call.”

— With assistance by Eddie Spence

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |