Something about the state of Gold

Am not sure what I am thinking, and just going w/ the flow, which may be dangerous, but as am unwilling to short against physical, and reluctant to go dramatically net short DRD, nothing much to dwell on. A drubbing of DRD below some pricing would hurt even as stance-d now. Must grin and bear.

Just have to have presence of mind to buy paper at the believed ‘bottom’ should such opportunity appear.

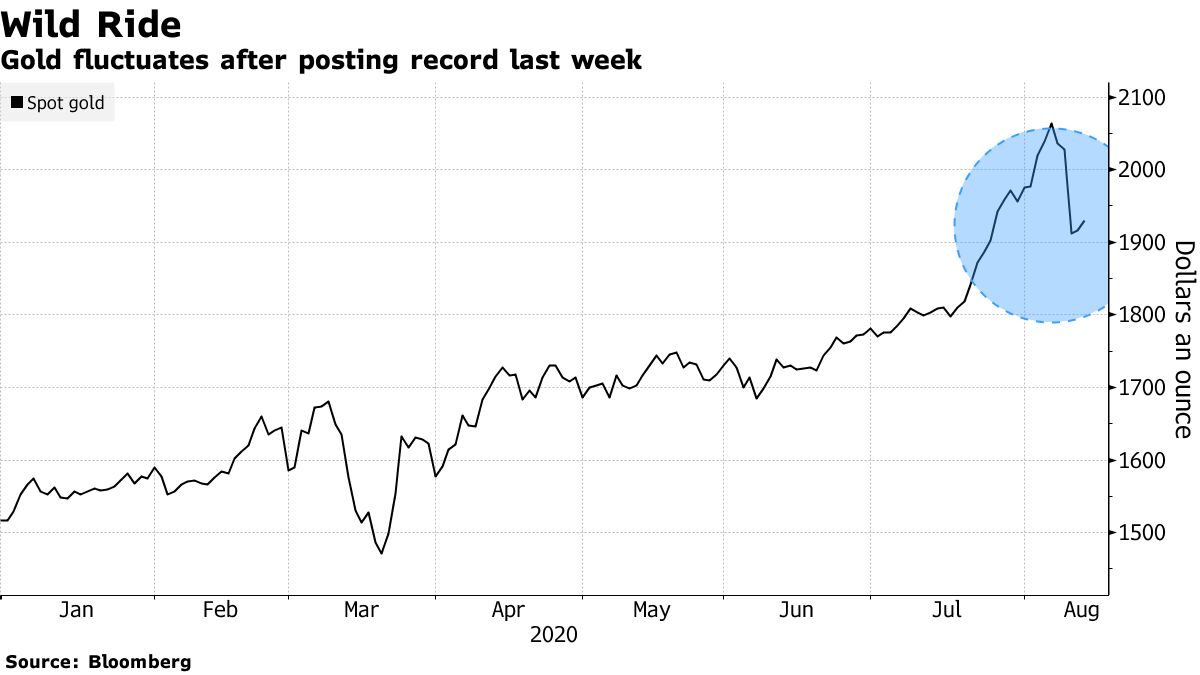

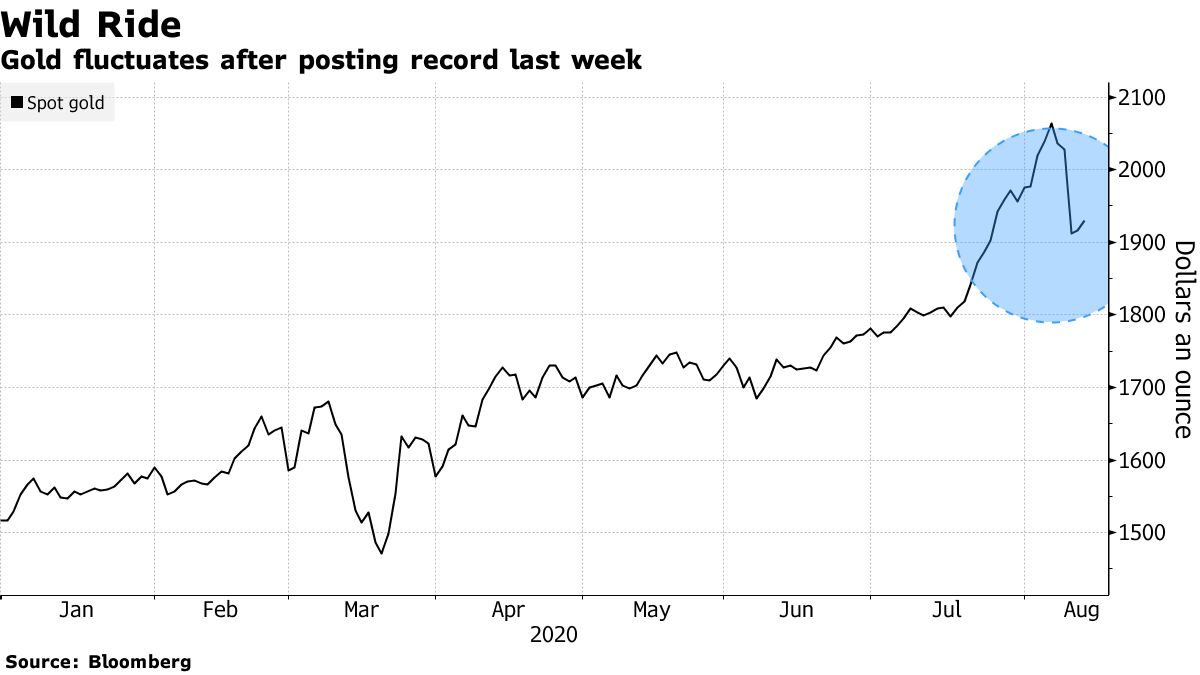

Volatility promised and volatility received.

bloomberg.com

Gold Calms Down After Wild Ride as Investors Weigh Next Steps

Ranjeetha Pakiam

August 12, 2020, 5:47 PM PDT

Gold held above $1,900 an ounce following wild swings as investors weighed the outlook for the metal’s record-setting rally, tracking moves in bond yields, a weaker dollar, as well as an uptick in risk appetite.

Spot bullion steadied, while futures dropped after U.S. stocks briefly surpassed their all-time closing high, curbing demand for haven assets. Gold had tumbled on Tuesday, then swung in a wide arc on Wednesday, as last-week’s rally likely spurred some technical selling and profit-taking.

Read More: Gold’s Sharp Plunge From Record and Where to Next in Four Charts

Even with the correction in prices, gold and silver remain among the best performing commodities this year, aided by negative real yields and vast stimulus to combat the fallout from the coronavirus pandemic. Goldman Sachs Group Inc. has described gold as the currency of last resort amid an inflation threat to the dollar, and forecast further gains above $2,000 an ounce.

“Gold’s roller-coaster ride is far from over as bond yields will likely remain volatile for the rest of the summer,” said Edward Moya, senior market analyst at Oanda Corp. “The relentless pace higher for gold will moderate but the outlook still warrants a strong stretch of fresh, record highs.”

Spot gold traded 0.2% higher at $1,920.38 an ounce at 8:02 a.m. in Singapore. On Tuesday, prices dropped 5.7%, the biggest one-day loss in seven years, following a rally to an all-time high of $2,075.47 last week. Futures for December delivery declined 1% to $1,930.40 on the Comex in New York.

Silver for immediate delivery rose 0.3% to $25.5884 an ounce after a 2.9% gain on Wednesday and 15% slump on Tuesday.

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |