Re <<reboot infrastructure>>

Requires right set of partners, providing value-packed hardware for local implementation by local labor, and benefiting local finances / economics, I am guessing.

For USA, am guessing that perhaps the Democrats, should they in the very unlikely event win big at all levels, might be able to finally get going on infrastructure spend, should they be so inclined, and I do not know if they claim to be inclined. Infrastructure spending requires broad-base agreement that no one party can push through, because much of it may at first seem like elephants of various shades.

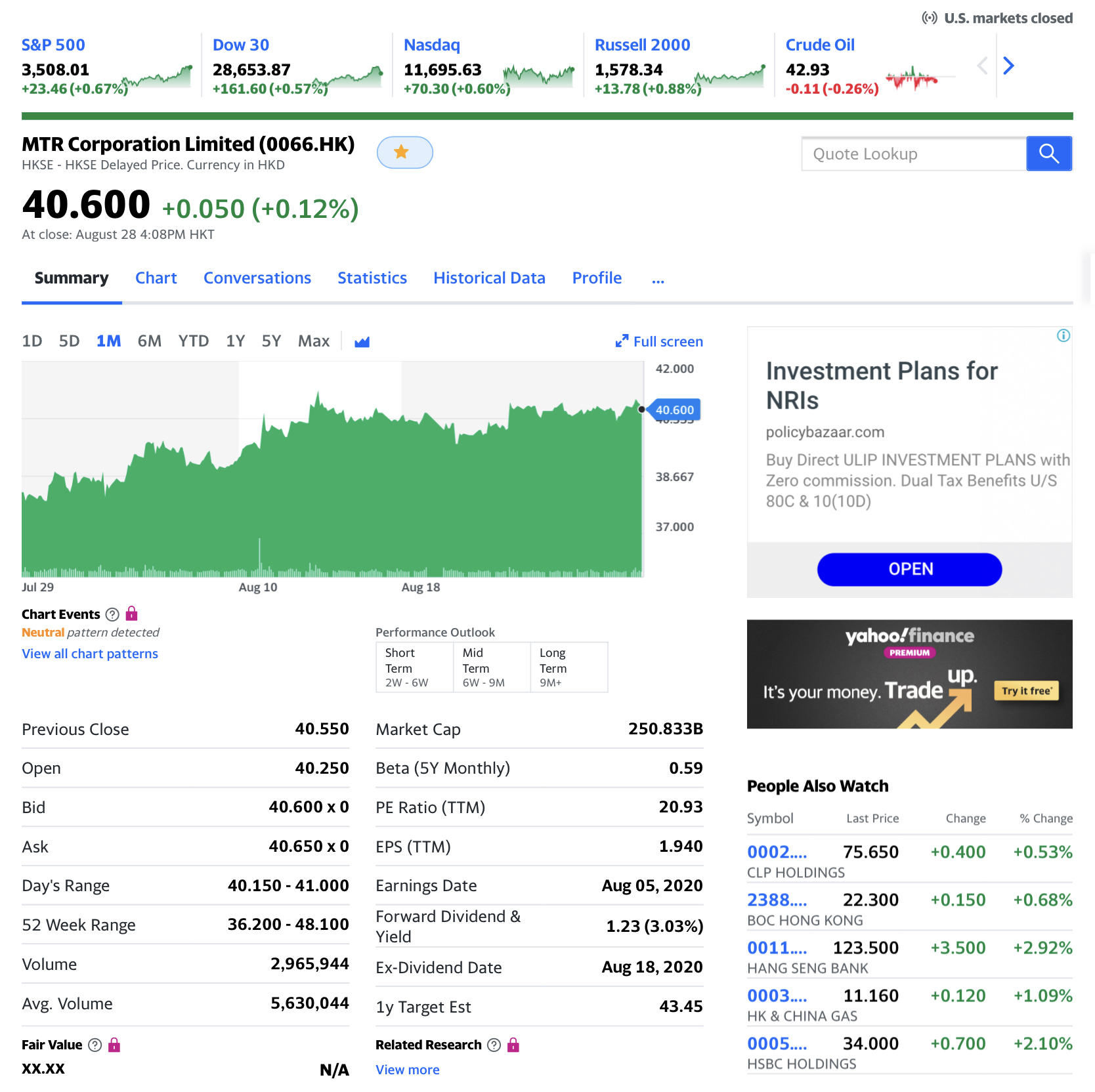

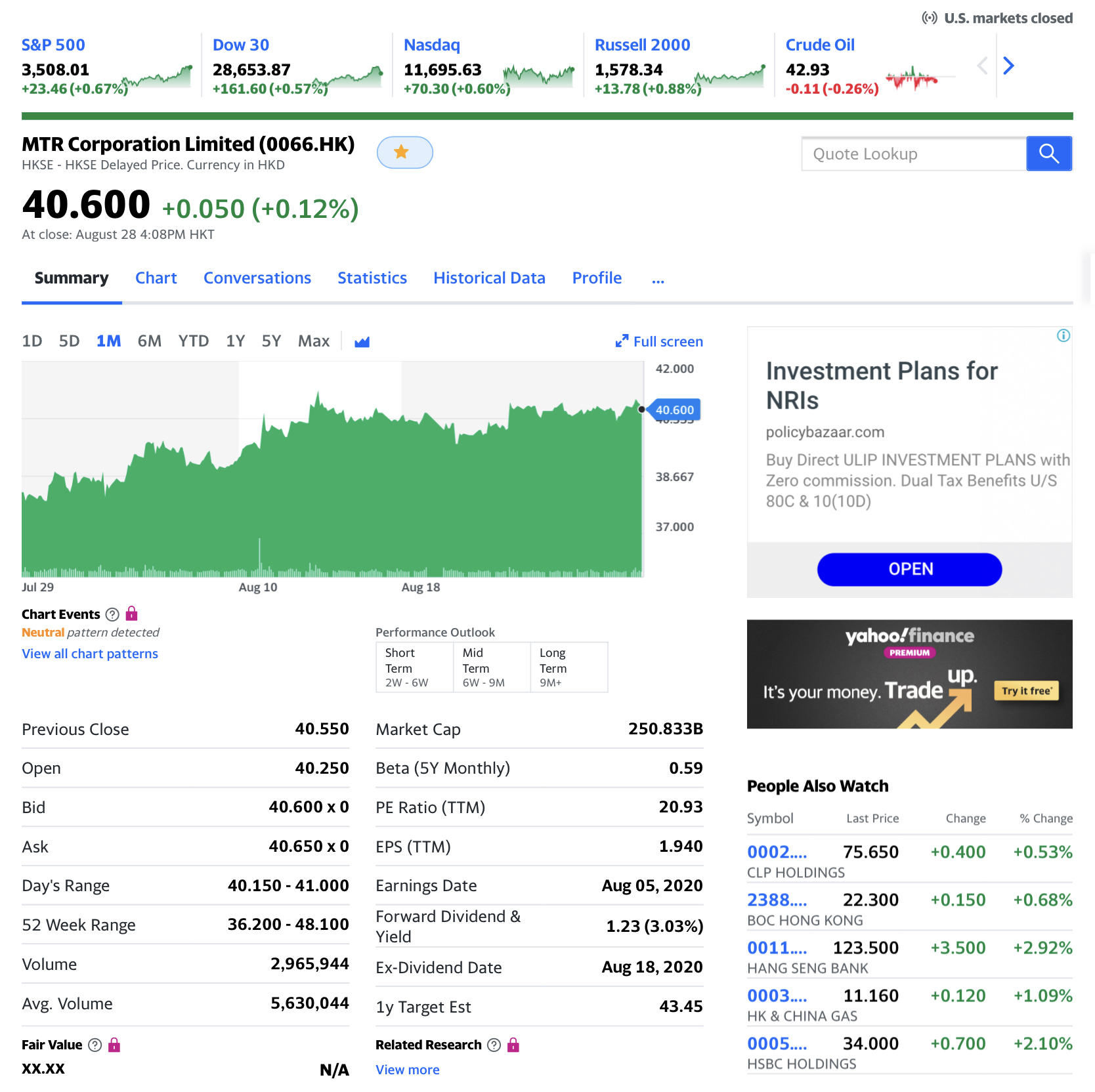

Take four example the NYC MTA system, second-world if that, and what I experienced when last there, distinctly third world. It should be making a profit as a simple horizontal elevator, and yet it racks up losses in numbers i am unfamiliar re to HK MTR corporation, Serving same ~ population.

Even accounting for burning looting riots, MTR makes a profit and pays a dividend and provides transaction value to our stock exchange 0388.hk and earnings to dividend investors allowing for win-win-win-win, whereas NYC MTA appears to be in a doom-loop, is a noose coupled with anchor, and with suitably natural weighted cement boots, as well as is a festering rat trap. Should the parties unite, so much good can flow.

I think Trump might win, and stands a good chance, because Biden might lose. But I doubt the Democrats would lose, and do not believe the Republicans can win. So impasse on infrastructure spend, possibly.

Maybe unity and cooperation requires existential awakening. Let’s see.

In Canada’s case, for its city sized population spread across a good part of the world, there is neither the hurry to up gaming, nor the oomph to do so, not without a partner. Canada already chose the partner by kidnapping Ms Meng, and so opting for perhaps temporary irrelevance and be satisfied with backwater state. Too comfortable, and is comfortable. Love Vancouver.

Be interesting to track over time the cities Vancouver, San Francisco, New York, Dalian, Shenzhen, Singapore, Hong Kong, St Petersburg, London, Paris, Berlin, and Cape Town, and not only on CoVid progressions. The numbers should tell a mathematically rational / physically logical tale.

finance.yahoo.com

zerohedge.com

The MTA Is Preparing For A "Doomsday Scenario" That Includes Higher Fares, 40% Cut In ServiceThe MTA says it is now preparing for a "doomsday scenario" that could include a 40% cut in service for both commuter trains and busses, resulting in longer wait times, lane closures, fare hikes and massive job cuts.

New York’s Metropolitan Transportation Authority says this will be the new reality for New Yorkers if the government doesn't come up with $12 billion in aid that it needs to cover a budget shortfall that has emerged as a result of the coronavirus pandemic. The MTA has an astonishing $45.4 billion in debt.

On Wednesday, MTA officials said that "a potential 40% cut to subway and bus service, a 50% reduction in commuter-rail service, higher fare increases and layoffs" could all soon be reality, according to Bloomberg. The MTA is now urging well connected New Yorkers, including executives and real estate developers, to put pressure on federal lawmakers to act.

Larry Schwartz, a board member who chairs the MTA's finance committee, said: “They need to get on the phone and call their friends in Washington and tell them to get off their butts and to meet and to take action and help the people of New York state and the ridership of the MTA.”

He continued: “Our economic quality of life and way of life is going to be drastically impacted. Our ability to provide essential services is going to be drastically impacted.”

Pat Foye, the MTA’s chief executive officer, said during the meeting: “Without question there is no economic recovery without a healthy MTA and there is no national recovery without a healthy New York. That is why investment in the MTA is in the national interest.”

But the question of how long the MTA can borrow its way out of its problems remains. Thomas DiNapoli, the state’s comptroller, said: “Despite these measures, it will still not be enough. Borrowing for operations will be necessary and push debt-service costs to more than a quarter of every dollar of revenue.”

Board member Andrew Albert commented: “The New York way of life is at stake right here, the ability to go out and get on a bus or train and get where you need to go. This should not be lost on Wall Street, on real estate and the other thousands of employers that have thousands and thousands of employees who rely on this miracle of a transit system which other cities envy and could not even hope to build.”

Recall, just a couple days ago we highlighted that the MTA was losing an astounding $200 million per week and was on the fast track to going broke without government assistance.

Pat Foye, the MTA’s chief executive officer, said earlier this week: “Our sole focus now is on survival, how to reduce costs, maintain service and minimize reductions in force while protecting the capital program.”

Subway ridership is down 75% from pre-pandemic levels; the Metro-North railroad has seen a drop of 83% and the LIRR has dropped 76% from pre-pandemic levels.

The MTA already secured $451 million last week from a new $500 billion lending program put in place by the Federal Reserve. At 1.92%, the rate was lower than what Wall Street offered the MTA, equating to about $12 million savings over the course of the 3 year loan.

And while this cash helps the MTA in the short term, its long-term outlook is still questionable. Bob Foran, the MTA’s chief financial officer, said: “We don’t have unlimited reserves. We cannot continue to spend money unless we have assurance that we’re going to receive this federal support. So that’s why we’re asking for the $12 billion for this year and for next year so that we don’t run off a cliff beginning in January.”

Brrr...

Sent from my iPad |