Softbank timing was not fortunate per the Barrron's article Message 32918177 cited, but may well have been the trigger of the call-option-led ramp of the market. If it turns out to be so, I have a recommendation - short everything

Whether it is so I do not know, and so must wait for more revelations.

Of course once the whole story is out, let us see what if anything the Goldman Sachs, Morgan Stanley, JPM etc etc did based on what they knew and when they knew it.

Maybe the time for no-prisoners and less-mercy is upon us.

Of course Softbank itself can be shorted even though it has not recovered from when I sold in late 1999 finance.yahoo.com

Very exciting ... reminds me of old times Message 14582771 circa 2000

I am thinking that Softbank is simultaneously the most expensive entry ticket I have ever paid for the joy of participating on a discussion thread and is also still my most profitable, in absolute number terms, speculation.

I loved Softbank Message 19091621 in 2003 and it may be a good time to revisit old times

In order to re-live the Softbank dream and Masayoshi Son's fantasy, I once again did what I had done before Message 8554586 and intend to do a even better job this time in shameless speculation and remorseless gambling Message 12355669 .

I bought a dollop of JP.9984 quote.yahoo.co.jp at JYen 3,540/shr.

Yes, I know it doubled from the low quote.yahoo.co.jp , but there is no law that states with any clarity that it will not double again, especially as the poorer Japanese bondholders try to escape the carnage of the bond market, as they, once again, surge forth in one great big mass, into a new mess.

I may have to look into buying some Vertical Net and Ariba, now that J6P is also surging forth towards something shimmering in the distance :0)

ft.com

SoftBank unmasked as ‘Nasdaq whale’ that stoked tech rally

Japanese conglomerate has been snapping up options in huge amounts over past month

yesterday

SoftBank founder Masayoshi Son. The Japanese conglomerate has established an asset management unit for public investments using capital contributed by Mr Son © Alessandro Di Ciommo/NurPhoto/Getty

SoftBank is the “Nasdaq whale” that has bought billions of dollars’ worth of US equity derivatives in a series of trades that stoked the fevered rally in big tech stocks before a sharp pullback on Thursday and Friday, according to people familiar with the matter.

The Japanese conglomerate had been snapping up options in tech stocks during the past month in huge amounts, fuelling the largest ever trading volumes in contracts linked to individual companies, these people said. One banker described it as a “dangerous” bet.

The aggressive move into the options market marks a new chapter for the investment powerhouse, which in recent years has made huge bets on privately held technology start-ups through its $100bn Vision Fund. After the coronavirus market tumult hit those bets, the company established an asset management unit for public investments using capital contributed by its founder, Masayoshi Son.

Now it has also made a splash in trading derivatives linked to some of those new investments, which has shocked market veterans. “These are some of the biggest trades I’ve seen in 20 years of doing this,” said one derivatives-focused US hedge fund manager. “The flow is huge.”

The surge in purchases of call options — derivatives that give the user the right to buy a stock at a pre-agreed price — has been the talk of Wall Street, as the sheer size of the trades appears to have exacerbated a “melt-up” in many big technology stocks over the past few months. In August alone, Tesla’s share price shot up 74 per cent, while Apple gained 21 per cent, Google’s parent Alphabet rose 10 per cent and Amazon 9 per cent.

One person familiar with SoftBank’s trades said it was “gobbling up” options on a scale that was even making some people within the organisation nervous. “People are caught with their pants down, massively short. This can continue. The whale is still hungry.”

SoftBank declined to comment.

The Nasdaq was at one point on Friday down 10 per cent from its peak — the common definition of a correction — yet the options boom means that the US stock market remains vulnerable to further bursts of volatility, according to Charlie McElligott, a strategist at Nomura. “The street is still very much in a dangerous space, and that flow is still out there,” he wrote in a note on Friday.

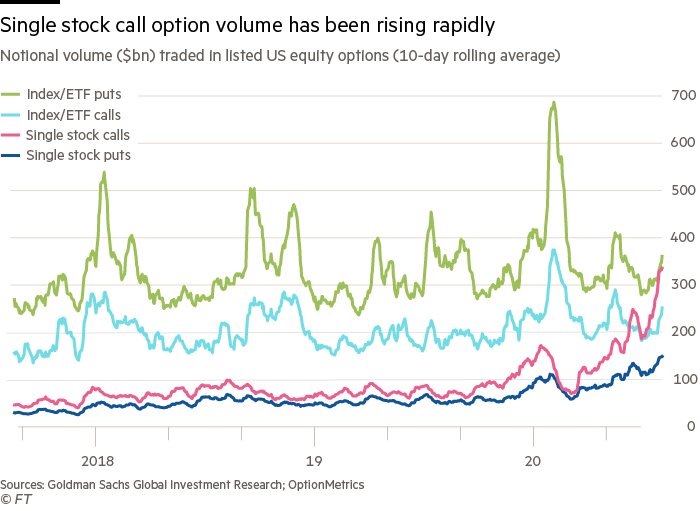

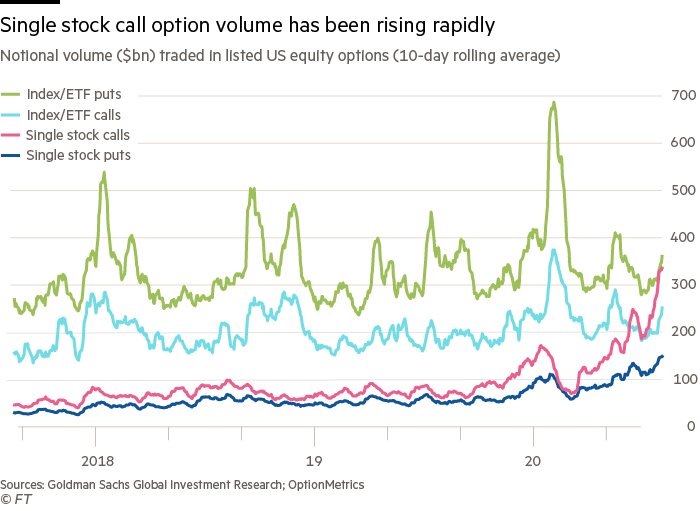

The overall nominal value of calls traded on individual US stocks has averaged $335bn a day over the past two weeks, according to Goldman Sachs. That is more than triple the rolling average between 2017 and 2019. The retail trading boom has played a big part in the frenzy, but investors say the size of many recent option purchases are far too big to be retail-driven.

Unusually, single-stock call trading volumes have surged beyond the average daily volumes of calls on the broader US stock market, and are almost as high as the level of trading in index puts — which give the buyer the right to sell at a preset price and act as a popular form of insurance against stocks falling.

Recommended

The size and aggressiveness of the mysterious call buyer, coupled with the summer trading lull, has been a big factor in the buoyant performance of many big tech names as well as the broader US stock market, according to Mr McElligott. This week, he warned that dynamics around options meant the heavy purchases forced banks on the other side of the trades to hedge themselves by buying stocks, in a “classic ‘tail wags the dog’ feedback loop”.

This explains the US stock market climbing in tandem with the Vix index — often referred to as Wall Street’s “fear gauge” — and meant that equities were fragile and vulnerable to the kind of sudden setback that erupted on Thursday. “The equity volatility complex is acting ‘broken’ and indicative that ‘something’s gotta give’,” Mr McElligott warned in a note shortly before the Nasdaq fell 5 per cent.

One banker familiar with the latest options trading activity said Thursday’s market pullback would have been painful for SoftBank, but he expected the buying to resume. A larger and longer-lasting stock market decline would be more damaging for this strategy, and would probably involve rapid declines, he added.

The options buying comes alongside $10bn in public investments SoftBank is targeting through its new asset management arm.

According to a filing to the Securities and Exchange Commission last month, SoftBank has bought stakes of almost $2bn in Amazon, Alphabet, Microsoft and Tesla — investments that are partially funded by cash from its $41bn asset sale programme that was triggered by a collapse in its share price during the Covid-19 market turmoil.

Additional reporting by James Fontanella-Khan

This article has been updated to correct Tesla’s share price rise |