the reason I got out of the I-dot come / e-slashnet bubble in good shape was totally accidental, as I was a fool once, but I accidentally read the last chapter of a book at a good time December 31st 1999, and proceeded to sell sell sell in January 2000

Knowing the script ahead of the murder mystery thriller was helpful :0)

February 1st was the peak of Nasdaq

Napoleon was correct, that luck matters a great deal.

Message 12392997

Selling MSFT, even if to buy SFTBF, would probably not be a good idea as I believe MSFT is dirt cheap in this age of instant triple IPOs. The spike up of PCCLF was due to a flurry of rumors, including NASDAQ listing, MSFT share swap. I sense a cash call coming. Now reading an excellent book "The Devil takes the Hindmost". Recommend to all on this thread. We are now no longer investing, but speculating. Getting into the no-name shares would be making a lateral move to gambling. I do not gamble, but I do speculate, and it is fun. I no longer have the Audi TT in mind, but the BMW Z8, parked amongst the foliage of a Maui ranch.

December 30th 1999

Message 12424137

Yesterday, the taxi driver did ask for and accept stock tips from me. Earlier, my 70 year old mom visiting now tried to understand from me what EMC's business was (she does e-mail and surf for info), and my father in-law (who does not use i-net) had bought and mis-sold MYPT, in at 13, out at 25, leaving US$ 500k+ on the table, and he still could not tell me what the company does, nor could he tell me what the closing price is. My office administrator is following my trades, my broker is passing around my trades as his own ideas (ever since my initial lucky (nay, studied) 9984 buy in November of 1998). My neighbor and I talked Golden Power while putting out the garbage, speculated on a joint purchase of the apartment on the third floor of our 3 storey building, and discussed his Malaysian friends wanting to place money with him to speculate with in Hong Kong (free capital movement is so very important to the continued prosperity of our little island). And finally, other asset classes are being talked about in the press as follow-ons to i-net frenzy (recent spat of biotech buzz, etc), and this is inevitable as the maniac fever runs its course, affecting other assets.

I am on page 69 of "Devil Take the Hindmost" by Edward Chancellor (purchaseable at Amazon, of course), and at the bottom of the page, from the year 1720, by an anonymous pamphleteer, in great clarity ...

"The additional rise of this stock above the true capital will be only imaginary; one added to one, by any rules of vulgar arithmetic, will never make three and half; consequently, all the fictitious value must be a loss to some persons or other, first or last. The only way to prevent it to oneself must be to sell out betimes, and so let the Devil take the hindmost."

The earlier part of the book described speculative events since the Roman empire days, and I observe that if one were to replace the nouns (i-net for gold, biotech for tulips, diving engines for cellular phone, treasure in South Seas for WTO in China, etc) and change the dates (1999 for 1720, etc), the resulting words can be published in Wall Street Journal and Barrons, with no loss of sense or education value.

I do (intellectually, at least) realize that 95% of i-net companies will no longer be around by half time, but I believe it would be criminal (not to mention irresponsible to imaginary offsprings) not to play this game out and gather assets for an eventual retreat to a quiet sunny cove in Maui. Our education, experiences, and sense of historic and social relevance and duty dictate that we must contribute to the progress of i-net globalism, and as in all progressive moves, someone must eventually pay a price, even as we ourselves edge towards the emergency fire exit.

We are living in historically significant time and feeling invincible and vigorous. I felt this way once before, during 1990-1991 in Manila/Borocay, immediated after the 1989 TianAnmen event having diminished my consulting business in China, renovating (nay, flipping, in English, or stir frying in Chinese) buildings. My two Aussie partners and I started with risk capital of US$ 100k, got our NAV to US$ 7 million, and back down to US$ 100k, all in 18 short months. I learnt that bankers do use four letter words, and that "we successfully crossed the rickety suspension bridge over the deep gorge, after making proper judgement of the risks involved; and a hungry mountain lion stepped out from the rocks ...".

We got sunk in Manila by 45% per annum interest rate when Saddam invaded Kuwait, causing oil price to go up, toureism to dry up and 500k filipinos to return to Manila from the Middle East, all looking for jobs.

December 31st 2000

Message 12432932

Read the "Devil take Hindmost". The parallels are uncanny. All the signs are there. We are living in 'living history'. We probably have a good 12 months to go (I almost think 9984 will reach 800k in 2000 or not ever get there at all), and I believe the proper way to play this is no longer diversification, but massive bets on a few names of different maturity (9984 vs dotcom.com), take profit out as we go. Diversification is only good against quakes in a few names, not in a market cataclysm. I feel more energized than ever, as if my whole life was spent preparing for this one glorious trip out of the harbour.

On this basis, Golden Power is cheap and MSFT is dirt cheap, and Reuters is free.

Being scared is healthy, but it must not paralyze us. In the game of Quake, the guy who stops moving and the guy moving slowly are dead. The guy who moves fast and the guy hiding like a girl (I do no mean that all girls hide, so no offense meant) are alive, but rewarded differently. ... The good events are still further down the program flyer, as we have not yet had a Bre-X situation.

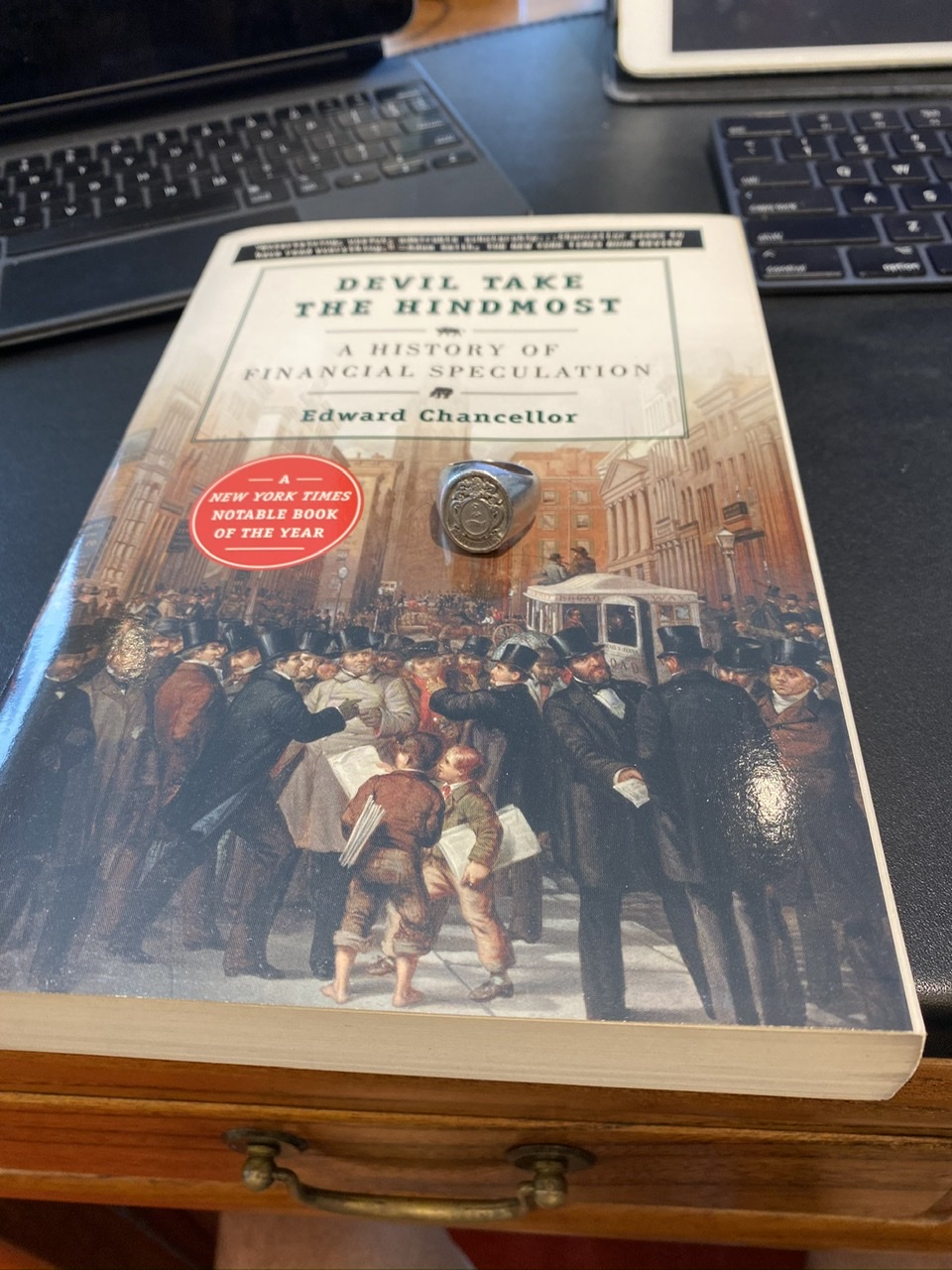

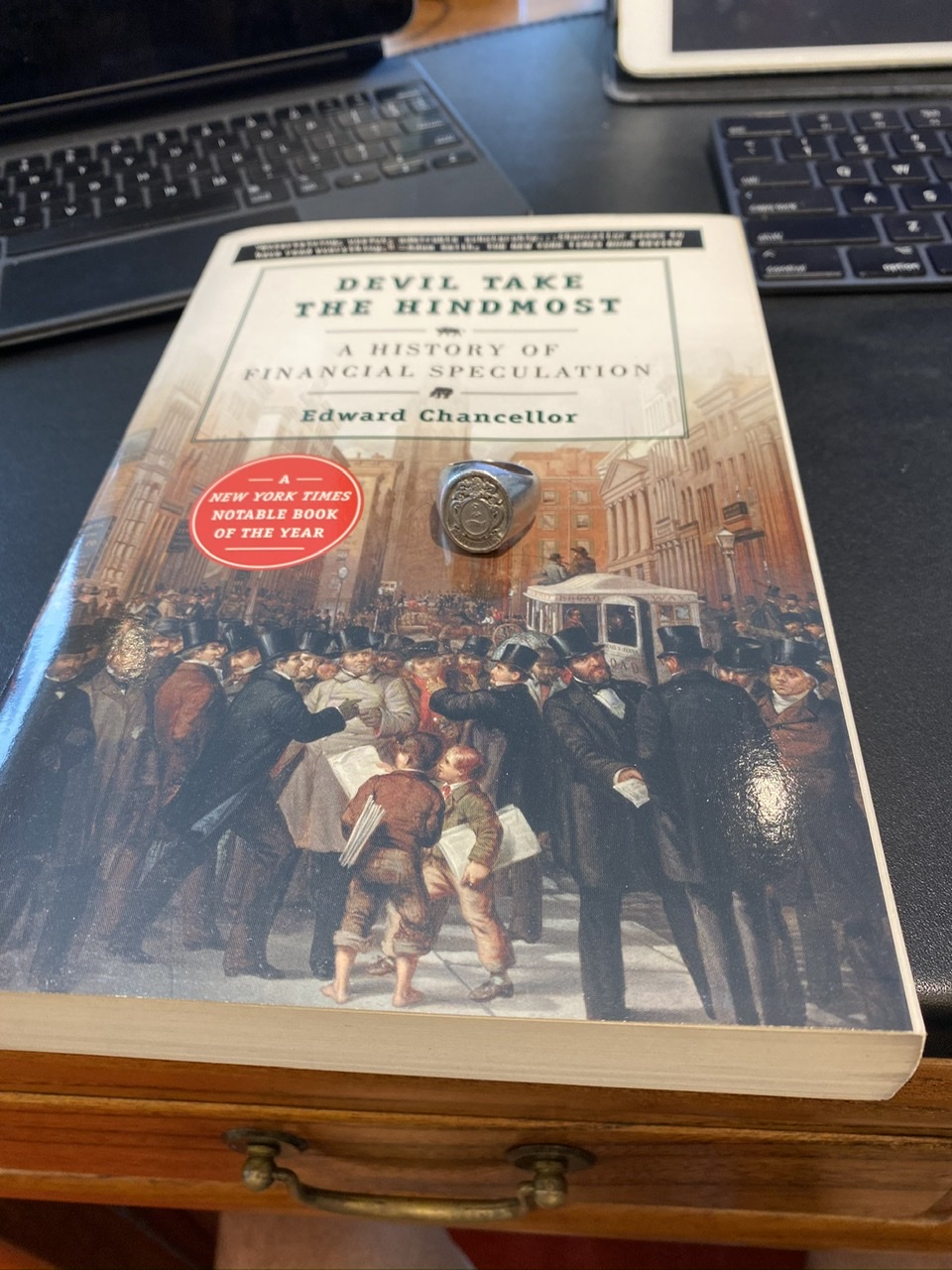

Here be the book that saved me amazon.com , still in near pristine condition, and so much happened along the way - wonderful

and here was the moment I was in middle of busy selling, selling more, and selling a lot more Message 12494921

Hi Edwin, I am writing this more to collect my wits.

You are correct. I am concerned. A bad market definitely does affect my psychology and no one likes to lose net worth, principal or unrealized gain.

My caution, or bearish stance, is indicated by earlier announced sales of RMBS, INKT, VERT, ICGE, etc earlier (apparently too early) to Founder, part of 9984, Yahoo Call, AOL, INTC, MSFT, now SNE, general retreat to cash, as well as my recently renewed willingness to trade 9984 on intra-day basis.

I am prepared to buy back all of the above shares (as in the case of Visio puts now) at lower prices (not ?the bottom?, just lower prices). I do not believe that the tech rally is over (if I did, I would be out of 9984 already).

I view the game as an absolute game, not as a relative game. In 1998, the Indonesian guy who lost 98% gave me no comfort even though I only lost only my then year-to-date gains and kept intact my beginning of year principal. The game continued with my bet in 9984 and increased US tech shares in November. Staying on the side line for long is not my tradition, as I believe there are always investment opportunities, even in the most dismal of times. The world is a big place.

My earlier but recent postings on mania phenomenon and game theory served to remind myself on what this game is all about. My retreat to cash was to prepare for later games. My enormous but very short and successful bets in Golden Power (603), China Overseas (688), and the ill-fated but limited damage holding of TCL (1070) was to take advantage of what I believed to be a temporary mania within the overall context of a bull market.

I believe this current phase is simply an inevitable correction in Nasdaq?s rapid (vertical for many shares) 33% rise within the past 60 days. The entirety of the rise may be re-traced in the correction, but I will not wait that long before starting to buy.

On the other hand, I am not sure that the overall bull market is not over (no one can say) and so my re-entry into the market will be paced, some rapidly, and some via puts. I need to see the foundation not crack (trade deficit must improve, debt must come down, interest rate must have risen already, etc). Money is difficult to come by, not always as simple as buying today, and selling tomorrow for more. I am cautious: for a man with no money, $10k is a lot, and so when we have $10k, take care of it.

Many of us in HK treat investment as an activity where we only have to engage in the pure mechanics of holding, trading, timing and betting. I know people who moved house 4-5 times within a 2-3 year period, trading apartments as if trading stocks. Now I know folks who sold their apartments and choosing to pay seemingly exorbitant rent until their hoped for real estates collapse. These guys are all investing or speculating or gambling, and the label can only be determined after we know the outcome. We are all hyper, and from other observers in the world, we are odd. There is a lack of intellectual content to the activity, and this is wrong.

Investment should be an activity that we learn and think about, engage in, adapting to the changing reality of the market, sometimes holding, sometimes trading, sometimes out and out betting, and some times sit on our cash and watch the world go by. There, I feel better. |