I also do not believe 800 by 20th November is doable

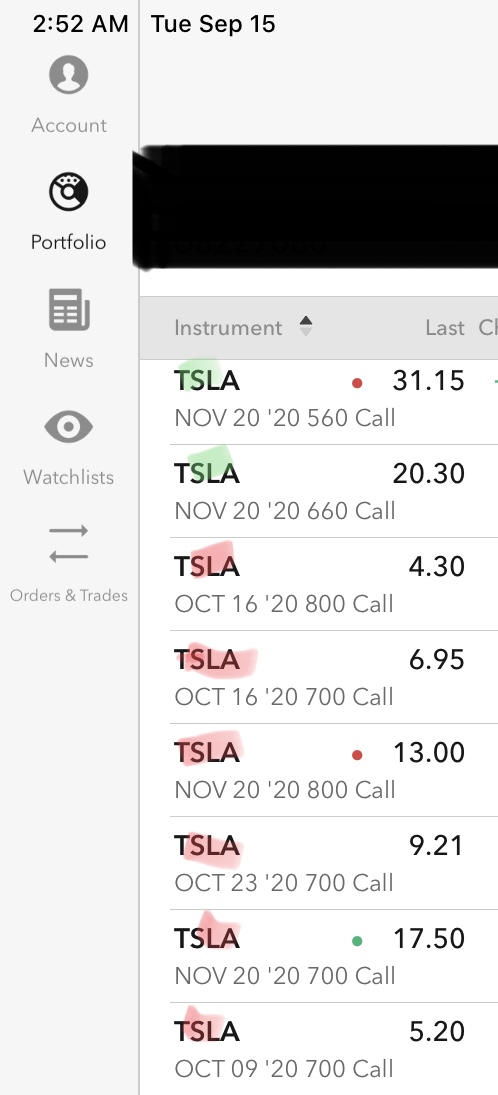

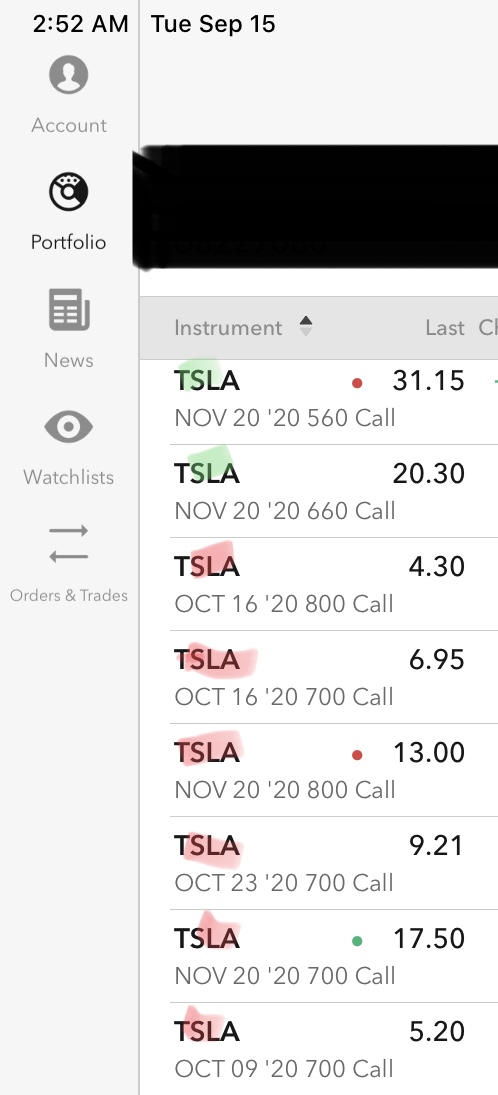

So I am short the November 20th Calls strike 800 (pre-split 4,000) now at 12.90 per share mark-to-market which should never be called unless the world goes to advanced insanity, and but ...

I do believe the market might continue to behave as if TSLA might reach 560 (2,800 pre-split), so am long November 20th Calls strike 560 now at 30.65, and

Am long November 20th Calls strike 660 (pre-split 3,300) now at 20.30 per share

Am showing large gain on my longs, mark-to-craziness

Am showing horrendous loss on my shorts, mark-to-insanity

Shall hold to at least battery-day and probably to a few days after

As the troops win the short battles along the way during October expirations, I (might) surely demobilize the longs by realizing profit

I have committed about equal amounts to the longs as i was able to finance by shorting. I believe inTSLA, IOW, just not in TSLA @ 800 by November 20th, and I mean to hold until I need to consider all-short by selling the longs.

The advantages of doing above as opposed to owning the shares?

- leverage to magnify and to accelerate winnings during the wait-time as the craziness take hold even as time-decay does corrosive work

- can choose to flexibly go all-short by closing the long calls and recognizing / realizing profit

- the then resultant short position, once all-short, is still relatively safe, at 800-by-November level

This way is meant for the current situation, that I believe TSLA shall rise, but not to insanity levels. During other periods I engage with TSLA in other ways. It is a lot like dating or war, different seasons / situations require bespoke tactic for the campaigns. Sometimes neutral, other times net short, and often enough all-short.

I can cheer for TSLA and do. Battery-day! Hip hip hooray!

I do also say about the RobinHooders and 9984 / SoftBank, may there be mercy on their soul, let us pray before we prey.

(Red means i am short, and green long)

|