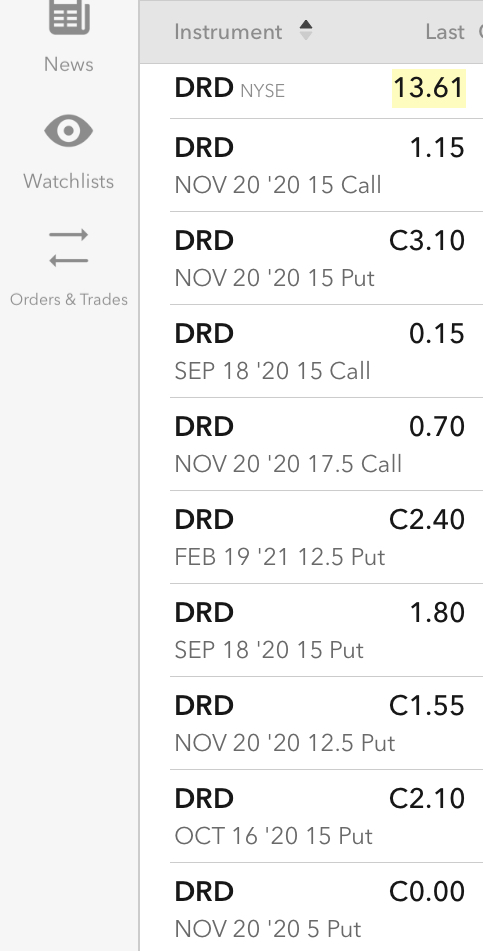

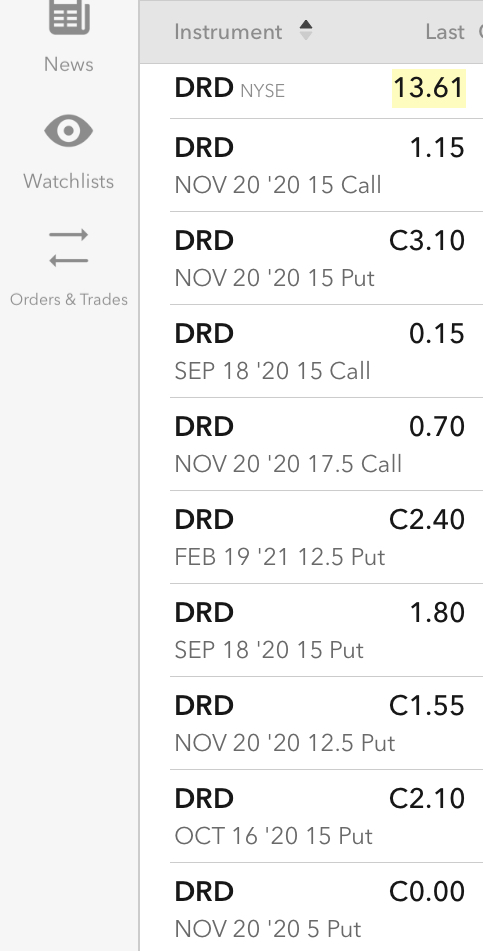

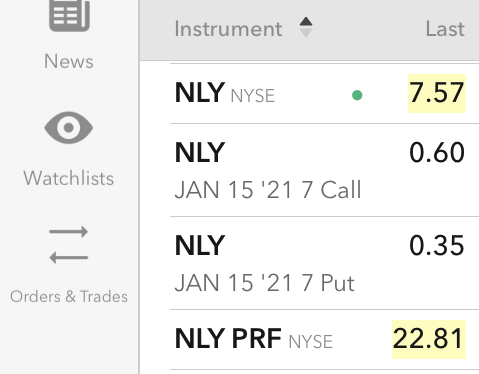

Here am wagering on DRD, long the shares and short all the options except the strike-5

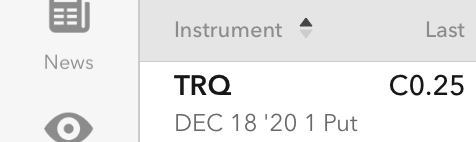

Here am just short the put, to collect any shares should they be put

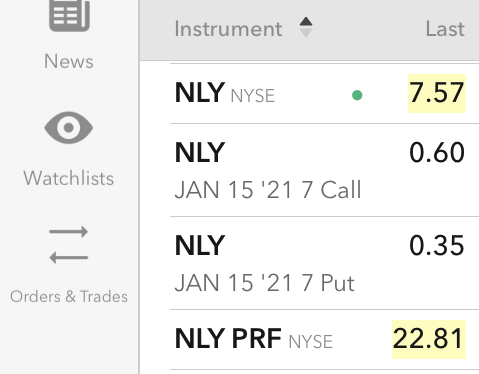

Here am in the shares, and short the put & call options to lower cost basis / collecting more ‘dividends’ on accelerated basis, if put, fine, and if called away, fine.

Etc etc etc

Stay safe

Generally ...

never buy options unless intending to be zero-ed

only short puts on stuff you do not mind buying at whatever price

only short covered calls

anything else = gambling per zero / one outcomes

There are exceptions to the general rules, but they are exceptions, for extraordinary times and incredible situations.

Option is about time, not just price.

BTW, in the time of a few postings, TSLA is up phuck-few-dollars, by my long call is up 10+%, and my short calls is mark-to-market loss a bit as well. Fantabulous. Real gains together w/ phantom loss, as long as I do not get greedy, or panic. And given the setup, I am greedy but shall watch myself, and I cannot panic, because there is no need as yet, and never a need unless I decide to rid of long calls.

As expirations roll around, I am forced to book profits, as short calls expire worthless on counter-party, as time does its terrible work.

I am one shorter who loves Elon, and appreciate his beast we know as TSLA.

I do not treat NKLA the same way. It might be a very different monster. |