Southwest Airlines trims Q3 average daily core cash burn expectation from $20M to $17M

Sep. 16, 2020 7:25 AM ET|About: Southwest Airlines Co. (LUV)|By: Niloofer Shaikh, SA News Editor

Southwest Airlines (NYSE: LUV) reports August operating revenue down 70% Y/Y vs. previous guidance of -70% to -75%. Load factor was 42% in the range of previous outlook of 40-45%. Capacity fell 27% for the month.

The company's average daily core cash burn in August was ~$19M, and its cuts Q3 daily cash burn outlook to $17M from $20M.

Southwest forecasts operating revenue will fall 65-70% in September, capacity -40% and a load factor of 40-45% is anticipated for the month.

Operating revenue will fall 65-75% in October, capacity -40% to -45% and a load factor of 45-55% is anticipated for the month.

The company continues to expect Q3 capacity to decrease in the range of 30-35% and currently estimates its November 2020 capacity to decrease in the range of 35-40% Y/Y.

Q3 economic fuel costs to be in the range of $1.20-1.25 per gallon vs. previous estimate of $1.20-1.30 per gallon; and operating expenses, excluding fuel and oil expense, special items, and profit sharing expense, to decrease in the range of 10-20%.

Since the beginning of 2020, the company has raised a total of ~$18.7B, net, including $13.2B in debt issuances and sale-leaseback transactions, $2.2B through a common stock offering, and $3.3B of Payroll Support Program proceeds.

As of September 15, 2020, the company had cash and short-term investments of ~$14.8B, well in excess of debt outstanding.

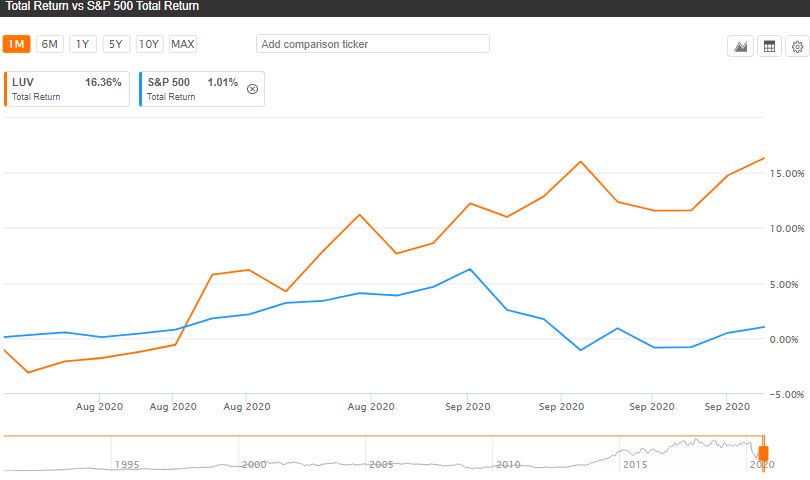

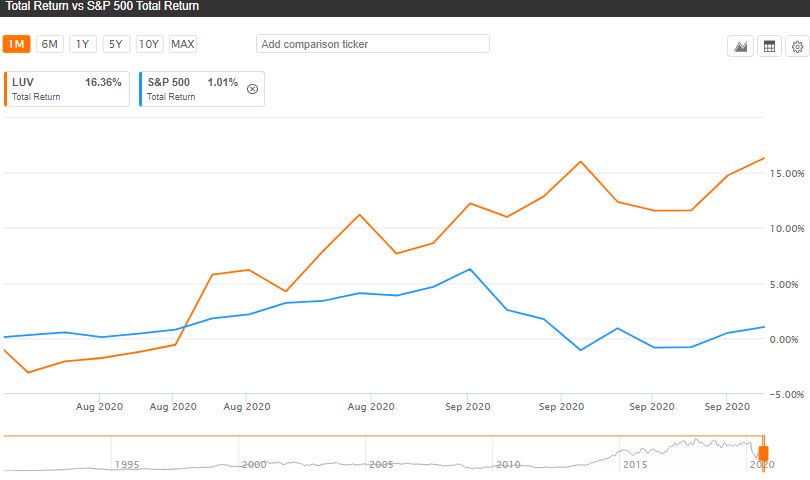

LUV's total return performance vs. S&P 500 for one month:

seekingalpha.com |