Pluck it,

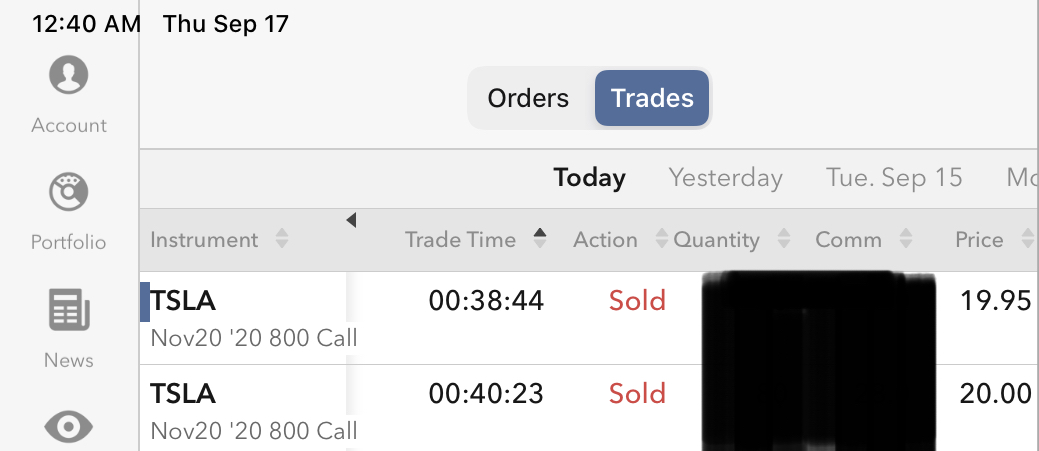

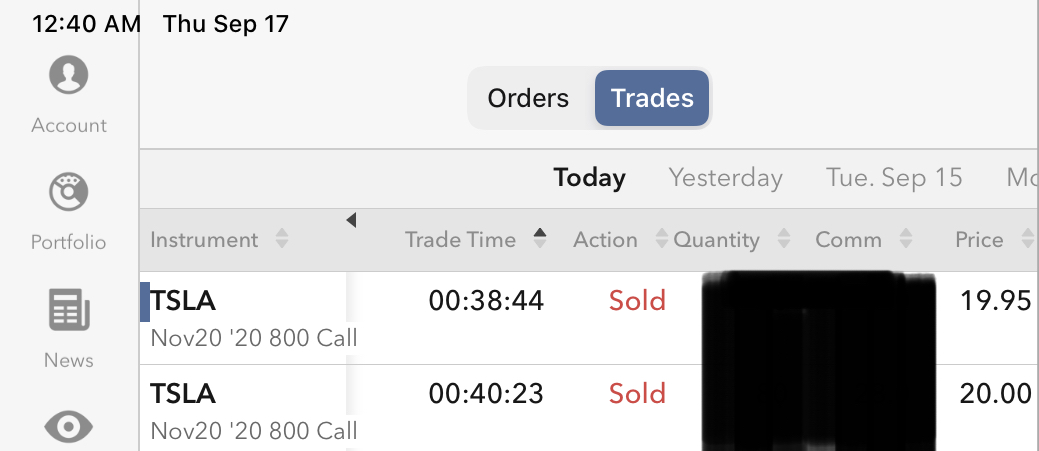

Decided to completely hedge my winnings on the long calls by shorting still more calls 20 November strike 800, so that for each dollar the long calls lose from here on out should be balanced w/ a dollar of gains on the short calls, at expiration time, the come to god moment, otherwise known as final exam time, November 20th

In the meantime I continue to ride the long calls into and through Battery Day, and see if to stay or run at that juncture.

Basically formatted option on option, still have effectively unlimited upside, but down side backstopped to current unrealized profit already embedded on the winning long side. Some kind of good, as the short side would never be called, as long as (or as short as) we define ‘never’ as 20th November, strike 800.

Am feeling very naughty. A lot like climbing cliff face, putting in safety anchors for the roping works, to avoid going to splat.

I hope TSLA goes to 801, and 1,000, but after 20th November. This is too much fun.

|