ETF hosting new crop of tech stars shines in FAANG carnage

It's hard to look past September's tech carnage.

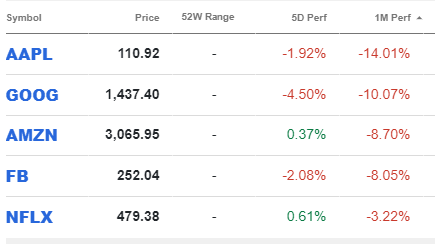

And understandably so. The gargantuan market caps of the tech giants that tumbled amounted to hundreds of billions in lost value. And it took a major toll on broader markets given tech's outsized roll in broadly held ETFs like Nasdaq 100 (NASDAQ: QQQ) and the S&P 500 (NYSEARCA: SPY).

But investors should be cautious about dismissing all of technology.

While the FAANG basket of stocks have reeled over the last month, a group of newer tech names have managed to thrive over that period. They have defied not only the technology sell off, but the broader turn down in a broad swath of risk assets.

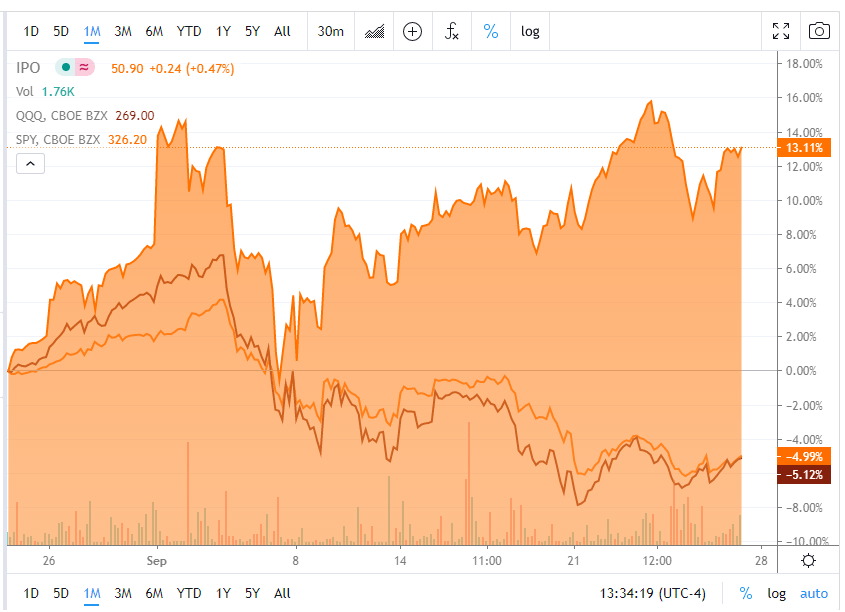

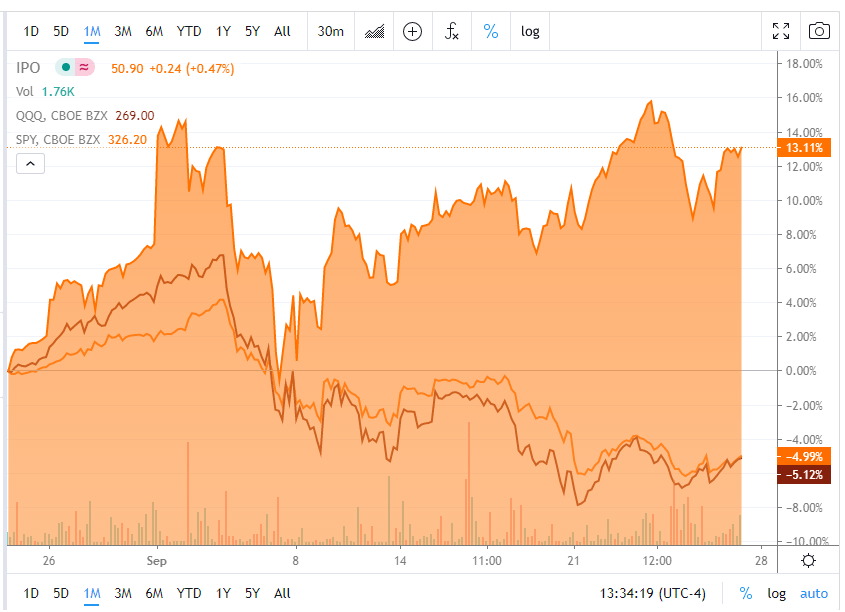

These technology names are the biggest gainers in the Renaissance IPO ETF (NYSEARCA: IPO). IPO itself has surged 13% over the last month, while the QQQ is off 5.2% and the SPY has dropped 5%.

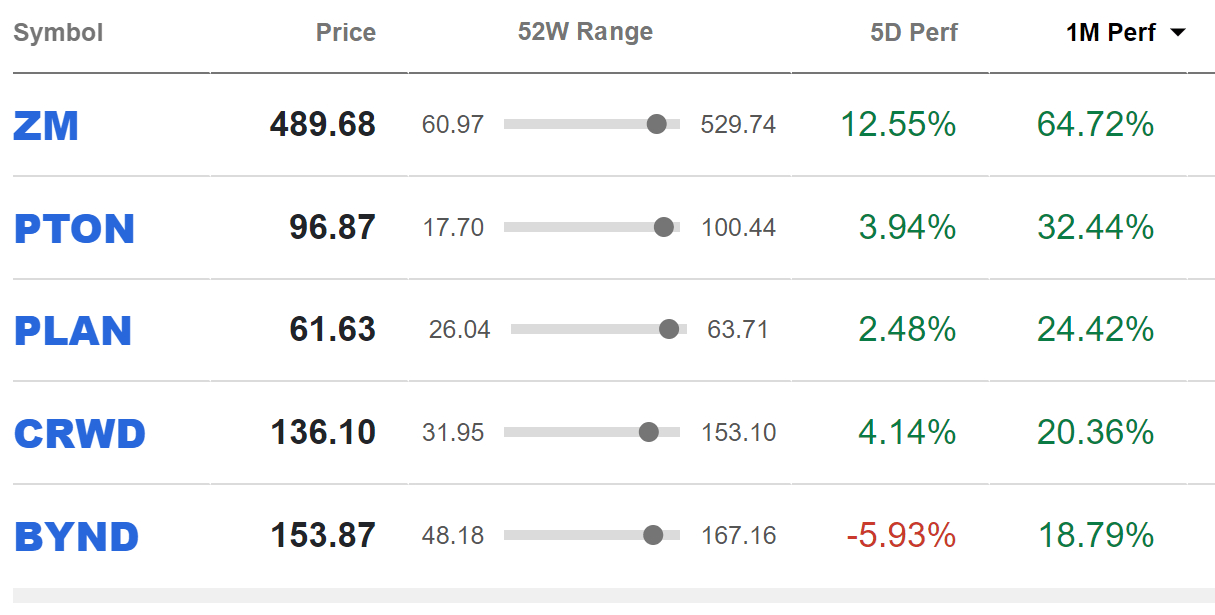

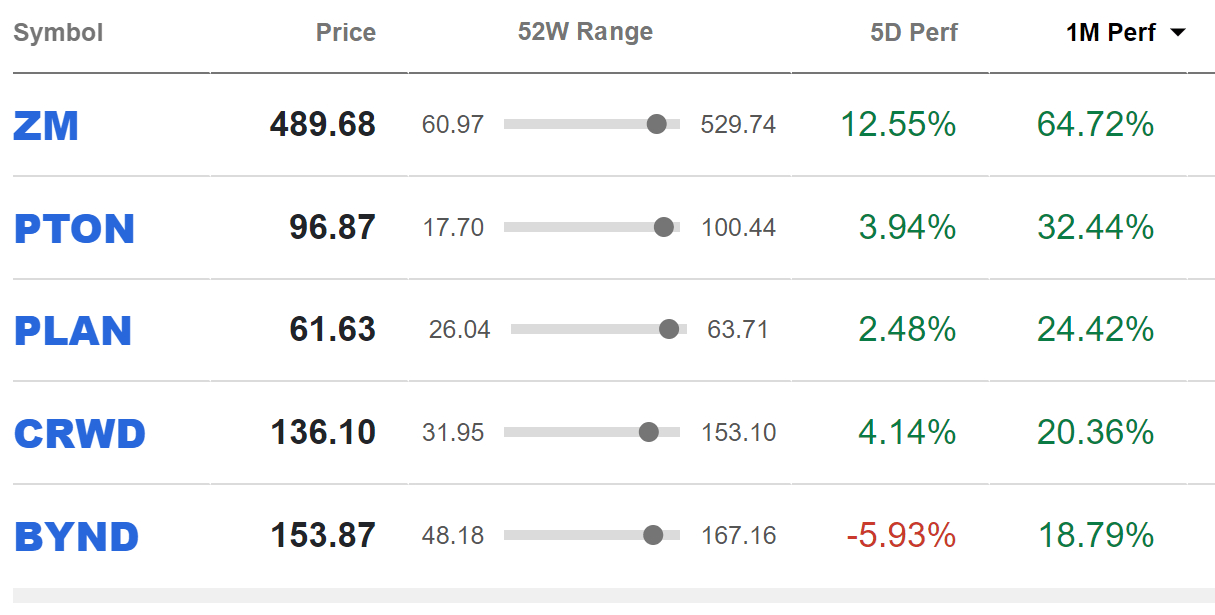

The biggest gainers in the ETF have all gained almost more than a fifth of their value over the last month.

The top five performers in the ETF over the last month are Zoom Communications (NASDAQ: ZM), Peloton (NASDAQ: PTON), Anaplan (NYSE: PLAN), Crowdstrike (NASDAQ: CRWD), and Beyond Meat (NASDAQ: BYND).

The ETF contains companies that have recently gone public. The most recent of its top five performers is Crowdstrike ( CRWD), which went public in June 2019.

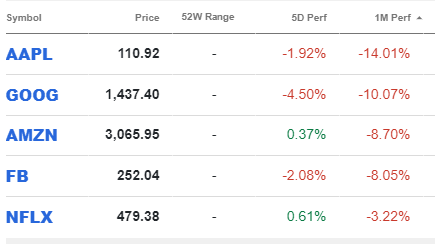

The soaring performance of these growth companies stands in stark contrast to the losses registered by the more established FAANG group.

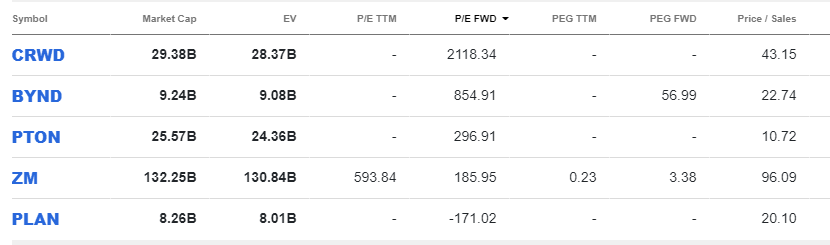

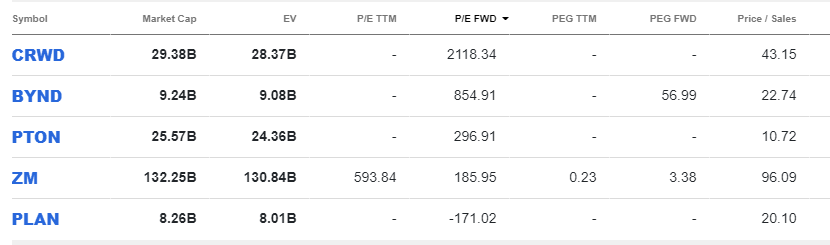

But - surprisingly for a time when risk appetite has seemed to come off broadly in markets - the valuation commanded by the newer crop of growth companies that have soared is far higher than the FAANGs.

Amazon (NASDAQ: AMZN), for example, is the most expensive of the FAANGs with a forward multiple of 95. Zoom Communications ( ZM), the cheapest of the new cohort, commands a multiple of 186.

There were plenty of signs over the last month that many investors were scrambling for safety. The dollar rallied sharply, taking a toll on a broad range of assets from stocks to gold.

The ability of these names to rally in the face of such headwinds, then, could speak to their upside potential in more forgiving markets.

seekingalpha.com |