I have been at work on SBSW to good effect starting when it was SBGL 2019 12 09 @ 8.33.

I know the beast well enough for hunting. I continue to like the company.

Whatever transpired since 2019 12 09 (not counting current options open) resulted in SBSW cost basis to be at well south of 8.33.

As example current campaign, never mind the actual cost basis of SBSW but its philosophical cost basis is the price on the day I entered the newest options trades:

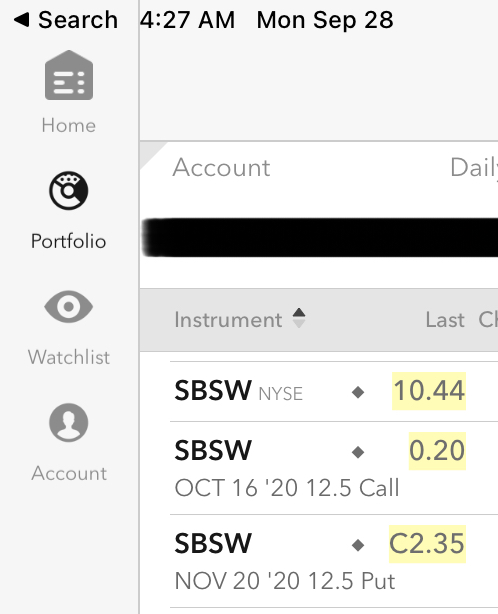

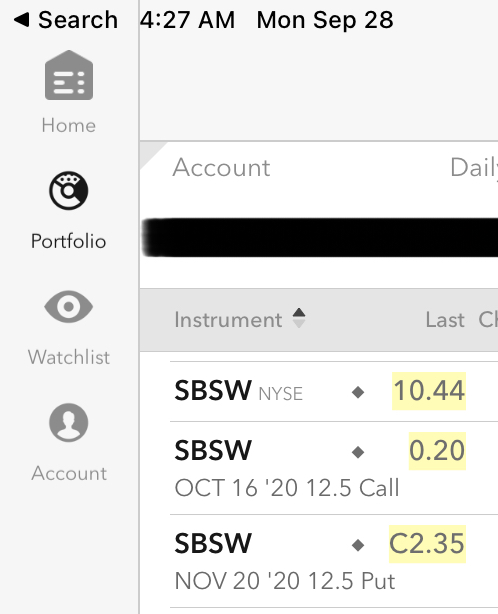

I hold current positions comprised of SBSW and am short both its calls and puts, strike 12.5 expiration 16th October and 20th November respectively.

I shorted the Oct 16 call options on 2020 08 21 @ 0.95 when the shares were at 11.60. So let us say my philosophical cost basis of SBSW is 11.60.

I shorted the the Nov 20 put options on 2020 09 18 @ 1.70 when the shares were @ 12.26. Neither options trades well-played but doesn’t matter, for combined premium take of 1.70 + 0.95 = 2.65.

Cost basis dropped by 11.60 - 2.65 on current lot, or 8.95.

Should all stay as is to October 16 expiration, I would be put another share at 12.50, resulting in average cost basis to rise to (8.95 + 12.50) / 2 = 10.73, compared to current market of 10.42. I do get to book a dividend ex-dividend 2020 09 for 0.24 on half of the shares, dropping average cost by 0.12 on the two lots, or 10.61.

I think current price level for SBSW is fine.

Its DRD content is not large (mkt cap @ ~7B vs DRD @ ~1B but owning 50.01%, so ~7%) and is more a play on eventual Pt recovery as opposed to continuing Pd high price.

I reckon Pd would not fall much and Pt can only increase. Call me an optimist. In any case Pd in S Africa is a byproduct of Pt as far as mining goes.

thevault.exchange

I carry on the campaign on the SBSW front, financed by cloud-ATM of TSLA since the notional value of that short TSLA position is 5.71X (after latest update of Friday trades and boosting of cash for safety margin on same day) portfolio, and bit more than 1X overall NAV. The situation shall sort itself out on or before 20th November unless I decide to re-up on the TSLA front for ‘just one more round’.

In some sense option fidget is an addiction and TSLA is like a casual and understanding girlfriend, politically-incorrectly speaking.

At current level I am considering shorting more puts, for I have capacity for SBSW even as am busy on TSLA.

The Oct calls shall doubtlessly (unless am surprised) expire worthless on my counter-party, meaning I get to again short calls going forward. Maybe I shall match the calls w/ puts for possible win-win, either at the same strike or different strikes.

|