It is difficult to trade the market indices because the Force is with the very few and narrowing leading stocks

The authorities mean to sacrifice all and target average inflation of 2%

Stocks going up 10% and fits the prescription, and the Force is strong

TSLA, NKLA, KODK ... should have fallen long ago, but are strong

zerohedge.com

Tech Turmoils After 'Positive' POTUS, Jobs Jolts, And SoftBank Squeeze

An ugly week for 'hard' real data in the US but 'hope' hit a two year high as 'soft' data outperformed...

Source: Bloomberg

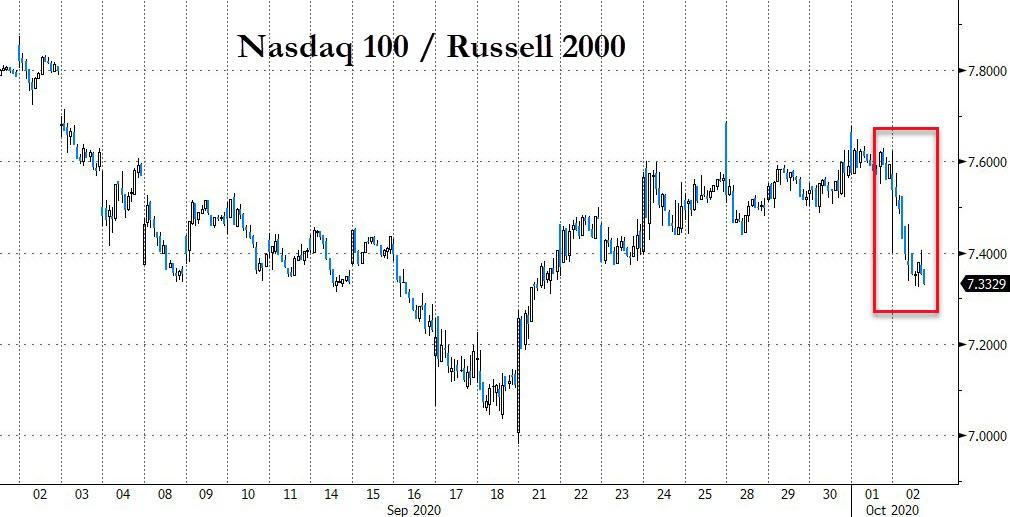

Small Caps exploded higher this week (pumped-up 6 of last 7 days) and best week in 2 months as Nasdaq lagged (but all were higher on the week)...

It's not the economy or fundamentals, it's the stimulus handouts, stupid!

Source: @AWMCheung

Because, COVID or not, Jobs or not, Fiscal stimulus or not, Biden or not, you gotta look on the bright side of life, right?

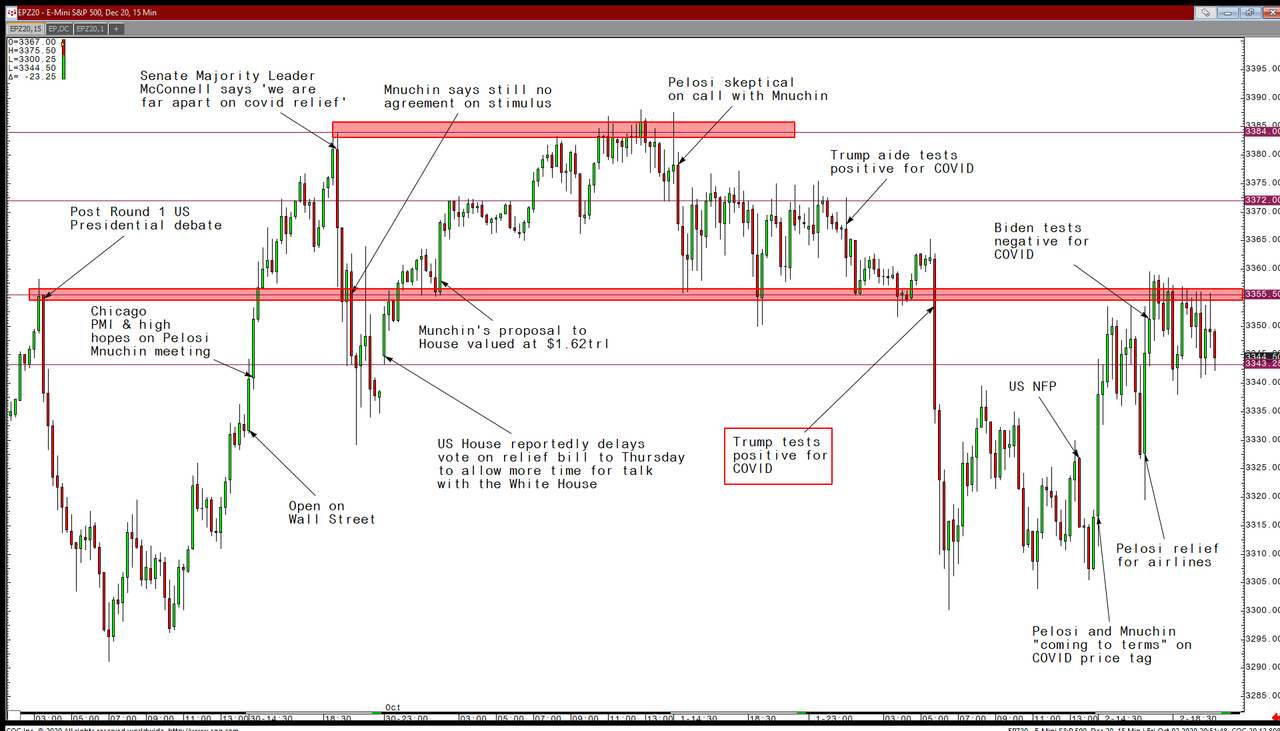

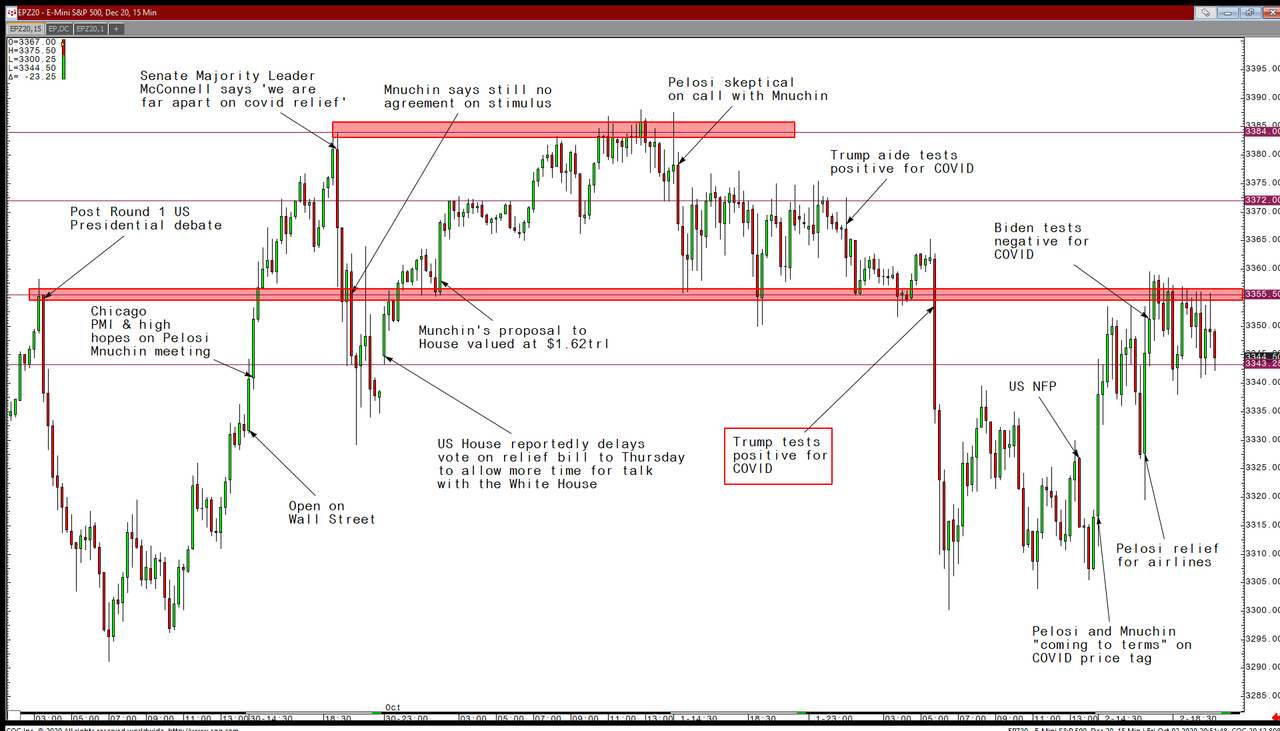

Of course today's market action was Trump Virus fears dueling with Pelosi's false hopes for fiscal help...(but look at that divergence between Nasdaq and Small Caps at the open)...ugly close today too

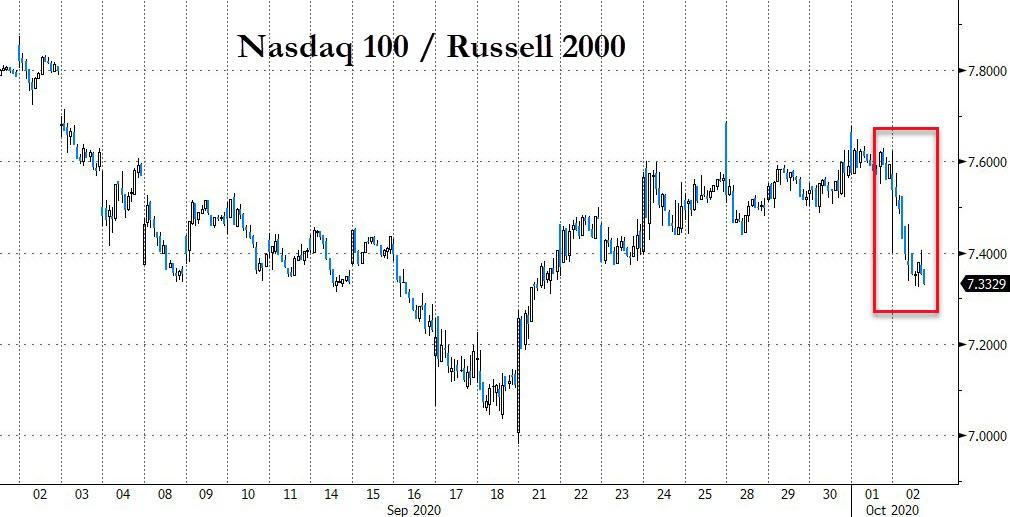

Nasdaq underperformed Russell 2000 by the most since May today as we suspect market-makers stomped on the throat of Softbank's gamma-squeezers...

Source: Bloomberg

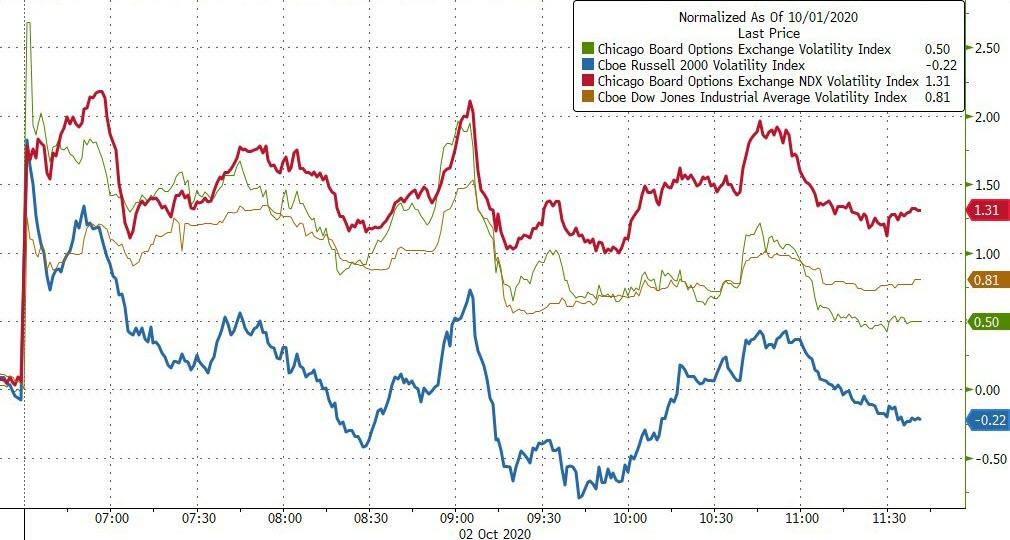

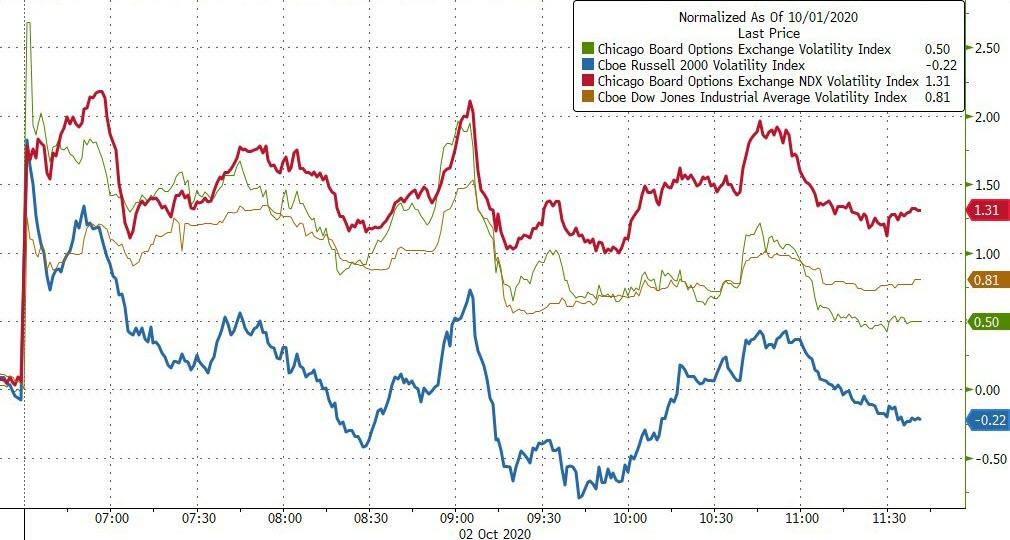

And we note that Nasdaq VIX spiked hardest at the open and was the most aggressively bid today...

Source: Bloomberg

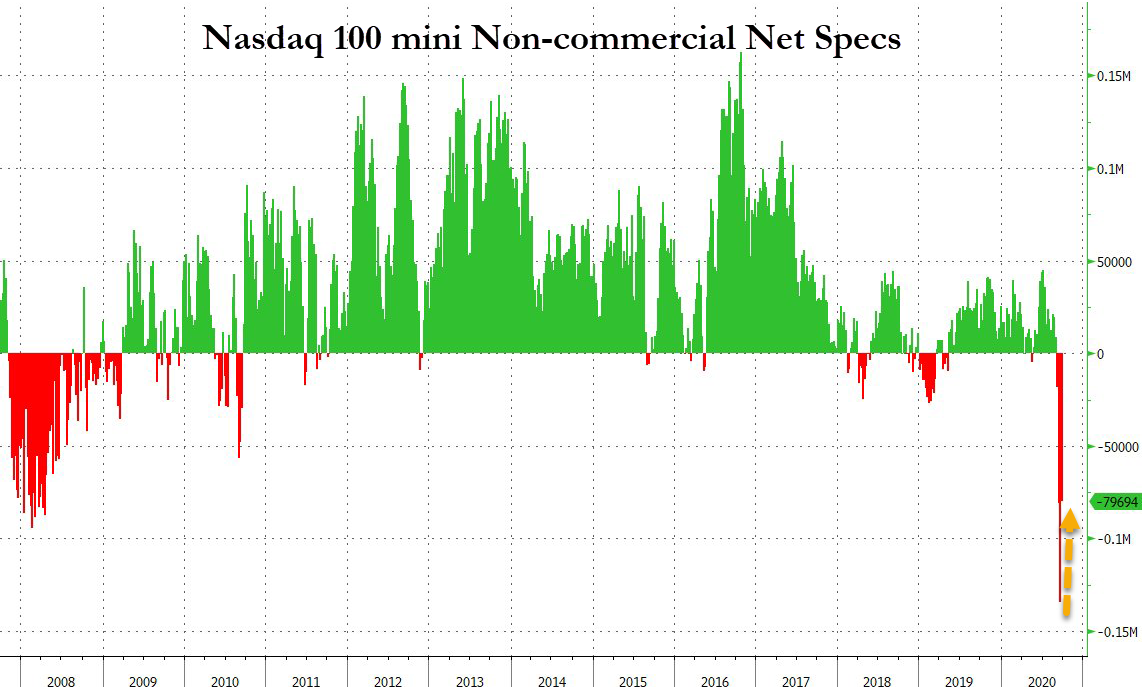

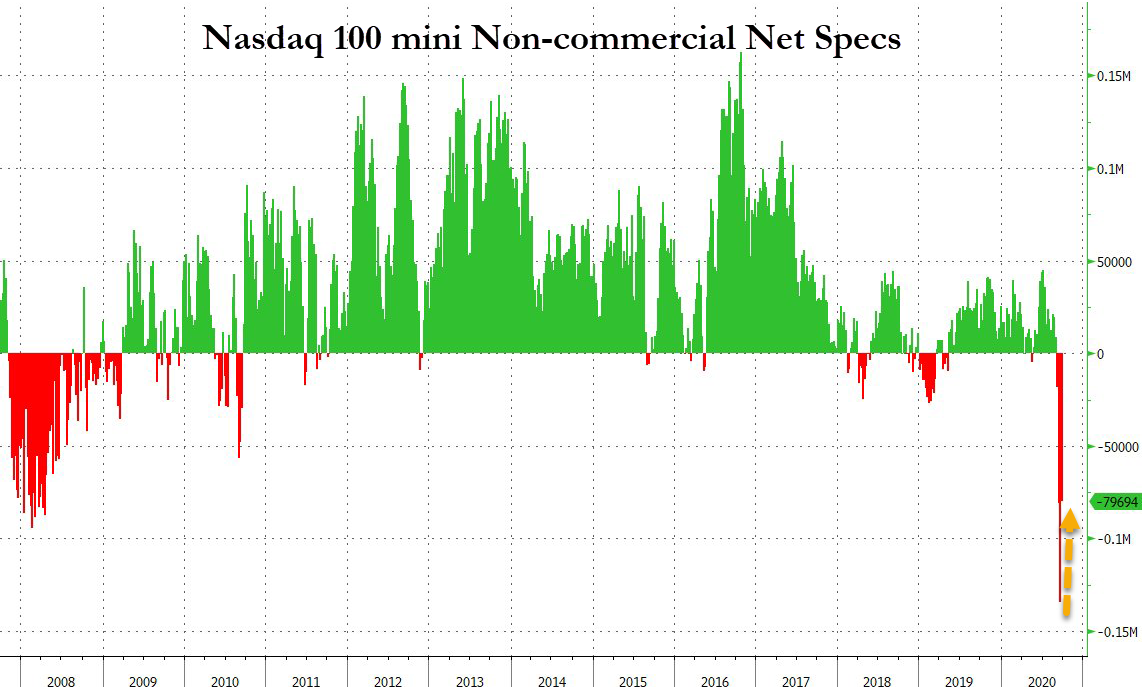

Notably, Nasdaq spec shorts collapsed by 40% but the index only managed marginally positive gains on the week (was Softbank trying to ignite a short-squeeze?)...

Source: Bloomberg

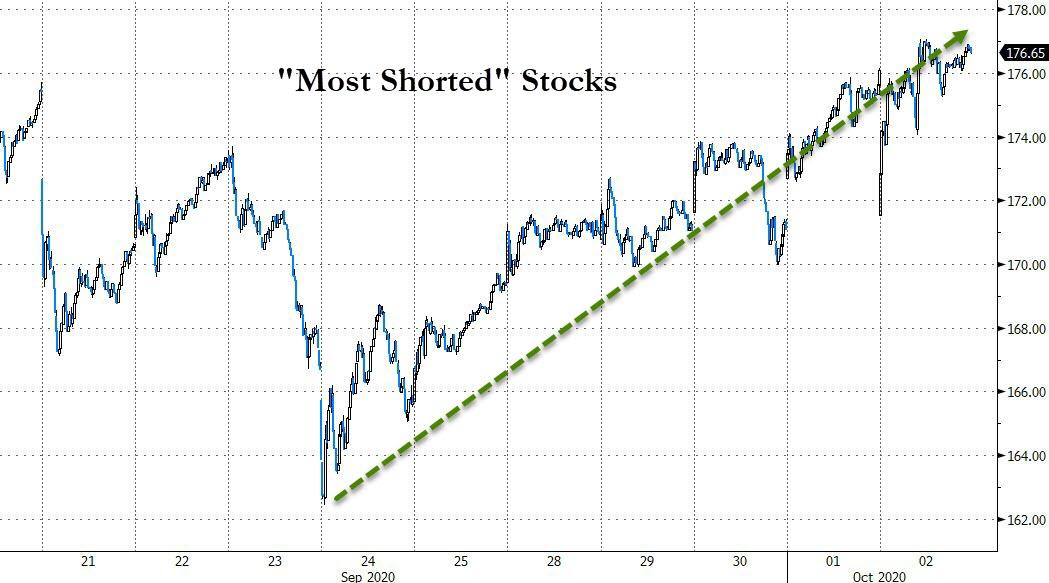

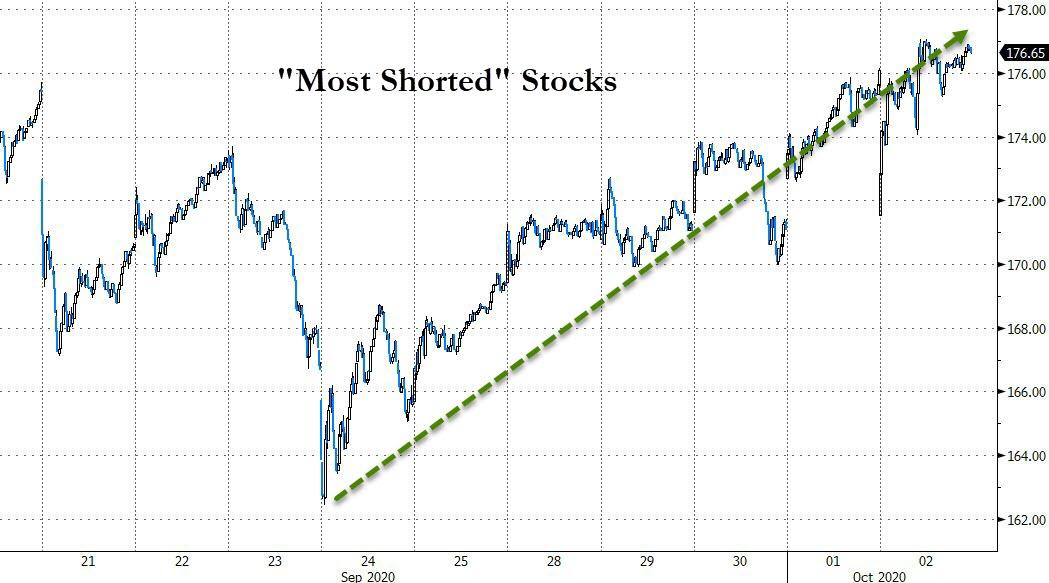

"Most Shorted" Stocks are up 6 days in a row (squeezed)

Source: Bloomberg

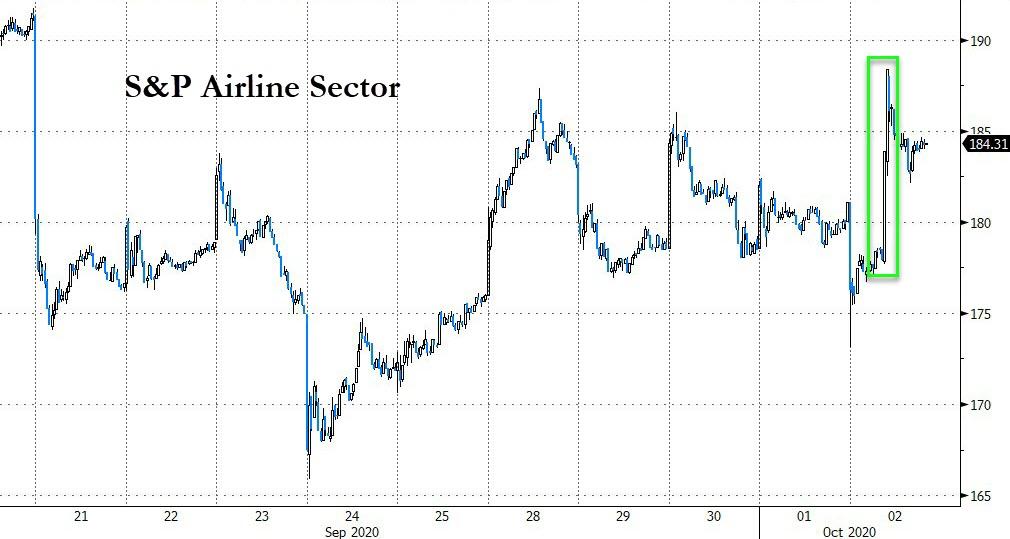

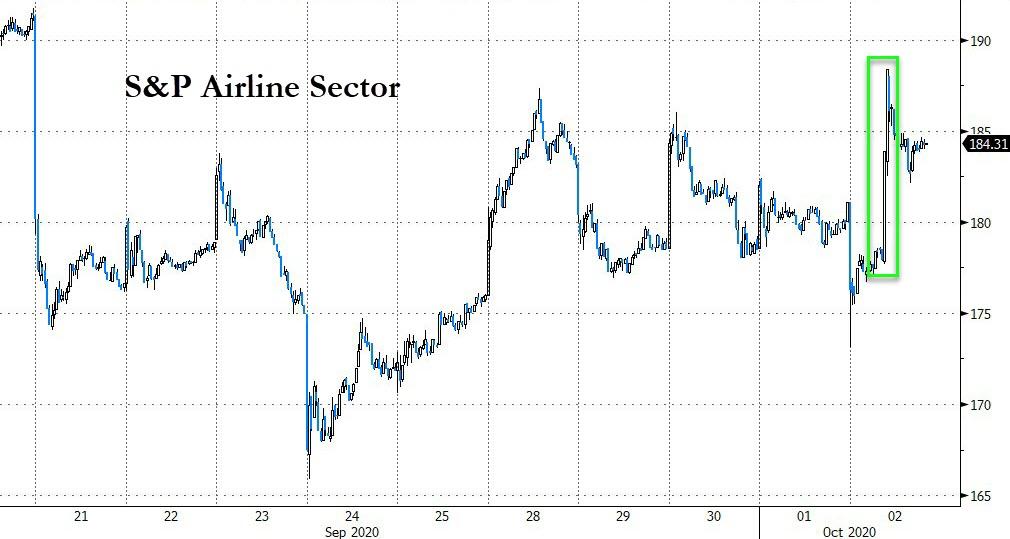

Some spurious comments from Pelosi on Airlines bailouts sparked a bid in that sector, but it faded somewhat as details were missing...

Source: Bloomberg

FANG Stocks were lower today but up on the week...

Source: Bloomberg

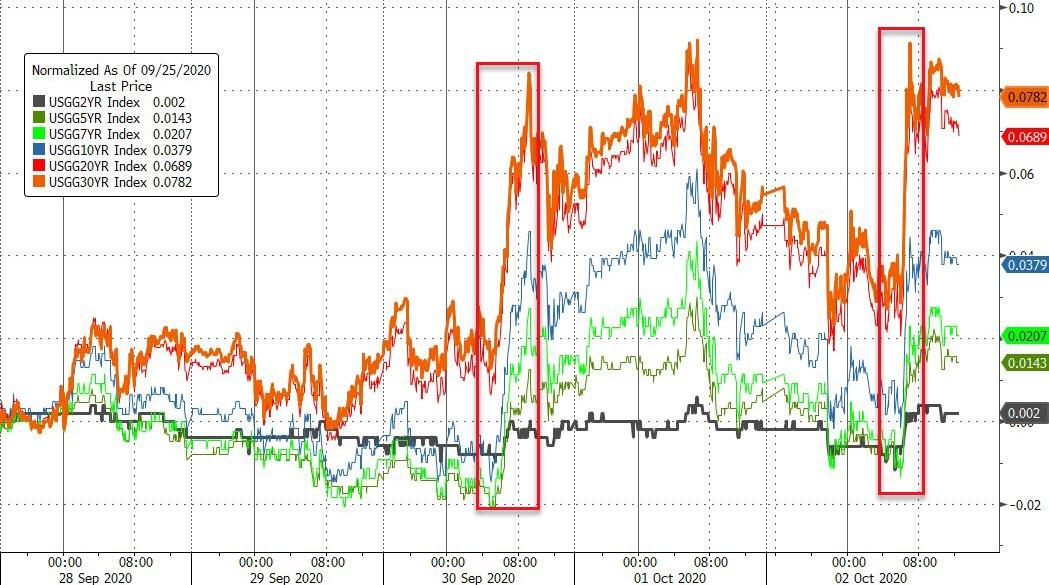

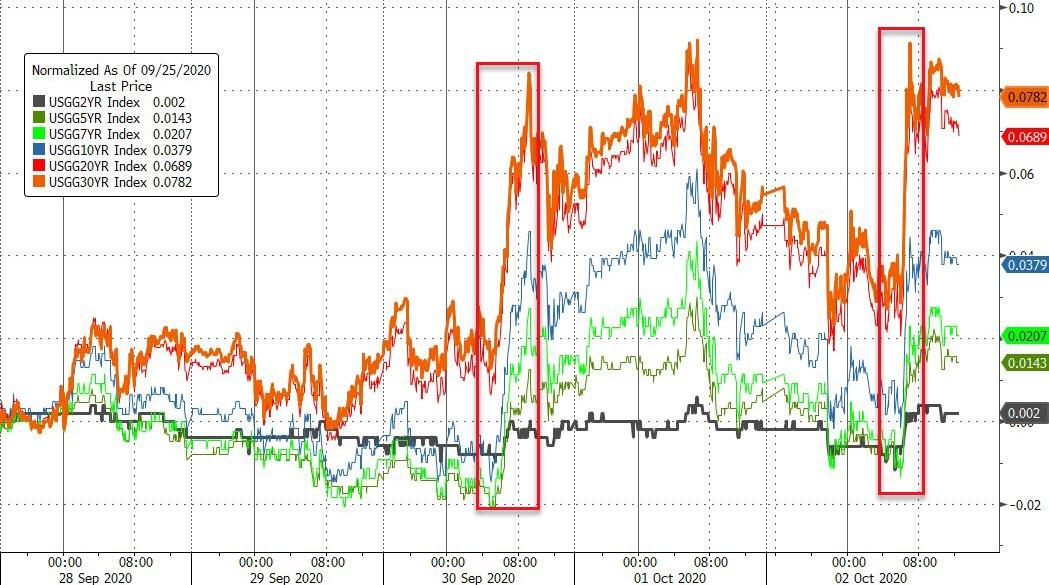

Treasury yields ended the week higher, driven by two rather notable spikes, seemingly sparked by stimulus optimism (and refused to unwind on reality)...

Source: Bloomberg

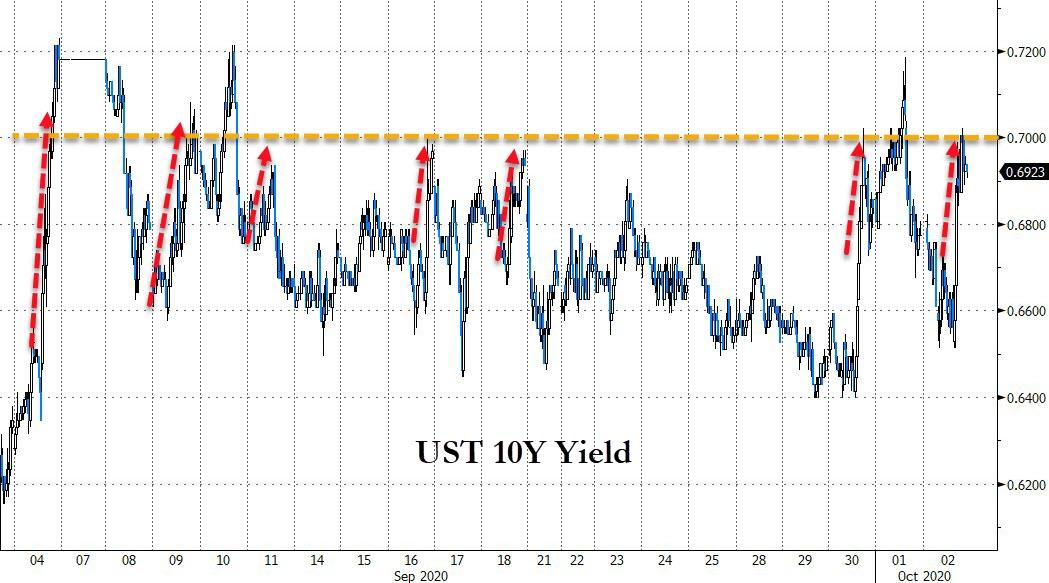

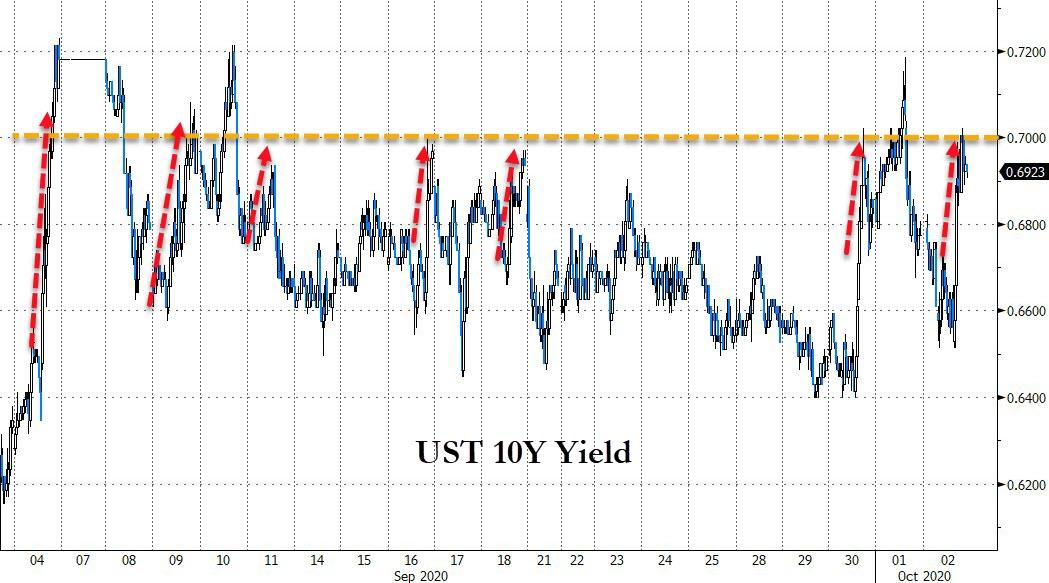

10Y Yields spiked up to 70bps and stalled again...

Source: Bloomberg

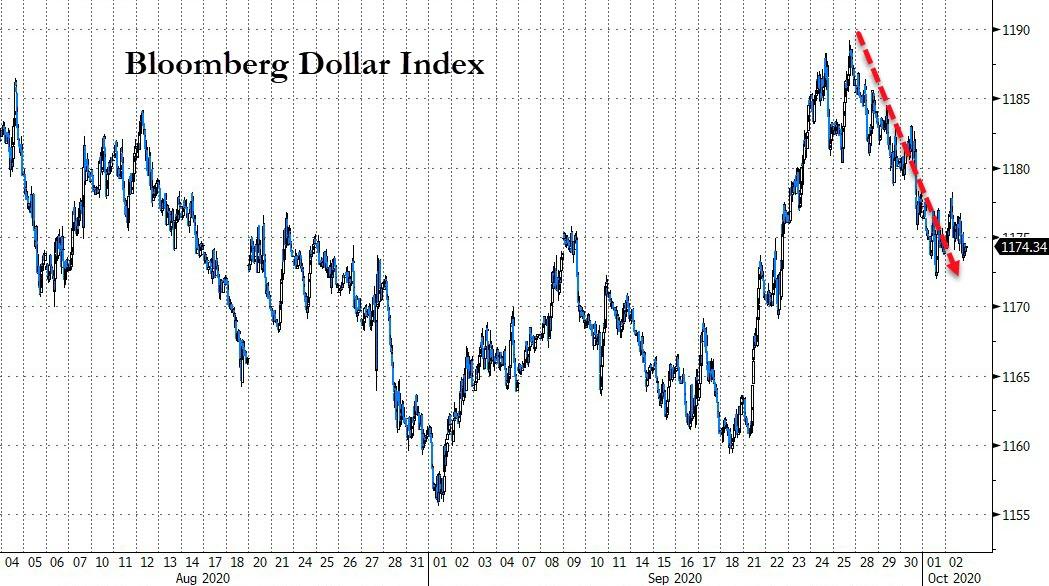

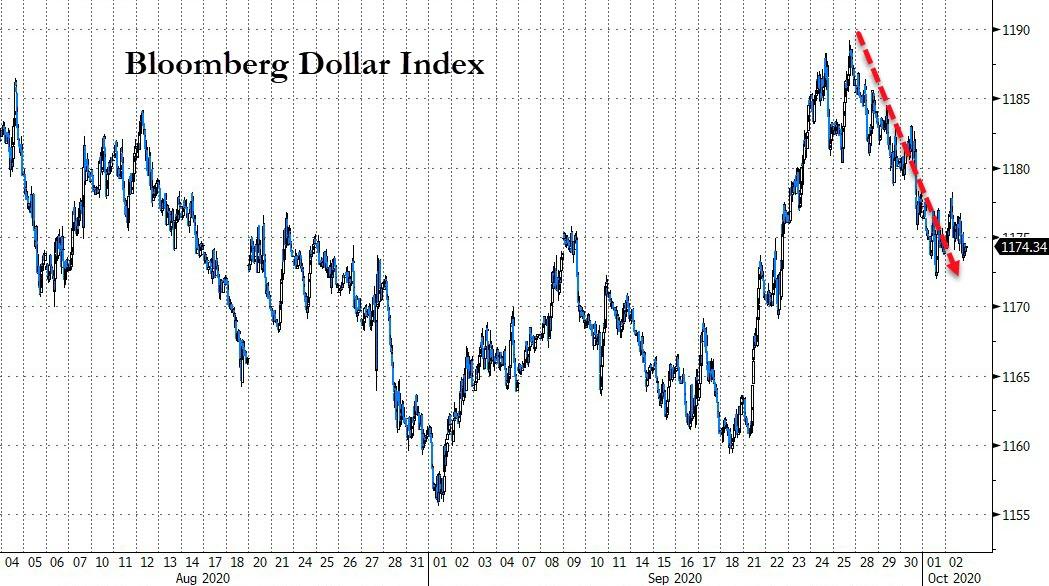

The Dollar erased about half of last week's gains this week...

Source: Bloomberg

Cryptos were lower this week...

Source: Bloomberg

NEVER MISS THE NEWS THAT MATTERS MOST

ZEROHEDGE DIRECTLY TO YOUR INBOX

Receive a daily recap featuring a curated list of must-read stories.

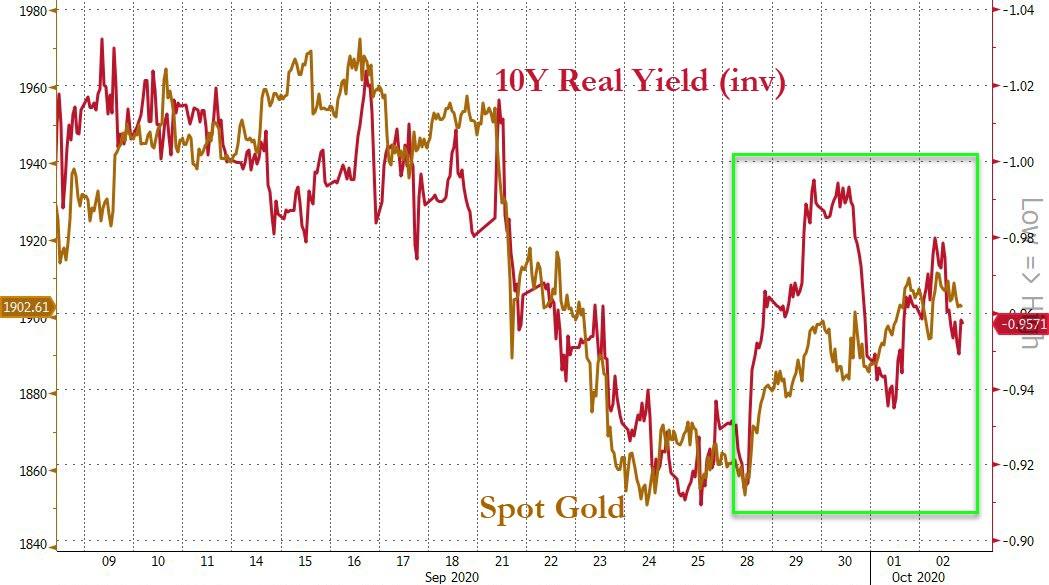

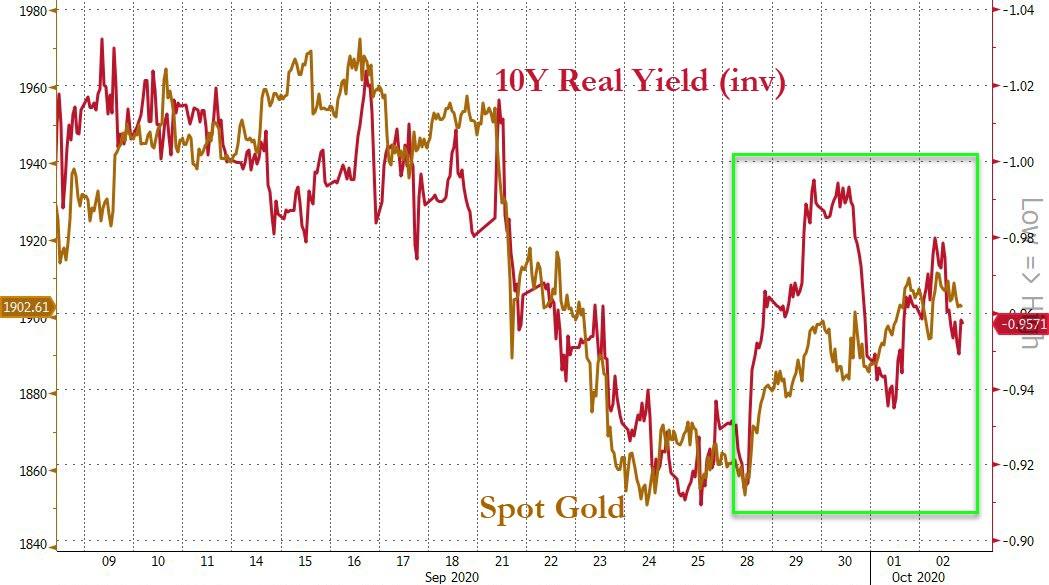

Real yields fell this week, helping send gold higher...

Source: Bloomberg

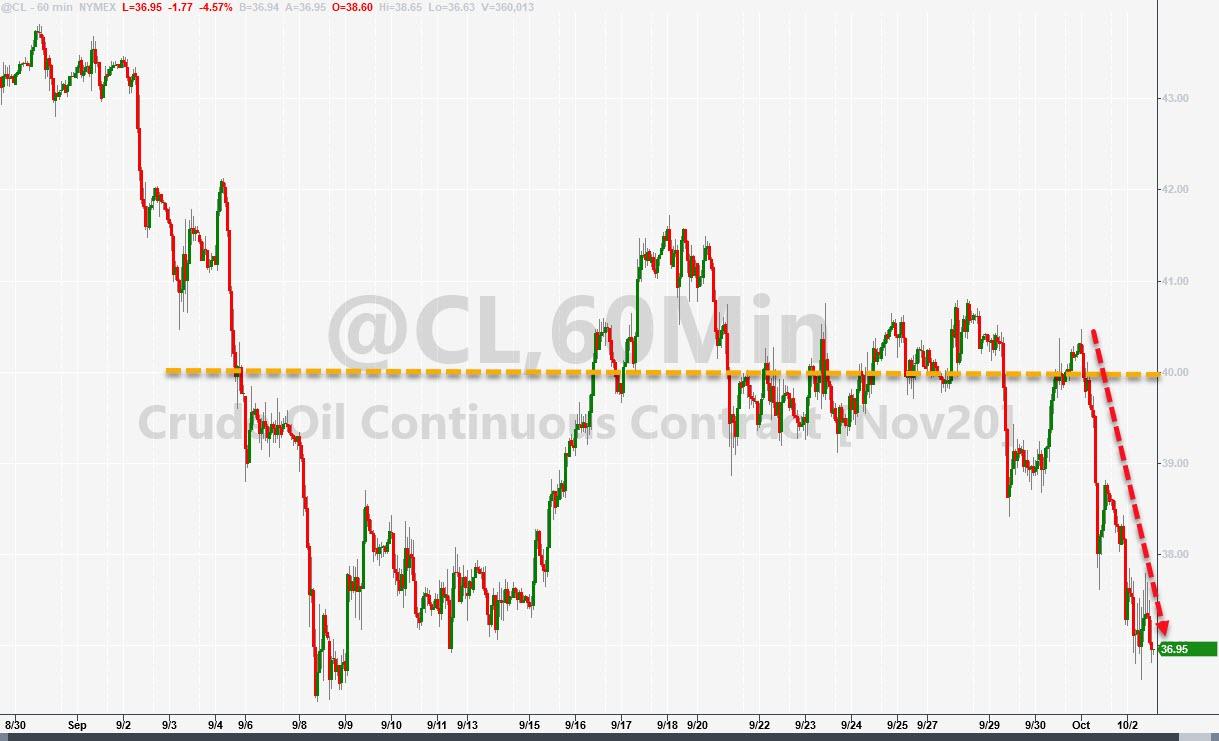

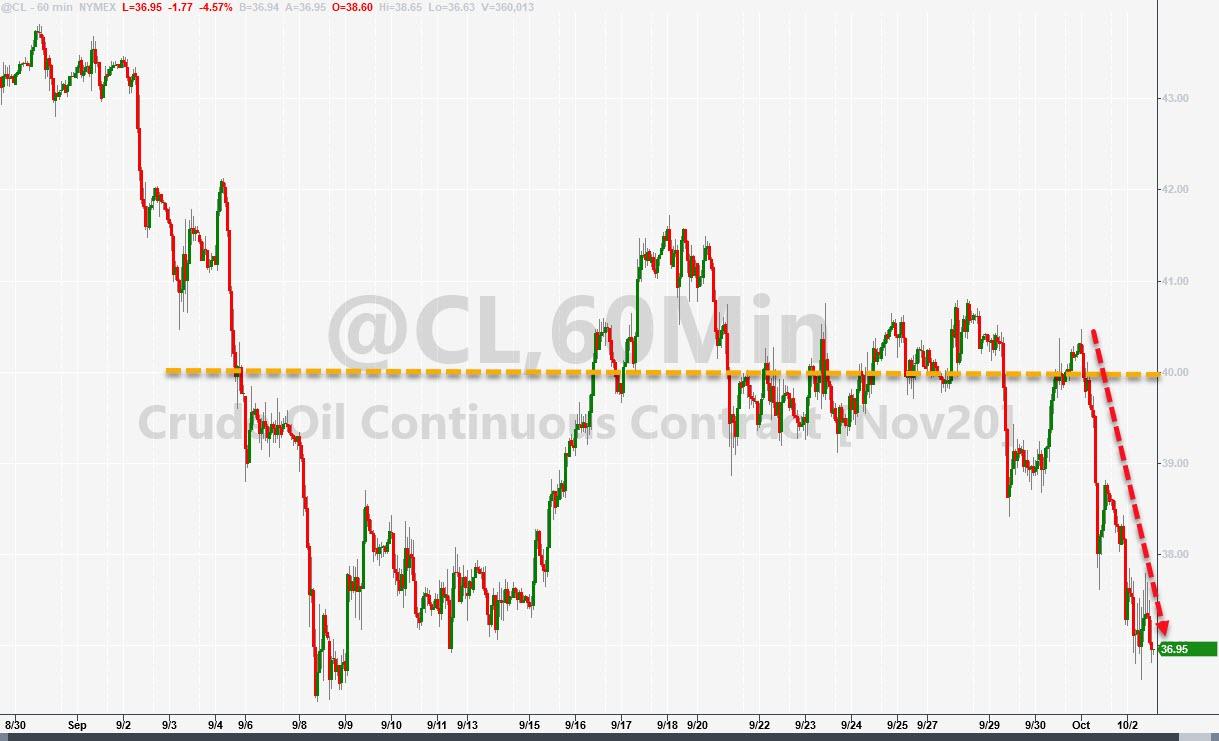

WTI was clubbed like a baby seal this week but Silver surged...

WTI ended with a $36 handle on the week, erasing all of the recent rebound gains...

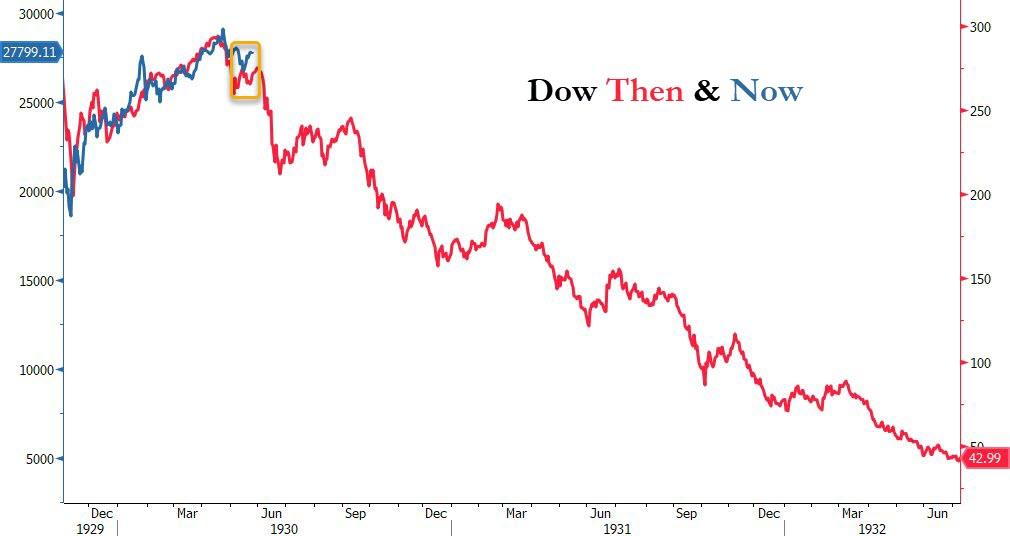

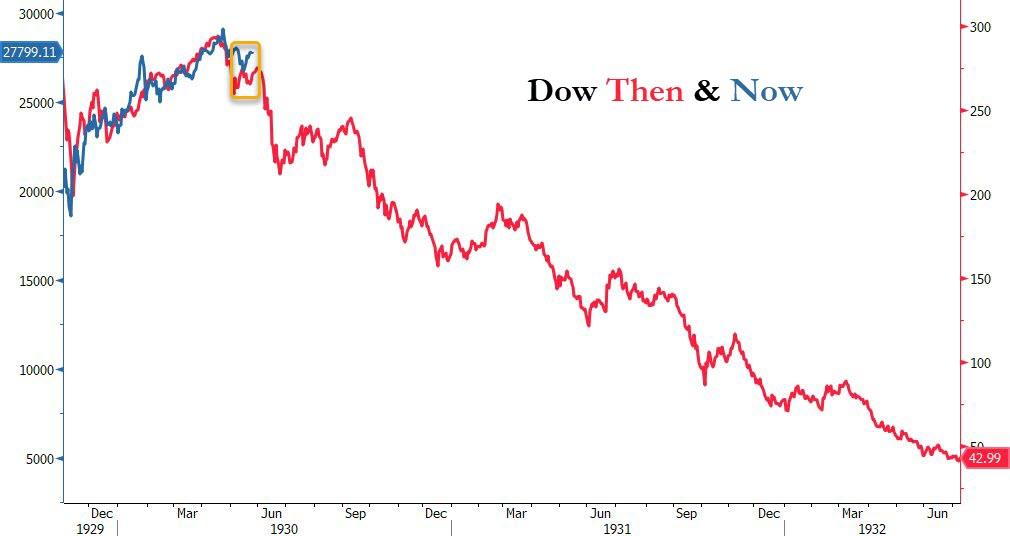

Finally, the 1930s analog remains in place...

Source: Bloomberg

Sent from my iPad |