Am firing the machine cannons as sustained as can

May the almighty have mercy on the souls of speculators

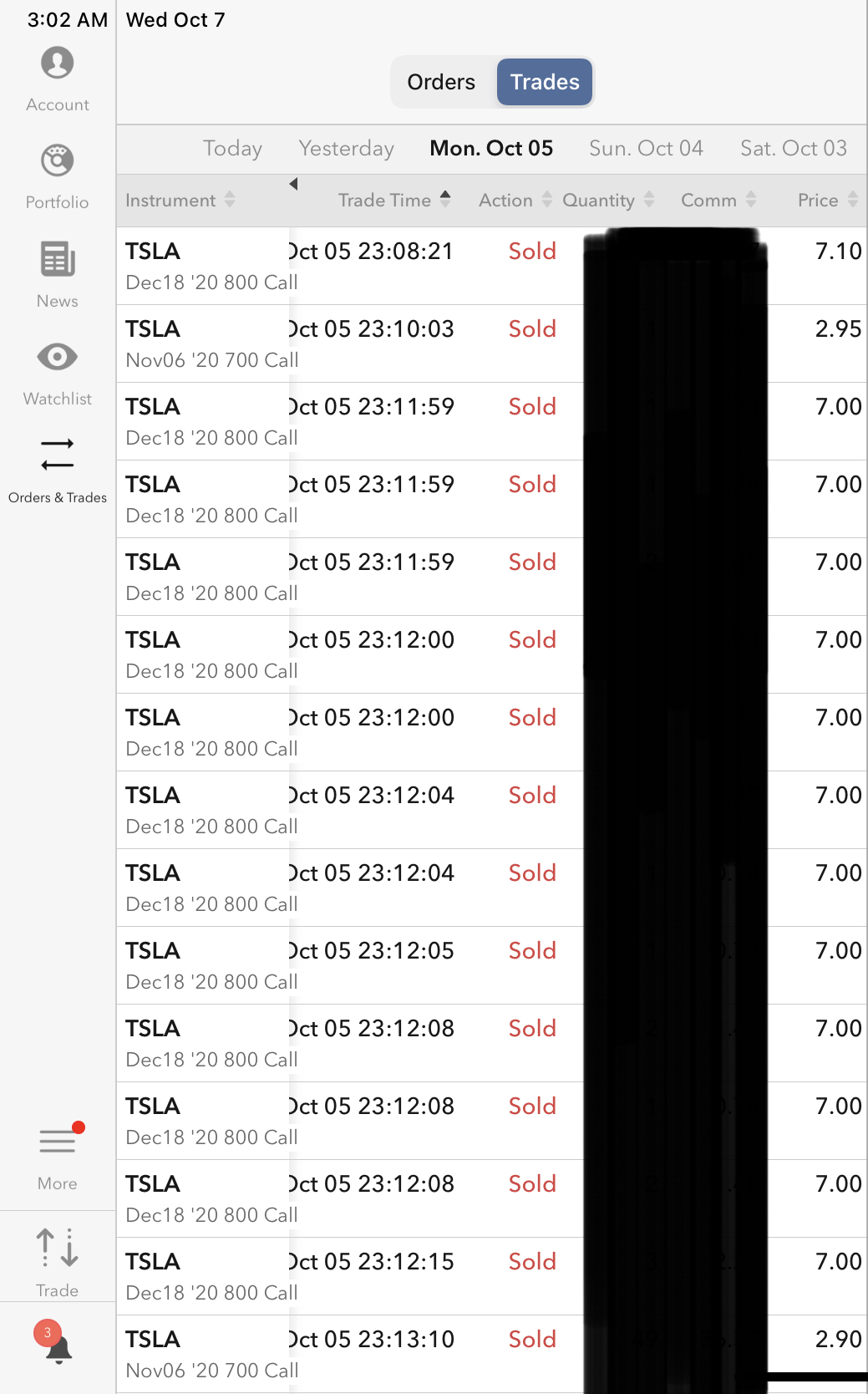

Have continued to increase net short position for three nights in a roll

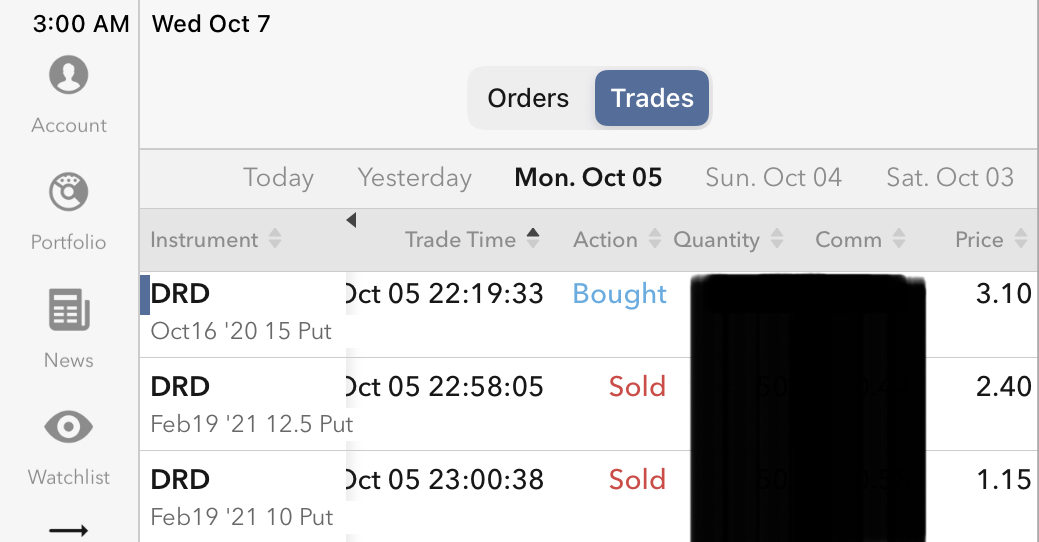

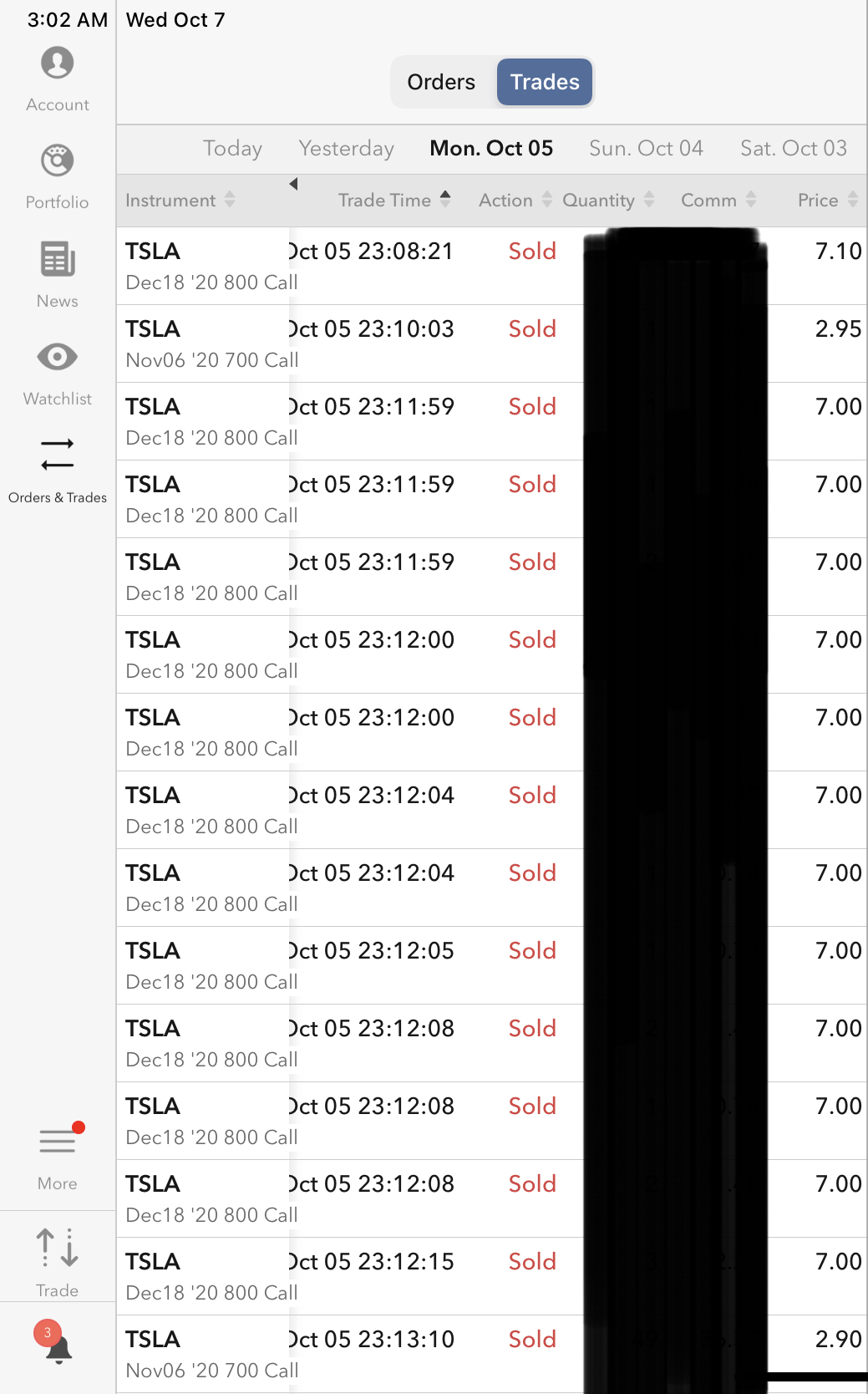

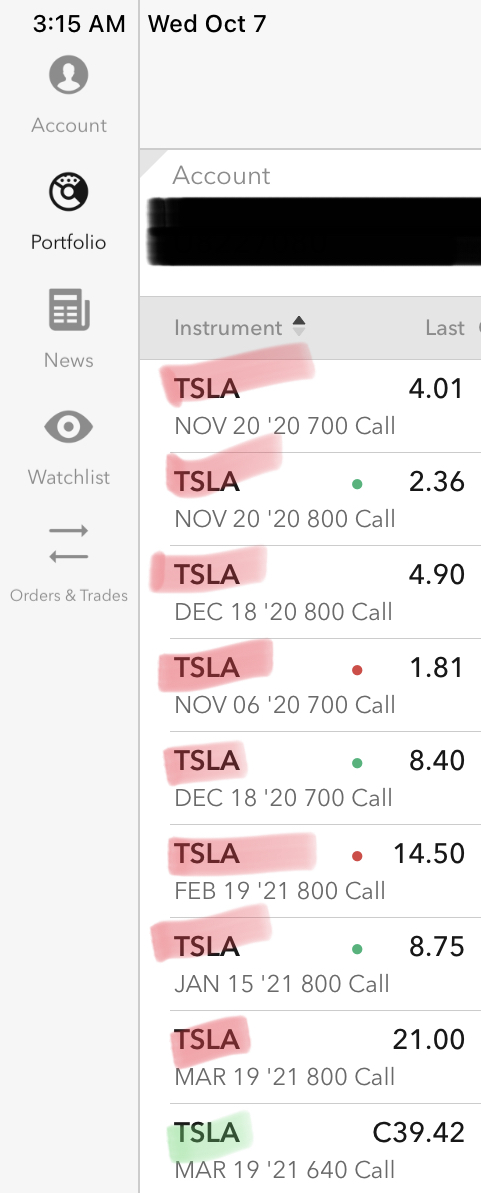

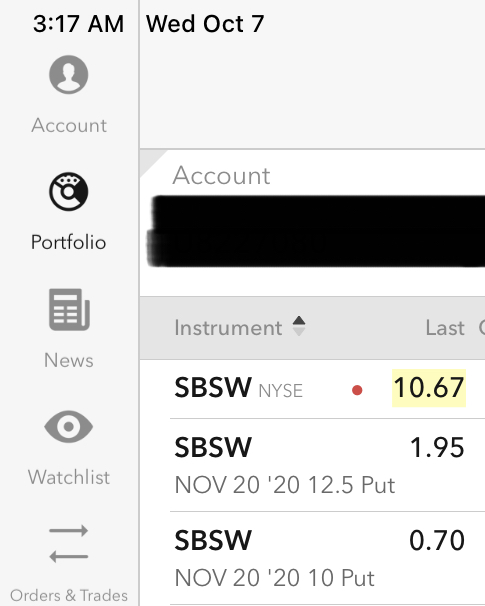

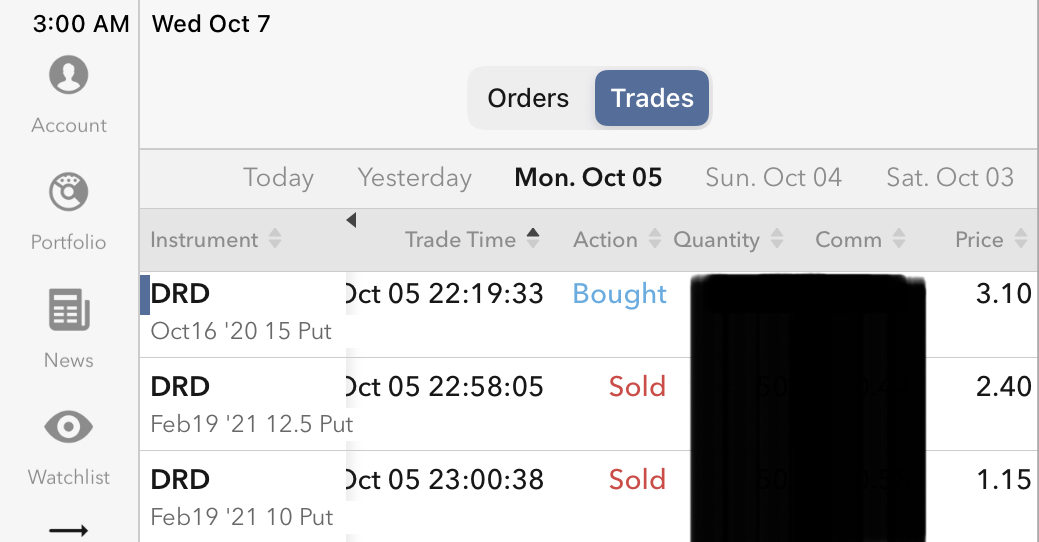

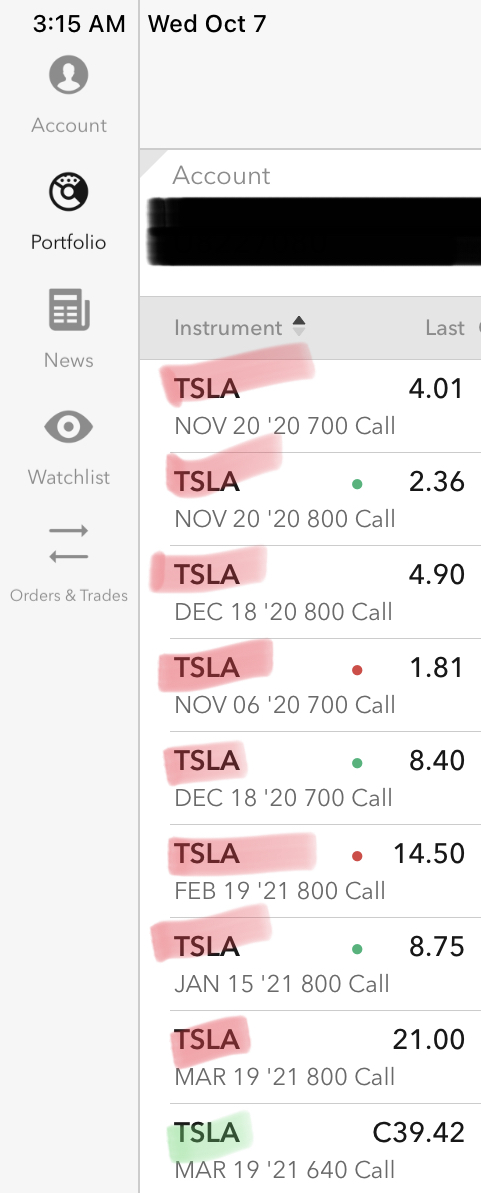

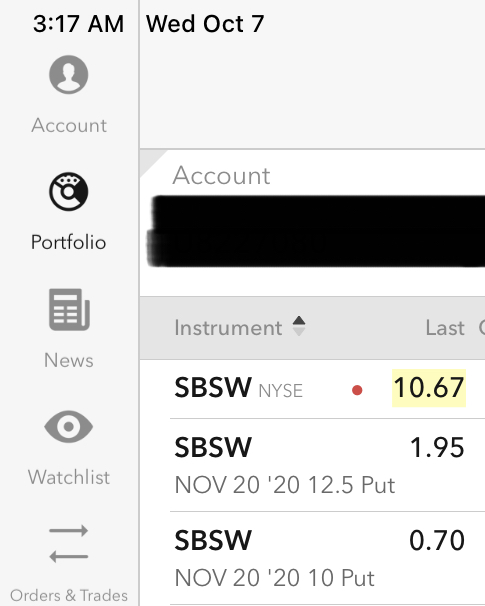

Added to long SBSW, increased long DRD, shorted (and roll) more TSLA, holding-still long NAK

Wagering on continuing printathon, betting for forever spendthrift, and counting on everlasting wastrelism

Oh, and kept w/ GEO, as more folks shall be housed at prison REIT facilities, supported and impelled by fiat money inflation

Right before market close just now as the Trump stopped fiscal stimulus talks, I managed to squeeze-in another volley against the fevered speculators, using munition TSLA Nov 6th Call Strike-700 @ 1.74-1.64. They want it, asked for it, deserve it, and so let them have it.

I do not understand why anyone is paying anything to hope that TSLA rises above 700 w/i such a short duration. One or the other side is very wrong.

Whomever wrong, calling them or I stupid would be generous, terming as morons would be kind, labeling as cretins would be gentle, and taking the money would be righteous, proper, and for the greater-good, for stronger hands better to keep the goodies.

Changing deployments

Order of battles

bloomberg.com

Day-Trader Fever Was Boiling Over Just Before October Surprise

Sarah Ponczek

Retail investors, who have grown into a stock-market force this year, recently boosted their optimism to the highest level of 2020 -- just in time for an October surprise.

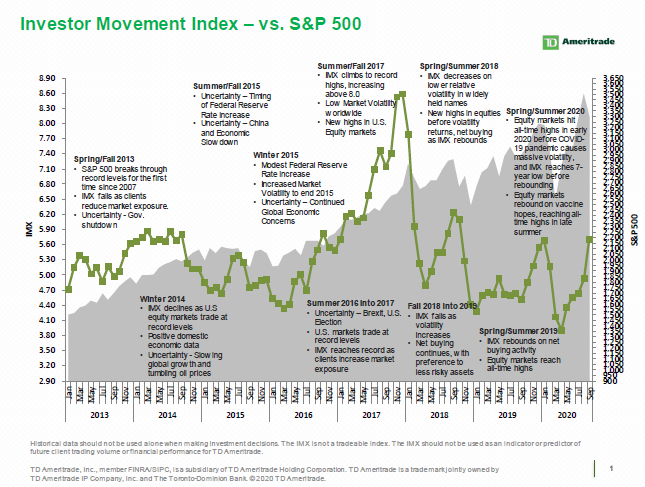

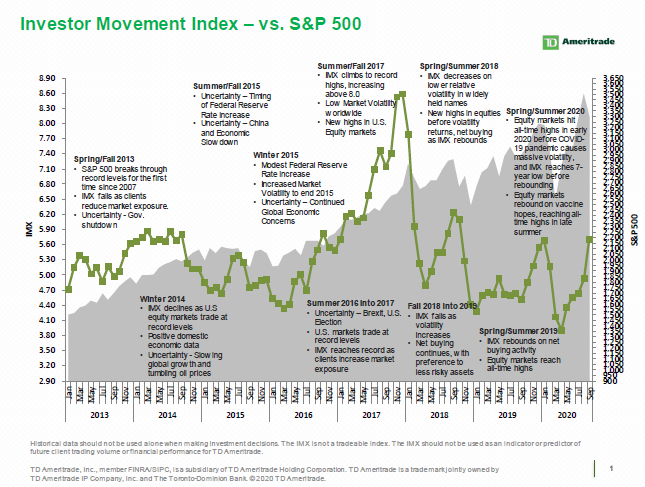

Clients at TD Ameritrade Holding Corp. increased their market exposure for a fifth straight month in September, pushing the firm’s measure of client positioning to the most bullish reading in two years, well before Covid-19 began roiling financial markets.

That backdrop may help explain why markets held up last week amid the turmoil of a presidential debate that raised concerns over a contested election outcome and then news that President Donald Trump and others in the highest ranks of U.S. government had contracted coronavirus. Through it all, the S&P 500 staged a 1.5% gain over five days, and by Monday afternoon the stock gauge had added another 1.4%.

The resilience of both equities and retail investors themselves is testament to the slightly-tongue-in-cheek saying in 2020 that stocks only go up. Conditioned to buy the dip, individual day traders are sticking to the strategy. With the Federal Reserve acting as a backstop with extremely supportive monetary policy, retail investors have been unbowed by everything from election uncertainty to a lack of new fiscal stimulus from Congress.

“Every time we’ve had a selloff, it’s been a nice opportunity,” said JJ Kinahan, chief market strategist at TD Ameritrade. “It’s like in football: You keep running the play until they stop you.”

A Goldman Sachs Group Inc. basket of stocks favored by retail investors is up more than 40% this year, and has just about doubled since the March bottom. In September, when the S&P 500 posted its first monthly decline since March and the tech-heavy Nasdaq 100 tumbled into a correction, the index of retail favorites was virtually flat.

According to Kinahan, TD Ameritrade’s clients used the volatility to boost stock exposure. The most popular equity purchases at the brokerage in September included Tesla Inc., Apple Inc. and Amazon.com Inc., all companies that saw their shares drop at least 16% in the September selloff. So far in October they’ve remained buyers, scooping up shares of tech stocks including Apple, Kinahan said.

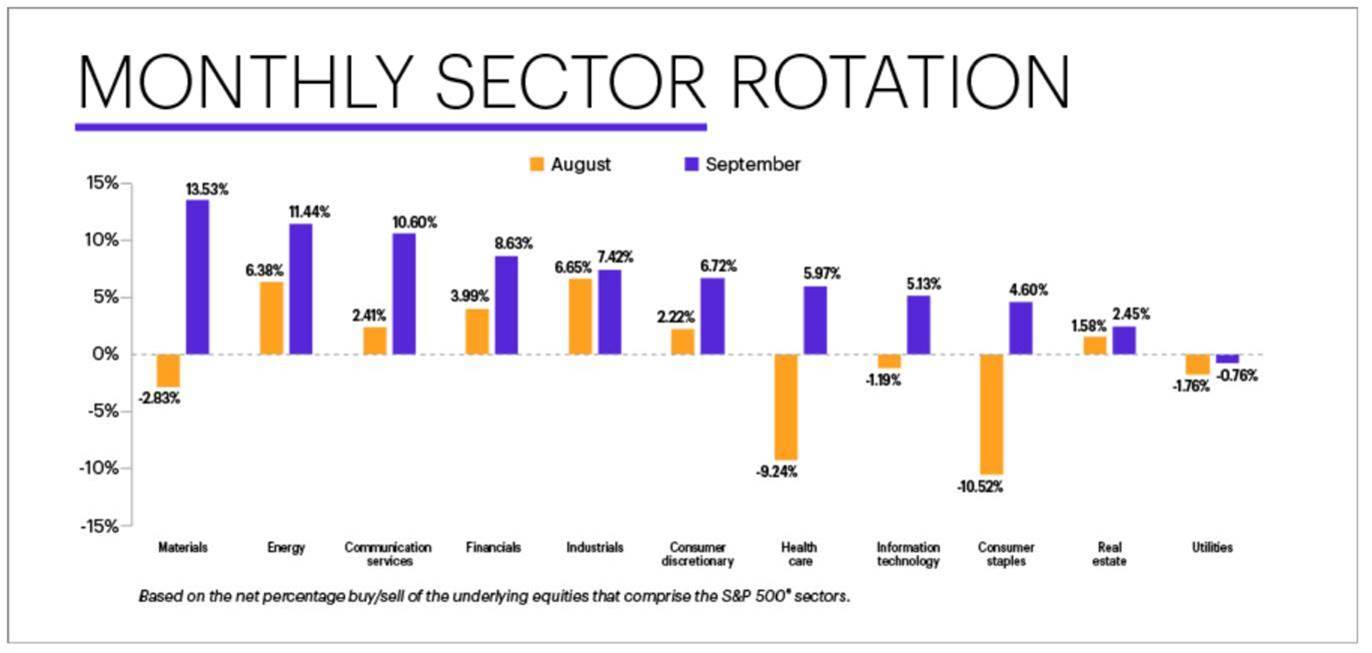

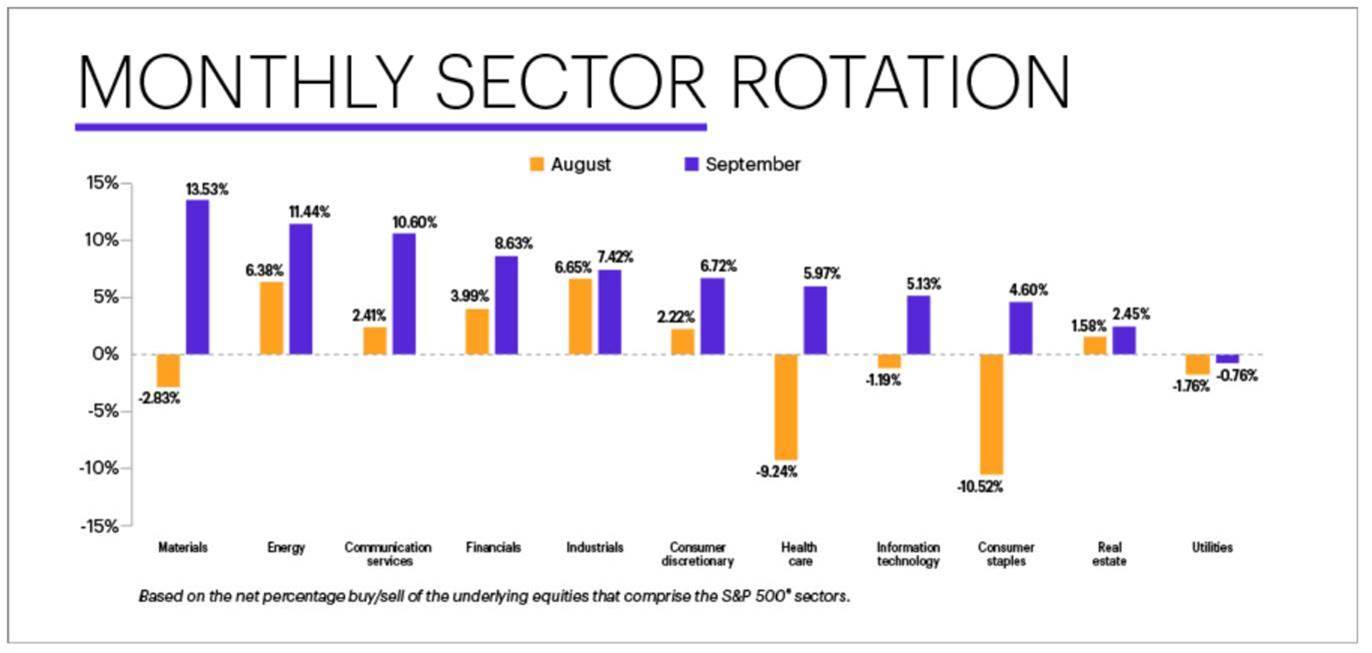

Clients at E*Trade Financial weren’t rattled by a choppy September either. Retail traders at the brokerage, comforted by economic reopenings, loaded up on shares of materials stocks and undervalued energy firms, according to Chris Larkin, the firm’s managing director of trading and investment product. They also picked up tech giants like Facebook Inc. and Twitter Inc., which have fared well during the pandemic. All told, the brokerage saw net buying in 10 of 11 sectors, with utilities being the sole holdout.

“They’re taking a little bit of a longer-term view and seeing that the economy is starting to open,” Larkin said. “For most people, they feel a lot better about where things are going and that’s why they’re starting to pick up some stock now.”

Source: E*Trade Financial

The presence of retail investors has exploded in 2020, encouraged by zero trading fees and, presumably, boredom during Covid-19 lockdowns. Calculations of their market share vary. Bloomberg Intelligence estimatesthey now account for 20% of equity trading, making them the second-largest group of investors in the market. At the higher end of the spectrum, strategists at Jefferies LLC including Steven DeSanctis estimate about 40% of all trading volume comes from retail investors.

The pickup in retail activity has led some Wall Street professionals to decry euphoria in markets, warning of a situation similar to the dot-com era when individual investors were heavily involved. Others see the increase as a trend that’s here to stay.

“I don’t necessarily think it’s a bad omen,” said Matt Miskin, co-chief investment strategist at John Hancock Investment Management. “If you did see a broadening of participation in the market, that could provide a tailwind into year-end.”

— With assistance by Claire Ballentine

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE

Sent from my iPad |