South Africa down today.

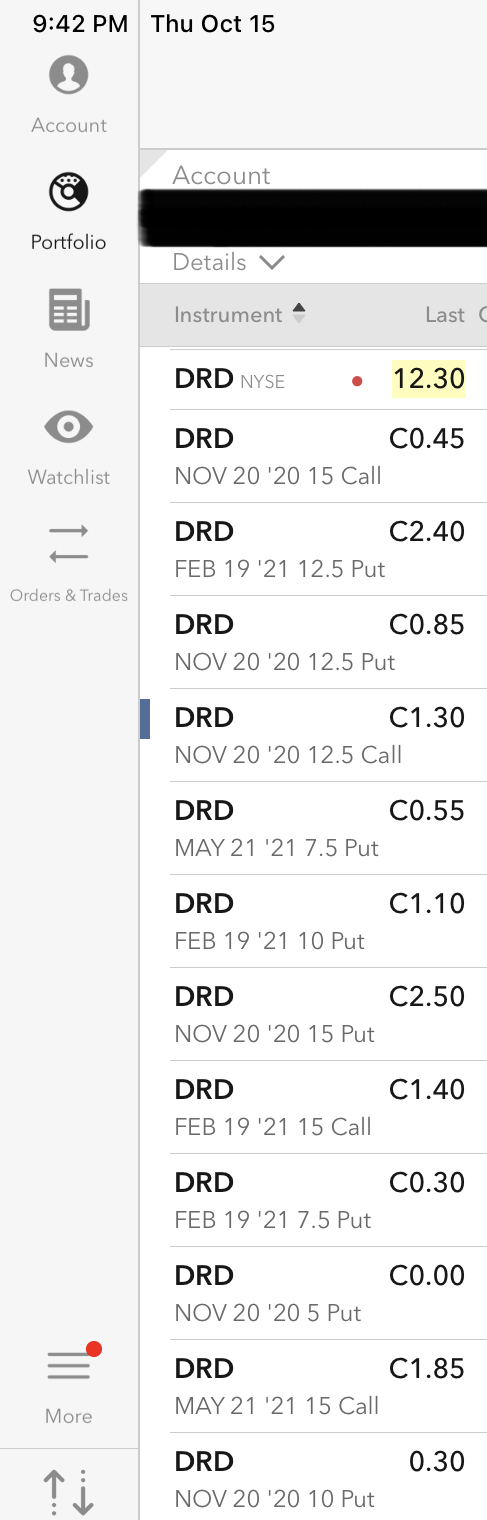

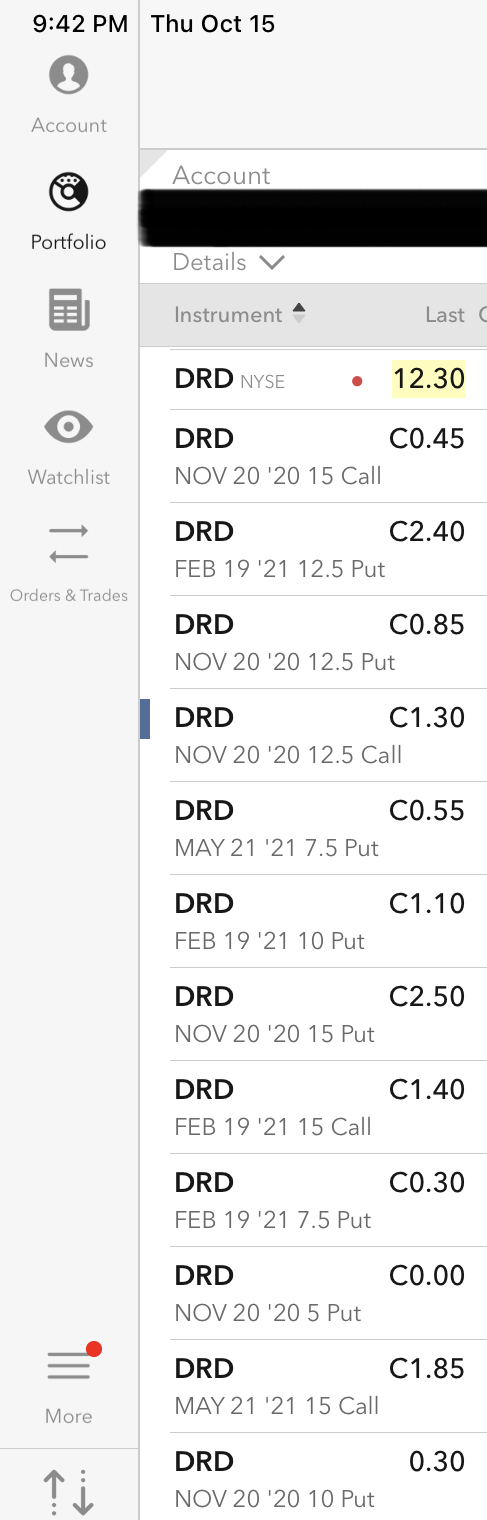

I have equal number / amount wagered on DRD short put / call strike-12.5, expiration November 20th

Believe 12.50 is the battle line, and the numbers shall wobble around that, unless either gold or gold companies or entire market tanks or ramps

My DRD short put / call strike-15, expiration November 20 is about 2 / 7, believing that net-net DRD shall remain below 15.

bloomberg.com

South African Stocks Drop as U.S. Stimulus, Lockdowns Hit Sentiment

Adelaide Changole

October 15, 2020, 4:04 PM GMT+8

A man passes a sign outside the Johannesburg Stock Exchange in the Johannesburg.

Photographer: Waldo Swiegers/Bloomberg

LISTEN TO ARTICLE

South Africa’s main stock index slid on Thursday as risk off sentiment dragged global equities lower.

The FTSE/JSE Africa All Share Index fell 1.4% at 9:59 a.m. in Johannesburg, the biggest decline since Sept. 25.

Asian and European stock markets declined as chances faded of a stimulus deal in Washington before next month’s presidential election. A resurgent virus outbreak weighed on sentiment, with France announcing stricter measures, Germany warning of economic risks and London set to tighten restrictions.

Giants Naspers Ltd., Anglo American Plc, BHP Group Plc and Richemont, making up 46% of market capitalization, led the index lower, with 99 of the 141 listed companies falling in early trading, while 30 gained.

Naspers halted a four-day rally, falling 2.9% to provide the biggest drag to the index, as partly owned tech giant Tencent Holdings Ltd. retreated in Hong Kong. |