Re <<Trade war>> on best customer, investor, and tourist

Let us see if Team Australia's iron ore go the way of Team Canada's canola oil, as did its beef, wine, and coal

bloomberg.com

Vale Is Ramping Up Faster Than Thought in New Blow to Iron Bulls

James Attwood

Vale SA produced more iron ore than expected last quarter amid a record haul at its newer mines in northern Brazil, in the latest sign of rising supplies that have stalled a rally in prices.

The Rio de Janeiro-based company reported third-quarter production of 88.7 million metric tons, its best result in almost two years and ahead of the 85.7 million-ton average estimate among six analysts surveyed by Bloomberg.

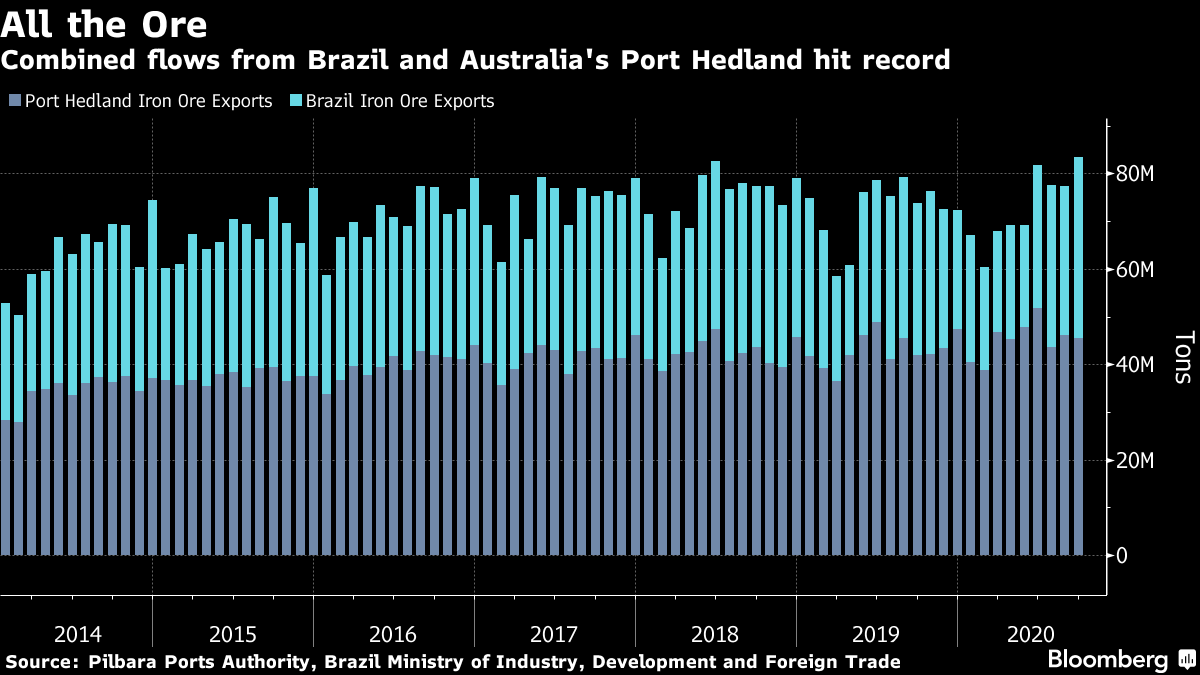

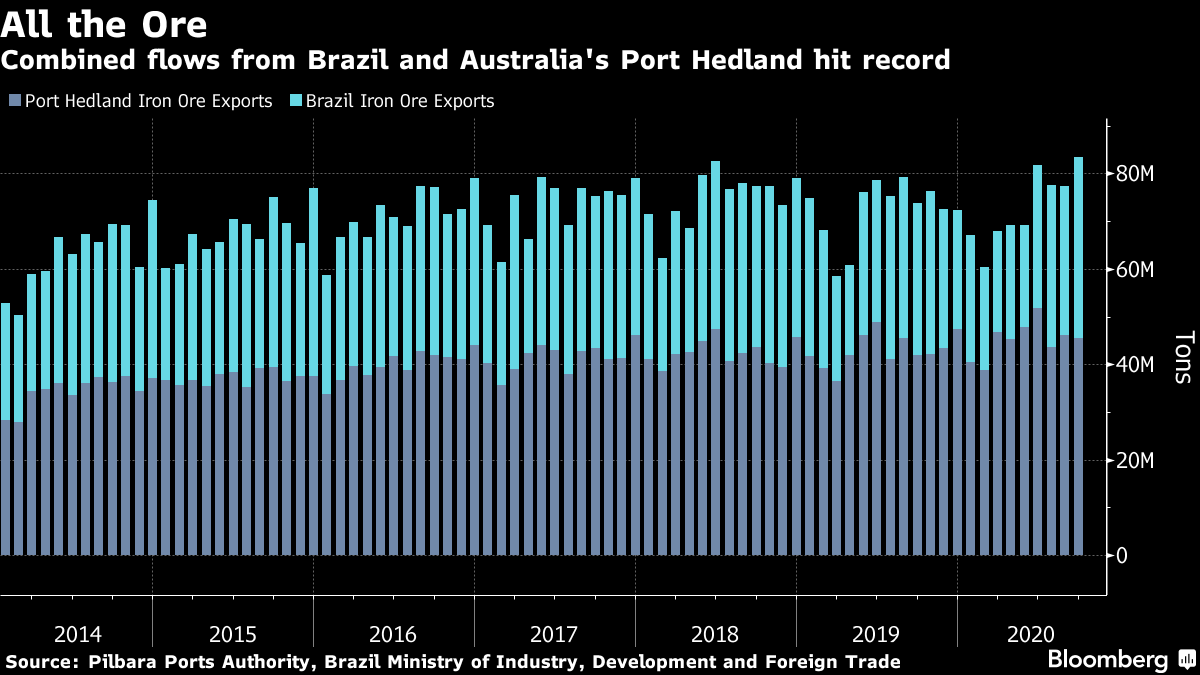

Futures of the steelmaking ingredient have slipped almost 8% since hitting a six-year high in mid-September as shipments out of top-producing nations Brazil and Australia increase ahead of a seasonal slowdown in Chinese demand.

Vale is navigating legal and pandemic obstacles in its recovery from the Brumadinho dam collapse that cost 270 lives and its title of world’s top producer. Accelerating second-half output has it on track to hit an annual target of 310 million tons, Chief Financial Officer Luciano Siani Pires said earlier this month, while Chief Executive Officer Eduardo Bartolomeo said last week he’s “pretty sure” of reaching 400 million tons by the end of 2022 or early 2023.

Despite the recent pullback, iron ore prices are still 27% above where they started the year amid strong Chinese demand. Vale was raised to an investment-grade credit rating by Moody’s early this month and has reinstated dividends after cases of Covid-19 among staff stabilized. Its shares are up 16% this year.

To be sure, not all of Vale’s output will hit the market immediately, with the company expected to replenish inventories along the supply chain, including in Asian distribution centers, said Bradesco analyst Thiago Lofiego. Sales volume was just 65.8 million tons in the third quarter.

Vale’s nickel production slumped 21% from April-June, mainly because of maintenance work that was rescheduled from previous quarters. Copper output was up slightly quarter on quarter but down 11% from a year earlier. Coal also improved from the second quarter but was down 40% in the year-ago comparison.

Vale is scheduled to report quarterly earnings after the close of regular trading on Oct. 28, with calls the following day at 9 a.m. and 11 a.m. New York time.

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |