Re <<GBTC ... Bitcoin>>

Do not know why anyone would want to invest in it, other than the facts that it has no governance, is consensual / p2p-based, rare progressing towards rarer, might one beautiful day turn into a bubble that history deliberates over, is FOMO-heavy, and besides, the chart looks good.

In any case, Bitcoin, under current macro and peculiarities of mania of other ‘things’, is free when funded at negative carry w/ rapidly devaluing ‘near-money’ that is TSLA

So I shorted more TSLA, and used 1/2 the funding to get free bitcoins

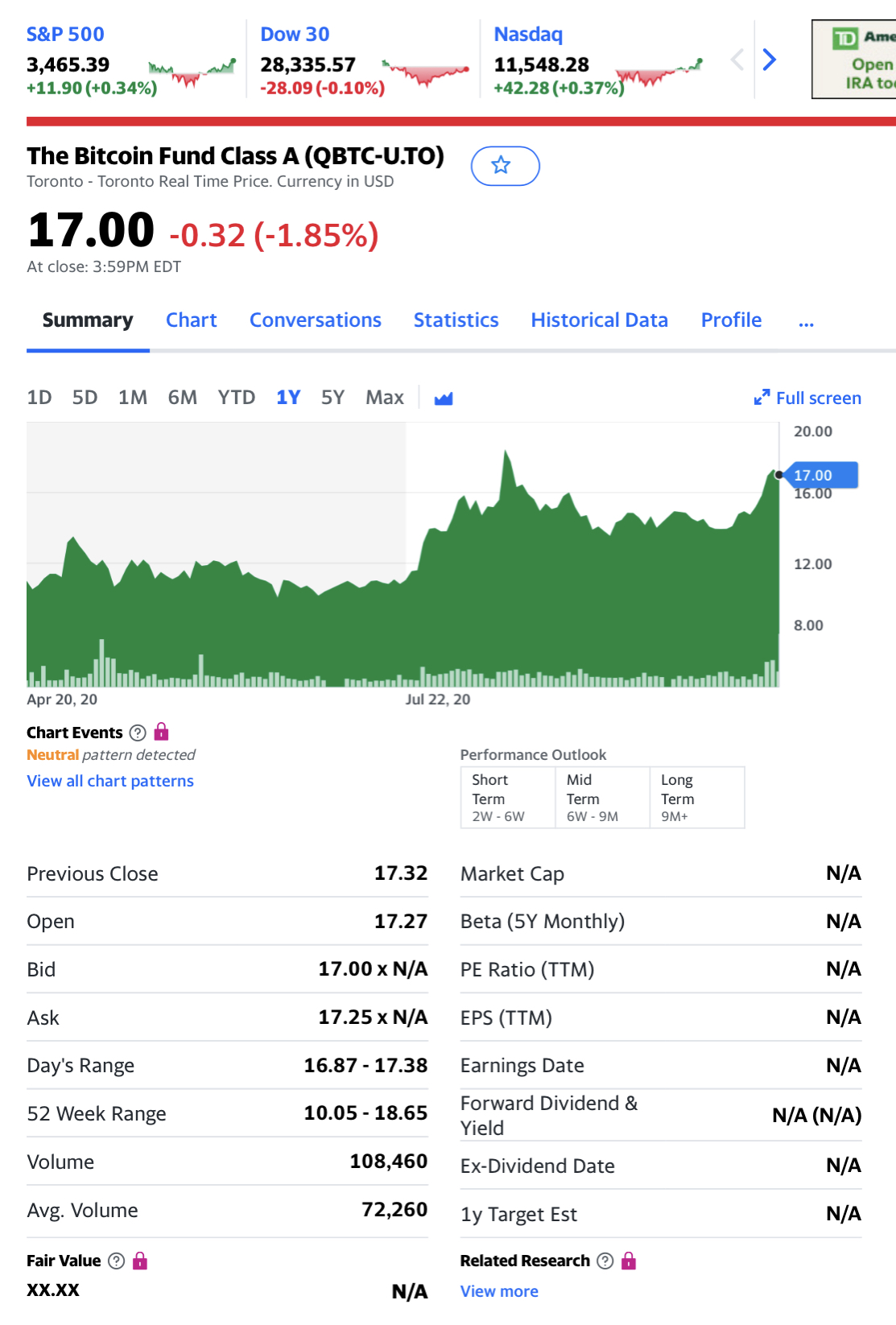

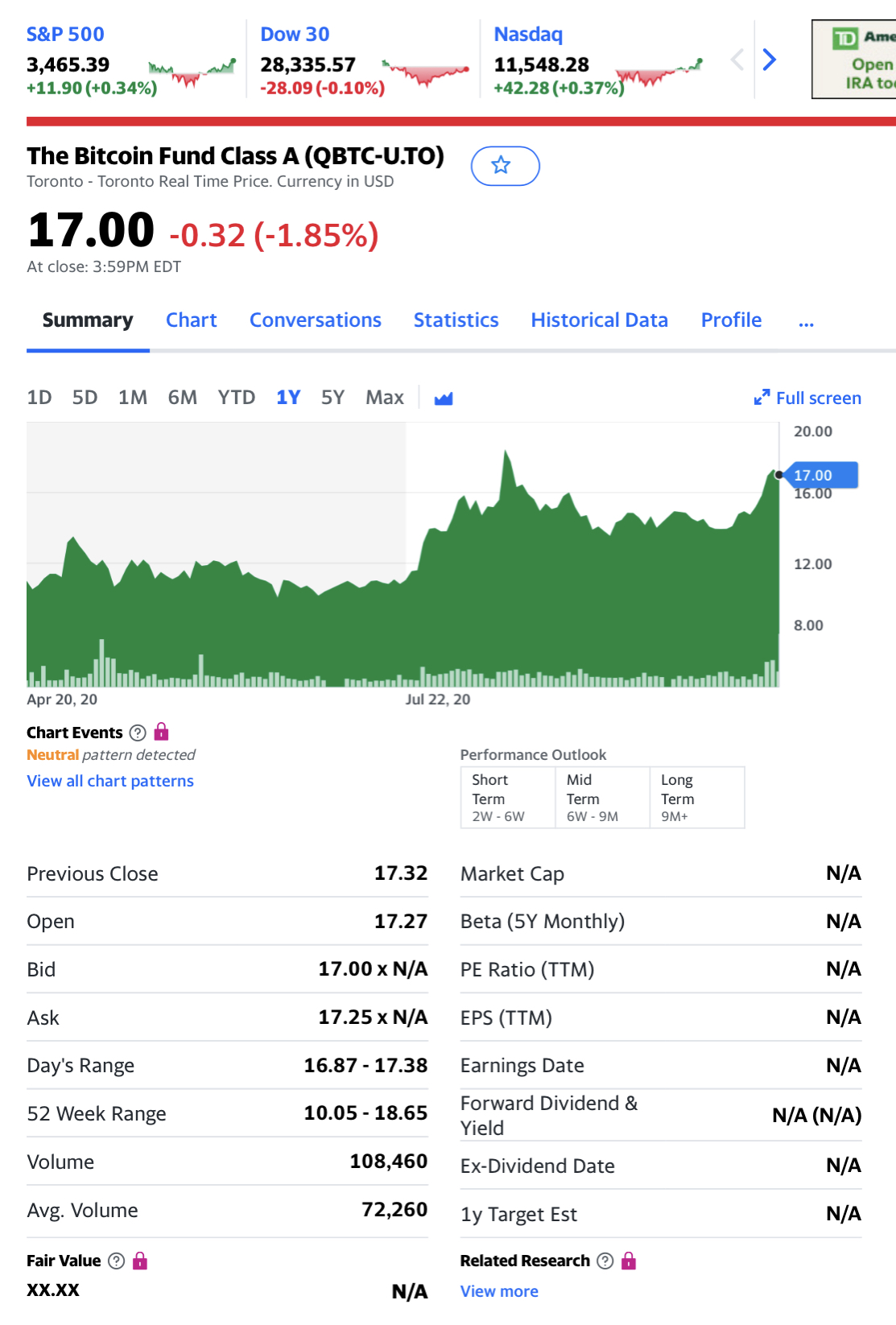

Am feeling uncomfortable w/ being not diligent enough to figure out how to use a hardware wallet left unpacked in sock drawer, and too busy having fun to ask for help, I decided to engage w/ additional online software wallet that is like GBTC but cheaper, QBTC

It also does not have any use other than holding something not useful. It is cheaper because it has a market cap of ~120M CAD, whereas GBTC is at 2.5B USD, and both together w/ all BTC in the universe, sums to ~200B, relative to gold, that which is much harder to lift by mania at this stage, at 11T

Neither GBTC nor QBTC carries debt, other than the debt of Fed for and on behalf of Team USA which balloons its debt in favor of and for the greater good of the planet. Very magnanimous and doubtless also for own good. So, good all around and much goodness shall pour forth as we progress as fate of empire at stake, all-in.

Strategy: short TSLA, buy X-BTCs, then pivot to gold, by ways of silver, DRD, and GLD, w/ end-game stop, Au the physical metal.

This should work okay with other ways, like shorting TSLA and buying Nio, via shorting of Nio puts, and if put, short covered calls.

Etc etc, all thanks to the Fed, until collapse, when we end up w/ a pile of gold.

QBTC is priced in CAD, and its pattern is same as GBTC except closer to the curve BTC itself would trace on below chart. Both tracks BTC well. Both enabled to beat gold for awhile at least, and certainly more volatile, like silver. And all free relative to TSLA.

It would be nicer if someone / anyone launches ETFs that is premised on above strategies, but expressed in 3X leverage versions, close-end fund without roll-friction. I am seriously lazy. Toiling at the mill is easily beaten by another day at the pool.

finance.yahoo.com

|