Re << Trump Jr. floats 2024 run for president: ‘This will make the lib heads explode’ >>

... that possibility is pretty funny should it happen, especially if Trump should win this round, and Jr the next round, and Trump serves as advisor to Jr.

But and however, am thinking all of MSM way too sure of a Biden win, that in the event Trump wins, the world stops spinning for enough and magnetic poles invert for plenty

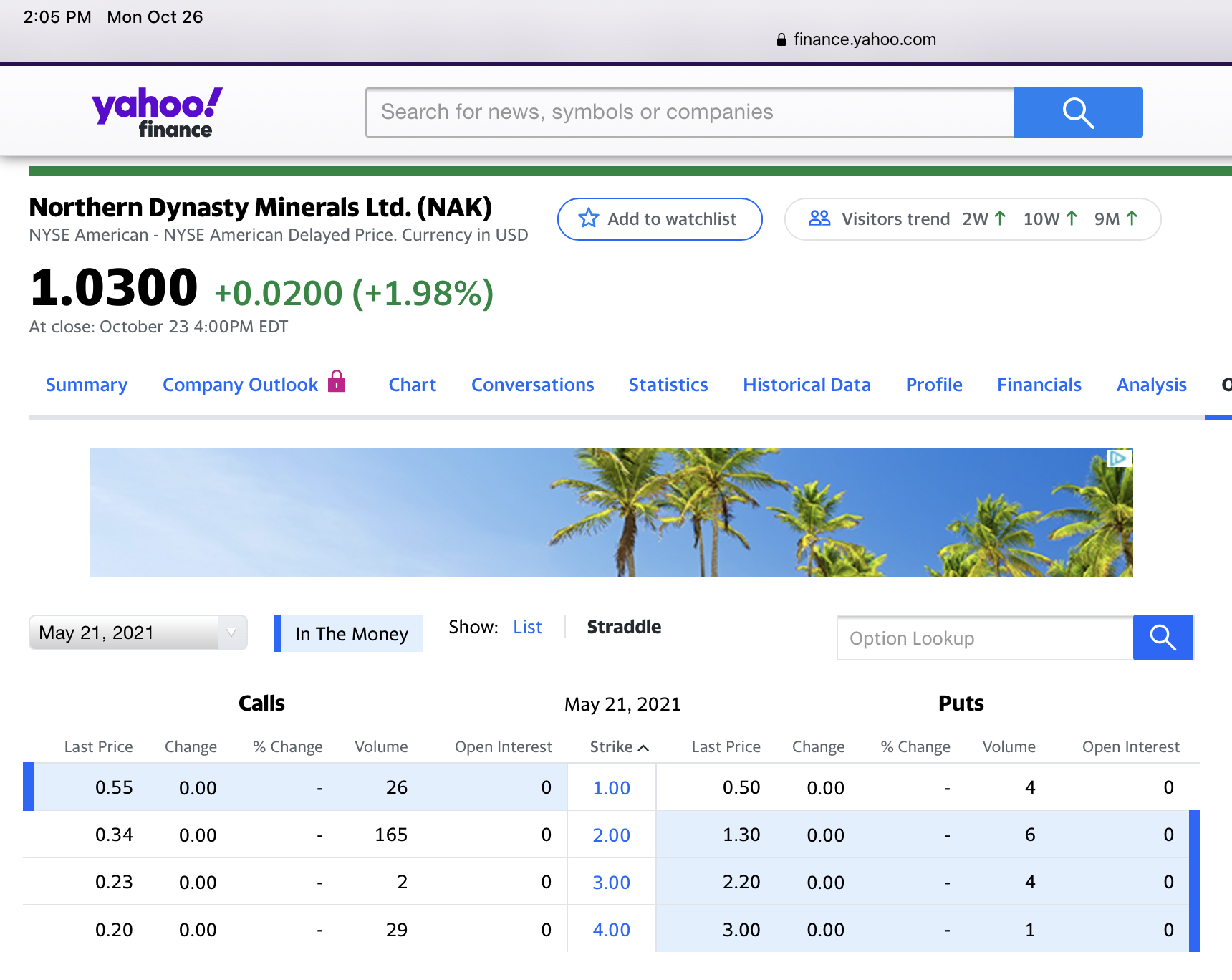

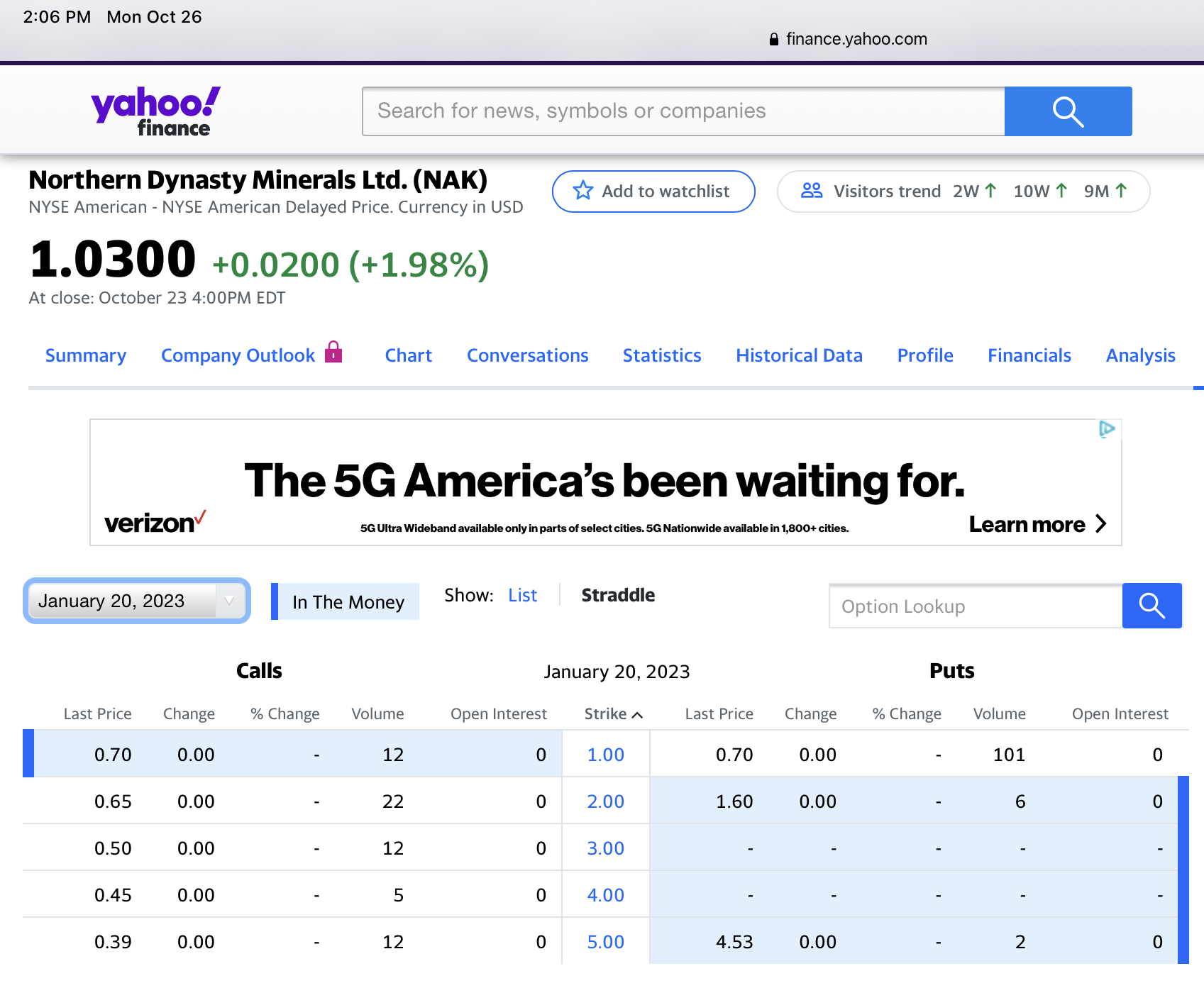

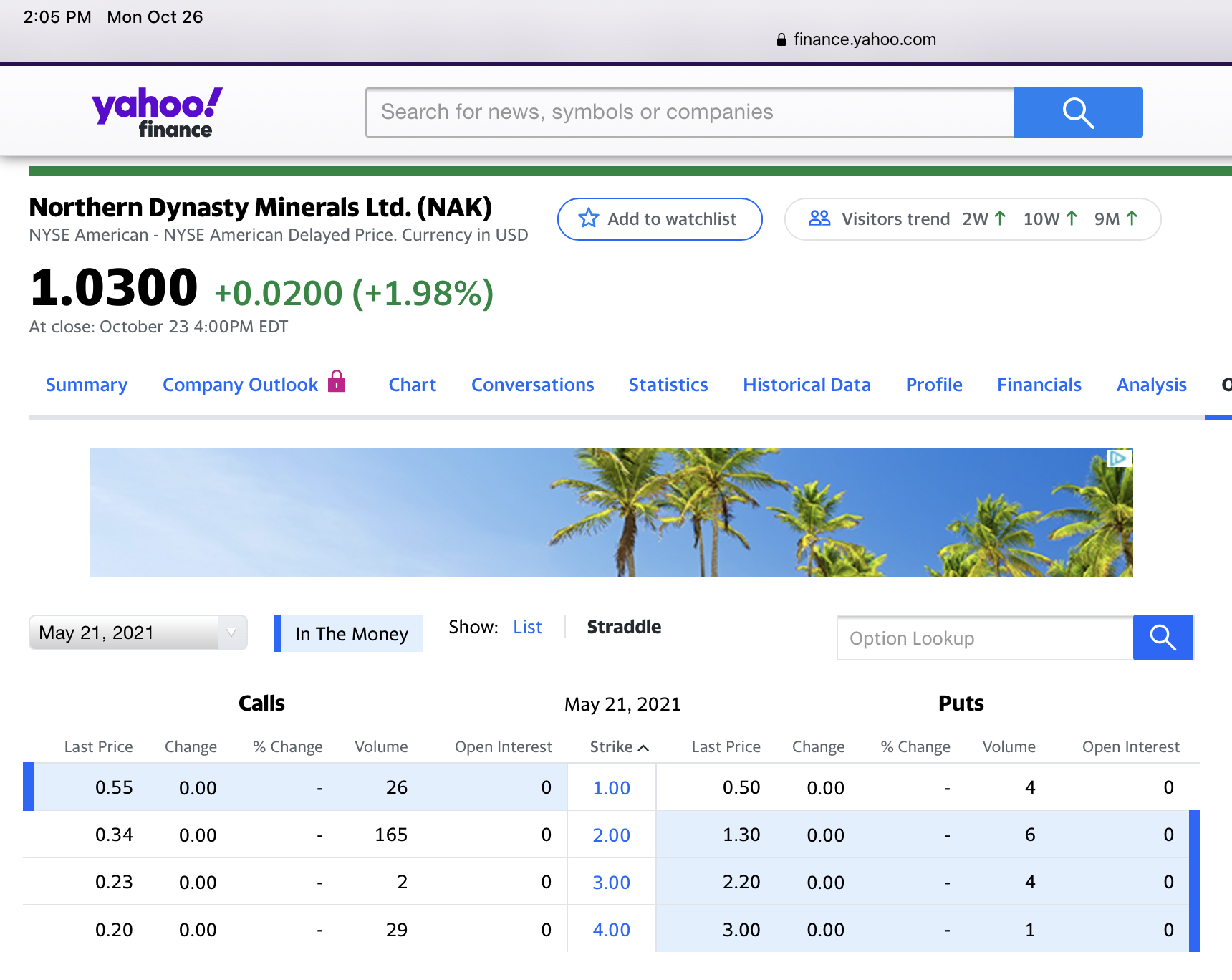

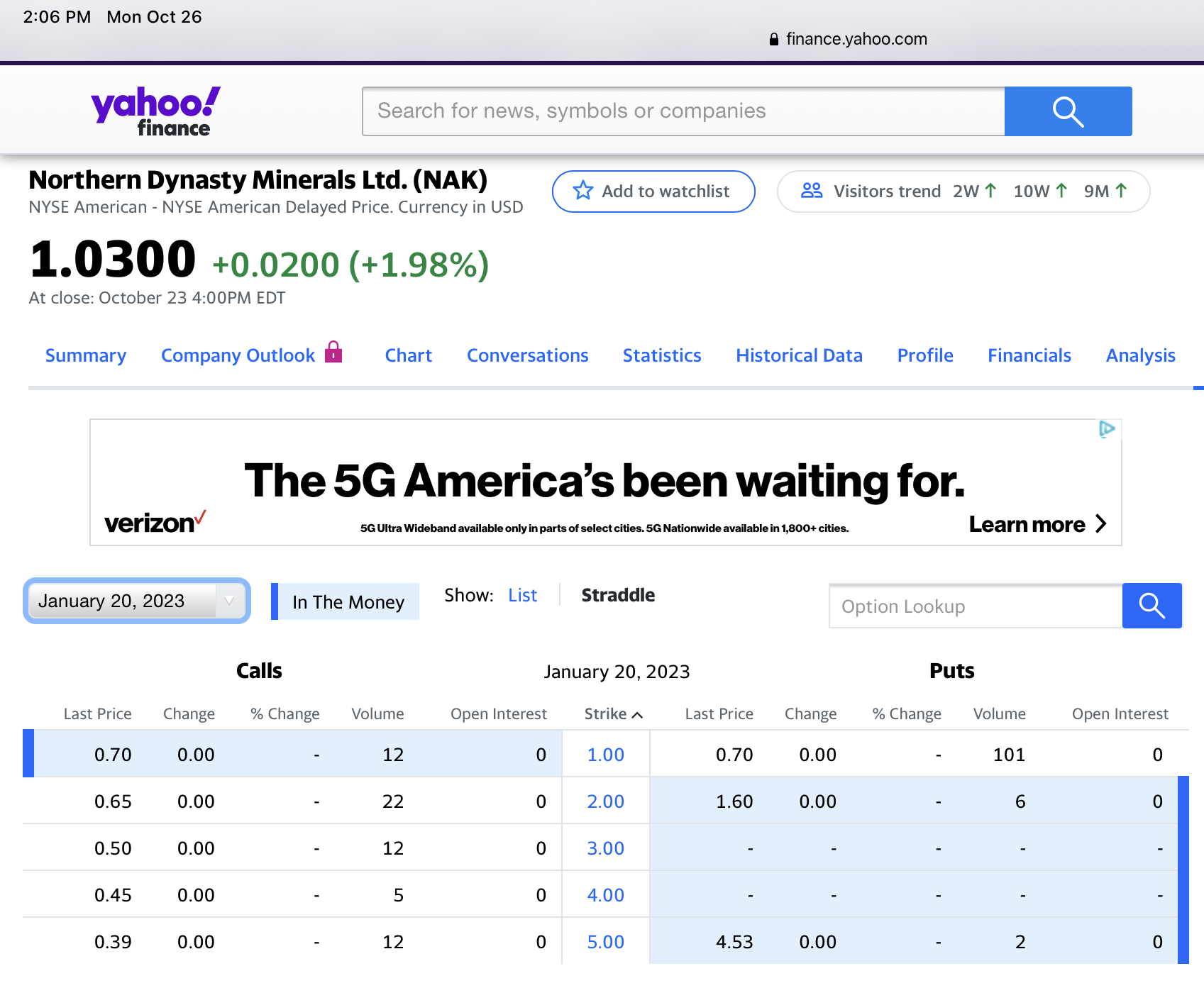

NAK finance.yahoo.com is edging up albeit by noise amount, but am thinking that a Trump loss already priced into the puts, and calls, and perhaps one can advisable wager by shorting the puts, and if extra bullish, long the calls

Looking at the photo of the gold bar I think folks are right to think of gold as barbaric, but that does not stop gold from going up, because of its barbarity.

Speaking of barbarity, bitcoin is not barbaric, but very modern. It also shall go up, am thinking. Need to get longer.

bloomberg.com

Gold Drops as Investors Weigh Stimulus Prospects, Virus Cases

Ranjeetha Pakiam

October 26, 2020, 8:05 AM GMT+8

One-kilogram gold bars at a Tanaka Holdings in Tokyo. Photographer: Akio Kon/Bloomberg

LISTEN TO ARTICLE

Gold declined to trade near $1,900 an ounce as investors weighed fading prospects for a U.S. stimulus deal, while the country reported record coronavirus infections for the second day in a row.

House Speaker Nancy Pelosi said the chamber could pass a plan this week, though a deal with the White House remains elusive and the Republican-led Senate might not act before the election. Speculation about a package has helped Treasury yields rise in recent weeks, dulling bullion’s allure.

“Gold is facing a bit of a headwind from the recent slight rise in real yields,” said Nicholas Frappell, global general manager at Sydney-based ABC Bullion. “Some investors are optimistic over the prospects for U.S. growth. Others are seeing positioning ahead of a Democratic win and assuming that the fiscal consequences will drive bond prices lower and yields higher.”

Spot gold dropped as much as 0.6% to $1,891.38 an ounce, and was at $1,898.80 at 11:23 a.m. in Singapore, down for a third day. Silver fell 1.2%, platinum lost 1.5% and palladium declined 0.9%. The Bloomberg Dollar Spot Index rose 0.2%. Real yields on 10-year Treasuries ticked lower after surging last week.

Separately, on the virus front, White House Chief of Staff Mark Meadows said the U.S. isn’t going to “control” the pandemic. The World Health Organization’s director general said some countries in the northern hemisphere are facing a “dangerous moment” as cases spike.

Before it's here, it's on the Bloomberg Terminal.

LEARN MORE |